New-Keynesian models produce some stunning predictions of what happens in a "liquidity trap" when interest rates are stuck at zero. They predict a deep recession. They predict that promises work: "forward guidance," and commitments to keep interest rates low for long periods, with no current action, stimulate the current level of consumption. Fully-expected future inflation is a good thing. Growth is bad. Deliberate destruction of output, capital, and productivity raise GDP. Throw away the bulldozers, let them use shovels. Or, better, spoons. Hurricanes are good. Government spending, even if financed by current taxation, and even if completely wasted, of the digging ditches and filling them up type, can have huge output multipliers.Even more puzzling, new-Keynesian models predict that all of this gets worse as prices become more flexible. Thus, although price stickiness is the central friction keeping the economy from achieving its optimal output, policies that reduce price stickiness would make matters worse.In short, every law of economics seems to change sign at the zero bound. If gravity itself changed sign and we all started floating away, it would be no less surprising.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, September 21, 2013

Quote of the Day: On the New Keynesian Liquidity Trap: Every law of economics seems to change sign at the zero bound

Thursday, September 13, 2012

Many Americans Opt Out of the Banking System

Perhaps mostly as a result of bad credit ratings from lingering economic woes, many Americans have turned into alternative means to access credit financing.

The following report from the Washington Post,

In the aftermath of one of the worst recessions in history, more Americans have limited or no interaction with banks, instead relying on check cashers and payday lenders to manage their finances, according to a new federal report.

Not only are these Americans more vulnerable to high fees and interest rates, but they are also cut off from credit to buy a car or a home or pay for college, the report from the Federal Deposit Insurance Corp. said.

Released Wednesday, the study found that 821,000 households opted out of the banking system from 2009 to 2011 and that the so-called unbanked population grew to 8.2 percent of U.S. households.

That means that roughly 17 million adults are without a checking or savings account. Another 51 million adults have a bank account, but use pawnshops, payday lenders or rent-to-own services, the FDIC said. This underbanked population has grown from 18.2 percent to 20.1 percent of households nationwide.

The study also found that one in four households, or 28.3 percent, either had one or no bank account. A third of these households said they do not have enough money to open and fund an account. Minorities, the unemployed, young people and lower-income households are least likely to have accounts.

This serves as proof that despite the lack of access through the conventional banking system, substitutes will arise to replace them. Demand for credit has always been there. Such dynamic resonates with the post bubble bust era known as the Japan’s lost decade.

I may add that people opting out of the banking system may not at all be about bad credit ratings, they could also represent manifestations of an expanding informal economy in the US. Chart below from Bloomberg-Businessweek includes undocumented immigrant labor, home businesses, and freelancing that escape the attention of tax authorities.

Over the past decade, the informal economy has been gradually ascendant even for developed nations. Advancement in technology may have partly contributed to this.

Although the recession of 2001 (dot.com bust) and the attendant growth in regulations, welfare and ballooning bureaucracies may have been the other principal factors.

My guess is that the post-Lehman era, which highlights governments desperate to shore up their unsustainable fiscal conditions, may only intensify the expansion of the informal economies even in the developed world.

Add to this the growing concerns over the economic viability of the banking system and continued innovation in technology (e.g. P2P Lending, Crowd Sourcing and etc…), the traditional banking system will be faced with competition from non-traditional sources.

Thursday, October 27, 2011

No Liquidity Trap, US Economy Picks Up Steam

From the Wall Street Journal Blog (bold highlights mine)

U.S. businesses are unsure where the economy is headed, but that has not stopped them from going ahead with capital spending projects. The dichotomy echoes consumer behavior, which finds consumers feeling pessimistic but still shopping.

The big difference: unlike consumers who have seen little wage growth, the U.S. business sector has piles of money to buy new equipment, modernize plants and retrofit office space. Now they just need to add workers.

Shipments of non-defense capital goods excluding aircraft jumped at a healthy 16.7% last quarter. That was the largest gain in five quarters and suggests third-quarter gross domestic product growth was solid (GDP data will be released Thursday).

In addition, new orders for capex goods increased last quarter, meaning business investment will keep growing into 2012.

Company executives are approving spending plans, while at the same time growing more uncertain about the U.S. economy.

