On November 17th, the long awaited Shanghai-Hong Kong Stock Connect launched, connecting Mainland China’s capital markets with Hong Kong in a way never seen before.Before the new investment channel link, individual investors could only participate indirectly in financial securities in the Mainland, such as specific funds and ETFs. The Shanghai-Hong Kong Stock Connect, however, now allows investors to trade securities in a range of listed stocks in each both markets through their respective securities companies. This helps to promote and strengthen the connection between the two markets.There is still a big disconnect between dual-listed companies traded in both Shanghai and Hong Kong. Some expected deeply discounted shares trading in Hong Kong to converge with their corresponding values on the Mainland. However, it is also true that shares are not directly fungible, which means that arbitrage is not possible.It is expected that the Shenzhen Exchange will follow suit in the future if the Stock Connect is deemed successful. With all three merged, it would create the 2nd largest exchange in the world with a market capitalization of $7.5 trillion. While not yet passing the NYSE in value, the combined exchange would be bigger than the NASDAQ which has a market capitalization of $7.3 trillion.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, December 10, 2014

Infographics: The Shanghai-Hong Kong Stock Connect

Wednesday, April 17, 2013

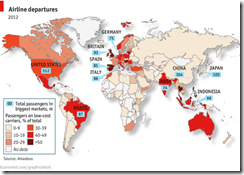

Philippine Economy: Airline Liberalization Yields Greatest Number of Cheap Travel

LOW-COST airlines like Ryanair and Southwest Airlines have swollen to formidable size in recent years by offering a very different approach to that of more traditional full-service airlines. With their single-class seating, range of ancillary charges and pared-down approach to all things aviation-related, these budget carriers have become a familiar, often bemoaned, feature of holidays and business trips around the globe. In British airports, for example, more than 50% of all passengers last year squeezed into seats on low-cost carriers. But Britain only comes seventh on a list ranking countries on that criterion. Figures released by Amadeus, a global travel distribution system, show that the Philippine aviation market has the greatest proportion of low-cost flyers. In that country of over 7,000 islands, 65% of all passengers used budget carriers last year. Cebu Pacific, the nation’s biggest low-cost operator, boasted over 46% of the domestic market. Among the smallest low-cost markets are Russia, Japan and China, where budget carriers accounted for just 5%, 4% and 1% of departures respectively. In China, the government keeps strict control of the airline industry and shields the three main state-controlled carriers (Air China, China Southern and China Eastern) from low-priced competition. Shanghai-based Spring Airlines, which launched in 2005, is the country's only low-cost carrier of any size.

Competition is the most promising means to achieve and to secure prosperity. It alone enables people in their role of consumer to gain from economic progress. It ensures that all advantages which result from higher productivity would eventually be enjoyed.

Friday, March 01, 2013

Mexico’s Trade Comeback Largely Due to Liberalization

The U.S. market has long been critical to Mexico—not only to its manufacturing sector, but to its overall economic strength. When Mexico signed the North American Free Trade Agreement (NAFTA) nearly two decades ago, the greater access it provided to the U.S. market was a boon to the country’s manufacturing base, whose share of the country’s GDP grew by almost 4 percentage points in the five years following the signing of the treaty. In turn, Mexico’s share of the U.S. manufactured goods import market increased from slightly above 7 percent in 1994 to nearly 13 percent in 2001.

Mexico’s manufacturing base has also been buttressed by the economy’s openness. Mexico’s trade agreement network is one of the world’s largest; it has free trade or preferential trade agreements with 44 countries and has shown a strong commitment to avoiding the use of trade restrictions and ensuring unrestricted access to markets and intermediate inputs to companies operating in Mexico. Moreover, Mexico has signed international standards and quality agreements that facilitate the participation of local manufacturing companies in global supply chains, particularly in the automotive and aerospace industries.A number of the factors that have contributed to Mexico’s increased competitiveness and its recovery of U.S. market share are likely to be long lasting—or structural, as economists say. These include the locational advantage, improved unit labor costs from enhanced manufacturing productivity and increased labor participation, and trade openness that appear to have underpinned Mexico’s improved competitiveness in the U.S. market in recent years.

