THE head of China's central bank, Zhou Xiaochuan, says quantitative easing is not working and more targeted measures are required to channel credit into areas where they are needed the most.Mr Zhou made the call in a speech delivered in April but not published on the website of the People's Bank of China until this week, as the chairman of the US Federal Reserve, Ben Bernanke, announced a new round of quantitative easing - an injection of cheap credit into the financial sector - aimed at resuscitating the sluggish US economy.Mr Zhou criticised the flood of cheap money as an inflexible and orthodox approach, although he stopped short of naming the Fed. Chinese authorities have long expressed their displeasure at US quantitative easing policy measures, which have eroded the value of the Chinese holding of US dollar-denominated assets such as Treasury bonds. Beijing is the largest holder of US government debts.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, September 22, 2012

Brazil and China Governments Slam the FED’s QE Forever

Tuesday, February 07, 2012

Peter Schiff Interviews James Rickards on the Currency Wars

Peter Schiff recently had an interesting interview with author James Rickards author of the sensational Currency Wars: The Making of the Next Global Crisis.

Find below the interview along with my comments [bold italics]

Peter Schiff: You portray recent monetary history as a series of currency wars - the first being 1921-1936, the second being 1967-1987, and the third going on right now. This seems accurate to me. In fact, my father got involved in economics because he saw the fallout of what you would call Currency War II, back in the '60s. What differentiates each of these wars, and what is most significant about the current one?

James Rickards: Currency wars are characterized by successive competitive devaluations by major economies of their currencies against the currencies of their trading partners in an effort to steal growth from those trading partners.

While all currency wars have this much in common, they can occur in dissimilar economic climates and can take different paths. Currency War I (1921-1936) was dominated by a deflationary dynamic, while Currency War II (1967-1987) was dominated by inflation. Also, CWI ended in the disaster of World War II, while CWII was brought in for a soft landing, after a very bumpy ride, with the Plaza Accords of 1985 and the Louvre Accords of 1987.

What the first two currency wars had in common, apart from the devaluations, was the destruction of wealth resulting from an absence of price stability or an economic anchor.

Interestingly, Currency War III, which began in 2010, is really a tug-of-war between the natural deflation coming from the depression that began in 2007 and policy-induced inflation coming from Fed easing. The deflationary and inflationary vectors are fighting each other to a standstill for the time being, but the situation is highly unstable and will "tip" into one or the other sooner rather than later. Inflation bordering on hyperinflation seems like the more likely outcome at the moment because of the Fed's attitude of "whatever it takes" in terms of money-printing; however, deflation cannot be ruled out if the Fed throws in the towel in the face of political opposition.

[My comment:

At this point policy actions by global authorities do not seem to indicate of a currency war or competitive devaluation as the olden days (as per Mr. Rickards scenarios].

While major central banks have indeed been inflating massively, they seem to be coordinating their actions to devalue. For instance, the US Federal Reserve has opened swap lines to major central banks and to emerging market central banks as well. Japan’s triple calamity a year ago prompted a joint intervention in the currency markets, which included the US Federal Reserve.

Current actions partly resembles a modern day concoction of Plaza Accord and Louvre Accord]

Peter: You and I agree that the dollar is on the road to ruin, and we both have made some drastic forecasts about what the government might do in the face of the dollar collapse. How might this scenario play out in your view?

James: The dollar is not necessarily on the road to ruin, but that outcome does seem highly likely at the moment. There is still time to pull back from the brink, but it requires a specific set of policies: breaking up big banks, banning derivatives, raising interest rates to make the US a magnet for capital, cutting government spending, eliminating capital gains and corporate income taxes, going to a personal flat tax, and reducing regulation on job-creating businesses. However, the likelihood of these policies being put in place seems remote - so the dollar collapse scenario must be considered.

Few Americans are aware of the International Economic Emergency Powers Act (IEEPA)... it gives any US president dictatorial powers to freeze accounts, seize assets, nationalize banks, and take other radical steps to fight economic collapse in the name of national security. Given these powers, one could see a set of actions including seizure of the 6,000 tons of foreign gold stored at the Federal Reserve Bank of New York which, when combined with Washington's existing hoard of 8,000 tons, would leave the US as a gold superpower in a position to dictate the shape of the international monetary system going forward, as it did at Bretton Woods in 1944.

[my comment: the direction of current trends in policymaking is the destruction of the US dollar standard. The alternative would be the collapse of the banking system along with the welfare-warfare state. Policymakers are caught between the proverbial devil and the deep blue sea.]

Peter: You write in your book that it's possible that President Obama may call for a return to a pseudo-gold standard. That seems far-fetched to me. Why would a bunch of pro-inflation Keynesians in Washington voluntarily restrict their ability to print new money? Wouldn't such a program require the government to default on its bonds?

James: My forecast does not pertain specifically to President Obama, but to any president faced with economic catastrophe. I agree that a typically Keynesian administration will not go to the gold standard easily or willingly. I only suggest that they may have no choice but to go to a gold standard in the face of a complete collapse of confidence in the dollar. It would be a gold standard of last resort, at a much higher price - perhaps $7,000 per ounce or higher.

This is similar to what President Roosevelt did in 1933 when he outlawed private gold ownership but then proceeded to increase the price 75% in the middle of the worst sustained period of deflation in U.S. history.

[my comment: I don’t think current policymaking trends has entirely been about ideology, a substantial influence has been the preservation of the incumbent political institutions comprising of the welfare-warfare state, the politically privileged banking and the central banking system. True, the markets will eventually prevail over unsustainable systems]

Peter: You also write that you were asked by the Department of Defense to teach them to attack other countries using monetary policy. Do you believe there has a been an deliberate attempt to rack up as much public debt as possible - from the Chinese, in particular - and then strategically default through inflation?

