The price paid for each ounce of bullion is composed of the metal’s spot price and the bullion premium.Here’s the price composition of some common rounds:Silver Eagle: 80% spot price / 20% bullion premiumSilver Canadian Maple Leaf: 84% spot price / 16% bullion premiumGold Eagle: 96% spot price / 4% bullion premiumHow are these bullion premiums determined? How can bullion buyers take advantage of the lowest possible premiums?DIFFERENCE BETWEEN SPOT PRICES AND BULLION PREMIUMSSpot Price: The current price per ounce exchanged on global commodity markets.Bullion Premium: The additional price charged for a bullion product over its current spot price.The calculation for bullion premiums depends on five key factors:The current bullion market supply and demand factors.Local, national, and global economic conditions.The volume of bullion offered or bid upon.The type of bullion products being sold.The bullion seller’s objectives.BULLION SUPPLY AND DEMANDThe total amount of supply and demand of bullion is a major influence on bullion product premiums.Bullion dealers are businesses, and they are actively trying to balance product inventory and profitability. Too much inventory means high costs. Too little inventory means angry customers. Fluctuations in the gold and silver markets affect bullion market supply, and this impacts premium prices.For example, in the Western hemisphere during the summer, calmer price patterns mean the bullion supply tends to increase. Sellers mark down their prices to attract market share.During other months, silver and gold prices tend to have more volatility. This leads to increased buying and selling, and bullion sellers react accordingly. Some may mark up prices to prevent running out of inventory, or to capture profits.ECONOMIC CONDITIONSDepending on their size and significance, market events can affect bullion premiums local to global stages.Examples:In a small town with only one brick and mortar coin shop, the dealer may boost their premiums to guard against running out of inventory.In a country like Venezuela, where the local currency is losing value at an extreme rate, locals may opt to buy bullion to preserve their wealth. This means higher premiums.At a global level, in the event of a large crisis (similar to the 2008 Financial Crisis), it is likely premiums would increase significantly as demand spikes and options diminish.VOLUMES BEING SOLDEvery seller incurs costs on each transaction such as time, overhead, or payment processing costs. For a seller, a single transaction for 1 oz of gold may have similar transaction costs as a 1000 oz transaction.Therefore, transactions with higher volumes of bullion have their costs spread out. As a result, premiums tend to be higher on small volume purchases, and lower per oz on high volume buys.FORM OF BULLION FOR SALEAs a general rule, the larger the piece of bullion is, the less the premium costs are per oz.It costs a mint far less to make one 100 oz silver bar, vs. 100 rounds of 1 oz each.There is also typically a significant difference in premiums between government and private mints.For example the most popular bullion coins in the world are American Silver and Gold Eagle coins. The U.S. Mint charges a minimum of $2 oz over spot for each Silver Eagle coin and +3% over spot for each Gold Eagle coin they strike and sell to the world’s bullion dealer network.A private company like Sunshine Minting will sell their silver rounds and bars in bulk for less than ½ the premium most government mints will sell their products for.BULLION SELLER’S OBJECTIVESWhether the seller is a large bullion dealer or a private individual, they will almost always want to yield the highest ask price they can get for the bullion they are selling.That said, just because one wants to receive a large premium on the bullion they are selling, that doesn’t necessarily mean the market’s demand or willing buyers will comply.Dealers must consider these factors when setting premiums:Market share objectivesCompetitor strategiesPrice equilibrium strategyIf a dealer sets its price too high, buyers will likely choose to go to a lower priced competitor.If a dealer sets their price too low, they could end up selling out of inventory without garnering enough profit margin to pay for the company’s overhead costs.Dealers and sellers are both typically trying to find the price equilibrium “sweet spot” where the time required to complete a sale is minimized and the seller’s profit is maximized.This is more difficult than it sounds, as there can be thousands of factors at play when establishing the best possible premium to charge in line with one’s overall objectives.PRICE COMPOSITION FOR BULLION PRODUCTSWhen bullion markets are experiencing normal demand, about 80-95% of silver bullion’s price discovery is comprised of the current spot price.For gold, spot prices approximately comprise of 95-98% of gold bullion’s overall price discovery.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Friday, December 04, 2015

Infographics: How are Silver and Gold Bullion Premiums Calculated?