Tuesday, January 08, 2013

Quote of the Day: GDP Measure Will Never Be Correct

'Valid,' talking about the GDP measure, would be the question whether the GDP estimate is correct. Does it capture the real economy 100%? Now we know that a GDP measure of the U.S. economy, the Germany economy, the Norwegian economy, will never be correct. It will always be a little bit off. Some data–there will be some cheating, there will be some data which are questionable. But we know we are more or less within bounds, off a couple of percentage here and there. And so that would be the question of validity. As we’ve seen from recent events in Ghana, and also forthcoming events in Nigeria, the validity question is really huge in sub-Saharan Africa. We are talking about plus-minus 50 to 100% on GDP levels. This would maybe not be a problem if you were interested in change, as we were talking about: what one type of change has a causal effect on another, such as GDP, liberalization, and parity. The problem is if you have that the validity of the measure changes through time. So that would be if you equated this with your bathroom scale at home–it wouldn’t be such a big problem if your personal scale was off a pound or two, if you were basically just interested in measuring yourself on a weekly basis to see if you are gaining or losing. The problem that comes in is that of reliability, and that is if someone changes your scale in the middle of the night. And therefore you have a scale that shows an error in a different direction. And there you will have different problems talking about time series or changes over time. Another problem is that validity still remains with us even if the data was reliable, in that if you started comparing your own weight with that of the neighbor, who uses a different scale, then it would still be very different to determine who is the heaviest or lightest.

Friday, October 26, 2012

Meet the Best ASEAN Economy in 2012: Booming Laos, Powered by Liberalization and the Informal Economy

To be sure, 8.3% growth isn’t exactly going to set investors’ hearts aflutter given that landlocked Laos has Southeast Asia’s smallest economy, and the opportunities for making money there are limited. Road and rail links are limited and the lack of a skilled labor makes Laos a tough bet for large manufacturing operations.But this year’s strong performance underscores the longer-term trend in a country that has consistently been one of Asia’s outperformers, including average growth of 7% a year over the past decade. Although nominally a Communist nation, Laos has liberalized its economy since the 1980s, and income levels have been rising.Much of the country’s growth these days is coming from mining, hydroelectric power and construction, all of which are relatively insulated from the turmoil in Europe and the related drop in export activity that has hurt some other Southeast Asian nations. Some economists fear Laos may be over-reliant on those sectors, despite their resilience this year.But Laos is expected to be accepted into the World Trade Organization on Friday, and over time that should help it attract more diverse drivers for the economy, including more of the manufacturing that has transformed other Southeast Asian nations. Leaders are especially hopeful Laos can lure some of the garment-factory investment that has helped create tens of thousands of jobs in nearby Cambodia.Either way, Laos is already seeing the impact of all the recent growth, with conspicuous consumption noticeably on the increase. Shiny new Cadillacs and Mercedes Benz cars – and even at least one Ferrari – are spotted on Vientiane’s streets. Sushi restaurants, boutique hotels and wine bars are proliferating.A. Barend Frielink, deputy country director for the Asian Development Bank in Vientiane, says he almost ran into a Bentley in town recently.“There is suddenly a lot of cash” in Laos, he said—so much so that economists don’t have a fully satisfactory explanation for all the spending. Partly it’s because Vientiane has undergone such a construction boom in recent years, with major projects to build new hotels and upgrade roads. Analysts have also pointed to gains from illicit drug trading and logging, though the economy has also earned a lot from its more legitimate sources of growth, including mining, that have helped spawn a larger consumer class.

Monday, July 23, 2012

Will North Korea Pursue Economic Liberalization?

This should signify as a wonderful development if this would materialize.

From Reuters,

Impoverished North Korea is gearing up to experiment with agricultural and economic reforms after young leader Kim Jong-un and his powerful uncle purged the country's top general for opposing change, a source with ties to both Pyongyang and Beijing said.