James: I do not believe there has been a deliberate plot to rack up debt for the strategic purpose of default; however, something like that has resulted anyway.

Conventional wisdom is that China has the US over a barrel because it holds more than $2 trillion of US dollar-denominated debt, which it could dump at any time. In fact, the US has China over a barrel because it can freeze Chinese accounts in the face of any attempted dumping and substantially devalue the worth of the money we owe the Chinese. The Chinese themselves have been slow to realize this. In hindsight, their greatest blunder will turn out to be trusting the US to maintain the value of its currency.

[my comment: There are always two parties to a trade, if China would be “dumping” then there has to be a buyer. Question is who would be the buyer? If the world will join China in the US treasury dumping binge, then obviously the buyer of last resort would be the US Federal Reserve. If the US Federal Reserve does not assume such role, then there would be a freeze in the global banking system similar to 2008 or worst.

As to freezing of China’s account; that may happen after the US Federal Reserve consummates the transaction. This stage may not even be reached, unless the US will declare economic sanctions against China which would signify an indirect declaration of war.]

Peter: In your book, you lay out four possible results from the present currency war. Please briefly describe these and which one do you feel is most likely and why.

James: Yes, I lay out four scenarios, which I call "The Four Horsemen of the Dollar Apocalypse."

The first case is a world of multiple reserve currencies with the dollar being just one among several. This is the preferred solution of academics. I call it the "Kumbaya Solution" because it assumes all of the currencies will get along fine with each other. In fact, however, instead of one central bank behaving badly, we will have many.

The second case is world money in the form of Special Drawing Rights (SDRs). This is the preferred solution of global elites. The foundation for this has already been laid and the plumbing is already in place. The International Monetary Fund (IMF) would have its own printing press under the unaccountable control of the G20. This would reduce the dollar to the role of a local currency, as all important international transfers would be denominated in SDRs.

The third case is a return to the gold standard. This would have to be done at a much higher price to avoid the deflationary blunder of the 1920s, when nations returned to gold at an old parity that could not be sustained without massive deflation due to all of the money-printing in the meantime. I suggest a price of $7,000 per ounce for the new parity.

My final case is chaos and a resort to emergency economic powers. I consider this the most likely because of a combination of denial, delay, and wishful thinking on the part of the monetary elites.

[my comment:

I am less inclined to think of a global money (or second) scenario.

I think that the incumbent currency system may transform or morph into a regime of multipolar currencies and or with possible gold/silver participation.

Since I don’t believe that the world operates in a vacuum, even if a global hyperinflation does become a reality, people, communities, states or even governments will act to substitute a collapsing currency incredibly fast.

The currency crisis hasn’t happened, yet we seem to see signs of nations already taking steps towards self-insurance, partly by engaging in bilateral trade financed by the use of local currencies (Brazil-Argentina, China-Japan), and partly by increasing gold’s role in trade: Some US states have begun to promote the use of gold and silver coins also as insurance.

So the seeds to a transition of monetary standards are being sown]

Peter: What do you see as Washington's end-game for the present currency war? What is their best-case scenario?

James: Washington's best-case scenario is that banks gradually heal by making leveraged profits on the spreads between low-cost deposits and safe government bonds. These profits are then a cushion to absorb losses on bad assets and, eventually, the system becomes healthy again and can start the lending-and-spending game over again.

I view this as unlikely because the debts are so great, the time needed so long, and the deflationary forces so strong that the banks will not recover before the needed money-printing drives the system over a cliff - through a loss of confidence in the dollar and other paper currencies.

[my comment: debts are symptoms of prior government spending both from welfare-warfare state and rescues/bailouts of crisis affected institutions including governments]

Peter: I don't think this scenario is likely either, but say it were... would it be healthy for the American economy to have to carry all these zombie banks that depend on subsidies for survival? Wouldn't it be better to just let the toxic assets and toxic banks flush out of the system?

James: I agree completely. There's a model for this in the 1919-1920 depression, when the US government actually ran a balanced budget and the private sector was left to clean up the mess. The depression was over in 18 months and the US then set out on one of its strongest decades of growth ever. Today, in contrast, we have the government intervening everywhere, with the result that we should expect the current depression to last for years - possibly a decade.

[my comment: indeed]

Peter: How long do you think Currency War III will last?

James: History shows that Currency War I lasted 15 years and Currency War II lasted 20 years. There is no reason to believe that Currency War III will be brief. It's difficult to say, but it should last 5 years at least, possibly much longer.

[my comment: past performance may not guarantee future outcomes]

Peter: From my perspective, what is unique about a currency war is that the object is to inflict damage on yourself, and the country often described as the winner is actually the biggest loser, because they've devalued their currency the most. Which currency do you think will come out of this war the strongest?

James: I expect Europe and the euro will emerge the strongest after this currency war by doing the most to maintain the value of its currency while focusing on economic fundamentals, rather than quick fixes through devaluation. This is because the US and China are both currency manipulators out to reduce the value of their currencies. In the zero-sum world of currency wars, if the dollar and yuan are both down or flat, the euro must be going up. This is why the euro has not acted in accord with market expectations of its collapse.

The other reason the euro is strong and getting stronger is because it is backed by 10,000 tons of gold - even more than the US This is a source of strength for the euro.

[my comment:

I don’t think the ex post gold holding under current monetary system will significantly matter.

Some countries (like crisis affected Europe) may sell gold while others (such as emerging markets) may buy gold. So gold ownership will be in a state of continued flux.

The crux would revolve around the following issues

-control of debt build up from government spending

-allowing markets to clear

-what governments does with their gold holdings or will governments reform their currency system by eliminating policy induced bubble cycles? How?]