The third-quarter Manufacturing Barometer done by business consulting firm PwC shows a plunge in the percentage of U.S. manufacturers who feel good about the economy.

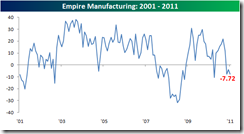

Kontra popular analysts whose incantations have been about an alleged liquidity trap that has been plaguing the US economy, the empirical data above disproves this highly fallacious but popular theory.

To add, signs of economic strength seems to defy the 'animal spirits'.

Instead, as what I have been saying, exploding money supply growth appear to be permeating into the US economy where the next possible risk could escalating inflation.

Gold prices appears to be signaling this, where a break above the 50-day moving averages would imply that the bull market in gold remains intact and would likely reaccelerate.

And if US consumer price inflation is to ramp up, then the attendant symptoms would be a recovery in the broader spectrum of commodity markets and the stock markets.

Nevertheless, we still need to see the feedback loop effects of the unfolding events in China and the Eurozone.

Sunday, October 02, 2011

Phisix-ASEAN Market Volatility: Politically Induced Boom Bust Cycles

It’s hard enough for politicians to face the music, to dispense bad news, to make hard choices, allocate pain to constituencies whether it’s spending cut or tax increase. But when the Fed destroys the bond market, which is the benchmark for the whole capital market, and tells the Congress that you can borrow money for two years at eighteen basis points, which is -- as far as Washington’s concerned -- that’s a rounding error. It’s the same as free. When you’re giving that kind of signal, then there is no incentive, there’s no motivation for people to walk the plank and face down this monster of a fiscal deficit and imbalance that we have. Washington thinks you can kick the can down the road, the debt is more or less free, and we’ll get around to solving the problem. But today, let’s not make any tough choices. That’s where we are. - David Stockman

It’s the Boom Bust Cycle, Stupid

Why would global markets fall in sync in September 22nd?

It would also seem myopic to suggest that this has been a byproduct of liquidity trap[1], where monetary stimulus—low interest rates and an increase in money supply—had been the cause of this.

The chart above of the ASEAN markets has been emblematic of what I have been repeatedly saying long ago—the message of which has been encapsulated from my earlier remarks[2] during the bear market embers of November 2008, (bold highlights original)

The other important matter is that of the understanding of the mutually reinforcing dynamics of inflation and deflation. Deflation and inflation is like assessing the virtues of right and wrong- an ex-post measure of a previous action taken. An action and an attendant reaction. Yet, you can’t have deflation when there have been no preceding inflation. At present times, the reason government has been massively inflating is because they have been attempting to combat perceived threats of equally intense debt deflation…

Thus, reading political tea leaves seem likely a better gauge in determining how to invest in the stock markets.

Since 2009, ASEAN markets had climbed on the back of the intensive inflationism employed by global central banks mostly led by the US Federal Reserve, through its zero bound rates and asset purchases or Quantitative Easing (see black arrow).

If this has been about a global liquidity trap then obviously there would have been no antecedent boom in ASEAN or global market equities during the stated period (2009-2010).

Yet during the past quarter where the Eurozone debt crisis has escalated, exacerbated by visible signs of an economic slowdown in the US and parts of the global economy, global financial markets has been strained.

Yet financial market expectations, whom have been deeply addicted towards bailout policies, have increasingly embedded expectations of another US Federal Reserve rescue.

Such expectation had not been realized.

The Liquidity Trap Canard

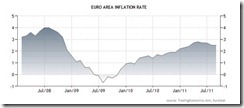

Before proceeding, it is important to point out that despite the current financial market turmoil, the Eurozone has not been suffering from ‘deflation’ as a result of lack of ‘aggregate demand’.

On the contrary, the EU has exhibited symptoms of stagflation[3].

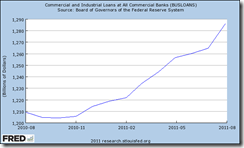

In the US, aside from exploding money supply, consumer and business loans have been materially improving.

5 year chart of Business Loans from St. Louis Federal Reserve

5 year chart of Consumer Loans from St. Louis Federal Reserve

Both charts depict that the current problem or market meltdown hasn’t been about liquidity traps.

Importantly consumer spending in the US has remained robust.

