In this issue:

The RISK OFF Environment Has NOT Abated

-Summary and Conclusion

-Dead Cat Bounce or Bottom?

-China’s Deepening Economic Slump in the face of Political Indecision

-Continuing Political Deadlock over the Euro Debt Crisis

Summary and Conclusion

Like it or not, UNLESS there will be monumental moves from central bankers of major economies in the coming days, the global financial markets including the local Phisix will LIKELY endure more period of intense volatility on both directions but with a downside bias.

I am NOT saying that we are on an inflection phase in transit towards a bear market. Evidences have yet to establish such conditions, although I am NOT DISCOUNTING such eventuality given the current flow of developments.

What I am simply saying is that for as long as UNCERTAINTIES OVER MONETARY POLICIES AND POLITICAL ENVIRONMENTS PREVAIL, global equity markets will be sensitive to dramatic volatilities from an increasingly short term “RISK ON-RISK OFF” environment.

And where the RISK ON environment has been structurally reliant on central banking STEROIDS, ambiguities in political and monetary policy directions tilts the balance towards a RISK OFF environment.

Dead Cat Bounce or Bottom?

Following the bloodbath from the other week, I partially expected a strong reaction to the current oversold conditions.

Disappointingly, the response by global equity markets seems to have been muted and mixed, where the kernel of the gains can be seen from the US and European markets.

Meanwhile many key Asian markets continue to post losses.

Credit standings as measured by Credit default swap (CDS) prices have also been affected. Doug Noland of the Prudent Bear notes that South Korea’s CDS have been 22 bps so far this month, 23 bps in China, 56 bps in Indonesia, 25 bps in Malaysia, 24 bps in Thailand and 44 bps in the Philippines[1].

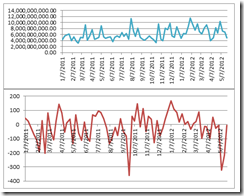

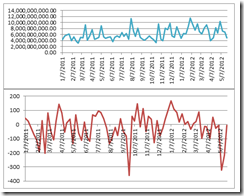

While the Phisix registered a weekly advance, the actions of the market breadth has not been impressive.

Last week’s rebound came amidst tapering volume (weekly average peso volume, upper window) as declining issues still remained slightly dominant over advancing issues (weekly averaged advance-decline ratio, lower window).

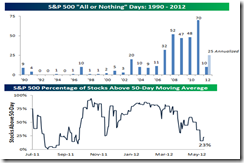

The same dynamic seem to operate in the US S&P 500.

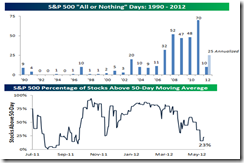

Even when all economic sectors contributed to the hefty 1.74% gain by the S&P over the week, broad market performance reveal that that most of stocks has been moving in tidal flows[2] and where the recent rebound seemed more like a reflexive recoil from severely oversold conditions[3].

Until we see substantial improvements in the market breath or market internals, last week’s market actions seem representative of a technical lingo known as Dead Cat Bounce[4]—a temporary recovery from a prolonged or intense decline.

China’s Deepening Economic Slump in the face of Political Indecision

Evidences seem to bolster my concerns over China’s economic slowdown (or possibly a bubble bust).

First, China’s factory orders posted a sharp drop last month[5], magnifying signs of a global economic slowdown. As the chart above from Danske Research shows, the Eurozone has been in rapid deceleration[6] which aggravates global economic position.

While the US economy continues to gain ground, the jury is out if the US will manage to weightlift her peers out of their current dire conditions.

On the other hand, the transmission effects from the marked slowdown in the Eurozone and China could likely drag the US or pose as significant headwind for the US economy.

Importantly, as previously pointed out[7], the US Federal Reserve remains reticent over the direction of monetary policies.

This vagueness in policy direction exacerbates or adds to the climate of uncertainty.

Next, China’s credit markets have suffered a deep contraction “for the first time in 7 years”[8].

Such credit contraction could signify revelations of the bursting of the China’s property bubble.

China’s currency, the yuan, represents a very important indicator of such event. As I pointed out last October 2011[9],

And contrary to public expectations, the unwinding of China’s bubble economy would lead to a depreciating yuan.