Peter: You and I both connect the Fed's dollar-printing with the recent revolutions in the Middle East. This is because our inflation is being exported overseas and driving up prices for food and fuel in third-world countries. What do you think will happen domestically when all this inflation comes home to roost?

James: The Fed will allow the inflation to grow in the US because it is the only way out of the non-payable debt.

Initially, American investors will be happy because the inflation will be accompanied by rising stock prices. However, over time, the capital-destroying nature of inflation will become apparent - and markets will collapse. This will look like a replay of the 1970s.

[my comment: the $64 trillion question is inflate against who? Every major central banks seem to be engaged in synchronous-coordinated inflation.]

Peter: How long do you think China's elites will put up with the Fed's inflationary agenda before they start dumping their US dollar assets?

James: The Chinese will never "dump" assets because this could cause the US to freeze their accounts. However, the Chinese will shorten the maturity structure of those assets to reduce volatility, diversify assets by reallocating new reserves towards euro and yen, increase their gold holdings, and engage in direct investment in hard assets such as mines, farmland, railroads, etc. All of these developments are happening now and the tempo will increase in future.

[my comment: Dumping isn’t going to happen unless there would be a buyer. See my earlier comment above]

Peter: In your view, what is the best way for investors to protect themselves from this crisis?

James: My recommended portfolio is 20% gold, 5% silver, 20% undeveloped land in prime locations with development potential, 15% fine art, and 40% cash. The cash is not a long-term position but does give an investor short-term wealth preservation and optionality to pivot into other asset classes when there is greater visibility.

[my comment:

I would adjust portfolio according to the evolving circumstances.

Taking a rigid stance under current heavily politicized conditions could bring about huge market risks. For example, if hyperinflation occurs which Mr. Rickards sees as a “more likely outcome at the moment”, then cash and bond holdings will evaporate]

Wednesday, February 01, 2012

Mercantilistic US Monetary Policies Has Political Implications

The conduct of ‘imperialist’ US foreign policies somewhat resembles US monetary policies: mercantilism channeled through currency wars.

Writes Professor Steve Hanke at the Financial Post, (bold emphasis mine)

The United States has a long history of waging currency wars in Asia. We all know the sad case of Japan. The U.S. claimed that unfair Japanese trading practices were behind the ballooning U.S. bilateral trade deficit.

To correct the so-called problem, the U.S. demanded that Japan adopt an ever-appreciating yen policy. The Japanese complied and the yen appreciated against the greenback, from 360 in 1971 to 80 in 1995 (and 77, today). But this didn’t close the U.S. trade deficit with Japan. Indeed, Japan’s contribution to the U.S. trade deficit reached almost 60% in 1991. And, if that wasn’t enough, the yen’s appreciation pushed Japan’s economy into a deflationary quagmire.

Today, the U.S. is playing the same blame game with China. And why not? After all, China’s contribution to the U.S. trade deficit has surged to 45%.

Above is the USDollar Japan Yen chart since 1970 (St. Louis Federal Reserve)

Yet in spite of the massive appreciation partly from US behests, Japan’s trade balance remained positive until last year (for the first time in 31 years; chart from the Economist)

Well, Professor Hanke points out that a currency war with China has had a precedent.

To appreciate just how dangerous currency wars can be, let’s lift a page from the U.S. government’s old currency war playbook. During his first term, President Franklin D. Roosevelt delivered on his Chinese currency stabilization “plan.” China’s yuan was pegged to the price of silver, and it was asserted that higher silver prices would benefit the Chinese by increasing their purchasing power. Congress granted the Roosevelt Administration the authority to buy silver in massive quantities. The administration pushed the price of silver up by 128% in the period between 1932 and 1935. As the dollar value of silver went up, so did the value of the yuan.

America’s “plan” worked like a charm, but it had consequences that Washington had not quite advertised. The rapid appreciation of the yuan threw China into the jaws of the Great Depression. Between 1932 and 1934, its gross domestic product fell by 26% and wholesale prices in the capital city, Nanjing, fell by 20%. China officially abandoned the silver standard on Nov. 3, 1935. This spelled the beginning of the end for Chiang Kai-shek’s Nationalist government.

Every political policy has designated winners and losers, which means that monetary policies too have political dimensions. And perhaps anytime the US government sees a serious contender to their economic tiara, their political-bureaucratic stewards intuitively resort to what seems as bullying or intimidation or “beggar thy neighbour” policies: currency war. [Brazil in 2010 raised the spectre of an escalation of a currency war or competitive devaluation.]

Yet such political stratagem of scapegoatism seems contrived to divert the attention of the average Americans from the policy mistakes committed by the US government (boom bust cycles, fast expanding welfare state, war on terror policies and etc…).

We can even fuse together monetary and US foreign policies—the EU’s recent sanction on Iran seems parceled into the US Federal Reserve’s bailout.

Also, the US has even been selling China as a military threat to advance US military’s exposure in Asia, simultaneously while the Obama administration has been criticizing China’s trade and currency policies. All these seem to be part of the psywar operative.

Never mind if the US seems on path towards internal policy induced decadence.

For what seems intended is the preservation of the status quo, or the entitlements of the entrenched patrons—the political class and their clients—the banking and military industrial complex—all at the expense of everyone else.

The philosophy of mercantilism or protectionism, once wrote Ludwig von Mises,is indeed a philosophy of war.

Monday, October 31, 2011

Competitive Devaluations: Japan Intervenes to Curb Yen gains for the Third Time this year

Japan intervened in the currency market today, to allegedly halt a rising yen. Today’s action is the third intervention this year.

From Bloomberg

The yen dropped by the most in three years against the dollar as Japan stepped into foreign-exchange markets to weaken the currency for the third time this year after its gains to a postwar record threatened exporters.