The source added that the cabinet had created a special bureau to take control of the decaying economy from the military, one of the world's largest, which under Kim's father was given pride of place in running the country.

The downfall of Vice Marshal Ri Yong-ho and his allies gives the untested new leader and his uncle Jang Song-thaek, who married into the Kim family dynasty and is widely seen as the real power behind the throne, the mandate to try to save the battered economy and prevent the secretive regime's collapse.

The source has correctly predicted events in the past, including North Korea's first nuclear test in 2006 days before it was conducted, as well as the ascension of Jang.

The changes could herald the most significant reforms by the North in decades. Previous attempts at a more market driven economy have floundered, most recently a drastic currency revaluation in late 2009 which triggered outrage and is widely believed to have resulted in the execution of its chief proponent.

"Ri Yong-ho was the most ardent supporter of Kim Jong-il's 'military first' policy," the source told Reuters, referring to Kim Jong-un's late father who plunged the North deeper into isolation over its nuclear ambitions, abject poverty and political repression.

The biggest problem was that he opposed the government taking over control of the economy from the military, the source said, requesting anonymity to avoid repercussions.

North Korea's state news agency KCNA had cited illness for the surprise decision to relieve Ri of all his posts, including the powerful role of vice chairman of the ruling party's Central Military Commission, though in recent video footage he had appeared in good health.

Ri was very close to Kim Jong-il and had been a leading figure in the military. Ri's father fought against the Japanese alongside Kim Jong-il's late father Kim Il-sung, who founded North Korea and is still revered as its eternal president.

The revelation by the source was an indication of a power struggle in the secretive state in which Kim Jong-un and Jang look to have further consolidated political and military power.

Kim Jong-un was named Marshal of the republic this week in a move that adds to his glittering array of titles and cements his position following the death of his father in December. He already heads the Workers' Party of Korea and is first chairman of the National Defence Commission.

Observe that despotic or totalitarian regimes, in realization of the futility of their centralized political institutions, have slowly been giving way to globalization.

However this runs in contrast to formerly free (developed) economies who seem to be progressively headed towards fascism if not despotism.

The opposite path of political directions represents the major force that will drive wealth convergence.

Wednesday, April 04, 2012

China Deepens Liberalization of Capital Markets

I have pointed out that the ongoing tensions in the political spectrum in China may have been ideologically based.

Entrepreneurs in China may have grown enough political clout enough to challenge to the degenerative command and control political structure of the old China order.

And it seems as if the forces of decentralization seem to be getting the upper hand, as China undertakes further liberalization of their capital markets.

From the Bloomberg,

China accelerated the opening of its capital markets by more than doubling the amount foreigners can invest in stocks, bonds and bank deposits as the government shifts its growth model to domestic consumption from exports.

The China Securities Regulatory Commission increased the quotas for qualified foreign institutional investors to $80 billion from $30 billion, according to a statement on its website yesterday. Offshore investors will also be allowed to pump an extra 50 billion yuan ($7.95 billion) of local currency into the country, up from 20 billion yuan

China, the world’s second-biggest economy, has pledged this year to free up control of the yuan and liberalize interest rates as the government deepens reforms to revive growth and offset slowing exports and a cooling housing market. China needs to rely more on markets and the private sector as its export- oriented model isn’t sustainable, World Bank President Robert Zoellick said in February.

Here’s more

The regulator had granted a total of $24.6 billion in quotas to 129 overseas companies since the program first started in 2003 through the end of March. About 75 percent of assets were invested in Chinese stocks, with the rest in bonds and deposits, according to the statement.

The CSRC accelerated the program last month, granting a record $2.1 billion of quotas to 15 companies. It was more than the $1.9 billion in 2011 as a whole.

“The QFII program enhances our experience of monitoring and regulating cross-board investment and capital flows,” the CSRC said in the statement. “It is a positive experiment to further open up the market and achieve the yuan convertibility under the capital account.”

Premier Wen Jiabao is seeking to attract international investment as economic growth cools, prompting the benchmark Shanghai Composite Index to slump 24 percent in the past year. The country posted its largest trade deficit since at least 1989 in February as Europe’s sovereign-debt turmoil damped exports.