To quote Angel Martin [4]

real personal consumption expenditures have recovered from pre-recession levels. This recovery can be clearly seen in this graph, which shows quarterly data from the first quarter of 2006 to the second quarter of 2011.

So the recent downdraft seen in the financial markets has NOT been about liquidity traps, which has been fallaciously and deceptively peddled by some.

Politically Induced Monetary Paralysis

So what has been the market ruckus all about?

In a September speech prior to the Federal Open Meeting Committee[5] (FOMC) meeting, which decides on the setting of monetary policy, Federal Reserve chief Ben Bernanke hinted that he would consider the lengthening the duration of bond purchases and possibly include further Quantitative Easing as part of the measures to further ease credit conditions[6].

Apparently going into the FOMC meeting on September 22nd, opponents of Bernanke’s asset purchasing program mounted a publicity assault which included several Republican legislators[7], and most importantly, even Mr. Bernanke’s predecessor Mr. Paul Volker at the New York Times[8].

Even the outcome of the FOMC meeting, where Mr. Bernanke’s telegraphed policy of manipulating the yield curve via “Operation Twist” had been formalized or announced, the decision arrived at had not been unanimous and reflected internal political divisions.

Except for the inattentive or those blinded by bias, it has been obvious that only half of what had been impliedly promised by the Mr. Bernanke became a reality.

The net result has been a global financial market jilted by Mr. Bernanke[9].

Lately, even Federal Reserve of the Bank of Dallas President Richard Fisher acknowledged that their institution has been under siege “from both ends of the political spectrum”[10].

Such political impasse is not only seen in the US Federal Reserve, but also over fiscal policies in Washington, as well as, the schisms over prospective measures required to deal with debt crisis in the Eurozone. A good example has been the rebuff US Treasury Secretary Tim Geithner received from the German Finance Minister[11].

This has been coined by some as ‘political paralysis’ which continues to plague the markets[12].

As proof of politically driven markets, this week’s furious rally in global markets has been bolstered by renewed expectations of bailouts, as the German parliament overwhelmingly voted to beef up their contributions to the European Financial Stability Facility bailout fund. There are still 6 of the 17 euro zone countries[13] whom will need to pass the agreement reached in July 21st.

Rumors have also floated that IMF might expand her exposure towards Euro’s bailout to a whopping tune of $3.5 trillion[14], which means the world, including the Philippines, will be part of the rescue team to uphold and preserve the privileged status of Euro and US bankers as well as the Euro and US political class.

Yet all these seem to have helped market sentiment and partly reversed earlier losses.

The point of all of the above is to exhibit in essence, how global financial markets have been substantially dependent on policy steroids. In other words, markets have been mainly driven by politics than by economic forces or that the current state of financial markets has been highly politicized and whose price signals has been vastly distorted.

And most importantly, the latest financial market meltdown represents as convulsions over failed embedded expectations from the apparent withholding of the expansion of rescue programs from which the financial markets have been operating on.

To analogize, today’s jittery volatile markets are manifestations of what is usually called as ‘withdrawal syndromes’ or symptoms of distress or discomfort from a discontinuation of a frequented or regularized activity.

In addition, financial markets appear to be blasé on merely promises, and seem to be craving for concrete actions accompanied by “big package approach[15]” from global policymakers. In short, policymakers will have to positively surprise the markets with even larger dosages of bailouts.

Non-Recession Bear Markets

I would like to further point out that it is not a necessary condition where recessions presage bear markets.

While some global equity indices have broken into bear market territory[16], the US and ASEAN markets have not yet reached the 20% loss threshold levels enough to be classified as bear markets.

Bear markets occur mainly because of political actions that creates boom bust conditions. This has been the case of China and Bangladesh[17].

The US has also experienced TWO non-recession bear markets.

The first instance was in 1962 which was known as the Kennedy Slide[18] where the S&P fell 22.5%.

Ironically the Kennedy Slide coincided with the failed original experiment of Operation Twist in 1961, as Ben S. Bernanke, Vincent R. Reinhart, and Brian P. Sack wrote in a 2004 paper[19],

Operation Twist does not seem to provide strong evidence in either direction as to the possible effects of changes in the composition of the central bank’s balance sheet.

Except that the authors thought that the limits to the size had been responsible for this policy inadequacy, and Ben Bernanke today is conducting this experiment in a very large scale.

