'Valid,' talking about the GDP measure, would be the question whether the GDP estimate is correct. Does it capture the real economy 100%? Now we know that a GDP measure of the U.S. economy, the Germany economy, the Norwegian economy, will never be correct. It will always be a little bit off. Some data–there will be some cheating, there will be some data which are questionable. But we know we are more or less within bounds, off a couple of percentage here and there. And so that would be the question of validity. As we’ve seen from recent events in Ghana, and also forthcoming events in Nigeria, the validity question is really huge in sub-Saharan Africa. We are talking about plus-minus 50 to 100% on GDP levels. This would maybe not be a problem if you were interested in change, as we were talking about: what one type of change has a causal effect on another, such as GDP, liberalization, and parity. The problem is if you have that the validity of the measure changes through time. So that would be if you equated this with your bathroom scale at home–it wouldn’t be such a big problem if your personal scale was off a pound or two, if you were basically just interested in measuring yourself on a weekly basis to see if you are gaining or losing. The problem that comes in is that of reliability, and that is if someone changes your scale in the middle of the night. And therefore you have a scale that shows an error in a different direction. And there you will have different problems talking about time series or changes over time. Another problem is that validity still remains with us even if the data was reliable, in that if you started comparing your own weight with that of the neighbor, who uses a different scale, then it would still be very different to determine who is the heaviest or lightest.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, January 08, 2013

Quote of the Day: GDP Measure Will Never Be Correct

Tuesday, August 14, 2012

Quote of the Day: Freedom and Wealth

To say that freedom creates prosperity is convenient shorthand.

To be more precise, freedom provides a conducive environment in which prosperity, the dynamic of wealth creation, can function.

What is this dynamic? Where does wealth come from? We ourselves are its creators. It is the nature of man to provide himself food and shelter, to improve his circumstances, to discover, to invent, to refine, and to expand.

When free to do so, he creates wealth, creates it again, and creates it anew.

The presence of petroleum was a nuisance to Pennsylvania farmers until in 1849 someone discovered how to refine kerosene. John D. Rockefeller’s fortune was begun in refining kerosene, although before long a man named Thomas Edison had invented a way to light homes that was superior, and Rockefeller’s business had to adjust.

The distribution of alternating current discovered by Nikola Tesla was commercially superior to the direct current Edison built his company on and Edison Electric was forced to adapt to the new improvement.

Wealth is created by the greatest resource of all: human beings. It is people who continually discover lesser resources and put them to use in new ways.

Look about at all the wealth people have created. Buildings and homes, schools and churches, stores and places of entertainment; leisure and literacy and libraries; heating and cooling systems; bright lives of bright lights, bright colors, and stunning clothing; marvels of electronics, digital magic, and the miracle of global communications; new medical techniques, devices, and medicines; high-speed travel and stores stocked full of food, much of it fresh from around the world.

A return to the path of prosperity does not lie in legislative prescriptions, new programs or new plans for what the state must do.

Our prosperity will not be restored by some new tax-cut proposal or new spending initiative; no laws will do it; no charming candidate.

Our problem transcends any mechanical solutions or reform package. We are beyond the ability to fix our problems with process tinkering.

As congressman Ron Paul has noted, “It’s not a budgetary problem. The budget is a symptom of this disease. Americans have to inquire into the nature of government itself.”

(italics original)

This is from Charles Goyette’s Red and Blue and Broke All Over as quoted by Dr. Martin Weiss at the moneyandmarkets.com

Saturday, August 11, 2012

Olympic Medals and Economic Health

The state of a nation’s economy seem to have a tight correlationship with the score of Olympic medals acquired.

As New York University’s William Easterly points out: (charts from Mr. Easterly too)

“what determines Olympic medals?” The answer is income per capita and population, or in other words total GDP.

But such correlationship may not be perfect.

Mr. Easterly notes of the outliers and of the lessons:

The big underachievers are (in order of underachievement) India, Mexico, Indonesia, Turkey, Saudi Arabia.

The big overachievers are Belarus, Ukraine, Kazakhstan, Romania, Iran, , and Jamaica.

The lessons seem to be:

(1) World Bank national development strategies in key emerging markets have failed miserably in the Olympics sector.

(2) a history of Communism may not have been so awesome for development and liberty, but it’s still amazing for Olympic medals.

(3) Islamist ideology is a mixed medal producer (Saudi Arabia no, Iran yes).

(4) if nothing else works, just run really fast.

