In banknotes at cash machines and exceptional transfers for "humanitarian supplies", large amounts of euros fled the east Mediterranean island before and after Cypriot lawmakers stunned Europe by rejecting a levy on all bank deposits.EU negotiators knew something was wrong when the Central Bank of Cyprus requested more banknotes from the European Central Bank than the withdrawals it was reporting to Frankfurt implied were needed, an EU source familiar with the process said. "The amount the Cypriots mentioned... on a daily basis was much less than it was in reality," the source said.Confusion over just how much money was pulled out of Cyprus' banks is illustrative of the confusion surrounding the negotiations as a whole. Representing just 0.2 percent of the euro zone economy, Cyprus nevertheless threatened to reignite the bloc's debt crisis. Cyprus' problems began in Greece - it is heavily exposed to the euro zone's first bailout casualty.No one knows exactly how much money has left Cyprus' banks, or where it has gone. The two banks at the centre of the crisis - Cyprus Popular Bank, also known as Laiki, and Bank of Cyprus - have units in London which remained open throughout the week and placed no limits on withdrawals. Bank of Cyprus also owns 80 percent of Russia's Uniastrum Bank, which put no restrictions on withdrawals in Russia. Russians were among Cypriot banks' largest depositors.While ordinary Cypriots queued at ATM machines to withdraw a few hundred euros as credit card transactions stopped, other depositors used an array of techniques to access their money.Companies that had to meet margin calls to avoid defaulting on deals were granted funds. Transfers for trade in humanitarian products, medicines and jet fuel were allowed.Chris Pavlou, who was vice chairman of Laiki until Friday, said while some money was withdrawn over a period of several days it was in the order of millions of euros, not billions.German Finance Minister Wolfgang Schaeuble said the bank closure had limited capital flight but that the ECB was looking closely at the issue. He declined to provide figures.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, March 26, 2013

How Money Oozed out of Cyprus during Negotiation of Bailout Deal

Thursday, January 03, 2013

Unintended Consequences from the French Financial Tax Experiment

One suggestion that has gained popularity in the post-crisis regulatory debate is a tax on financial transactions.Proponents suggest that the tax would raise revenues for governments (at a time when such revenues are badly needed) and curb the excessive speculation that contributed to the global financial crisis.In August 2012, France became the first eurozone nation in the wake of the financial crisis to implement such a tax, and so far, it's been a total failure.In an article for Risk.net, Hannah Collins explains that in France, the tax – which amounts to 0.2 percent on transactions involving buying or selling of shares of stock – is actually just shifting investors out of equities and into even riskier, more opaque products like derivatives and derivatives-based ETFs:Investors who own French shares are selling them and taking positions on them through derivatives instruments such as contracts for difference, structured products and ETFs, according to a Paris-based lawyer. "Most structured transactions remain outside the tax," he says. "It is due only if you have actually purchased the shares."In other words, instead of curbing excessive speculation, the tax is simply forcing those speculative activities into darker, less-regulated corners of the market.

Tuesday, November 20, 2012

Financial Bubble: Shadow Banking System Soar to US $67 Trillion or 100% of World GDP

The current inflationary boom is unique. It is global in nature unlike anything previously experienced. The global Credit Bubble completely engulfed the “dollar reserve” global financial “system.” The massive inflation of dollar financial claims fomented a corresponding historic inflation in various currency Credit systems worldwide. Unprecedented global Credit inflation has been fueled by a globalized system of electronic “money” and Credit. This prolonged cycle has been unique in terms of a global Credit expansion unconstrained by a monetary anchor, gold backing or even restraint imposed by bank reserve and capital requirements. It’s been runaway non-productive debt growth on a scale never before seen.

The shadow banking industry has grown to about $67 trillion, $6 trillion bigger than previously thought, leading global regulators to seek more oversight of financial transactions that fall outside traditional oversight.The size of the shadow banking system, which includes the activities of money market funds, monoline insurers and off- balance sheet investment vehicles, “can create systemic risks” and “amplify market reactions when market liquidity is scarce,” the Financial Stability Board said in a report, which utilized more data than last year’s probe into the sector…

Supervisors consider shadow banking activities to be those that allow banks to carry out business off balance sheets, as well as those which allow investors to bypass lenders and the functions they traditionally fulfill on the markets.