The Kennedy Slide’s boom phase appears to be triggered by the dramatic lowering of interest rates following the recession of 1960-61.

The bear market turned out to be short lived as the S & P 500 had fully recovered in a about a year later.

The second non-recession bear market is the notorious Black Monday Crash of October 1987.

The expansionary policies of the Plaza Accord[20] which represented coordinated moves by major developed economies to depreciate the US dollar, fuelled a boom bust cycle which eventually paved way for the lurid global one day crash.

As the great Murray N. Rothbard wrote[21],

To put it simply: the reason for the crash was the credit boom generated by the double-digit monetary expansion engineered by the Fed in the last several years. For a few years, as always happens in Phase I of an inflation, prices went up less than the monetary inflation. This, the typical euphoric phase of inflation, was the "Reagan miracle" of cheap and abundant money, accompanied by moderate price increases.

By 1986, the main factors that had offset the monetary inflation and kept prices relatively low (the unusually high dollar and the OPEC collapse) had worked their way through the price system and disappeared. The next inevitable step was the return and acceleration of price inflation; inflation rose from about 1% in 1986 to about 5 % in 1987.

As a result, with the market sensitive to and expecting eventual reacceleration of inflation, interest rates began to rise sharply in 1987. Once interest rates rose (which had little or nothing to do with the budget deficit), a stock market crash was inevitable. The previous stock market boom had been built on the shaky foundation of the low interest rates from 1982 on.

The crash had been a worldwide phenomenon according to the Wikipedia.org[22]

By the end of October, stock markets in Hong Kong had fallen 45.5%, Australia 41.8%, Spain 31%, the United Kingdom 26.45%, the United States 22.68%, and Canada 22.5%. New Zealand's market was hit especially hard, falling about 60% from its 1987 peak, and taking several years to recover. (The terms Black Monday and Black Tuesday are also applied to October 28 and 29, 1929, which occurred after Black Thursday on October 24, which started the Stock Market Crash of 1929. In Australia and New Zealand the 1987 crash is also referred to as Black Tuesday because of the timezone difference.) The Black Monday decline was the largest one-day percentage decline in the Dow Jones. (Saturday, December 12, 1914, is sometimes erroneously cited as the largest one-day percentage decline of the DJIA. In reality, the ostensible decline of 24.39% was created retroactively by a redefinition of the DJIA in 1916.)

Yet many experts had been misled by the false signal from the flash crash to predict a recession, again from the same Wikipedia article,

Following the stock market crash, a group of 33 eminent economists from various nations met in Washington, D.C. in December 1987, and collectively predicted that “the next few years could be the most troubled since the 1930s”. However, the DJIA was positive for the 1987 calendar year. It opened on January 2, 1987, at 1,897 points and would close on December 31, 1987, at 1,939 points. The DJIA did not regain its August 25, 1987 closing high of 2,722 points until almost two years later.

And in typical fashion, central banks intuitively reacted to crash by pumping mass amounts of liquidity into the system[23].

It took 2 years for the S&P to return to its pre-crash level.

The non-recession bear markets reveal that in the case of the US, such an occurrence would likely be shallow and the recovery could be swift.

But it would different story in China as the Chinese government continues to battle with the unintended effects of their policies which has spilled over to the real estate or property markets. Apparently, China’s tightening policy drove money away from the stock market, which continues to drift near at September 2009 lows, but shifted them into the real estate sector.

In short, like the crisis afflicted West, the current depressed state of China’s stock market signifies as an extension of the bubble bust saga which crested in October 2007, a year ahead of the Lehman episode. China’s cycle remains unresolved.

Should the US equity markets suffer from a technical bear market arising from the current stalemate in Federal Reserve policies, but for as long as a recession won’t transpire from the current market distress, then the downside may be mitigated.

So far, the risk for a US recession has not been that strong and convincing as shown by the above recovery in lending.

Conclusion: Navigating Turbulent Waters Prudently

And as I concluded two weeks ago[24],

I would certainly watch the US Federal Reserve’s announcement and the ensuing market response.

If team Bernake will commence on a third series of QE (dependent on the size) or a cut in the interest rate on excess reserves (IOER), I would be aggressively bullish with the equity markets, not because of conventional fundamentals, but because massive doses of money injections will have to flow somewhere. Equity markets—particulary in Asia and the commodity markets will likely be major beneficiaries.