Interesting.

Friday, April 13, 2012

Video: Economic Freedom is about Improving People's Lives

Sunday, January 15, 2012

I Told You Moment: Philippine Phisix At Historic Highs!

This is the fundamental problem with relying on macro-accounting tautologies; people often bring in causal arguments from economic theories without realizing they are doing so. Robert P. Murphy

The Philippine Phisix posted a blistering start for 2012, which also seems as a lucky initiation for me. That’s because the performance of the local composite benchmark has been realizing what I have been saying especially last December where I pounded the table on the likelihood of this occurrence.

Even better, the Philippine Phisix closed the week to take on the second spot as the best performer[1], based on nominal local currency, among global equity benchmarks (of 78 nations).

Where we had been told by an establishment analyst in a conference that the Phisix will NOT break into NEW highs unless the Euro crisis will get resolved, I argued otherwise.

As I wrote last December[2],

And even more, any hiatus from the perceived worsening of the EU crisis, which will likely be treated with the band-aid approach most likely emanating from massive ECB purchases and possibly from the US Federal Reserve, will likely lead to ASEAN bourses outperforming the region or the world.

This means that contra mechanical chartists and consistently wrong mainstream deflationists, my bet is for the Phisix to breach the August highs perhaps sometime within the first quarter of 2012. Again, all these are conditional or subject to the premise where global central banks will continue to unleash waves and waves of inflationism. Otherwise all bets are off.

Of course the other point is that charts patterns, as I previously noted, will not fulfill its gloomy portent which again validated my projections.

Charting theory says that long term patterns should have a stronger effect[3] than the short term, yet the 15 month bearish head and shoulder (blue arcs) has clearly been neutralized by the shorter 5 month reverse head and shoulder (red arcs).

In short, the limits of using chart patterns as an investing guide can clearly be observed in the above.

Breaking Out Amidst the Euro Crisis; Refuting Some Euro Crisis Bunk

The Phisix breakout DOES NOT come amidst the resolution of the Euro crisis.

Instead, as I have been repeatedly pointing out, aggressive ECB intervention will work to defer the impact of the crisis and give the pretext for the bulls and for the yield chasers to push up the markets.

Again as from the same article I wrote,

If global central bankers will inflate massively, far more than the market’s expectations from the adverse effects of the crisis then the answer should be a conditional “yes”.

This exactly is what has been happening as provided by the charts from Danske Bank[4],[5].

So far yields of Spain and Italy has positively responded to such ‘back door’ intervention[6] by the ECB, as debt auctions were reportedly oversubscribed as Euro banks took advantage of subsidized cheap loans from the ECB to acquire sovereign debt of Italy and Spain. Essentially the subsidized rates give EU banks breathing room to earn from the yield spreads and at the same time helps to finance government funding requirements.

Also, the above debunks the mainstream claims that Eurozone policy operates on a quasi “gold standard”. We won’t see monetary inflationism of such magnitude being conducted on a gold standard as this would result to capital flight or a massive outflow of gold reserves.

Writes Joseph Salerno[7],

Briefly, according to the Currency School, if commercial banks were permitted to issue bank notes via lending or investment operations in excess of the gold deposited with them this would increase the money supply and precipitate an inflationary boom. The resulting increase in domestic money prices and incomes would eventually cause a balance-of-payments deficit financed by an outflow of gold. This external drain of their gold reserves and the impending threat of internal drains due to domestic bank runs would then induce the banks to sharply restrict their loans and investments, resulting in a severe contraction of their uncovered notes or “fiduciary media” and a decline in the domestic money supply accompanied by economy-wide depression.

Also this refutes the masquerade about the alleged deleterious effects of austerity. There has hardly been a meaningful austerity (reduction of government expenditures or debt) taking place whether in Europe or the US.

This certainly has not the case in the US, where government debt has been replacing the deleveraging process being experienced by the private sector components as shown in the chart from PIMCO[8]

What has been happening instead in the Eurozone has been a transfer of resources mainly from the welfare state and the real economy into the highly politically privileged and protected banking sector and even to the arms or weapons industry (!), where the latter seems to be part of a quid pro quo agreement[9] with crisis affected PIIGS in return for bailouts.

And it is also absurd or simply false to claim that a dysfunctional banking system will aggravate current economic conditions in the Eurozone, which are premised on faulty assumptions that credit only drives growth.

Fact is, like Japan’s experience in the 1990s, as the bust phase deepened, credit supply flowed from the impaired banking system to the non-banking sector[10].