-Aggregating Flow of Funds data from 20 jurisdictions (Argentina, Australia, Brazil, Canada, Chile, China, Hong Kong, India, Indonesia, Japan, Korea, Mexico, Russia, Saudi Arabia, Singapore, South Africa, Switzerland, Turkey, UK and the US) and the euro area data from the European Central Bank (ECB), assets in the shadow banking system in a broad sense (or NBFIs, as conservatively proxied by financial assets of OFIs) grew rapidly before the crisis, rising from $26 trillion in 2002 to $62 trillion in 2007. The total declined slightly to $59 trillion in 2008 but increased subsequently to reach $67 trillion in 2011.-Expanding the coverage of the monitoring exercise has increased the global estimate for the size of the shadow banking system by some $5 to 6 trillion in aggregate, bringing the 2011 estimate from $60 trillion with last year’s narrow coverage to $67 trillion with this year’s broader coverage. The newly included jurisdictions contributing most to this increase were Switzerland ($1.3 trillion), Hong Kong ($1.3 trillion), Brazil ($1.0 trillion) and China ($0.4 trillion).-The shadow banking system’s share of total financial intermediation has decreased since the onset of the crisis and has been recently stable at a level around 25% of the total financial system, after having peaked at 27% in 2007. In aggregate, the size of the shadow banking system in a broad sense is around half the size of banking system assets.-The size of the shadow banking system (or NBFIs), as conservatively proxied by assets of OFIs, was equivalent to 111% of GDP in aggregate for 20 jurisdictions and the euro area at end-2011 (Exhibit 2-3), after having peaked at 128% of GDP in 2007-The US has the largest shadow banking system, with assets of $23 trillion in 2011 on this proxy measure, followed by the euro area ($22 trillion) and the UK ($9 trillion). However, its share of the total shadow banking system for 20 jurisdictions and the euro area has declined from 44% in 2005 to 35% in 2011. The decline of the US share has been mirrored by an increase in the shares of the UK and the euro area

Monday, September 10, 2012

Fatal Conceit: Philippine Authorities to Avert Asset Bubbles

Philippine authorities suddenly become “cognizant” of internal bubbles.

From the Bloomberg,

The Philippines’s move to enhance oversight of real-estate lending this year will help curb speculation and improve its ability to prevent a property bubble from forming, the central bank said.

The regulator ordered banks to provide more details on their real-estate exposure in August, including reporting investments in stocks and bonds that fund property ventures and loans to developers of low-cost homes. Closer monitoring will encourage banks “to exercise more self-restraint,” Deputy Governor Nestor Espenilla said in a phone interview Sept. 7.

“It’s a preemptive move,” Bangko Sentral ng Pilipinas Deputy Governor Diwa Guinigundo said in an interview the same day in his office. “We don’t see at this point signs of strains in the market but we don’t want to wait for that. That’s the trick with asset bubble; when you see it, that means it has formed and you’re too late.”

The country joins Asian nations including China and Singapore seeking to temper soaring property prices and avoid the economic fallout created by the bursting of the U.S. subprime bubble and real-estate crashes from Spain to Ireland. Philippine bank loans and investments in the property sector surged to a record in March, central bank data show, and rising prices have spurred Ayala Land Inc. (ALI) and other developers to build more homes.

More signs of blowing bubbles. Again from the same article…

The number of condominium units built in the Philippines rose 48 percent to 33,000 last year as construction of 50,000 units started, Colliers said in its report. The PSE Property Index (PPROP), which tracks developers including Ayala Land and SM Development Corp. (SMDC), has risen 36 percent this year, surpassing the 19 percent increase in the Hang Seng Property Index. (HSP)

Philippine banks’ loans and investments in the property sector rose to a record at the end of March to 538.1 billion pesos, 21 percent higher than a year earlier and 3.8 percent more than the previous quarter, central bank data show. Real estate made up 15.2 percent of lenders’ total loans in the first quarter, rising from 14.5 percent a quarter earlier, according to the central bank.

25,000 Homes

Ayala Land, the nation’s biggest developer, plans to start construction of a record 25,000 homes this year, 20 percent more than last year, Chief Executive Officer Jaime Augusto Zobel de Ayala said in an interview in March. It boosted 2012 spending to 47 billion pesos from an earlier budget of 37 billion pesos, Ayala Land said in a report posted on its website last month.

The central bank’s latest moves “are credit positive for Philippine banks with substantial real estate lending because they will prompt the banks to tighten credit controls,” Moody’s said on Aug. 30.