So far, the yuan’s recent depreciation against the US dollar appears to be the deepest since the past year, as shown by the above chart.

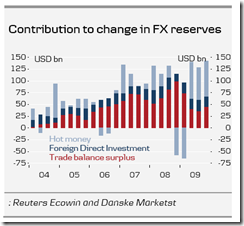

These may have accounted for hot money outflows. And “hot money” flows have functioned as significant driver of China’s asset markets, particularly the property markets.

In January of 2010[10] I quoted the Danske Research team on the context of the importance of hot money flows in fueling China’s property bubble. (bold emphasis mine)

…it underlines that despite China’s capital controls, capital flows has become more important and it has become more difficult for China to maintain an independent monetary policy, while simultaneously maintaining a quasi peg to USD.

And each time the yuan fell against the US dollar, the Shanghai Index staggered (see green ovals).

The Shanghai index (SSEC) has now been adrift at the crucial support level of the trend continuing pennant pattern formation. This means that should a breakdown of the SSEC occur in the coming sessions, we could see further downside pressures both on commodity markets and the yuan.

And this brings us to the third point on China’s seeming hastening economic slowdown, there have been increasing news where Chinese buyers of major commodities have been defaulting[11].

Since China represents the gorilla in the proverbial room for the global commodity markets, then slowing demand of commodities could be construed as added manifestations of China’s intensifying economic slowdown.

The Shanghai index and the major commodity benchmark have had tight correlations over the past year and a half.

This means that if this correlation should hold, and China’s economy goes into a deeper slump then commodity exporting countries, mostly emerging markets, will also be affected.

Not only will commodity producers and exporters be adversely impacted, a further risk would be a disruption in the globalization model of transnational supply chain networks[12]

So far the actions at the commodity markets and of major Asian equities appear to chime with the China slowdown theme.

But it would be misguided to fixate solely on China, as it would be imprudent to focus on the Euro crisis alone, since these plus many other factors conspire to produce the current environment[13]. There may be one or two outstanding momentary themes, but in a world where there are millions of spontaneously moving parts, to concentrate on one factor would be equivalent to resorting to heuristics.

Yet if there is any one source of social action that has the firepower to distort people’s aggregate activities, it would be through the channels of manipulation of money via inflationism.

As the great Professor Ludwig von Mises explained[14],

The social consequences of inflation are twofold: (1) the meaning of all deferred payments is altered to the advantage of the debtors and to the disadvantage of the creditors, or (2) the price changes do not occur simultaneously nor to the same extent for all individual commodities and services. Therefore, as long as the inflation has not exerted its full effects on prices and wages there are groups in the community which gain, and groups which lose. Those gain who are in a position to sell the goods and services they are offering at higher prices, while they are still paying the old low prices for the goods and services they are buying. On the other hand, those lose who have to pay higher prices, while still receiving lower prices for their own products and services. If, for instance, the government increases the quantity of money in order to pay for armaments, the entrepreneurs and workers of the munitions industries will be the first to realize inflationary gains. Other groups will suffer from the rising prices until the prices for their products and services go up as well. It is on this time-lag between the changes in the prices of various commodities and services that the import-discouraging and export-promoting effect of the lowering of the purchasing power of the domestic money is based.

So far what Chinese authorities have done has been to tepidly issue a pledge to bolster growth[15] (which many has deduced as signs of a forthcoming stimulus), as well as, plans to reduce the state’s stranglehold over the economy[16]. The latter should be terrific news and serves as increasing evidence of the growing political clout by entrepreneurs[17].

Two weeks ago, the People’s Bank of China cut the banking system’s reserve requirements[18]. Yet interest rates remain untouched.

There have been speculations that there may not be much support to expect from Chinese authorities until AFTER the national elections. The 18th National Congress of the Communist Party of China[19] will be held this October 2012 from where delegates will be chosen to pave way for the selection of the heads of states, particularly including the President, Premier, and State Council at the March 2013 12th National People’s Congress[20].