In Italy today, organized crime groups or the Mafia has taken over credit provision in many parts of their economy and was even reported as having assumed the “number 1 bank”[11]. So we seem to be seeing the same dynamics of having non-bank sectors taking over.

And this certainly has NOT been true with the US, where despite falling business loans, the US recession cycle ended in 2009. Credit conditions only bottomed out during the late 2010 way after the US economy have convalesced. Today, improving commercial and industrial loans seem to augmenting the current momentum fuelled by an inflationary boom.

Yet the mainstream gives us false choices premised on accounting tautologies premised on “400 years of accounting understanding”[12].

Try applying this to the stateless Somalia (or failed state as per media’s lingo) to see if such appeal to math and aggregates has been valid. Since there is no state (ergo government spending) such statistics becomes irrelevant. [Perhaps this could be the likely reason Somalia has been excluded in many statistics]

Yet the false dilemma being presented is that Europe’s policy option has been limited to a choice from the following: private sector leverage or public sector leverage or adjusting trade balances. The focus on accounting leads to a solution that requires MORE government intervention by acquiring MORE debt or by inflationism.

The fact is, what prompts for massive trade deficits and deficiencies in trade competitiveness has been brought about by the capital consumption effects of government spending and the boom bust cycles. Political, legal, bureaucratic and regulatory risks also contributes to the business environment uncertainties which put a shackle on entrepreneurship that drives competitiveness.

And proof to this assertion is that despite cheaper wages compared to their developed counterparts, as previously pointed out[13], the crisis affected PIIGS has been least competitive in terms of labor efficiency mainly due to bureaucratic and regulatory impediments. Most of the PIIGS rank nearly (except for Ireland) at the bottom relative to their counterparts in terms of Doing Business.

As for consumption effects of government spending let me quote the great Murray Rothbard[14], [italics original]

All government expenditure for resources is a form of consumption expenditure, in the sense that the money is spent on various items because the government officials so decree. The purchases may therefore be called the consumption expenditure of government officials. It is true that the officials do not consume the product directly, but their wish has altered the production pattern to make these goods, and therefore they may be called its “consumers.”

And boom bust policies likewise alters time preferences of consumers and producers that encourages consumption and misdirection of investments

Writes Professor Robert P. Murphy[15]

The low interest rates of the boom period mislead entrepreneurs into borrowing too much, but they also mislead consumers into borrowing too much and saving too little. This is physically possible because resources that otherwise would have gone into replenishing the capital structure are instead devoted to new projects or additional consumption goods.

Also the great Ludwig von Mises[16]

The essence of the credit-expansion boom is not overinvestment, but investment in wrong lines, i.e., malinvestment. The entrepreneurs employ the available supply of r + p1 + p2 as if they were in a position to employ a supply of r + p1 + p2 + p3 + p4. They embark upon an expansion of investment on a scale for which the capital goods available do not suffice. Their projects are unrealizable on account of the insufficient supply of capital goods. They must fail sooner or later. The unavoidable end of the credit expansion makes the faults committed visible. There are plants which cannot be utilized because the plants needed for the production of the complementary factories of production are lacking; plants the products of which cannot be sold because the consumers are more intent upon purchasing other goods which, however, are not produced in sufficient quantities; plants the construction of which cannot be continued and finished because it has become obvious that they will not pay.

In other words, what the mainstream cannot see as the principal cause of a society’s orientation towards consumption, hence the trade deficits, are government interventionism and the welfare state. The crisis affected Euro economies look as great examples of these policy induced imbalances.

And even worse is the reverential awe towards statistics as an accurate measure of the functioning economy, particularly via the GDP. Little do many understand that such spending biased statistics has been designed towards looking at the economy from the Keynesian perspective, and which in corollary, would lead to Keynesian policy prescriptions.

The fact is the GDP is a highly flawed metric.

Professor Bryan Caplan explains[17],

Gross Domestic Product is staunchly atheoretical. If someone spends money on X, X is GDP - even if "someone" is Congress, and X="a bridge to nowhere."

There are exceptions; most notably, the stats supposedly exclude "intermediate goods" to avoid double counting. I say "supposedly" because the list of "intermediate goods" is so inconsistent. Insofar as police protection and the military protect firms from harm, aren't the police and military intermediate goods? But despite these tensions, a big part of the philosophy of GDP is to eschew philosophical arguments about what's "really productive."