This despite current regulatory measures…

Bangko Sentral currently caps banks’ real-estate exposure at 20 percent of total lending, with some exclusions. With the additional information now required from lenders, the central bank will decide if its policy needs to be reviewed, Espenilla said.

The central bank said Aug. 23 it will expand reporting of real-estate exposure to include real-estate projects and “ancillary services like buying and selling, rental and management of real estate properties.” The scope is broader than the previous ruling, which limited real-estate activities to the acquisition, construction and improvement of property, it said.

Who decides and what makes of a bubble? Or how will bubbles be defined? The definition of bubbles essentially shapes the path of regulation.

Will bubbles be based at specified price levels? Designated number of units available or being constructed? Amount of lending? Shadow banking?

Yes there have been regulatory caps, but as I have been pointing out (I am partly being validated by these, see some past articles here, here and here) nobody really knows where money will flow into. Nobody really knows how proceeds of loans will be allocated or spent. All statistics bruited by the political agencies are presumptions of the strict compliance. They ignore human action.

There is such a thing called regulatory arbitrage.

A good example is the stock market crash of Bangladesh in 2011. Money borrowed for supposed industrial uses has been diverted to the stock market which led to a stock market bubble. The ensuing crash came about as government tightened money.

Yet how will regulators “prevent the bubble”? Supply side caps? Demand side caps? Financial caps?

All these talks about curtailing bubbles again represents authorities superficially dealing with symptoms. In reality, they are pretentious actions. They are intended to paint the imagery of the politics of “do something” in the assumption that they “know” or fully comprehend the situation.

Really?

Bubbles serve to bloat statistical economic growth. This gives media mileage and approval ratings for the incumbent authority. They also enrich the political as well as the politically favored economic class whom are usually the first recipients of easy money policies.

So why they should political authorities curb a bubble? Should they kill the goose that lays their golden eggs?

Why do governments pursue easy money policies anyway?

Let me give the stereotyped political economic answer, because they want to achieve “permanent quasi-booms” by inducing statistical economic growth via demand management policies channeled through debt acquisition and the socialization of investments (deficit spending). In short, DEMAND MANAGEMENT POLICIES are in reality BUBBLE POLICIES.

Let me quote Henry Hazlitt again. The Inflation Crisis and How to Resolve It (p.121)

In sum, if we directly lower the interest rate, we encourage more borrowing and therefore encourage an increase in the money-and credit supply. If we begin by increasing the money-and-credit supply, we thereby lower the interest rate. So one begets the other: lower interest rates bring about inflation, and inflation brings about lower interest rates

So political authorities ease policies which generate internal bubbles and then blame the private sector from which they call for more restrictions on civil liberties. Nice. A great set up for totalitarianism.

I previously quoted Nassim Taleb’s caustic attack on intellectuals

Intellectuals and academics (except for Hayekians) tend to treat the rest of the population as total idiots. So it is very hard for them to swallow the statement that, statistically, an intellectual is as much, much more likely to be the total idiot.

Let me add that defining bubble in itself will become a political issue. Developers, construction industry, property owners, banks, financial industry (e.g. stock market, mutual funds, pension and insurance and etc…) and OFWs the among many specific interests groups who benefit from the current bubble will compete to influence decisions of policymakers.

Politicians, as noted above, will also prefer to see bubbles in order to push on their political agenda (example near record high stock market backed by high approval ratings facilitates national credit rating upgrades that lends to increased government spending and more debt based accumulation by political favorites)

Of course, no politicians will admit to this directly. They channel these mostly through their expert allies who intimidate the public with technical ‘spending and welfare economics ’ gobbledygook.

Yes F. A. Hayek was right.

The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design

Spurious knowledge of containing bubbles presented as self-righteous omniscience.

Tuesday, September 04, 2012

How the Rent Seeking Model Failed Enron

When companies shift focus from servicing the consumers to seeking to profit from regulation, trouble lies ahead. That’s the story of Enron’s debacle according to a former employee.

Enron used to be the seventh largest corporation in the US, but filed for bankruptcy in 2001 (see timeline of Enron scandal here)

Writes Robert L Bradley Jr. at the Library of Economics and Liberty (hat tip Professor David Henderson)

Enron was a political colossus with a unique range of rent-seeking and subsidy-receiving operations. Ken Lay's announced visions for the company—to become the world's first natural-gas major, then the world's leading energy company, and, finally, the world's leading company—relied on more than free-market entrepreneurship. They were premised on employing political means to catch up with, and outdistance, far larger and more-established corporations.