As a caveat, with markets being sustained by policy steroids, expect sharp volatilities in both directions.

The point of the above was that my expectations had conditionally been aligned to the clues presented by Ben Bernanke of putting into action further bailouts which apparently did not occur.

And since Mr. Ben Bernanke appears to be politically constrained to institute his preferred policies, it is my impression that he would be holding the financial markets hostage until political opposition to his policies would diminish that should pave way for QE3.0. This means that the balance of risks, in my view, have now been tilted towards the downside unless proven otherwise.

Remember, it has been a dogma of his that the elixir to US economy emanates from asset value determined ‘wealth effect’ spending via the transmission mechanism which he calls the Financial Accelerator[25]

To quote the BCA Research[26],

But until QE3 is credibly articulated by Bernanke, there could be more downside for risky assets and further upside for the dollar.

And converse to my abovestated condition or premises, and because I practice what I preach, I materially decreased exposure in the local markets, as I await further guidance from the actions of policymakers.

Although I still maintain a bullish bias, in order to play safe, I would presume a worst case scenario—current global bear markets are signifying a recession—as the dominant forces in operation.

It’s easy to falsify the worst case scenario with incoming policy actions, data and unfolding market events.

Alternatively, this means that for as long as a non-recession scenario becomes evident then it would be easy to position incrementally, hopefully with limited downside risks.

In other words, for as long as there remains no clarity in the policy stance, I see heightened uncertainty as governing the markets. Thus I would need to see the blanc de l'oeil or the French idiom for seeing ‘the white of their eyes’ before taking my shots.

Bottom line: In the understanding that incumbent markets have been driven by politics, reading political tea leaves or the causal realist approach will remain as my principal fundamental analytical methodology in ascertaining my degree of market level risk-reward exposure.

[1] Wikipedia.org Liquidity trap

[2] See Stock Market Investing: Will Reading Political Tea Leaves Be A Better Gauge?, November 30, 2008

[3] See Stagflation, NOT DEFLATION, in the Eurozone, October 1, 2011

[4] Martin Angel The Stagnant U.S. Economy: A Graphical Complement to Higgs’s Contributions, Independent.org, September 23, 2011

[5] US Federal Reserve Federal Open Market Committee

[6] See US Mulls ‘official’ QE 3.0, Operation Twist AND Fiscal Stimulus, September 9, 2011

[7] Yahoo News Republican lawmakers warn Federal Reserve against action on economy, September 21, 2011

[8] See Paul Volker Swings at Ben Bernanke on Inflationism, September 20, 2011

[9] See Bernanke Jilts Markets on Steroids, Suffers Violent Withdrawal Symptoms, September 22, 2011

[10] Bloomberg.com Fisher Says Central Bank Is Under Attack From Ron Paul, Barney Frank, September 28, 2011

[11] See German Minister Calls Tim Geithner’s Bailout Plan ‘Stupid’, September 28, 2011

[12] New York Times, Stocks Decline a Day After Fed Sets Latest Stimulus Measure, September 23, 2011

[13] New York Times, Germany Approves Bailout Expansion, Leaving Slovakia as Main Hurdle, September 29, 2011

[14] See Will IMF’s bailout of Euro Reach $ 3.5 trillion? September 30, 2011

[15] Johnson Simon What Would It Take to Save Europe?, New York Times September 29, 2011

[16] Bloomberg.com Global Stocks Drop 20% Into Bear Market as Debt Crisis Outweighs Profits, September 23, 2011

[17] See Can Bear Markets happen outside a Recession? China’s Shanghai and Bangladesh’s Dhaka Indices October 1, 2011

[18] Wikipedia.org Kennedy Slide of 1962

[19]Bernanke Ben S., Reinhart Vincent R., and Sack Brian P. Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment, 2004 US Federal Reserve

[20] Wikipedia.org Plaza Accord

[21] Rothbard, Murray N. Nine Myths About The Crash, Making Economic Sense Mises.org

[22] Wikipedia.org Black Monday (1987)

[23] Lyons Gerard, Discovering if we learnt the lessons of Black Monday, thetimesonline.co.uk, October 19, 2009

[24] See Definitely Not a Reprise of 2008, Phisix-ASEAN Equities Still in Consolidation, September 18, 2011

[25] Bernanke Ben S. The Financial Accelerator and the Credit Channel, June 15, 2007 US Federal Reserve

[26] BCA Research U.S. Dollar: Waiting For More Policy Action, September 27, 2011

Saturday, October 01, 2011

Stagflation, NOT DEFLATION, in the Eurozone

Some Keynesian diehards reach a state of egotistical orgasm, when they see the financial markets crashing, accompanied by record low interest rates.