The bottom line is that should this be the case where there will not be material interventions, then economic uncertainty will be exacerbated by political uncertainty which increases the probability of further deterioration of China’s bubble economy.

Yet while the PBoC may likely engage in policies similar to her Western central bankers peers where inflationism has signified as an enshrined creed, it is unclear up to what degree the PBoC will be willing get exposed. That’s because China has made public her plans to make her currency, the yuan, compete with the US dollar as the world’s foreign currency reserve, which is why she has been taking steps to liberalize her capital markets[21] and China has also taken a direct bilateral financing trade route with Japan[22], which seems to have been designed as insurance against burgeoning currency risks and from the risks of trade dislocations from potential bank runs. It is important to point out that the US has some exposure on major European nations[23].

Further speculations and rumors have it that China covertly plans to even issue a Gold backed currency[24] as part of her quest to attain a foreign currency reserve status.

In short, the path towards foreign currency reserve status means having to embrace a deeper market economy (laissez faire capitalism) from which boom bust policies runs to the contrary.

Again, developments in China will MAINLY be hinged on the response by political authorities on the unfolding economic events.

Continuing Political Deadlock over the Euro Debt Crisis

In the Eurozone, it has obviously been a problem of political uncertainty.

The political impasse which has been prompting for an acceleration in the intra-region bank run, particularly in crisis affected nations of the PIIGS has NOT been out of fear of bank failures, but of out of concerns of massive devaluation from a severance of ties with the European Union. Obviously this has been the result of the populist anti-austerity sentiment.

The people’s nightmare has been in the realization that euros on their bank accounts would forcibly be converted into ‘drachmas’, ‘liras’, ‘escudos’ and ‘pesatas’ which extrapolates to massive losses relative to the euro and other currencies.

As Gavyn Davis at the Financial Times aptly points out[25]

First, the underlying fear of depositors in the periphery is not simply, or even mainly, one of bank failure. Instead, they probably fear the devaluation of their deposits relative to those in core economies if the euro should break up.

Therefore, the run is being caused by concerns about exchange rate risk, not necessarily by the fear of bank failure as such. This makes it much more complicated to deal with, since it is very difficult to offer guarantees against future exchange rate losses to today’s depositors. Germany would not want to stand behind such guarantees to Greek and Spanish citizens in the event of a euro break-up.

Such fear has not just been about exchange rate risks but likewise the inflation risks once devaluation from an exit route has been chosen.

So experts who peddle the elixir of devaluations are being exposed for their ideological quackery, as harsh reality reveals that people in these countries are having deep anxieties and apprehensions about being robbed of their savings, hence the capital flight.

People, thus, will seek the refuge in other currencies, or gold, not because this has been a “given” or part of the “intuition”, but because of the fear of the LOSS of PURCHASING POWER of the currency from which their savings has been denominated.

And add to the broadening regional risk has been ECB’s guarantees on intra-region capital flows, through the Target 2 program.

Again Mr. Davies

Second, the bank run is greatly increasing the scale of potential transfers between nation states which until recently have been disguised within the ECB balance sheet. As deposits are withdrawn from Greek banks, the ECB replaces these deposits with liquidity operations. If these are standard repo operations, such as those undertaken in the LTROs in December and February, then the ECB is directly assuming risks which the Greek private deposit holder is no longer willing to hold. If the liquidity is injected via Emergency Lending Assistance, then the Bank of Greece is theoretically assuming the risk, rather than the ECB as a whole. But in the event of a euro break-up, these losses would ultimately fall on the ECB itself.

Initially, the ECB aimed at converging interest rates (see chart above[26]) through inflationist policies. However the ensuing bust has led to the increasing use of emergency programs based on national measures particularly through the stealth Emergency Liquidity Assistance: ELA[27].

Thus the nationalisation of the regional markets gives credence to angst over the prospects of intense devaluations, from the risk exposures assumed by national central banks, once EU ties with crisis afflicted countries as Greece, have been abrogated.

Everyone seems focused on a “Greece exit”. Yet should an exit become reality, it is unclear if the Greece affair will be isolated. Thus the added uncertainty factor.

