Profit margins reflecting internal yields on US corporate assets have increased in the last few years. According to what Andrew Smithers disparagingly refers to as “stock broker economics”, high rates of profit are good for stocks. The Austrian economist Jesús Huerta de Soto makes an under-appreciated point about profit margins and stock prices. Pervasively high or increasing rates of profit may show that the rate of time preference is increasing, implying that the capital stock is shrinking. If not time preference, then the perception of risk may be increasing, which would have a similar depressing effect on investment.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, February 25, 2014

Quote of the Day: Why High Profits have a depressing effect on investment

Thursday, July 25, 2013

Quote of the Day: The main difference between non-profit and for-profit

The main difference between non-profit and for-profit is that non-profits are accountable to donors and for-profits are accountable to customers. This means that the non-profit sector is going to be more elitist and more less efficient than the for-profit sector. It does not mean, as so many people think, that the non-profit sector operates from better motives or provides more social benefit.I am not saying that a non-profit sector is a bad thing. Just remember that it is inherently paternalistic, and that is problematic.

Friday, July 19, 2013

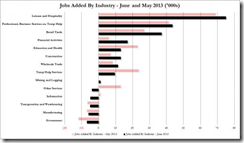

US Part Time Jobs: Obamacare and Regime Uncertainty

The number of workers holding full-time positions fell in the U.S. in June as part-timers hit a record after rising for three straight months, according to the Bureau of Labor Statistics household data. Part-time employment has been outpacing full-time job growth since 2008. Economists cite still-tough economic conditions as the root cause, with some saying President Barack Obama’s 2010 health-care law exacerbates the trend.U.S. Federal Reserve Chairman Ben Bernanke told a House committee July 17 that policy makers consider underemployment, which includes part-time workers who want full-time jobs, one of the gauges of labor-market strength…The number of part-time employees in June rose by 360,000, the Bureau of Labor Statistics reported, based on its survey of households. Full-time workers fell by 240,000, erasing much of the gains from April and May. The share of Americans who work part-time for economic reasons, meaning they can’t find full-time jobs or because their hours have been cut, is 78 percent higher than in December 2007, when the 18-month recession began.

“It’s hard to make any judgment,” Bernanke said when Stutzman asked if the Patient Protection and Affordable Care Act’s mandates are slowing the economy. Bernanke said that it has been cited in the economic outlook survey known as the Beige Book, which the Federal Open Market Committee considers in assessing the economy.“One thing that we hear in the commentary that we get at the FOMC is that some employers are hiring part-time in order to avoid the mandate,” Bernanke said. He added that “the very high level of part-time employment has been around since the beginning of the recovery, and we don’t fully understand it.”

The Federal Reserve reported Thursday that nonfinancial companies had socked away $1.84 trillion in cash and other liquid assets as of the end of March, up 26% from a year earlier and the largest-ever increase in records going back to 1952. Cash made up about 7% of all company assets, including factories and financial investments, the highest level since 1963.

-Small business represents 99.7 percent of all employer firms.-In 2010, there were an estimated 27.9 million small businesses in the U.S.—5.9 million with employees and 21.4 million without employees.-Small businesses employ about half of the country’s private sector workforce.- Small firms accounted for 64 percent or 9.8 million of the 15 million net new jobs created between 1993 and 2011.

The economy remains “bifurcated”, with the big firms producing most of the GDP growth with little help from small business. That balance is shifting, but unfortunately because larger firms are losing ground, not because small business is growing faster. Housing and energy are helping, and that does involve a lot of small businesses but the rout in housing was so severe that there are now supply constraints developing in new home construction due to lost capacity that cannot be easily reconstituted. Home prices are now increasing at double digit rates. Consumer net worth is allegedly doing well due to stock prices and house prices rising. But the quantity of items held, real wealth (houses, cars, fractions of a company owned), is not increasing that fast, just the prices. Been there, done that.

Wednesday, January 23, 2013

Quote of the Day: Selfishness, via Profits, Guides People to Serve the Need of Others More Effectively

making money honestly means creating something other people value, not necessarily what you value. The more money I want, the more I have to think about what other people want, and find better, faster, cheaper ways of delivering it to them. The reason someone is poor – and, yes, I know all the excuses for poverty – is that the poor do not produce more than they consume. Or if they do, they don’t save the surplus…Selfishness, in the form of the profit motive, guides people to serve the needs of others far more reliably, effectively, and efficiently than any amount of haranguing from priests, poets, or politicians. Those people tend to be profoundly anti-human, actually.