On reflection, though, the standard approach is anything but agnostic. Official stats tacitly make an extreme assumption: waste does not exist. Astrology counts, even though astrologers can't predict the future. Every penny of health care counts - regardless of its efficacy. The whole defense budget counts - even if it's provoking war rather than deterring it. Indeed, if two countries' militaries mutually annihilate, both countries count the cost as a benefit.

So the mainstream case has immensely been pockmarked by half-truths and by reading effects as the cause, all dedicated to the promotion of the status quo whose policies paradoxically constitutes the roots of the current crisis.

And more ironically is that their prescribed policies seem to signify as political insanity—doing the same actions and expecting different results—or as similar to engaging the mythical beast Lernaean Hydra[18] which Greek legendary hero Hercules fought as part of his second labor[19], where for each head that had been cut off from the hydra, two grows in replacement.

The crux of the matter is that current interventionist policies being applied by EU authorities have been contrived at bolstering asset prices in order to keep the balance sheets of the banking sector afloat, and in tandem, to ensure access to financing for the unsustainable welfare state.

So essentially, the tight interdependence of the banking sector and governments can be analogized as two drunks trying to prop each other up by consuming more alcohol which is continually being provided by the bartender (the ECB abetted by the FED).

And this has not been limited to the Eurozone. Mr. Ben Bernanke, the chairman of the US Federal Reserve, has reportedly been itching for QE 3.0, but this time, the Bernanke led FED appears to have changed tactic to focus on providing support to the mortgage industry[20] which may reduce political opposition than from the previous QE which concentrated on acquiring US treasuries.

Analyst and portfolio manager Doug Noland thinks the FED will make a go on a mortgage based QE3.0[21],

Fed is quite worried about Europe, global de-risking/de-leveraging, and the strengthened dollar. Especially if the euro faces additional selling pressure, the Fed will talk – and at some point implement- additional quantitative ease in hopes of dampening dollar bullish sentiment. With more Treasury purchases posing significant political risk, they’re cleverly building a case for buying MBS.

And I would add that since the mandated debt ceiling by the US congress has already been breached[22], there seems to be a big likelihood for another accord to hike the debt ceiling levels, of course after some vaudeville opposition acts.

This means that we should expect the US Federal Reserve to actively but perhaps indirectly facilitate the financing of these liabilities possibly through the banking system in exchange for the Fed’s buying of mortgages.

So the ECB and the FED will work to overcome political obstacles by resorting to legal loopholes. They who make the rules, break it.

The bottom line is that we will likely see intensification of central bank actions in 2012. Although I share the view that such conditions are unsustainable and represent as boom bust cycles, it is unclear that any unwinding will happen anytime soon.

As explained last week[23], interest rates will most likely determine the popping of this bubble where interest rates may be driven by any of the following dynamics, changes in: 1) inflation expectations 2) state of demand for credit relative to supply 3) perception of credit quality and or 4) of the scarcity/availability of capital.

And as interest rate levels remain benign, this should mean more upside for global equity markets including the Phisix perhaps until the end of the first quarter. It would be best to assess issues periodically and see how politicians respond to market developments.

The Permanence of Change Represents the Endgame

I might add that it is utter poppycock to talk about any grand finale or Mayan type Armageddon—usually heard from mainstream jeremiads—as outcomes for the current imbalances.

In reality, the ultimate outcome we should expect is the permanence of change.

For instance, the collision of the forces of decentralization with forces of the relics of the industrial era via 20th century political institutions, legal framework and current top-down policies and mindset will likely intensify and may increase social tensions that may lead to some upheavals. Because of the many entrenched groups, profound changes will not be seamless. But eventually people will adapt.

As for inflationism, these have signified as boom bust CYCLES throughout the ages, with the worst consequence leading to death and the eventual birth, or if not, drastic reforms of the monetary system or through defaults. But again people learn to live or move on.

We must realize that in over 200 years, despite 2 major world wars and the grand but botched wretched experiments of communism, aside from pandemics[24] (e.g. Swine Flu) which resulted to massive losses of human lives and large swath of property destructions, world living standards has remarkably spiked[25].

Internal Market Conditions Supports The Phisix’s Breakaway Run

As I wrote in my last major article on the stock market for 2011[26]

Any sustained rally in the Phisix which may come during the yearend or during the first quarter of 2012 will likely translate to a broad market rally.

The 2012 rally has largely been supported by substantial advances in market internals.