“I’ve repeatedly said that we’ll take bold action against speculative moves in the market,” Japanese Finance Minister Jun Azumi told reporters today in Tokyo after the government acted unilaterally. “I’ll continue to intervene until I am satisfied.”

The yen weakened against the more than 150 currencies that Bloomberg tracks as Azumi said that he ordered the intervention at 10:25 a.m. local time because “speculative moves” in the currency failed to reflect Japan’s economic fundamentals. Today’s drop reversed this month’s previous gain by the yen against the greenback, which came amid speculation the Federal Reserve may add to stimulus measures as the U.S. economic recovery stagnates.

Statements like this “I’ll continue to intervene until I am satisfied’” might mislead people to think that political authorities really have the power to control the markets.

It is true enough that their actions may have a momentary or short term impact.

That’s the yen headed lower following today’s intervention.

But from a one year perspective, the first two interventions eventually resulted to a HIGHER and NOT a lower yen (blue uptrend)! The initial intervention was in March 18 where the BoJ bought $1 billion and the second was in August 4, both interventions are marked by green ellipse.

Talk about hubris.

Nevertheless, the inflationism or competitive devaluations being undertaken by Japan has hardly been about exports—why prop up exporters when this sector account for only less than 15% of Japan’s GDP?

Instead, like her contemporaries, the devaluation has been meant to prop up Japan’s rapidly decaying debt laden political institutions of the welfare state-banking system-central banking.

Japan’s government has the largest share and has the biggest growth of Japan’s overall debt (McKinsey Quarterly)

And as the great Ludwig von Mises wrote

The devaluation, say its champions, reduces the burden of debts. This is certainly true. It favors debtors at the expense of creditors. In the eyes of those who still have not learned that under modern conditions the creditors must not be identified with the rich not the debtors with the poor, this is beneficial. The actual effect is that the indebted owners of real estate and farm land and the shareholders of indebted corporations reap gains at the expense of the majority of people whose savings are invested in bonds, debentures, savings-bank deposits, and insurance policies.

It is sad know how politicians misrepresent what they stand for and use class warfare or supposed underprivileged sectors to rationalize the imposition of what are truly designed as self preservation measures.

Put another way, the BoJ’s serial devaluations has actually been meant to illicitly transfer the resources of the average Japanese citizens to the political class and her banking system. Incidentally, the latter, like the Euro counterparts, has been under strain.

From Bloomberg (Topix Banks index)

Share prices of Japan's banks have slumped since 2007.

So much for blabbering about public interest. Devaluations are all about political greed.

Saturday, June 04, 2011

Serial Bailouts For Greece (and for PIIGS)

From the Bloomberg

European Union officials will focus on preparing a new aid package for Greece that includes a “voluntary” role for investors after the EU and International Monetary Fund approved the fifth installment of Greece’s 110 billion-euro ($161 billion) bailout.

“I expect the euro group to agree to additional financing to be provided to Greece under strict conditionality,” Luxembourg Prime Minister Jean-Claude Juncker said after meeting with Greek Prime Minister George Papandreou in Luxembourg yesterday. “This conditionality will include private-sector involvement on a voluntary basis.”

Papandreou agreed to 78 billion euros in additional austerity measures and asset sales through 2015 to secure the 12 billion euro bailout payment and meet conditions for receiving an additional rescue package. He agreed to make “significant” cuts in public-sector employment and establish an agency to manage accelerated asset sales, according to a statement released in Athens yesterday. The plan is fueling popular opposition and protests across Greece...

Under the original rescue, Greece was due to sell 27 billion euros of bonds next year. EU leaders and Papandreou have acknowledged that a return to markets won’t be possible with Greece’s 10-year debt yielding 16 percent, more than twice the level at the time of the bailout. The EU is looking to close that funding gap through new loans and bondholders’ willingness to roll over Greek debt, EU officials have said.

Europe’s financial leaders needed to hammer out a revised Greek package to persuade the IMF to pay its share of the 12 billion-euro tranche originally due in June. The IMF had indicated that it would withhold its 3.3 billion-euro piece unless the EU comes up with a plan to close Greece’s funding gap for 2012. The EU-IMF statement said the full payment would be made in early July. [all bold highlights mine]

These developments seem on the way to validate my views.

Mainstream has been ignoring the political role of the EU’s existence, the role of central bankers, the intertwined complex political relationships between the banking sector, the central banks and the national governments and the inherent ability of central banks to conduct bailouts by inflating the system.

If the US had QE [Quantitative Easing] 1.0, 2.0 and most likely a 3.0...until the QE nth, despite poker bluffing statements like this [Morningstar.com]

"The trade-offs are getting--are getting less attractive at this point. Inflation has gotten higher," Bernanke said. He cited the rising inflation expectations seen then and offered "it's not clear that we can get substantial improvements in payrolls without some additional inflation risk." He went on, "If we're going to have success in creating a long-run sustainable recovery with lots of job growth, we've got to keep inflation under control."

...or that the earlier consensus view that QE 3.0 is unlikely,

central bank watchers believe there is simply no appetite within the central bank to undertake such an effort, which some in markets are already referring to as QE3.

...QE 3.0 will be coming for the above reasons as earlier discussed.

The path dependence from previous actions of regulators and political leaders and the dominant ideological underpinnings which influence their actions combined with the framework of current network of political institutions are highly suggestive of the direction of such course of actions.

Importantly, the implicit priority to support the politically privileged industries as the banking system—which functions as the main intermediary that channels private sector funds to governments. Alternatively, this means policies has been designed to sustain the status quo for politicians and their allies.

Further, it would be misplaced to put alot of emphasis on political protestations by the public as measure to predict future policies.

Political leaders have learned the lessons of Egypt and Tunisia and have been applying organized violence as seen in Libya, in Yemen or in Syria.