Friday, May 25, 2012

Quote of the Day: Profits are about Consumer Welfare

What if a business does not maximize profits? Then it is either not making the products that consumers want the most, or it is not producing its products at the lowest cost. In either case, consumers are harmed. Any argument against "profit maximization" is an argument against consumer welfare.

Maximizing consumer welfare is the ultimate justification for an economy. Consumers are of course also workers and voters.

That’s from Professor Paul H. Rubin of the Emory University writing at the Wall Street Journal

Wednesday, November 02, 2011

The Economist’s Marxist Fallacies on Corporations and Profits

The Economist eulogizes Karl Marx (bold emphasis mine)

WRITING in "Das Kapital" in 1867, Karl Marx observed that in the capitalist system competition "ends in the ruin of many small capitalists, whose capitals partly pass into the hands of their conquerors". This way, he posited, capital would become increasingly concentrated in the hands of a few. Out of the 6,000 or so companies whose primary listing is on an American stock exchange, the top 5% accounted for 70% ($10.6 trillion) of the market value and 90% ($765 billion) of the total profit in 2010. In 2000, the profit from the top 5% of companies was greater than 100%, offsetting the huge losses by the bottom 50%. The figures are remarkably similar for listed companies in Western Europe. Confounding the view of the "Occupy" protests taking place across the globe that the world is run by increasingly rapacious corporations, those proportions have declined since 2000 (the earliest year for which robust data are available). At the very top, the largest 1% of listed companies in America and Western Europe accounted for 53% and 48% of market value in 2000. In 2010, those proportions had declined to 40% and 28% respectively.

The Economist, if they are not engaged in a pun, has been guilty of logical sophism.

“Capital would become increasingly concentrated in the hands of a few” represents a post hoc fallacy; capital does not mechanically or automatically gravitate into the hands of a few. The Economist does not elaborate on the process except to irresponsibly and uncritically adhere to the Marxian creed.

Next, it would be a monumental folly to imagine that the world today as operating on a laissez faire ‘capitalist system’ considering the countless regulations, legal proscriptions, market manipulations and other forms of interventionisms in almost every social activity that one is engaged in, everywhere around the world.

Also by also engaging in reductio ad absurdum the article attempts to oversimplify correlations and the causation nexus between corporations and profit concentrations.

Such preposterous assertions assume away the influences, contributions and the effects of specific political policies on affected groups, the periphery and the rest of society, as well as, the impact of the incumbent legal environment and political institutions to the marketplace...which ultimately shapes the variable scale of interrelationships and degree of complicity between corporations and their respective governments (where they operate on).

As earlier pointed out, many of these huge companies has been beneficiaries of government concessions or political privileges as subsidies, cartels, monopolies, licensing, behest loans, tariffs, bailouts, private-public partnerships, tax credits, and sundry regulations that are essentially anti-competition based that has led to their current heft and widespread global reach.

In short, 'rapacious corporations' are the outcome of policies from political leaderships aimed at sustaining welfare-warfare based crony capitalist governance and not of the deceptive and logically bereft Marxist premises.

As Ludwig von Mises wrote of Marxism,

The incomparable success of Marxism is due to the prospect it offers of fulfilling those dream-aspirations and dreams of vengeance which have been so deeply imbedded in the human soul from time immemorial. It promises a Paradise on earth, a Land of Hearts Desire full of happiness and enjoyment, and — sweeter still to the losers in life's game — humiliation of all who are stronger and better than the multitude. Logic and reasoning, which might show the absurdity of such dreams of bliss and revenge, are to be thrust aside

Wednesday, May 18, 2011

Video: Morality of Profits; Should We Give Back Wealth to the Society?

In this video the illustrious Tom Palmer explains the morality of profits by distinguishing between wealth obtained from voluntary and involuntary (pelf) exchanges.

As Ludwig von Mises once wrote,

Profit is the reward for the best fulfillment of some voluntarily assumed duties. It is the instrument that makes the masses supreme.