The weekly averaged advance decline-spread has decisively swung to the side of the bulls.

Average daily trades have also sprung higher. This means more participation (possibly from neophytes) or more churning from existing participants or both. The spike in the trading activities exhibits snowballing confidence.

This is where the recent breakout seems amiss though, while average daily volume has improved this has not been as extensive as the intensity of the breakout would suggest.

Finally foreigners appear to be more bullish as net foreign buying averaged on a weekly basis has been on the upside.

As I used to point out, once foreigners become bullish their tendency is to push up major Phisix components or the heavyweights (largest market caps which are most liquid). The consequence is to amplify the gains of the Phisix.

Such bullishness may have filtered into the Philippine Peso, which almost in line with the Phisix was unchanged in 2011, but eked out .8% gain for this week. The Peso was at 44.11 last week compared to this week’s close at 43.75 per US dollar.

Given the strong move by the Phisix which seems to have significantly outraced our neighbors, there is a possibility that interim profit taking would be the order of the coming sessions. Yet even if profit taking mode occurs, the likelihood would be rotational activities—where previous winners may take a recess while the laggards gain the market’s attention—than a broad based decline.

However in a bullmarket, overbought conditions usually may extend.

Overall, since the market is likely to move higher overtime, the short term bias is likely to reflect on a positive sentiment despite interim volatilities.

And for as long as markets remain politicized and highly dependent on actions of policymakers, our task is to monitor their activities and assess and project the possible impacts from such actions on the markets.

[1] See Global Equity Markets: Philippine Phisix Grabs Second Spot, January 14 2012

[2] See Can the Phisix rise Amidst the Euro Crisis? December 4, 2011

[3] Learntechnicaltrading.com Buying signals using trend lines

[4] Danske Bank FX Top Trades 2012 December 14, 2011

[5] Danske Bank Weekly Focus, January 13, 2012

[6] Reuters.com UPDATE 3-Yields fall sharply at Spanish, Italian debt sales, January 12, 2012

[7] Salerno Joseph T. Money and Gold in the 1920s and 1930s: An Austrian View, thefreemanonline.org

[8] Gross William H. Towards the Paranormal, January 2012

[9] See Greece Bailout: The Military Industry as Beneficiaries, January 12, 2012

[10] See Japan’s Lost Decade Wasn’t Due To Deflation But Stagnation From Massive Interventionism, July 6, 2010

[11] Reuters.com Mafia now "Italy's No.1 bank" as crisis bites: report, January 10, 2012

[12] Mauldin John The End of Europe? January 14, 2012 Goldseek.com

[13] See Euro Debt Crisis: The Confidence Fairy Tale and Devaluation Delusion, November 28. 2011

[14] Rothbard Murray N. 1. Introduction: Government Revenues and Expenditures Man, Economy & State Mises.org

[15] Murphy Robert P. Correcting Quiggin on Austrian Business-Cycle Theory, Mises.org

[16] Mises Ludwig von 6. The Gross Market Rate of Interest as Affected by Inflation and Credit Expansion, XX. INTEREST, CREDIT EXPANSION, AND THE TRADE CYCLE, Human Action Mises.org

[17] Caplan Bryan Real Real GDP, Library of Economics and Liberty, January 14, 2012

[18] Wikipedia.org Lernaean Hydra

[19] Wikipedia.org Labours of Hercules

[20] Bloomberg.com, Bernanke Doubles Down on Fed Mortgage Bet, January 11, 2012

[21] Noland Doug, The Year Of The Central Bank Credit Bubble Bulletin January 13, 2012 Prudent Bear.com

[22] See US Debt Ceiling Breached, President Obama to Seek Increase, January 12, 2012

[23] See What To Expect in 2012, January 9, 2012

[24] CNN.com Deadliest pandemics of the 20th century April 27, 2009

[25] See BBC’s Hans Rosling: 200 Years of Remarkable Progress and a Converging World, December 3, 2010

[26] See Phisix: Primed for an Upside Surprise, December 11, 2011

Tuesday, August 02, 2011

Russia’s Vladimir Putin Calls US a ‘Parasite’ Economy

From Reuters,

Russian Prime Minister Vladimir Putin accused the United States Monday of living beyond its means "like a parasite" on the global economy and said dollar dominance was a threat to the financial markets.

"They are living beyond their means and shifting a part of the weight of their problems to the world economy," Putin told the pro-Kremlin youth group Nashi while touring its lakeside summer camp some five hours drive north of Moscow.