Friday, November 16, 2012

Substitution Effect: Many Indians Shift from Gold to Silver

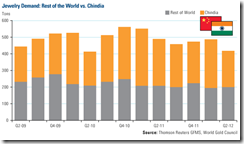

It is not just gold that caught the eye of Indian consumers celebrating Diwali. Brisk business in silver was also seen in select parts of the country.Given the high price of gold and the Indian government’s new regulation on buying gold and tax deductions at source, the sale of silver items at jewellery shops soared to a new high.

Saturday, October 13, 2012

Asia as the World’s Precious Metal Hub: Singapore Cuts Taxes on Gold as Hong Kong Adds Storage Facilities

Singapore has repealed a 7% tax on investment-grade gold and other precious metals to spur the development of gold trading in the country. It is hoped the move will lift demand for gold bars and coins in the fourth quarter and applies to gold of 99.5% purity, silver of 99.9% purity and platinum of 99% purity.While in the works for several months, the repeal came into effect on October 1.Singapore is hoping the scrapping of the tax will lure bullion refiners to the country and convince trading houses to open storage facilities, transforming it into a key Asian pricing hub. along the lines of London and Zurich. Currently holding 2% of global gold demand, the Southeast Asian city-state aims to hike that to 10% to 15% over the next five to 10 years.Currently, Singapore imports gold bars from Australia, Switzerland, Hong Kong and Japan, which are then sold to buyers in Southeast Asia and neighbouring India.Singapore's investment gold demand nearly tripled to 3.5 tonnes in 2011, according to consultancy firm GFMS. Singapore has already tripled gold imports year over year, ending December.At least one major refiner has already shown interest in opening a factory in Singapore. More gold traders are expected to set up offices and store more bullion, post the move.Gold scraps from the across the region are also traded in Singapore, which helps determine the premiums for gold bars against prices in London. Earlier, refiners were put off by Singapore's taxes, opting instead to mould and sell gold bars in Hong Kong, which does not impose duties on bullion, and Japan, where the consumption tax on gold was very low.

While the current world hubs for gold trading and storage are London, Zurich, and New York, stores of physical metal are also beginning to migrate east. Gold storage facilities are springing up all over Asia like mushrooms after a summer rain.Back in 2009, the Hong Kong Airport Authority set up the first secure gold storage facility inside the confines of the Hong Kong Airport.This September, Malca-Amit, the Tel Aviv-based diamonds and precious metals company is opening a second state of the art facility at the airport, which will have capacity for 1,000 metric tons of gold.That compares to the 4,582 tons that the US government claims is in Fort Knox, and the record 2,414 million tons that the world’s exchange traded gold funds collectively held – mostly in London– as of July 5th.Malca-Amit also has a facility in Singapore’s Freeport complex, and the company is planning a third Asian precious metals storage facility in Shanghai in the near future.

Saturday, October 06, 2012

Charles Goyette: Are the Central Bank Vaults Empty of Gold?