It won’t be different for the political leaders of the developed world. As indications of their prospective actions against popular political pressure, even several protestors on US Memorial Day have suffered from police brutality from just “dancing”

In addition, sentiment can shift swiftly.

Recent soft patches in economic data, which I think has been part of the signaling channel maneuver, which has likewise began to affect markets, appear to be reversing previous sentiments which says that the Fed has “no appetite” for QE 3.0.

Again from Morningstar

Having received the strongest indication yet of a slowing economic recovery, traders of U.S. interest rate futures on Friday backed off on the notion that the Federal Reserve will start raising its short-term federal-funds rate during the first half of next year.

Finally, for those who say they are ‘massively’ short the Euro...

...it’s gonna be alot of pain for them.

So like the US, the above only reveals that the Eurozone crisis will mean that Greece and the PIIGS will experience bailouts after bailouts after bailouts. Thus, an implied currency war in the process until the unsustainable system of fiat money collapses or people awaken to the risk thereof and apply political discipline.

For now, the policy of bailouts and inflationism will continue to be the central feature of today’s global policy making process where currency values will be determined by the degree of relative inflationism applied.

Monday, January 17, 2011

US Dollar, Gold and Democracy

I find it odd or self-contradictory for a high profile investment expert[1] to claim that Eurozone bondholders should accept losses while declaring US muni bonds as a “buy”. In short, bearish Euro bullish USD. I view this more as an endowment bias where people place a higher value on objects they own than objects that they do not[2] (That’s because the expert is domiciled in the US).

It may true that state of the US muni bonds should be seen at the local level, but this should apply to the Eurozone too. In other words, prospective haircuts should apply to any nations/state where the cost to maintain debt levels can’t be economically sustained and where the policy of bailouts ceases to be part of the picture.

The cost to maintain debt levels can also be read as the willingness to pay, as Dr. Antony P. Mueller rightly commented[3],

``With debt it is as much the willingness to pay as it is the ability to pay. One could even say that the willingness to pay precedes de ability to pay.”

In addition, there is the tendency to ignore the role played by central banks. In as much as the US Federal Reserve can print money to conduct bailouts, so as with the Europeans through the ECB. So who prints more money will likewise impact on the relative economics of debt.

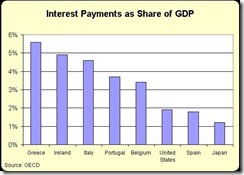

While it may be true that interest rates would impact the Eurozone more than the US (see figure 2), interest rate dynamics can swiftly change depending on either rate of change of inflation at the national level or on the public’s fluid perception of credit quality conditions.

Interest Payments as share of GDP[4]

Besides, both the US dollar and the Euro are fiat based money that are structurally flawed, as it is being shown today with a gamut of bailout policies left and right, targeted at rescuing the banking system and welfare nations/states in distress.

Thus, like all paper money subject to currency debasement and currency wars or competitive devaluation, that would make both like a race to the bottom.

So it’s a matter of which country (US or the Euro) would make more policy errors.

So even while I may be bullish the Euro over the US over the short-term, I wouldn’t recommend positioning on either one of them over the opportunity costs of holding other assets.

Why the USD or the Euro when there are others to choose from?

And many investors seem to share my view and vote with their money. According to analyst Doug Noland[5]

``The past year saw another $500 billion flee the U.S. money fund complex in search of higher yields. Tens of billions flooded into perceived low-risk bond and muni funds, while tens of billions more headed overseas. Meanwhile, money flowed into the hedge fund community, where assets and leverage are said to now approach pre-crisis levels. All of this amplifies systemic risk.”

So while it may hold the US dollar may rally, mostly as a result of a weakened Euro, I think this could be temporary.

Yet even as the USD should rally, we shouldn’t expect the same pattern of asset behaviour to occur as with the 2008 paradigm as some other experts seem to suggest.

It’s not true that a strong USD automatically translates to weakness in all other assets.

In 2005 the US dollar rallied alongside commodities and global equity markets. Thus, reference points can give divergent views and the view that a strong USD means automatic weakness in all others means anchoring to the 2008 post Lehman bankruptcy episode.

For me, it will always be a question of how authorities are likely to respond to any unfolding problems than simply projecting past or present conditions into the future.

For now, the auto response mechanism or path dependency by policymakers has been to engage in bailouts. Thus, in sustaining these policies means we should position for boom bust cycles, or at worst, insure ourselves from the prospects of a crack-up boom phenomenon (flight to commodities) since money is never neutral.

In a similar vein, it would seem to be impractical to be bearish on gold or precious metals for the same reasons.

And in growing recognition of these reckless monetary policies, in the US, lawmakers of some 10 states have reintroduced bills to recognize gold and silver as money[6].

Thus, it would misguided to suggest that democracy can’t be compatible with gold.

As Professor Tibor Machan points out[7]:

In a just society it is liberty that is primary – the entire point of law is to secure liberty for everyone, to make sure that the rights of individuals to their lives, liberty and pursuit of happiness is protected from any human agent bent on violating them. Democracy is but a byproduct of liberty

Thus if gold should represent liberty then democracy, as a byproduct of liberty, should blend well with gold as money.