"They are living like parasites off the global economy and their monopoly of the dollar," Putin said at the open-air meeting with admiring young Russians in what looked like early campaigning before parliamentary and presidential polls.

As the world’s largest economy that owns the de facto world reserve currency, the US has naturally been taking advantage of this seignorage privilege.

Nevertheless, having abused this position through Keynesian policy induced boom bust cycles and the constant bailouts of the cartelized ‘too big to fail’ banking system, the US dollar’s dominance has been in erosion.

Chart from Wikipedia.org

But Mr. Putin's rants seem to be diverting blame on his country’s woes to the US.

Russia’s autocratic political economy has hardly been a beacon of economic progress worthy of emulation.

chart from the Heritage Foundation

This implies that Mr. Putin holds no moral high ground. It would be like the envious ‘pot calling the kettle black’.

Saturday, July 30, 2011

Graphic: A Prospering World

From USAID (sourced from Professor Don Boudreaux's Cafe Hayek)

From USAID,

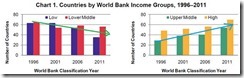

More interesting is the shift over the last two decades of countries out of the bottom two groups and into the top two groups (see Chart 1). The number of Low-income and Lower Middle-income countries, often referred to as ‘developing economies’, is clearly diminishing.

A further look at total population by World Bank Income Group shows that the majority of the world’s population in absolute poverty cannot possibly be in the Low income group. In fact they are in the two Middle income groups (see Table 3 and the ESDB’s Data by Sector: Poverty and Income Distribution).

Thanks to Globalization, the world is indeed getting richer.

Monday, June 13, 2011

Video: Cato and Fraser Institute on the Economic Freedom of The World Report

Friday, June 10, 2011

A Booming Anarcho-Capitalist City in India?

At the Mises Blog, Stephan Kinsella points to this fascinating article about a booming city in India.

Gurgaon appears to operate on a very unusual or unorthodox dynamic which the author calls as ‘dysfunctional’.

The New York Times, (bold emphasis mine)

With its shiny buildings and galloping economy, Gurgaon is often portrayed as a symbol of a rising "new" India, yet it also represents a riddle at the heart of India's rapid growth: how can a new city become an international economic engine without basic public services? How can a huge country flirt with double-digit growth despite widespread corruption, inefficiency and governmental dysfunction?

In Gurgaon and elsewhere in India, the answer is that growth usually occurs despite the government rather than because of it…

In Gurgaon, economic growth is often the product of a private sector improvising to overcome the inadequacies of the government.

To compensate for electricity blackouts, Gurgaon's companies and real estate developers operate massive diesel generators capable of powering small towns. No water? Drill private borewells. No public transportation? Companies employ hundreds of private buses and taxis. Worried about crime? Gurgaon has almost four times as many private security guards as police officers.

The article continues with the success story.

Today, Gurgaon is one of India's fastest-growing districts, having expanded more than 70 percent during the past decade to more than 1.5 million people, larger than most American cities. It accounts for almost half of all revenues for its state, Haryana, and added 50,000 vehicles to the roads last year alone. Real estate values have risen sharply in a city that has become a roaring engine of growth, if also a colossal headache as a place to live and work.

Before it had malls, a theme park and fancy housing compounds, Gurgaon had blue cows. Or so Kushal Pal Singh was told during the 1970s when he began describing his development vision for Gurgaon. It was a farming village whose name, derived from the Hindu epic the Mahabharata, means "village of the gurus." It also had wild animals, similar to cows, known for their strangely bluish tint.

"Most people told me I was mad," Mr. Singh recalled. "People said: 'Who is going to go there? There are blue cows roaming around.' "

And makes a comparison with the sibling city which has been managed by orthodox means…

Gurgaon was widely regarded as an economic wasteland. In 1979, the state of Haryana created Gurgaon by dividing a longstanding political district on the outskirts of New Delhi. One half would revolve around the city of Faridabad, which had an active municipal government, direct rail access to the capital, fertile farmland and a strong industrial base. The other half, Gurgaon, had rocky soil, no local government, no railway link and almost no industrial base.

As an economic competition, it seemed an unfair fight. And it has been: Gurgaon has won, easily. Faridabad has struggled to catch India's modernization wave, while Gurgaon's disadvantages turned out to be advantages, none more important, initially, than the absence of a districtwide government, which meant less red tape capable of choking development.