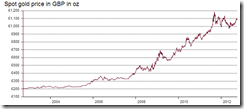

New mine supply of gold this year is estimated to be just under 2,700 tons. But gold demand, growing rapidly over the last 12 years, amounts to an additional 2,268 tons of new gold demand a year today that didn’t exist in 2000.That number was derived from the buying of just five sources: non-western central banks (Russia, Turkey, Kazakhstan, Ukraine and the Philippines), the mints of the U.S. and Canada, ETFs, and Chinese and Indian consumption.This increase in gold demand seems to actually understate the matter, since it doesn’t include huge private investment purchases of physical gold from around the world. For example, Sprott cites China’s Hong Kong gold imports, expected to reach 785 tons this year, as just one additional source of net investment that sees real total demand exceeding new mine supply.But the private investment demand amounts to much more than the Hong Kong gold imports he cites.Other substantial purchases of physical bullion include those by hedge funds and other institutions (the University of Texas endowment fund alone purchased and took delivery of $1 billion of physical gold in 2011), as well as purchases by Russian plutocrats and Persian Gulf petrocrats.The bull market in gold has, after all, been a global event.In short, Sprott concludes there is a big discrepancy between real physical gold demand (own any gold bars yourself? If so, they don’t show up in the demand numbers!) and the purported supply.Where Is All the Gold Coming from?Who is selling the gold that fills the gap between supply and fast-growing demand? Who is releasing physical gold to the market without it being reported, Sprott asks?"There is only one possible candidate: the Western central banks. It may very well be that a large portion of physical gold currently flowing to new buyers is actually coming from the Western central banks themselves. They are the only holders of physical gold who are capable of supplying gold in a quantity and manner that cannot be readily tracked …"Under current reporting guidelines, therefore, central banks are permitted to continue carrying the entry of physical gold on their balance sheet even if they’ve swapped it or lent it out entirely. You can see this in the way Western central banks refer to their gold reserves."The UK government, for example, refers to its gold allocation as, ‘Gold (including gold swapped or on loan).’ That’s the verbatim phrase they use in their official statement."Same goes for the U.S. Treasury and the ECB, which report their gold holdings as ‘Gold (including gold deposits and, if appropriate, gold swapped)’ and ‘Gold (including gold deposits and gold swapped),’ respectively."Unfortunately, that’s as far as their description goes, as each institution does not break down what percentage of their stated gold reserves are held in physical, versus what percentage has been loaned out or swapped for something else."The fact that they do not differentiate between the two is astounding."Loans? Swaps? Repurchase agreements? A house of cards by any other name would topple as fast.It is impossible to know exactly what shenanigans are afoot at the Federal Reserve. Have the gold reserves held by the Fed, the property of the American people, been loaned out? Have the banksters and other Fed cronies borrowed U.S. gold, sold it to China, and left an IOU in the Fed’s vaults?In an age rich with banking and other institutional, credit, and counterparty failures and frauds, such transactions are anything but prudent. Especially since whatever gold the Fed holds is not its property.In a one-time partial audit that the Federal Reserve resisted mightily, the Government Accounting Office found that from Dec. 1, 2007, through July 21, 2010, the Federal Reserve provided more than $16 trillion – a sum equal to America’s entire visible national debt – in secret loans to some of the world’s most politically powerful banks and companies.Among the major recipients of the windfall were Citigroup, Morgan Stanley, Merrill Lynch, Bank of America, Bear Stearns and Goldman Sachs. But the beneficiaries weren’t just American financial institutions.Central Banker to the World?At one point (in October 2008), 70% of Fed loans were to foreign banks. Foreign recipients of the windfall included powerful European banks: Barclays, Royal Bank of Scotland, Deutsche Bank, UBS, Credit Suisse and others.Among the disclosures the Fed was forced to make is that it extended 73 separate loans for an aggregate $35 billion to Arab Bank Corp., owned in substantial part by the Central Bank of Libya.The Fed is a hot bed of cronyism: The discount window, bond purchasing, its primary dealer system and pricing structure, currency and gold swaps and repurchase agreements, Open Market Committee operations, and so on.The light of a full and thorough audit is likely to find all kinds of cronies lurking in these dark corners of the Fed.And with the new, third round of quantitative easing under way, it may not be long before the money-printing game collapses entirely. At that point the calamity will compound if Americans turn to the vaults where the gold was purported to be, and find that the gold has long since been loaned out or otherwise cleaned out.

Tuesday, October 02, 2012

Charts: Gold versus Major Fiat Currencies

It must be emphasized that gold was not selected arbitrarily by governments to be the monetary standard. Gold had developed for many centuries on the free market as the best money; as the commodity providing the most stable and desirable monetary medium. Above all, the supply and provision of gold was subject only to market forces, and not to the arbitrary printing press of the government.

Saturday, August 25, 2012

Video: Peter Schiff takes on Gold Bear Chartist

Peter Schiff here staunchly defends the bullish case of gold based on fundamental long term perspective against a gold (short term) bear chartist. (hat tip: Bob Wenzel)

Charts or trend patterns are usually interpreted based on the underlying bias of the technician.

Moreover, the video wonderfully exhibits the stakeholder's dilemma at work-where the incentives to secure knowledge are driven by the degree of stakeholdings.

Such conspicuous nuances can be seen from the perspective of the institutional "analyst" who lack the meticulousness in her analysis of the gold market (because she don't have exposures on them) and of "equity holders" (as represented by Peter Schiff) who has direct stakeholding on gold.