A big-picture Ph.D. economist with Washington, D.C. experience regulating oil, gas, and electricity, Lay found his niche in the private sector managing federally regulated interstate gas-transmission companies, first at Florida Gas Company and then at Transco Energy Company. When Lay became CEO of Houston Natural Gas Corporation, he transformed a largely unregulated intrastate natural-gas company to a federally regulated (interstate) one in 1984-85. Then, during the next 16 years, he steadily moved the renamed Enron into rent-seeking.

The interesting part is how Enron gamed the system (bold added)

Any analysis of Enron's business history will reveal entrepreneurial error and unhealthy government dependence that left major divisions of Enron in the red or just marginally profitable. But rather than make midcourse corrections, Enron manipulated the highly prescriptive—indeed politicized—tax and accounting systems to create the illusion of profitability. Such gaming was another crucial government front for the company.

The corporate tax division acted as a profit center at Enron by meeting earnings targets. Federal investigators identified 881 offshore subsidiaries as part of Enron's tax-sheltering strategy. Enron's general tax counsel remembers reaching his gaming limit: "When the [tax-saving] number got up to $300 million [in 2001] I said... 'We have to come up with a way to get this through [real] earnings—through regular business'."

Gamed financial reporting was a second "profit center," as Enron scoured the Generally Accepted Accounting Principles (GAAP) rulebook to book paper earnings where economic profit (positive cash flow from operations) was absent. "Financial engineering" also hid liabilities and inflated assets, allowing Enron to meet investor expectations and concoct peculiar narratives about its business performance.

A particularly contrived business in this regard was Enron Energy Services (EES), which purportedly split energy savings with customers via long-term outsourcing agreements. EES buttressed Enron's "green" image, but the green was not monetary. Mark-to-market accounting turned into mark-to-model, under which arbitrary assumptions about future energy prices turned losses into profits. The GAAP game was even explained in Enron's employee Risk Management Manual:

Reported earnings follow the rules and principles of accounting. The results do not always create measures consistent with underlying economics. However, corporate management's performance is generally measured by accounting income, not underlying economics. Risk management strategies are therefore directed at accounting rather than economic performance.

A third exercise in government gaming that gave Enron false profitability concerned electricity trading in California in 2000-2001. Through contrived schemes with code names like "Get Shorty" and "Ricochet," Enron exploited loopholes in the state's highly regulated system, which generated hundreds of millions of dollars of paper profits that utilities and their ratepayers could not and would not pay. One manipulation was described in an Enron memo: "The net effect of these transactions is that Enron gets paid for moving energy to relieve congestion without actually moving any energy or relieving any congestion."

The bottom line:

Although an Enron could not have been predicted, it is yet another example of the unintended consequences of interventionism in the field of energy, as well as from the politicized accounting and tax systems that governed all corporations

And then there is the ultimate consequence from the dynamics of intervention. Historically, the failures of the mixed economy have been an excuse to further politicize the economy. Richard Epstein warned: "The greatest tragedy of the Enron debacle is not likely to be the consequences of the bankruptcy, but from the erroneous institutional reforms that will take hold if its causes are not well understood." The Sarbanes-Oxley Act (2002) and the Bipartisan Campaign Reform Act (2002), enacted with Enron in mind, proved him right.

Read the rest here

Wednesday, April 11, 2012

China’s War against the Informal Economy or the Shadow Banks

From the Bloomberg, (bold emphasis added)

When a Chinese court sentenced 28- year-old Wu Ying, known as “Rich Sister,” to death for taking $55.7 million from investors without paying them back, it sparked an unexpected firestorm that has drawn in China’s top leadership.

Her crime involved a common, illegal practice in China: raising money from the public with promises to pay back high interest rates. Known as shadow banking, these underground lending and investing networks are estimated to total $1.3 trillion, according to Ren Xianfang, an economist with IHS Global Insight Ltd. (IHS) in Beijing. That’s the size of the 2011 U.S. government deficit.

Operating outside the banking system or government regulation, the informal networks provide an important source of economic growth, capital for private companies and return for investors seeking to beat inflation. Premier Wen Jiabao, in an unusual move, weighed in on the case at a March 14 news conference. His comments highlighted a public debate over the importance of shadow banking to the Chinese economy, government efforts to bring it under control -- and whether capital punishment is an effective means to do so.

“Chinese companies, especially small ones, need access to funds,” Wen said when asked about Wu’s case. “Banks have yet to be able to meet those companies’ needs, and there is a massive amount of idle private capital. We need to bring private finance out into the open.”