They extrapolate these selective events as having to prove their point that today’s environment has been enveloped by a deflation induced liquidity trap- or the economic conditions, which according to Wikipedia.org, when monetary policy is unable to stimulate an economy, either through lowering interest rates or increasing the money supply.

Let’s see how valid this is.

The Dow Jones Euro Stoxx 50 or an equity index representing 50 blue chip companies within the Eurozone is down by about 28% as of yesterday’s close from its peak in mid-February.

For the month of August, the Stoxx 50 fell by a dreadful 16%.

Yet according to the Bloomberg the Eurozone’s inflation has raced to the highest level in 3 years.

European inflation unexpectedly accelerated to the fastest in almost three years in September, complicating the European Central Bank’s task as it fights the region’s worsening sovereign-debt crisis.

The euro-area inflation rate jumped to 3 percent this month from 2.5 percent in August, the European Union’s statistics office in Luxembourg said today in an initial estimate. That’s the biggest annual increase in consumer prices since October 2008. Economists had projected inflation to hold at 2.5 percent, according to the median of 38 estimates in a Bloomberg survey.

Chart above and below from tradingeconomics.com

So low growth, high unemployment and elevated inflation in the Eurozone characterizes a stagflation climate and NOT deflation, in spite of the stock market meltdown.

While it is true given that commodity prices have crashed lately, which should temper on or affect consumer price inflation levels downwards, this is no guarantee that deflation in consumer prices will be reached. Perhaps not unless we see a nasty recession or another bout of a funding crunch. So far global central banks continue to apply patches in the fervid attempt to contain funding pressures.

Besides, contra-liquidity trap advocates, everything will depend on how monetary policies will be conducted in the face of unfolding events.

The ECB has actively been purchasing bonds (Danske Bank).

Yet despite these actions, the ECB has adapted a relatively less aggressive stance compared to the US in 2008. This implies that the policy response has continually lagged market expectations, and importantly, has been continually hobbled by political divisions, which has led to the ensuing turmoil.

This is not to say that aggressive responses by political authorities would solve the problem, but as in the US, they could serve as a balm. These are the “extend and pretend” actions that eventually will implode. For me, it’s better to have the painful market adjustments now, than increasingly built on systemic fragility which eventually would mean more pain.

Yet, despite current hurdles central bankers have not given up.

Denmark will unleash the same inflationism to bailout her banks. According to this report from Bloomberg,

Denmark’s central bank said it will provide as much as 400 billion kroner ($72.6 billion) as part of an extended collateral program to provide emergency liquidity to the country’s banks.

Lenders will also be able to borrow liquidity for six months, alongside the central bank’s existing seven-day facility, at a rate that tracks the benchmark lending rate, currently 1.55 percent, the bank said in a statement today.

The country’s lenders face a deepening crisis that threatens to stall a recovery in Scandinavia’s worst-performing economy. Two Danish bank failures this year triggered senior creditor losses, leaving international funding markets closed to all but the largest banks. Lawmaker efforts to spur a wave of consolidation and help banks sidestep Denmark’s bail-in rules have so far failed.

For as long as central bankers fight to preserve the political status quo by using expansionary credit easing tools or inflationism, deflation remains a less likely outcome.

Friday, September 16, 2011

US in a Deflationary Environment, NOT! (In Charts)

The mainstream meme has been about the US economy being embroiled in a ‘liquidity trap’, therefore enduring a deflationary environment.

There have been many signs that the US economy seems flagging of late. (The following 2 wonderful charts from Bespoke Invest)

But there hardly seem signs of deflation with money aggregates skyrocketing (charts from St. Louis Fed)

M2…

MZM…

And credit environment has been conspicuously improving too.