The fact is that “exit” and “default” represent two different things. What makes the public confused over the two has been the deceptive phraseology conducted as propaganda where Greece’s salvation comes with “devaluation”.

Instead, what the EU may do is to announce, according to Chicago Professor John Cochrane[28], that they will tolerate sovereign default, bank failures, and drastic cuts in government payments rather than breakup.

In reality, real reforms as liberalization of the labor markets and allowing markets to clear would have a significant impact on resolving the current crisis[29] than through the mirage of devaluation.

But the latter two measures, viz, tolerance for default and economic liberalization, seem hardly the steps politicians have been working on.

And that’s where another aspect of uncertainty lies.

And add to the potential flight to gold are the risks of forcibly converting accounts of EU citizens, even if they are located outside their home nations, into domestic currencies.

Since the ECB has the monitoring and identification capabilities over such intra-region transfers, it may not be farfetched that the ECB may consider passing some of its losses to account holders within the region, based on citizenship, which could be done by fiat.

Analyst James Turk explains through an analogy[30]

So let’s assume Nico transfers euros from his Greek bank to his bank account in Germany before the Grexit. Nico thinks his euros are now safe, but are they?

What if the Eurocrats in Brussels decide that Nico was “speculating” with the “hot money” he transferred to Germany? Even though Nico was simply acting prudently seeking what he thought was a safe-haven for his life savings, which were held in euros, the Eurocrats could easily make the claim he was speculating because he moved the money out of Greece, his home country.

So to put their words into action, the Eurocrats determine that coincident with the Grexit and re-launch of the drachma, all euros deposited in banks anywhere in Euroland by Greek nationals becomes a drachma deposit. Germany is saved because it no longer owes euros to Nico. But Nico’s life savings are not safe after all. And the same thing could happen to Juan, Paddy, Luigi and their countrymen in the PIIGS, if they think that moving their euros to Germany is safe.

All these add up to signify a problem of a festering system that has thrived on economically unsustainable redistributionist model.

There is no such thing as “credible guarantee” that will save the current system. Printing money or centralization via ‘fiscal union’ will NOT rescue or resurrect the system. All they do is to kick the can down the road. That’s because a parasitical relationship, which the EU framework has been, can only exist for as long as parasites don’t kill the host, or until the host develop ways of getting rid of or protecting themselves from parasite[31]. Thus we have both dynamics going against the EU.

People have to realize that the EU crisis has been ONGOING or CONTINUING development since 2008, yet conditions have been WORSENING despite all the intercessions.

As author and Professor Philipp Bagus rightly points out[32]

Similarly, there is the problem of TARGET2 claims and liabilities. If Germany had left the EMU in March 2012, the Bundesbank would have found TARGET2 claims denominated in euros of more than €616 billion on its balance sheet. If the euro depreciated against the new DM, important losses for the Bundesbank would result. As a consequence, the German government may have to recapitalize the Bundesbank. Take into account, however, that these losses would only acknowledge the risk and losses that the Bundesbank and the German treasury are facing within the EMU. This risk is rising every day the Bundesbank stays within the EMU.

If, in contrast, Greece leaves the EMU, it would be less problematic for the departing country. Greece would simply pay its credits to the ECB with the new drachmas, involving losses for the ECB. Depositors would move their accounts from Greek banks to German banks leading to TARGET2 claims for the Bundesbank. As the credit risk of the Bundesbank would keep increasing due to TARGET2 surpluses, the Bundesbank might well want to pull the plug on the euro itself (Brookes 1998).

Intellectual honesty requires us to admit that there are important costs to exiting the euro, such as legal problems or the disentangling of the ECB. However, these costs can be mitigated by reforms or clever handling. Some of the alleged costs are actually benefits from the point of liberty, such as political costs or liberating capital flows. Indeed, other costs may be seen as an opportunity, such as a banking crisis that is used to reform the financial system and finally put it on a sound basis. In any case, these costs have to be compared with the enormous benefits of exiting the system, consisting in the possible implosion of the Eurosystem. Exiting the euro implies ending being part of an inflationary, self-destructing monetary system with growing welfare states, falling competitiveness, bailouts, subsidies, transfers, moral hazard, conflicts between nations, centralization, and in general a loss of liberty.