This is just an example of the abominable repercussions from arbitrary laws or how arbitrary laws are used as instruments for oppression.

Here, the private sector, clearly acting in response to government’s policies as evidenced by “seeking to beat inflation”, have been driven to become “criminals”. Yet China’s “criminal” shadow banks, which is no more than regulatory arbitrage practiced by grassroots entrepreneurs, has grown to an “estimated to total $ 1.3 trillion” or about 1/5 of the economy.

The conviction of the “Rich Sister” looks like another futile exercise at political symbolism to project the illusions of “virtuous” government or “government in action”. Nevertheless exposes on how arbitrary laws are used as instruments for oppression.

Of course, shysters and manipulators will always exist in every society and deserve punishment for the violation of the property rights of their victims.

However, Ponzi schemes, which these scoundrels frequently employ, are magnified in an environment where money have been debauched as I earlier pointed out here.

That’s because the anti-savings policies by governments through central banks, encourages or incentivizes such behavior by narrowing the public’s time orientations or increasing the public’s time preferences.

So instead of savings, inflationism leads the public to chase for yields, speculate, gamble, increase debt loads and to consume at the expense of production. This policy induced shifts in people’s incentives make the public vulnerable to skullduggery and knavery.

And that’s why the biggest Ponzi schemers and ultimate insider traders are no more than central bankers and political authorities who use financial repression to plunder wealth from people.

In reality, the China’s informal economy has been emblematic of dynamic market forces at work, viz, filing the gap of the “need access to funds”, since state sanctioned or regulated private banks, as well as, state owned banks “have yet to be able to meet those companies’ needs”.

So Premier Wen’s statement and the actions of China’s government represents the proverbial “left hand doesn't know what the right hand is doing” or a patent self-contradiction.

The truth is that the Chinese government has virtually been exercising the same decorum as their Western counterparts—the promotion of the interests of politically privileged rent seekers or crony bankers who finances the activities of political authorities.

China’s war against informal economy serves as another indicator of the growing political fissures from a command and control political structure against the forces of decentralization or the “marginal revolutions”, as evidenced by the expanding political clout of entrepreneurs in and out of the ambit of China’s government.

China’s war against the informal economy or the shadow banks is bound for failure.

Thursday, February 09, 2012

Arbitrary Laws: ex US President John F. Kennedy on Cuban Cigars

Here is an example of how politicians make use of, or arbitrage regulations to their advantage.

From the Daily Mail, (hat tip Professor Russ Roberts)

President John F Kennedy ordered an aide to buy him as many Cuban cigars as he could just hours before he authorised the U.S. trade embargo - which subsequently made them illegal.

Kennedy asked his head of press and fellow cigar smoker Pierre Salinger to obtain '1,000 Petit Upmanns' on February 6, 1962, so he could have them in his hands before they were deemed contraband.

Then, seconds after he was told the next morning that 1,200 of Cuba's finest export had been bought for him, he signed the decree to ban all of the communist state's products from the U.S.

As Edmund Burke once said

Law and arbitrary power are at eternal enmity

Friday, November 25, 2011

China Aims To Centralize Underground Stock Exchanges

Informal economies are symptomatic of the state of affairs for economies struggling with byzantine legal and bureaucratic entanglements.

But in today’s modern finance based economy, it’s my first time to hear of the proliferation of informal stock exchanges.

From Bloomberg,

China will ban trading of securities and futures on unauthorized exchanges to regulate the market and prevent financial risks, the State Council said.

Some of the trading activities have led to price manipulation and fund embezzlement by the exchange managers, China’s cabinet said in a statement dated yesterday. Such problems may cause regional financial risks and endanger social stability, the statement said.

There are over 300 unregulated bourses across the country, the Financial Times reported today, citing analysts. Turnover on the three authorized commodity futures and a financial futures exchanges in China fell 4 percent to 113.4 trillion yuan ($18 trillion) in the first ten months from a year ago, according to the China Futures Association.

“Regulators are concerned because these exchanges do not pay much attention to risk control, and volatile trading could hurt the participants and have a spillover effect on other companies and related industries,” said Shen Zhaoming, a Shanghai-based analyst at brokerage Changjiang Futures Co. “Local governments all hope for bigger economic influence, and they think establishing such exchange platforms is an efficient way to achieve the goal.”