For businesses…

And so with consumer loans…

Importantly, the current economic landscape has certainly NOT BEEN A PROBLEM OF CONSUMER SPENDING, which have much been bruited about by deflationists.

(chart below from Professor Mark Perry)

…but from the lack of investments. (See Robert Higgs magnificent explanation here)

Lastly, US CPI inflation keeps ascending (again from Bespoke)

…yet one would note that the calculation for the CPI index may not be accurate or has vastly understated the above inflation rates, perhaps for political reasons (Wikipedia.org).

The composition of CPI index has been disproportionately weighed towards housing.

Great chart above and below from DSHORT.com

And in looking at the performance of each of the components…

…we find that except for the apparel, the entire spectrum of goods and services in the CPI basket has been ascendant! With the only difference seen at the relative performance of prices.

Bottom line:

What Deflation, where?

NOT until central banks will cease and desist from inflating either forced by markets or by politics, and NOT until central banks will sacrifice to the alter of economics and the markets, the high privileged but beleaguered banking cartel.

Bonds markets have NOT been an accurate indicator, for the simple reasons of government designed financial repression and or government manipulation (QEs).

In planet earth, we see inflation as THE predominant theme or the prospects of a stagflation (which could transit into hyperinflation) risk.

And with global political authorities coordinating efforts to intensify inflationism in the hope that the liquidity therapy will solve the malady of insolvency, then expect MORE INFLATION ahead.

Deflation, which has signified as a bogeyman, will be further used to justify expanded inflationism which in reality has been designed to preserve the existing political order.

As the great Ludwig von Mises wrote

It is no answer to this to object that public opinion in the capitalist countries favors the policy of cheap money. The masses are misled by the assertions of the pseudo experts that cheap money can make them prosperous at no expense whatever. They do not realize that investment can be expanded only to the extent that more capital is accumulated by saving. They are deceived by the fairy tales of monetary cranks. Yet what counts in reality is not fairy tales, but people's conduct. If men are not prepared to save more by cutting down their current consumption, the means for a substantial expansion of investment are lacking. These means cannot be provided by printing banknotes and by credit on the bank books.

Unfortunately for us, political authorities and their zealots, fables are seen and adapted as reality, where we have to bear the consequences of their actions.

Tuesday, October 26, 2010

Popular Sentiment Over Deflation Recedes

Aside from failed effects of the fiscal stimulus, one of the factors that could have been swaying political sentiment against Keynesian economics is the inordinate focus on “deflation”.

Yet for all the supposed threats that deflation would bring, there has been little signs of the emergence of the bogeyman since the culmination of the crisis.

This popular sentiment may have reached a "tipping point".

This from the Wall Street Journal Blog,

The gold market has been saying this ever since.Deflation anxieties may be about to spur the Federal Reserve to do more to help the economy, but for bond traders, fears of a downward spiral in prices appear to be pretty low.

A paper published Monday by the Federal Reserve Bank of San Francisco said that based on pricing levels in the inflation indexed government bond market — the securities are commonly called TIPS — investors are sanguine the economy can escape a crippling bought of falling prices…

Fed officials fear that while growth remains positive, it is not powerful enough to overcome the ground lost over the course of the recession, leaving inflation at dangerously low levels, and unemployment unacceptably high. They want to act to help get growth levels higher, even though many economists and some in the Fed wonder if the institution can be effective in boosting activity, given that borrowing rates are already near historic lows and the financial system is flush with liquidity.

The TIPS market has long been one of the ways policymakers, economists and market participants could get a handle on the outlook for inflation. That said, the use of TIPS to tell a broader story is a complicated task.

The rap against the TIPS market goes like this: It is a relatively new market sector, and it has less liquidity than other parts of the Treasury trading world. That means price movements can be signaling something other than a shift in investors’ inflation outlook. In the market’s favor, however, is the fact that it at least represents a real money bet on something — an investor can lose cash if they predicted the pricing outlook incorrectly. In any case, Christensen argued his model compensates for these factors.

And as we long been saying here, false premises will eventually be unmasked.

Tuesday, February 16, 2010

Emerging Local Currencies In The US Disproves The 'Liquidity Trap'

Further they allege that monetary policies will be ineffective to arrest this phenomenon which leads to a Keynesian "liquidity trap".