In short, the easy answer to the current crisis will be to put one’s house in order: earn more than what one can spend. This represents a commonsensical and a pragmatist approach which does NOT require complex mathematical equations.

Unfortunately, when it comes to politics, ideas premised on the law of scarcity, opportunity costs and common sense have almost always been compromised and reduced to a thinking minority.

As for the financial markets, the risks of contagion from bank runs and of the prospects of losses from a Greece exit, has so far eclipsed the inflationism engaged by national central banks in Europe. As to the extent of the political pursuit of current dynamics, we can only observe through the price mechanism.

While I wouldn’t know precisely the scale of any potential contagion from anyone of the above risks, it’s hard to presume about immunity, UNTIL SOME CLARITY OVER POLICIES AND POLITICAL DEVELOPMENTS WILL SURFACE.

For now, all the abovementioned circumstances exhibit the current dominance of UNCERTAINTY. This means that the current conditions are likely aggravate or are conducive for the furtherance of the RISK OFF environment.

Again like it or not, reality tells us that we have to face the painful choice between taking more risk or wealth preservation.

[1] Noland Doug “Here Comes The Policy Response!” May 25, 2012 Credit Bubble Bulletin, The PrudentBear.com

[2] BespokeInvest.com All or Nothing Days on the Rise, May 24, 2012

[3] BespokeInvest.com Breadth Update on S&P 500 Sectors May 24, 2012

[4] Investopedia.com Dead Cat Bounce

[5] See Sharp Slowdown in China’s Factory Activity Amplifies the China Uncertainty Factor, May 24, 2012

[6] Danske Research Global: Waiting for the policy response, May 25, 2012

[7] See Risk ON Risk OFF is Synonym of The Boom Bust Cycle May 21, 2012

[8] See More Signs of Big Trouble in Big China as Loans Sharply Contract May 25, 2012

[9] See More Evidence of China’s Unraveling Bubble? October 16, 2011

[10] See China’s Attempt To Quash Its Homegrown Bubble, January 25, 2010

[11] See China’s Demand for Commodities Plummets as Buyers Default May 22, 2012

[12] See Black Swan Event: Has China’s Bubble Been Pricked? October 9, 2011

[13] See Is ASEAN Resilient from Euro Debt Woes? , May 25, 2012

[14] Mises, Ludwig von INTERVENTIONISM:AN ECONOMIC ANALYSIS p.36 Mises.org

[15] Bloomberg.com Wen Growth Pledge Spurs Speculation Of China Stimulus, May 21, 2012

[16] Bloomberg.com China To Smash ‘Glass Walls’ To Aid Investors, NDRC Says, May 24, 2012

[17] See China’s Coup Rumors: Signs of the Twilight of Centralized Government? March 22, 2012

[18] See China Cuts Reserve Requirement, May 14, 2012

[19] Wikipedia.org 18th National Congress of the Communist Party of China

[20] Wikipedia.org 12th National People's Congress

[21] See China Deepens Liberalization of Capital Markets April 4, 2012

[22] See China and Japan to Trade Currencies Directly May 27, 2012

[23] See US Banks are Exposed to the Euro Debt Crisis October 8, 2011

[24] Washington Blog Will China Make the Yuan a Gold-Backed Currency? May 22, 2012

[25] Davies Gavyn The anatomy of the eurozone bank run, May 20, 2012, Financial Times.com

[26] Spiegel Online Graphics Gallery: The Most Important Facts about the Global Debt Crisis August 15, 2011

[27] See ECB’s Stealth Mechanism to Bailout Banks: Emergency Liquidity Assistance (ELA), May 25, 2012

[28] Cochrane John H. Leaving the Euro May 23, 2012 The Grumpy Economist

[29] See Germany’s Competitive Advantage over Spain: Freer Labor Markets, May 25, 2012

[30] Turk James, Preparing for the “Grexit” May 23, 2012 FGMR.com

[31] NECSI.edu Parasitic Relationships

[32] Bagus Philipp Is There No Escape from the Euro? April 23, 2012 Mises.org