China needs to break a banking “monopoly” of a few big lenders that makes easy profits, Wen told private company executives in Fujian province yesterday, as cited by China National Radio.

Breaking up a privileged banking monopoly essentially transfers resources to the productive sector which should serve China well, as well as, serves as welcome and enriching news for Asia and the rest of the world.

And by liberalization of their capital markets, China will become more integrated with the world, and thus diffusing risks of brinkmanship geopolitics, or the risks of military confrontations.

Again such development adds evidence to my theory that the Spratlys tensions may have just been about political leverage or about helping promote indirectly the US arms sales.

Nevertheless, China has yet to face the harmful unintended consequences of her past and present Keynesian bubble policies.

However the long term is key, or far more important. The kind of reforms matters most.

And reforms that deepen economic freedom or laissez faire capitalism (away from state capitalism) in China and the attendant development of capital markets could likely mean that the rest of Asia may follow suit. The implication is that regional and domestic capital will less likely be recycled to the West, and instead would find more productive use at home or a ‘home bias’ for Asian investors.

Moreover, the crumbling welfare states of the west would mean more capital flows into the Asia as savings seek refuge from sustained policies of inflationism.

All these should accentuate my wealth convergence theory.

Of course, China’s strategy to liberalize her capital markets may also represent a move to challenge the US dollar standard.

Recently BRICs officials slammed US and Euro’s monetary “tsunami” policies and in the process has been contemplating to put up their version of a World Bank—joint development bank.

While these gripes have been valid, the latter’s action has little substance. What the other ex-China BRICs should to do is to mimic China’s path to rapidly liberalize their economy and their capital markets.

That’s because societal integration functions as a natural force when commercial activities or economic freedom intensifies.

As the great Ludwig von Mises wrote about the social effects of the division of labor,

Social cooperation means the division of labor.

The various members, the various individuals, in a society do not live their own lives without any reference or connection with other individuals. Thanks to the division of labor, we are connected with others by working for them and by receiving and consuming what others have produced for us. As a result, we have an exchange economy which consists in the cooperation of many individuals. Everybody produces, not only for himself alone, but for other people in the expectation that these other people will produce for him. This system requires acts of exchange.

The peaceful cooperation, the peaceful achievements of men, are effected on the market. Cooperation necessarily means that people are exchanging services and goods, the products of services. These exchanges bring about the market. The market is precisely the freedom of people to produce, to consume, to determine what has to be produced, in whatever quantity, in whatever quality, and to whomever these products are to go. Such a free system without a market is impossible; such a free system is the market.

Friday, September 16, 2011

Will Burma Embrace a Market Economy?

Forbes Magazine’ Simon Montlake thinks so (bold highlights mine)

It usually pays to be bearish on Burma. But a flurry of initiatives by a new, semi-elected government has raised hopes of a fresh start. Since taking power in March, it has begun tackling barriers to economic growth, such as commodity import cartels and restrictive investment and labor laws. President Thein Sein, a retired general, has pledged to support local entrepreneurship and to attract foreign investors to special economic zones. He's also tapped independent thinkers as economic advisors and appointed businessmen as ministers. In much of Asia this would be mainstream politics. In Burma it's almost a Tea Party movement. Even the political standoff that has defined Burma on the world stage--the Lady versus the Generals--appears to have eased with a warm presidential reception on Aug. 19 for Aung San Suu Kyi, the opposition leader. "Things have moved surprisingly quickly," says a European diplomat. A veteran foreign aid worker concurs: "The political conversation has changed."

Burma's political history is strewn with false starts and reversals. The question on everyone's lips is whether this time is different. Skeptics say Thein Sein has yet to deliver on his reformist rhetoric and faces resistance from political hardliners and conservative bureaucrats, as well as rent-seeking tycoons who thrived under the dictatorship.