And this may be zeitgeist of the current trend of gold prices

[1] Moneynews.com Pimco’s El-Erian: European Bond Investors Must Accept Losses, January 14, 2011

[2] Wikipedia.org, Endowment Effect

[3] Mueller, Antony P. Portuguese Bond Sale, cashandcurrencies.blogspot.com, January 12, 2011

[4] Mitchell J. Daniel Which Nation Will Be the Next European Debt Domino…or Will It Be the United States?, Cato.org, January 11, 2011

[5] Noland Doug Issues 2011 Credit Bubble Bulletin, PrudentBear.com, January 14, 2011

[6] TPMDC At Least 10 States Have Introduced Gold Coins-As-Currency Bills, January 5, 2011

[7] Machan Tibor R. Reexamining Democracy, January 4, 2011

Sunday, October 25, 2009

The Evils Of Devaluation

``The much talked about advantages which devaluation secures in foreign trade and tourism, are entirely due to the fact that the adjustment of domestic prices and wage rates to the state of affairs created by devaluation requires some time. As long as this adjustment process is not yet completed, exporting is encouraged and importing is discouraged. However, this merely means that in this interval the citizens of the devaluating country are getting less for what they are selling abroad and paying more for what they are buying abroad; concomitantly they must restrict their consumption. This effect may appear as a boon in the opinion of those for whom the balance of trade is the yardstick of a nation's welfare.”-Ludwig von Mises, The Objectives of Currency Devaluation, Human Action, Chapter 31

Policies can be said to be socially beneficial if gains exceed the costs.

By such measure we can say that devaluation, as seen by some as a necessary evil, is nothing but an illusion.

How? Because devaluation:

1. Undermines the role of the US dollar as international currency reserve.

The role of the US dollar as the world’s currency reserve is to provide the medium of exchange function not only for national use but for the global economy. This means that the main channel of providing liquidity for international exchange is to have strong (overvalued) currency that imports more than it exports. By expanding current account deficits, the US finances global transactions mostly invoiced in US dollars.

However once the US dollar reaches a point where deficits would be vented on the currency, the role of the US dollar as the sole international currency reserve may be in danger.

The global central bank holdings of US dollar have reportedly been down to about 62% from over 70% during the past years. Moreover, as discussed in What Global Financial Markets Seem To Be Telling Us, the clamor to replace the US dollar standard has been getting strident.

Last week, a Latin American trade bloc of 9 members, the Bolivarian Alternative for the Americas (ALBA) declared that it would cease using the US dollar for regional commerce next year (Chosun English).

All these means that if the US continues to devalue its dollar, to point of losing its privileges from international seignorage [net revenue derived from issuing currency], or its international currency reserve status, this would translate to diminished access to global finance to fund domestic (trade or fiscal) deficits, reduced access to more goods and services worldwide, and a diluted leverage on the geopolitical sphere.

In short, the cost of devaluation greatly overwhelms the alleged benefits.

2. Overestimates the role of international trade as the share of the US economy.

One of the mainstream reductio ad absurdum is to overemphasize or, on the other hand understate, the role of global trade in the US economy, depending on the bias of the commentator.

For instance, some deflation proponents use 13% of import share to the US economy as rationale to downplay the transmission mechanism of global inflation to the US economy.

Using the data from wikipedia.com, we note that exports account for only 9% ($1.283 2008) of the US economy ($14.441 trillion 2008) while imports account for 15% ($2.115 trillion). The point is international trade accounts only one fourth of the US economy.

Yet common sense tells us that policies that allegedly promote 9% (exports) of the US economy at the expense of 91%, which is deemed by some as being net beneficial to the economy, is deceiving oneself or is consumed by political or economic ideological blindness, or is totally ignorant of the tradeoffs of the cost and benefits from said policies or is extending the intoxicating influence of political propaganda.

3. Creates Systemic Inflation Which Overwhelms Advantages From Currency Depreciation

When governments decide to devalue, it embarks on credit expansion or conduct fiscal spending or other monetary tools or a combination of these policies, in support of special interest groups, as in the case of the US, the banking system (for media, the exporters) for a specific goal (debt repudiation or promotion of exports/tourism).

This in essence would lead to a redirection of investments or a diversion of real resources from other activities.

If the currency depreciates as a result of the government actions but the impact of which does not reflect on domestic prices, then the interest groups supported by such policies or those that engage in foreign currency exchange or trade will likely incur large profits.

However, once prices adjust to manifest the impact of the currency depreciation on imports and to producer and consumer goods, then the short term advantage erodes.

According to Dr. Frank Shostak, ``the so-called improved competitiveness on account of currency depreciation means that the citizens of a country are now getting less real imports for a given amount of real exports. In short, while the country is getting rich in terms of foreign currency, it is getting poor in terms of real wealth, i.e., in terms of the goods and services required for maintaining peoples' life and well-beings. As time goes by however, the effects of loose monetary policy filters through a broad spectrum of prices of goods and services and ultimately undermine exporters profits. In short, a rise in prices puts to an end the illusory attempt to create economic prosperity out of thin air.” (bold emphasis added)

In short, the beneficial impact of devaluation to certain groups will likely be short term and will eventually be offset by inflation.

4. Neglects The Role of Division Of Labor In Terms Of Imports and Exports

Adding to the fallaciously oversimplistic methodology by which mainstream seem to look at the world as operating from a homogeneous form of capital, whose product is produced by a single type of labor and sold as one dimensional product to an indiscriminate market affected by the same degree of price sensitivity, they also seem to think that exports have little correlation to imports, whereby final product sold abroad are all locally designed or processed- raw material sourcing, assembly, manufacturing, packaging, testing and etc...

The mainstream forgets about re-exports or imports of semi assembled products, parts or components that make up another product to be re-exported.

Applied to Asia, global parts and component trades have increasingly made up manufacturing output (see figure 3)

To quote the ADB, ``In Integrating Asia, the share of parts and components trade (PCT) in manufacturing trade shot up from 24.3% in 1996 to 29.4% in 2006. That is a remarkable rise, not least since worldwide its share has scarcely increased, edging up from 19.6% to 20.2% over the same period.