Gurgaon’s success comes amidst a seeming absence of central planning agencies…

Ordinarily, such a wild building boom would have had to hew to a local government master plan. But Gurgaon did not yet have such a plan, nor did it yet have a districtwide municipal government. Instead, Gurgaon was mostly under state control. Developers built the infrastructure inside their projects, while a state agency, the Haryana Urban Development Authority, or HUDA, was supposed to build the infrastructure binding together the city.

And that is where the problems arose. HUDA and other state agencies could not keep up with the pace of construction. The absence of a local government had helped Gurgaon become a leader of India's growth boom. But that absence had also created a dysfunctional city. No one was planning at a macro level; every developer pursued his own agenda as more islands sprouted and state agencies struggled to keep pace with growth.

Where public services have been delivered by the private sector…

Even at the fringes of Gurgaon's affluent areas, large pools of black sewage water are easy to spot. The water supply is vastly inadequate, leaving private companies, developers and residents dependent on borewells that are draining the underground aquifer. Local activists say the water table is falling as much as 10 feet every year.

Meanwhile, with Gurgaon's understaffed police force outmatched by such a rapidly growing population, some law-and-order responsibilities have been delegated to the private sector. Nearly 12,000 private security guards work in Gurgaon, and many are pressed into directing traffic on major streets.

Well the above somewhat or partly resembles a society which Austrians call as anarcho-capitalism, where

law enforcement, courts, and all other security services would be provided by voluntarily-funded competitors such as private defense agencies rather than through taxation, and money would be privately and competitively provided in an open market.

Gurgaon's development may not be perfect, but her unorthodox model seems to have vastly outclassed her politically oriented development models adapted by her peers.

Nevertheless Gurgaon’s experience isn’t about attaining perfection but about relative efficiencies.

It’s one development model which should be look at, learned from and possibly assimilated.

Wednesday, June 08, 2011

Socialism on its Way Out in Europe?

That’s what the Economist claims, (bold highlights mine)

TEN years ago almost half of the 27 countries that now make up the European Union, including Germany, Britain and Italy, were ruled by left-wing governments. Today, following the defeat of the ruling Socialists in Portugal's general election on June 5th, the left is in charge of just five: Spain, Greece, Austria, Slovenia and Cyprus. In Spain, by far the largest of these, polls suggest the Socialists will be removed from office at an election that must be held by next March. There are many theories for the left's weakness in Europe. One is simply that left-wing parties struggle when times are hard. Our chart shows the number of left-wing governments in the EU-27 countries over the past couple of decades against the annual GDP growth rate in the region. The growth figure is shown with a two-year lag, the hypothesis being that economic changes take time to have political effects. So the five left-wing governments this year are shown against the growth (or, in this case, contraction) figures for 2009.

Well if this true then this should be good news. This only goes to show that socialism has been and will always be a failed economic development model.

Although I think Europe's socialism has merely been replaced by crony capitalism or state capitalism as evidenced by the string of bailouts which is not exactly a good or promising development.

Besides, I’d add two more factors to what seems as fueling a structural decline of socialist leaderships: one is globalization and two is the internet. More people interacting with each other across the globe impels for the growth of forces of decentralization which goes against the rigid vertical structure of industrial era based governments.

Anyway, the next crisis will blow up both the balance sheets of the politically favored banking system and that of the governments’ (and this includes Central Banks). This will likely push political developments away from socialism, unless governments successfully enforce mass protectionism circa 1930s by shutting down the web and trade.

My guess is that people around the world are beginning to appreciate economic and political freedom more than what has been depicted by the mainstream.

Saturday, May 28, 2011

World Bank: Freedom and Liberty As Recipe To Prosperity!

The World Bank seems to have experienced an epiphany.

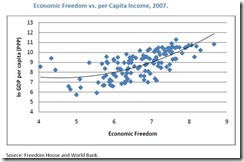

A recent research paper arrives at the conclusion that the formula to social prosperity are through Economic Freedom and Civil Liberties! [my earlier post here shows that economic freedom precedes civil liberties]

What makes this unusual is that the World Bank is a multilateral government agency. This means that the economics of classical liberalism and the politics of libertarianism has been gaining supporters even among government insiders.

Another way to see this is that some bureaucrats and politicians could be seeing the light of the delusions and failures of central planning.