Apart from the stock and futures exchanges approved by the State Council, no other bourses are allowed to list new shares, offer centralized pricing or make markets, the statement said. Exchanges that trade gold, insurance or credit products must receive approvals from financial authorities under the State Council, it said.

Price manipulation and fund embezzlement (e.g. MF Global Holdings) have also been present in ‘regulated’ exchanges.

Centralization does not sanitize or prevent markets from having miscreants. To the contrary, politicized regulated markets may even spawn them e.g. Philippines’ BW Resources Scandal and the US shadow banking system, where the former is the result of cronyism and the latter has mostly been product of regulatory capture and regulatory arbitrage.

So price manipulation and fund embezzlement would be a flimsy pretext by the Chinese government to exercise control over informal exchanges.

Besides, bailouts, unilateral credit margin maneuvering, quantitative easing, artificially low interest rates, Operation Twist (manipulation of the yield curve), Basel Accord (Financial Repression), ban on shorts and other forms of politicization of the marketplace represent price manipulations which has been the du jour policies being undertaken by global governments at the expense of the average market participants and the taxpayers.

So it is ‘legal’ for governments and their cronies to finagle or to manipulate or to exercise insider trading of the markets. To add, governments are beyond or are exempt from the laws which they implement. Again this implies that 'what may be legal is not moral'. One would call this political inequality.

Finally it is simply amazing how “300 unregulated bourses” exists in China.

Again some possible drivers here,

-regulated exchanges have been too much bureaucratic or extensively politically controlled to force many financial market investors to go underground,

-the major bourses of mainland China Shanghai and Shenzhen have not expanded enough to cover the entire country. However, the current state of technology seem to reduce the odds of such dynamic unless restrained by politics.

-China’s capital markets have been so limited or constrained such that boom bust policies have been compelling many investors to seek ways to stretch on yields by participating in the informal stock exchanges. And a possible symptom of this would be the China’s version of the shadow banking or financing system that has funded the recent property boom (and possibly informal stock exchanges too?).

This should be a great example of how the markets are always way ahead of and manage to circumvent regulators—a perpetual cat and mouse game.

Tuesday, August 16, 2011

Quote of the Day: Agency Problem in the Mutual Fund Industry

From Investment guru David F. Swensen of Yale University

The companies that manage for-profit mutual funds face a fundamental conflict between producing profits for their owners and generating superior returns for their investors. In general, these companies spend lavishly on marketing campaigns, gather copious amounts of assets — and invest poorly. For decades, investors suffered below-market returns even as mutual fund management company owners enjoyed market-beating results. Profits trumped the duty to serve investors…

This churning of investor portfolios hurts investor returns. First, brokers and advisers use the pointless buying and selling to increase and to justify their all-too-rich compensation. Second, the mutual fund industry uses the star-rating system to encourage performance-chasing (selling funds that performed poorly and buying funds that performed well). In other words, investors sell low and buy high.

Read the rest here

This has been a dynamic which I have repeatedly been talking about, see here and here

I agree with Mr. Swensen that EDUCATION has to be in the forefront in the campaign to protect investors against such conflict of interests

But I strongly disagree with the suggestion that the SEC has to play a greater role in regulation and enforcement.

One of the reasons why investors have become vulnerable has been due to the complacency derived from the expectations that the nanny state will do the appropriate due diligence and provide protection in behalf of the investors.

Such smugness reduces individual responsibilities and increases the risk taking appetite. Yet for all the regulations and bureaucracy added over the years, why has Bernard Madoff been able to pull one off over Wall Street and the SEC?

Romanticizing the role of arbitrary regulations and bureaucrats won’t help.

Two, unquestionably putting clients ahead is an ideal goal. But this is more an abstraction in terms of implementation. The ultimate question is always how? The devil is always on the details. Has more regulations led to greater market efficiency or vice versa?

Or to be specific in terms of the industry's literature how should these be designed, should they encourage short term trades or long term investments? How does the regulators determine which is which?

Three, it would be wishful thinking to believe that regulators know better than the participants with regards to the latter’s interest. Yet giving too much power to regulators would translate to even market distortions, more conflict of interests, corruption, regulatory arbitrages and benefiting some sectors at the expense of the rest. For example, the shadow banking industry, which has played a crucial role in the 2008 crash, has been a collective byproduct of myriad regulatory arbitrages.

Lastly, since regulators are people too, conflict of interest with the regulated is also likely to occur. This means that the risk of the agency problem dynamic will not vanish but take shape in a different form; the difference is that conflict of interest will shift from the marketplace to the political realm. This is known as regulatory capture.