``As a share of GDP, PCT is among the highest in the world in the ASEAN (especially in Malaysia, the Philippines, Singapore, and Thailand) and in Taipei,China, perhaps because the relatively small size of their economies makes specializing in small niches of comparative advantage particularly important. Broadly speaking, the success of these economies is based on policies that welcome foreign companies, encourage technological upgrading, and build strong connections with world markets, as well as on their proximity to Asian neighbors following similar strategies. PCT is particularly significant among ASEAN countries: it rose from an average of 35% of manufacturing trade in 1996 to 43% in 2006. The PCT share in the PRC nearly doubled over the same period, from 12.5% to 24.0%, while in India it remained at around 10.0%.” (bold emphasis mine)

In short, in a world where the integration of the global economy has been deepening to reflect on the specialization or division of labor, imports has significantly contributed to manufactured products which are eventually re-exported. Such trade specialization constitutes as the lengthening of the economic structure.

As an example, the ADB shows how Asia’s parts and component trade (PCT) for a hard disk drive, assembled in Thailand, is networked within Asia and partly outside the region. And that’s merely for a hard disk, which also is only a component for a computer set.

So currency prices haven’t been the only factor that shapes production, but importantly trade openness, comparative advantages, division of labor and variability of markets as the ADB points out.

Here, globalization reveals that the division of labor and comparative advantage has been more than just “ideal” or “theoretical”. Instead, these economic forces depict of its pervasiveness in the global economic capital construct. They have even proven to be a more potent force than simply acquiring market share via currency price adjustments.

Talk about a genuine multiplier effect from free trade!

5. Overlooks On The Role of Societal Transition

One of the reasons why many support the government’s devaluation policies has been underpinned by concerns that US manufacturing output as a share of GDP has been declining.

The misimpression is that jobs have been exported out to third world countries.

Again, mainstream myopia which only looks at the surface sees jobs as one dimensional in nature. Their highly mechanistic viewpoint can’t seem to distinguish between low-scale low-value highly-commoditized jobs vis-à-vis high value specialized jobs or can’t seem to comprehend or digest the role of comparative advantage and specialization or division of labor in a world which practices globalization or freer trade.

The US supposedly is the premiere representative of the world’s democratic capitalism which implies that she has once been the world’s freest economy. Yet it is when an economy is economically free or open to trade that the advantages of comparative advantage and specialization can be seen and felt most.

For instance: in the 2008 capital goods accounted for the top US exports, according to US Department of Commerce, International Trade Administration, ``Capital goods represent the largest goods export category (end-use) for the U.S. with $469.5 billion worth of exports in 2008. The U.S. trade surplus in capital goods rose $12.8 billion to reach $15.7 billion in 2008, up from a surplus of $2.9 billion in 2007.”

On the other hand, top imports for 2008 crude oil, passenger cars, medicinal preparation, automotive accessories, other household goods, computer accessories, petroleum products, cotton apparel, telecom and video equipments (world’s richest countries). This means that aside from final consumption goods, the US imports parts and components for assembly or re-exports as well as raw materials.

The other way to look at this is that the US sells goods or services which reflect on its advance “technology age” state (capital goods) while buying input goods for reprocessing or commoditized goods for the end user.

Simply said, if the world has evolved from the agricultural era (agricultural economy) to the industrial era (manufacturing economy), then we are presently in a transition towards the information age or the post industrial society as identified by Alvin Toffler in his Third Wave Theory.

This means that the lengthening or expanding phase of an economy’s capital structure in an information age extrapolates to a bigger share of contribution from information and technology based goods and services relative to the overall economy.

As much as the share of output in agriculture shrank relative to the overall economy during the industrial era, today’s modern economy should see a smaller or declining contribution from the vestiges of the agricultural and the industrial output relative to economy.

Nevertheless, contrary to mainstream’s fanatical obduracy, US manufacturing in terms of productivity is at a record high (left window).

Moreover, while manufacturing jobs have been on a decline to reflect on productivity gains (right window), it is only during the last year’s recession where a drop of manufacturing output from record highs occurred. Still yet, all these, signify the advancement and not retrenchment of US manufacturing at the present state.

As University of Michigan’s Professor Mark Perry recently observed, ``More and more manufacturing output with fewer and fewer workers should be considered a positive trend for the U.S. economy, not a negative development. We should think of it the same way as the trend in farming over the last 150 years - we're much better off as a country, with a much higher standard of living, with 3% of Americans working on farms compared to 150 years ago when about 65% of Americans toiled on farms. If we can continue to produce more manufacturing output with fewer workers, we'll be better off as a country, not worse off.” (bold highlights mine)

So anyone who expects a return of the conditions of the industrial manufacturing age in today’s post industrial society simply suggest of the curtailment of progress or a throwback in time similar to Argentina in the 1930s or is against human progress.

And to adopt a protectionist economy combined with massive devaluation, which likewise signifies fear of competition, is a sure route towards decadence.

6. Promotes Capital Flight

Mainstream outlook seem to discern people as irresponsive to the incentives provided for by the governing circumstances. They haughtily presume of better intelligence than most of the society. While they could be somewhat correct, in terms of information (and not knowledge), we know that macro thinking is a poor substitute to the knowledge of F.A. Hayek’s “man-on-spot”.

This implies that when major policies which tend to have a momentous impact on society are undertaken, people consequently will respond in accordance to how such policies are transmitted into their respective fields or industries. In other words, in the marketplace a micro outlook is fundamentally superior than a presumptive model based macro analysis.

And devaluation policies would likely have an unintended effect: capital flight!

While there will be some sectors or interest groups that would benefit from a reconfiguration of investment flows, the alternative bet would be for capital to flow out of the country which have been engaged in policy devaluation and flow into assets of foreign currencies which have not or to real assets.

Economist David Malpass, a columnist at Forbes magazine, recently wrote an incisive article articulating how capital flight will subdue any tinge of benefits from devaluation.