Writes Jean-Pierre Chauffour (bold emphasis mine) [hat tip: Don Boudreaux]

Freedom and entitlement are largely two different paradigms to think about the fundamentals of economic development. Depending on the balance between free choices and more coerced decisions, individual opportunities to learn, own, work, save, invest, trade, protect, and so forth could vary greatly across countries and over time. The empirical findings in this paper suggest that fundamental freedoms are paramount to explain long term economic growth. For a given set of exogenous conditions, countries that favor free choice—economic freedom and civil and political liberties—over entitlement rights are likely to growth faster and achieve many of the distinctive proximate characteristics of success identified by the Growth Commission (2008): leadership and governance; engagement with the global economy; high rates of investment and savings; mobile resources, especially labor; and inclusiveness to share the benefits of globalization, provide access to the underserved, and deal with issues of gender inclusiveness. In contrast, pursuing entitlement rights through greater state coercion may be deceptive and even self-defeating in the long run.

Amen!

Tuesday, March 15, 2011

Despite The Disaster, Japan Reports Less Incidence Of Looting

Despite the horrible disaster, Professor William Easterly posits a very interesting observation and asks, why has there been no looting in Japan?

I quote Prof. Bill Easterly’s entire terse post... (bold highlight mine)

Amidst the heartbreaking devastation in Japan, many have noticed (especially this blog from the Telegraph) how much social solidarity — and little stealing — there has been. The Telegraph blogger Ed West notes vending machine owners giving out free drinks, in contrast to large-scale looting after Katrina.

Economists have been saying for a while that trust is a good candidate to be a major determinant of development. Think how much contract enforcement is critical to make trade and finance possible. Think how much easier contract enforcement is when nobody tries to cheat. This is supported by empirical studies correlating per capita income with a measure of trust, like that shown below, which is computed as …oh forget that, the current example is much more compelling.

Responding to tragedy, the Japanese have resources because they are rich, and it was their social solidarity that helped get them there.

While it may be argued that Japan’s homogenous society-a strong sense of group and national identity and little or no ethnic or racial diversity-could be attributed to such social cohesion, this idea of 'homogeneity' isn’t entirely true as such differences exists in Japan, like in all societies, as Harvard University professors Theodore Bestor (anthropology) and Helen Hardacre argues.

The economic development paradigm based on “Social solidarity that helped get them there” is perhaps what Henry Hazlitt explained in his The Foundations of Morality (quoted by Bettina Bien Greaves) as, (bold emphasis mine)

For each of us social cooperation is of course not the ultimate end but a means … But it is a means so central, so universal, so indispensable to the realization of practically all our other ends, that there is little harm in regarding it as an end in itself, and even in treating it as if it were the goal of ethics. In fact, precisely because none of us knows exactly what would give most satisfaction or happiness to others, the best test of our actions or rules of action is the extent to which they promote a social cooperation that best enables each of us to pursue his own ends.

Without social cooperation modern man could not achieve the barest fraction of the ends and satisfactions that he has achieved with it. The very subsistence of the immense majority of us depends upon it.

In short, a culture of (trust) social cooperation brought about by the interdependence of people founded on the division of labor, respect for private property and voluntary exchanges is what has mostly led to Japan's civil society that has greatly reduced the incidences of violence and theft even during bleak moments.

Saturday, January 29, 2011

Commodities And The Good Life

In a book review, the ever brilliant Matt Ridley narrates how commodities has contributed to economic progress and our good life.

An excerpt…

The discovery of the elements shadows and to some extent explains this evolving history of specialisation. The ancients knew of just seven metals: gold, silver, copper, tin, iron, lead and mercury. By giving each specialised roles, they improved their living standards—tin for hardening bronze, lead for moulding, silver for coinage and so on. By the modern era only one more metal—zinc—had joined them (although platinum was known to natives of the Americas). But then came a steady flow of new metals, each of which finds its particular role in technology and society: tungsten for hardness, aluminium for lightness, chrome for polish, neodymium for magnets, barium for medicine. Each finds its niche as surely as each profession and vocation does in human society. Just as our story is one of specialisation, so the story of chemistry is one of purification.

Each metal marches into our lives along a path from novel to banal, says Aldersey-Williams. Aluminium was once so difficult to make that Napoleon III used aluminium cutlery for only his most favoured guests and gave his son, the Prince Imperial, an aluminium rattle. Then it became so cheap that it was considered, well, cheap. Titanium, once rare and exotic, is becoming ubiquitous. For niobium and tantalum, Aldersey-Williams writes, “the journey is just beginning.” This is a tantalising thought. There are so many elements whose talents we have barely begun to use.