The contrast of incentives frequently leads to the principal-agent problem or ethical dilemma. It is just in this case, the equity holder has been in command of the situation and is aware of the weakness of the analyst. In usual cases, it is the latter that influences the former.

Thursday, July 26, 2012

The Deepening Gold Markets of Asia: Hong Kong Opens New Gold Storage

Gold markets in Asia will get a huge boost from the opening of Hong Kong’s largest gold storage

From Bloomberg,

Hong Kong’s largest gold-storage facility, which can hold about 22 percent of the bullion now in Fort Knox, will open in September to meet rising demand from banks and the wealthy, according to owner Malca-Amit Global Ltd.

The facility, located on the ground floor of a building within the international airport compound, has capacity for 1,000 metric tons, said Joshua Rotbart, general manager for the Hong Kong-based company’s Malca-Amit Precious Metals unit. Two of the vaults may hold assets, including gold, for banks and financial institutions, and others will be used for diamonds, jewelry, fine art and precious metals, said Rotbart.

The move in Hong Kong reflects increased demand for gold in Asia even as the commodity struggles to sustain its rally into a 12th year. Gold-demand growth in China, the world’s second- largest user after India last year, is slowing, according to the World Gold Council. Vault charges will depend on each customer’s operations, according to Rotbart, who declined to give a figure for the venture’s cost beyond millions of dollars.

Reports attribute this to the growing wealth in Asia, from the same article…

Asia-Pacific millionaires outnumbered those in North America for the first time last year, according to Capgemini SA and Royal Bank of Canada’s wealth-management unit. The number of individuals in the region with at least $1 million in investable assets rose 1.6 percent to 3.37 million, helped by increases in China and Indonesia, according to the firms’ World Wealth Report, released last month. So-called high-net-worth individuals in North America dropped 1.1 percent to 3.35 million.

Gold markets in Asia will likely become more competitive, from the same article…

The new storage facility will compete with services offered by the Airport Authority Hong Kong, which began storage operations at a 340 square meter site in 2009 for government institutions, commodity exchanges, bullion banks, refiners, wealthy individuals and exchange-traded funds. Capacity is reviewed on a regular basis to ensure there is adequate storage over the medium term, the authority said in a statement.

Singapore’s Push

Singapore is also among economies in Asia vying for a greater share of the bullion trade. In February, the government announced a plan to exempt investment-grade gold, silver and platinum from a goods and services tax, starting from October. The aim is to raise the city-state’s share of the global gold trade to as much as 15 percent in five to 10 years from about 2 percent, according to IE Singapore, the external trade agency.

Competitive gold markets are signs of the burgeoning free markets in Asia.

Besides, gold has been embedded in the culture for many Asian nations (e.g. India, Vietnam, Malaysia, China, etc…), which I think is why the “gold as money” theme will be more receptive to Asians.

Yet this seems to exclude the Philippines, where much of the public still cling to the romanticized notion that the US dollar represents as THE ultimate currency—this seems tied to the popular social democratic mindset which gives mandate to the political economy of state (crony) capitalism.

I believe that the Asia’s blossoming gold market has been more than just about the showcase of wealth, but about gold as insurance…which essentially may pave way for gold to reclaim its role as money.

Perhaps this may signal that Asia may lead the world towards the restitution of sound money.

Thursday, February 23, 2012

Singapore: The Best Place to Own and Store Gold

The Sovereign Man’s Simon Black says that Singapore is the best place to secure ownership of physical gold

Mr. Black writes,

It’s official. Starting October 1, 2012, Singapore will be the best place in the world to store gold.

As a major international financial center, Singapore is rapidly becoming THE place to invest and do business in Asia. Why? Because it’s just so easy. Regulation is minimal, corruption is among the lowest in the world, and the tax structure is very friendly to businesses and investors. With one exception.

Traditionally, physical gold and silver purchases in Singapore have been taxed at a 7% GST rate (like VAT, or a national sales tax). The only legitimate exception was purchasing (and subsequently storing) at the Freeport facility, adjacent to the main airport.

In just-released budget documents, however, the government of Singapore announced that it will begin waiving GST on purchases of investment grade gold, silver, and other precious metals effective October 1st.

This is huge… and it should really make Singapore the best place in the world to buy and store gold. Prices are already incredibly competitive, with ultra-low premiums and very reasonable storage costs.

Thanks for the tip.