Mr. Malpass wrote, ``Some weak-dollar advocates believe that American workers will eventually get cheap enough in foreign-currency terms to win manufacturing jobs back. In practice, however, capital outflows overwhelm the trade flows, causing more job losses than cheap real wages create. This was the lesson of the British malaise, the Carter malaise, the Mexican malaise of the 1990s, Yeltsin's Russian malaise through 1999 and the rest. No countries have devalued their way into prosperity, while many—Hong Kong, China, Australia today—have used stable money to invite capital and jobs. The more the dollar devalued against the yen in the 1970s and '80s, the more Japan gained share in valued-added manufacturing, using the capital from weak-currency countries to increase productivity. China is doing the same now. It watches in chagrin as the U.S. pleads with it to strengthen the yuan, adding productivity fast with the dollars rushing its way in search of currency stability” (bold emphasis mine)

Figure 6: Casey Research: Drumbeats For The US Dollar

Figure 6: Casey Research: Drumbeats For The US Dollar

Systemic inflation aggravated by capital flight is likely to overwhelm any purported gains from devaluation.

Currently, foreign flows into the US by both private and official sectors appear to be in a swan dive as the interest to own US securities have evaporated (see figure 6).

If capital flight from US residents and foreigners snowball into a tsunami, then the risks of exchange controls could be in the horizon.

This would be different from the recent capital controls imposed by Brazil, which uncannily slapped a 2% tax on foreign capital flows into fixed income and the stock market (Bloomberg). Such unorthodox move was meant to stem the tide of capital inflows where the Brazilian government deems the recent surge of the real and its stock market as indications of a seminal bubble.

Conventionally, capital controls are instituted to curb capital from stampeding out of a national economy or from the region.

Applied to the Asian financial crisis of 1997 which had been largely blamed by the domestic officialdom on speculative hedge funds, Joe Studwell in Asian Godfathers, Money and Power in Hong Kong and Southeast Asia argue that local tycoons were more culpable, ``An enquiry after the crisis found little evidence that hedge funds and other leverage investors played a significant role. There was widespread in the region of massive capital flight orchestrated by local tycoons; but Singaporean and Hong Kong banking secrecy is such that this is impossible to quantify.”

Exchange controls only serve to appropriate the properties of its constituents and of foreigners. By adopting a close door policy in finance and trade, the impact would be to dramatically increase the risk profile of a country. This should translate to a reduction of wealth via a markdown on assets as investors will pay less to own income flows or property or demand higher premium than where there is full convertibility of the currency.

The bottom line is present policies aimed at attenuating the US dollar risks not only capital flight from foreigners but also from local residents.

7. Raises The Risks Of Global Currency War

The perils of using models for prediction would be the assumption that conditions of the past have similar dynamics today. For instance, when Fed Chair Ben Bernanke used the Great Depression as paradigm for measuring the success of devaluation, he probably assumes that the US dollar today can devalue against other currencies without much resistance or would be cordially tolerated by other central bankers.

This would be highly presumptuous.

During the Great Depression, the US managed to devalue because it operated under a gold standard. President Franklin D. Roosevelt’s EO 6102 basically confiscated gold from every Americans in 1933 from which gold’s role as the public’s medium of exchange had been indefinitely suspended.

Since President Richard Nixon closed the Bretton Woods standard in 1971, otherwise known as the Nixon shock, the US dollar has assumed the role of gold as transaction currency for international exchange and as anchor reserve currency for global central banks.

Compared to gold based notes whose rate of issuance would depend on the rate of output from extracting gold from the ground, which is vastly limited due to the high cost and the attendant risks from mining, should the US decide to massively devalue, it could easily facilitate these using the Federal Reserve’s printing press or the technology enhanced digital press. Yet this would impact fundamentally all currencies, given its role as the world’s foreign reserve currency.

To consider according to wikipedia.org, 14 countries are unofficial users of the US dollar or has a dollarized economy. In addition, 23 countries are pegged to the US dollar. If the US dollar continues with its descent in response to the prevailing policy actions, then basically all 37 countries will be importing inflation from the US. Yet, their economies haven’t been afflicted by the same debt woes.

This may lead to a supply shock, where massive waves of money will be chasing after scarce supply of real goods or property.

Moreover, one can’t discount that the other central bankers may not be as cordial or as permissive as Ben Bernanke expects them to be and might attempt to counteract the US devaluation policies by arbitrarily conducting their own currency weakening process.

At the end of the day, if more and more government hops into the devaluation bandwagon then we could countenance a global currency war. And a global currency war risks a horrendous hyperinflation on a worldwide scale.

Ludwig von Mises has admonished us on the possibility of such risks, ``If one looks at devaluation not with the eyes of an apologist of government and union policies, but with the eyes of an economist, one must first of all stress the point that all its alleged blessings are temporary only. Moreover, they depend on the condition that only one country devalues while the other countries abstain from devaluing their own currencies. If the other countries devalue in the same proportion, no changes in foreign trade appear. If they devalue to a greater extent, all these transitory blessings, whatever they may be, favor them exclusively. A general acceptance of the principles of the flexible standard must therefore result in a race between the nations to outbid one another. At the end of this competition is the complete destruction of all nations' monetary systems.” (bold emphasis mine)

Devaluation is a risk endeavor which US policymakers appear likely to undertake (or in my view “gamble on”) in order to neutralize the impact from an unmanageable debt burden plaguing its system.

And this has been cheered upon by their exponents. Yet given the above, it would seem that policymakers and their cheerleaders don’t truly have the necessary understanding or comprehension of the risks involved or has vastly underestimated them.

Devaluation isn’t a necessary evil. Devaluation can take the form of the inflation demon, from which having emerged from the inferno, may wreak more systemic havoc than expected. After all, in the context of history, devaluations have been the seeds to the extinction of currencies. This time may not be different.