This uncertainty, as much as sanctions and boycotts, prevents many Western firms from taking the plunge, says Luc de Waegh, founder of West Indochina, a consultancy in Singapore. "The business environment isn't friendly to foreign investors yet. It's challenging to do business there," he says. Asian manufacturers have also been deterred by high costs for inputs and dilapidated infrastructure, despite a cheap labor pool. Only Burma's natural resources have attracted significant investment, led by China, though this has proven controversial.

Still, some Western executives are keen to size up a potential market of 54 million people with an estimated GDP of $43 billion. Tourist arrivals rose 23% in the first half of 2011, and not all were vacationers. "The big guys from the big companies are going there for tourism and business curiosity. It's like the last frontier," says De Waegh, who used to run British American Tobacco's Burma operations. Under political pressure at home, BAT exited in 2003.

While some will think that a seminal market economy for Burma will pose as threats to them, I think Burma’s possible conversion should be very positive, not only for Burma, but for ASEAN and for the world.

This means more business opportunities and access to a previously closed market that is not only resource rich but likewise has significant human capital and also fabulous recreational sites or vacation spots for potential tourists (like me).

A universal axiom is that de-politicization of any economy extrapolates to the empowerment of the masses through the markets, where the interests of the consumers should reign supreme than the interests of the political overlords.

As the great Ludwig von Mises once wrote,

The fundamental principle of capitalism is mass production to supply the masses. It is the patronage of the masses that makes enterprises grow into bigness. The common man is supreme in the market economy. He is the customer "who is always right

I hope Burma will indeed commence on the path of embracing a market economy.

Wednesday, May 18, 2011

The Wonderful Effects of Deflation in the Telecommunication Sector

Telecom fees continue to fall almost everywhere.

Notably, the largest decline can be seen in developing economies. Yet in spite of this, developed economies still maintain the lowest rates.

From the Economist,

DEVELOPING countries still pay far more for communications than developed countries as a proportion of overall income. But over the past two years these services have become more affordable worldwide, according to the ITU (International Telecommunication Union). The ITU’s ICT price basket combines the average cost of fixed-line telephones, mobile phones and fixed-line broadband internet services, calculated as a proportion of gross national income per person. (Broadband is not shown on the chart because in countries where it is still rare, its high cost swamps the chart and makes it difficult to read.) Africa made the biggest gains. Of the countries covered, seven countries had overall price-basket declines greater than 50%, mainly because of declines in fixed broadband. Mobile-phone charges are higher in developing countries in part because many customers pay for calls using pre-paid scratch cards rather than via monthly contracts which include large "buckets" of calling time for which the effective cost per minute is much lower.

Developed economies have the natural advantage of having lower rates primarily because of accumulated wealth (capital stock) and high productivity.

This also shows that an industry once thought as “natural monopoly” has proven to be a myth.

As Professor Thomas DiLorenzo writes,

The biggest myth of all in this regard is the notion that telephone service is a natural monopoly. Economists have taught generations of students that telephone service is a "classic" example of market failure and that government regulation in the "public interest" was necessary.

The ITU seems reticent on why costs have been falling. Their narratives have mainly focused on the developments of falling prices rather than the essence of what makes cost of telecom services decline.

Nevertheless I’ll quote the ITU in 2008,

Market liberalisation has played a key role in spreading mobile telephony by driving competition and bringing down prices.

Lastly, telecom fees signify as great examples of what we shouldn’t be afraid of—deflation.

On the contrary, basic economics in the telecom sector has worked magnificently...

...where falling prices (arising from market based competition) equates to greater volume. This has translated to mass adaption by the public. Worldwide, there are 69 mobile subscribers per 100 people and growing. Chart from Google Public Data

To quote ITU’s Secretary-General Dr Hamadoun Touré

With ICTs now a primary driver of social and economic development, these results are highly encouraging...Our next challenge is to find strategies to replicate the ‘mobile miracle’ for broadband, which is fast becoming basic infrastructure. Countries without affordable broadband access risk falling quickly behind.

Well, the answer to the desire for "mobile miracle" in broadband should be the same dynamics that has made the above circumstances possible—market liberalisation!