Thursday, June 02, 2011

China’s Bubble Cycle Deepens with More Grand Inflation Based Projects

So China isn’t just preparing for a bailout, she has also put into the pipeline another huge stimulus program to prevent the risk of a slowdown.

Reports the Bloomberg, (bold emphasis mine)

China’s plan to rein in property prices with a record homebuilding program may worsen local debt risks even as it proves a boon to companies from domestic cement makers to Chilean copper exporters.

Premier Wen Jiabao aims to build 36 million low-cost homes by 2015, an initiative that will see 2 trillion yuan ($307 billion) added to local government borrowing by 2012, bringing it to a total 12 trillion yuan, Standard Chartered Plc estimates. The surge of loans to local authorities may spark a wave of bank bailouts that hobble economic growth.

And the symptoms of a bubble are getting visible as time passes; China has even her version of financial innovation or regulatory arbitrage or “shadow banking system”!

From the same article, (emphasis added)

Local governments have created more than 8,000 investment companies that allow them to get around regulations prohibiting direct borrowing. Fitch Ratings cites lending to the vehicles and to property developers in a worst-case scenario predicting bad loans could reach 30 percent of the total at China’s banks.

Moody’s Investors Service also built a 10 percent bad-loan ratio into its stress tests on China’s banks, which the company says probably will provide most of the social-housing funding.

So where will China get the money to finance these grand projects?

Again from the same article, (bold underscore mine)

Banks had a total of 50 trillion yuan of all loans outstanding in April. Standard & Poor’s has said the bad-loan ratio may climb next year to as high as 10 percent, from 1.1 percent now.

Social housing projects have “a pretty thin profit,” said Zhang Yi, senior analyst at Moody’s in Beijing. “It’s not like you are lending to highly profitable companies.”

Chris Ruffle, who helps manage $19 billion for Martin Currie Inc. in Shanghai, said, “it’s not a great situation and I wouldn’t want to be an investor in banks” after the record boom in lending.

The government hasn’t spelled out how construction of low- income housing will be financed over the full five years or how local governments will recoup their costs.

The central and local governments combined will provide 500 billion yuan of a total of at least 1.3 trillion yuan to build 10 million homes this year, Vice Minister of Housing and Urban- Rural Development Qi Ji said March 9, without saying how they will come up with the money. The central government will provide about 121 billion yuan.

While officials have pressed banks not to expand lending to local government financing vehicles, China Banking Regulatory Commission Chairman Liu Mingkang said that credit dedicated to affordable-housing developments with “repayment capability” was exempted from the push, the China Securities Journal reported March 7.

By building cheaper homes, either for rent or sale below market prices, Wen seeks to prevent social unrest caused by record property prices. He’s also countering rising prices in major cities with curbs on lending and mortgages, and a trial property tax in some cities. The risk is a slowdown in land sales that contribute about a third of local government revenue...

The program is front-loaded, with 10 million units planned for this year, a 170 percent surge from the 2010 total. Vice Premier Li Keqiang said Feb. 24 that the 2011 target is “mandatory” and local governments must increase funding for the plan.

A “financing hole” of between 817 billion yuan and 1.4 trillion yuan this year alone means most of the construction will probably be funded through bank loans, said Stephen Green, head of China research at Standard Chartered in Shanghai. He estimates that construction this year may cost as much as 1.9 trillion yuan.

Well like all bubbles, financing will emanate from inflationism and financial repression or via the diversion of private sector savings through money printing and expansion of circulation credit from the banking system to fund government pet projects.

China’s government looks desperate to avert a slowdown by attempting to maintain the current price levels, so as to maintain the profitability of sectors benefiting from the stimulus programs. The government, as shown above, does this by applying more inflation. So on one hand the government facetiously pretends to prevent a bubble by applying preventive tightening on some sectors. On the other hand, she inflates more. The left hand does not know what the right hand is doing.

As the great Murray Rothbard explained, (bold emphasis added)

First it pumps in a great deal of new money because, in the depth of recession, prices go up very little in response. Emboldened by this "economic miracle," it pumps more and more new money into the system. Then, when prices finally start accelerating, it tries to prolong the inevitable and thereby only succeeds in delaying market adjustments.

The policy of quasi booms eventually will end up with a bust. China is playing well into the Austrian Business Cycle script.