We say this is garbage.

Why? Empirical proof from the emergence of local currencies, which reportedly numbers nearly 100, is a manifestation that there hasn't been a fall in demand for goods or services or consumption.

This from Fox News, (all bold highlights mine)

``Today, there are close to 100 types of local currencies operating in the United States.

``While some currencies are true to their name and are backed by federal dollars, others are simply a record of hours worked by contributing “time bank” members. “Whenever you have a shortage of money, people look to invent their own medium of exchange,” said David Boyle, fellow of the New Economics Foundation and Author of "Money Matters."

``The earliest local payment system on record began in the 1930’s, which isn't surprising; historically, local currencies have been most popular during times of economic crisis, and the U.S. then was in the midst of the Great Depression."

``Today, the Community Exchange hours system has 450 members, though similar systems work with just 50 or more members. When one member does something for another, they get credit for the amount of time spent helping. Each member’s time is worth the same, whether they’re giving tax advice or cooking dinner.

``Because there is no set standard for what a local currency should be, many times the grassroots effort to start a program doesn’t gain the momentum it needs. The average success rate for local currency is around 20%, according to a study done by Professor Ed Collom at the University of Southern Maine, which looked at 82 such currencies.

So local currencies operate like an improved version of the barter system but is limited to the locality.

More from MSNBC, (all bold highlights mine)

``In most cases, these communities are simply looking to boost local commerce. The currency has to be spent in town, obviously, because it's worthless anywhere else. But a growing distrust of the U.S. dollar is also at work.

``When the Treasury prints billions to bail out banks and automakers, people look for alternatives. These folks may look nutty now, goes the quip, but wait till the dollar goes the way of the Argentine peso. Then you'll be exchanging a wheelbarrow of cash for a bay buck, local currency boosters say...

``At central Vermont's Onion River Exchange, services recently offered included basics such as haircuts but mostly oddities like puppet shows, trips to the dump and left-handed knitting. Among the service requests were a call for rawhide goat skins and a plea from someone named Pam, who "flushed a hair-catch thingy down the toilet and needs help getting it out."

Here's a list of community local currencies in the US.

So "shortage of money", "a growing distrust of the U.S. dollar" and "boost local commerce" hardly are signs of falling consumption, instead they reflect on the malaise plaguing the banking system.

GMU's Charles Rowley argues on the absurdity of the liquidity trap (hat tip: Cafe Hayek) [bold emphasis mine, italics his]

``The concept of the liquidity trap, as outlined by Keynes, and developed by his early disciples, is one aspect of the theory of liquidity preference. Liquidity preference is a theory of the demand for money. Individuals have a certain transactions and a certain precautionary preference for holding money over bonds, because of money’s property of liquidity. They have a speculative preference for holding money over bonds when their expectations are that interest rates are likely to rise, bringing down upon the holders of bonds significant reductions in the value of their bond portfolios.

``If this speculative fear is sufficiently high, the demand for money becomes infinite. In such circumstances, the monetary authority cannot lower interest rates on bonds by selling money in exchange for bonds on the open market. If this liquidity trap occurs under conditions of recession, the monetary authorities cannot stimulate the demand for investment by lowering bond rates of interest. In such circumstances, increasing government expenditures appears to be an attractive mechanism for returning the economy to full employment equilibrium. As Keynes emphasized, he knew of no such situation ever having occurred in the real world."

So has there been an extraordinary demand for money?Again from Mr. Rowley,

``There is no evidence whatsoever that the demand for investment at current interest rates (incidentally Treasury notes with more than three years to maturity are nearer to 4 per cent than to zero in nominal terms, Mr. Krugman) is inadequate to move the economy to full employment equilibrium.

``Evidence suggests that small firms are desperate for loans from the banks at current interest rates, but cannot obtain them because the big banks will not lend. The big banks will not lend, not because they are are short of high-powered money (Bad Ben Bernanke has drenched the economy in high-powered money), but because their balance sheets are rock-bottom rotten and they are trying to use Bernanke money to bring their financial ratios back from insanely low levels."

Well, the reported shortages of money that has spurred the emergence of local community currencies seem to validate or corroborate this perspective. Moreover, inflationism could be another factor why people have indeed been looking for alternatives.