As I have been saying, the phase of China’s inflation cycle have been more advanced compared to her major counterparts, as exhibited by this chart from Pragmatic Capitalist

And the above development represents as more signs that the next financial crisis will likely emanate from China.

Saturday, February 19, 2011

China’s Real Estate Bubble: Using Divorce As Regulatory Arbitrage

The cat and mouse game between the regulators and the markets or regulatory arbitrages have not been limited to institutions.

Even individuals practice them for profit reasons.

In China, one way to elude government administrative controls on the ballooning property bubble has been for families to apply for divorce.

Writes Teresa Kong of Matthews Asia, (bold emphasis mine)

Real estate risks are still big concerns for investors in China. The central authorities have been trying to dampen property speculation, but as the saying goes in China: “for every government policy, the people have a counterpolicy.” Trying to control demand through administrative means leads people to devise some novel ways around the rules. This begs the question of just how effective China’s new regulations may be in moderating property prices. In September last year, the Chinese government announced that all mortgages on second homes would require at least a 50% down payment, and mortgages on third homes were banned. While on tour at one of the developments, I heard one property manager say that he and his wife got a divorce to get around this rule. It was simple, he explained, a divorce certificate required 10 yuan (US$1.50), and a visit to city hall. That way they would be considered two households and his wife would be able to finance her “first” home with a traditional first-home mortgage—practical, though not exactly romantic.

And it is no wonder why China’s divorce rate has recently skyrocketed.

Yet China’s government controlled media has blamed the accelerating divorce rates on “rising wealth and independence” according to the China Post.

As earlier mentioned, governments and their apologists, as well as the media, employs such deep-seated bad habits of mistakenly treating symptoms as the underlying cause of the unfolding events.

That’s why governments end up not only having regulations that prompts for an economic backfire, but importantly, become direct promoters of the decline of a nation’s moral fibre.

Regulatory Arbitrage: Some Banks In The US Circumvent The New Capital Rule

The major flaws of the interventionist ideology are that they seem to always figuratively “fight the last war”, treat symptoms rather than the source of the disease and starkly misjudge market dynamics in adapting to a new regulatory environment.

A good example of the last condition, largely known as regulatory arbitrage, can be defined as, according to moneyterms.co.uk, “financial engineering that uses differences between economic substance and regulatory position to evade unwelcome regulation. The term is also sometimes used to describe firms structuring or relocating transactions to choose the least burdensome regulator, but this is better described as regulator shopping.”

The essence is that in search of profits, private enterprises tend to look for loopholes which circumvent unfavourable regulations from where they can operate.

It’s fundamentally a cat-mouse game between authorities and the markets.

Below is a good example.

From the Wall Street Journal, (bold highlights mine)

Some foreign banks are moving to restructure their U.S. operations to avoid one of the most-burdensome requirements of the new Dodd-Frank law.

In November, Barclays PLC quietly changed the legal classification of the U.K. bank's main subsidiary in the U.S. so that the unit would no longer be subject to federal bank-capital requirements. Several other banks based outside the U.S. are considering similar moves, according to people familiar with the matter.

The maneuver allows them to escape a provision of the financial-overhaul law that forces the pumping of billions of dollars of new capital into the U.S. entities, known as bank-holding companies.

"It's just not worth it to have all that capital trapped" in the holding company, said a New York lawyer who is advising banks on how to restructure.

The moves are the latest example of how banks are scrambling to cushion the impact of new laws and rules around the world.

Policy makers are demanding banks hold more capital and cash to help prevent a repeat of the financial crisis. But bank executives are worried that all the changes will crimp profits without making the financial system safer.

Last summer's Dodd-Frank law beefed up rules governing the quantity and types of capital banks must keep to protect themselves from potential losses. The provision also closed a loophole that allowed foreign banks to run their U.S. subsidiaries with thinner capital buffers than those of their local rivals.

All these simply show how markets are much superior to governments and how government regulations may lead to unintended consequences.

Thursday, December 23, 2010

Capitalism And World Peace

Here is a wonderful Christmas gift for humanity: World peace!

Citing a study from the Human Security Center at the University of British Columbia, the Democratic Leadership Council (DLC) notes that the world has become more peaceful

Their observations (from DLC): (italics original)

Wars are less frequent: The Center's 2009/2010 report group finds 34 conflicts, including 5 international wars in Afghanistan, Iraq, and the Congo Basin. This is a lower total than at any time since the 1970s, reflecting the fact that warfare in Europe has almost vanished, with exceptions in the Caucasus; and that the numbers of wars in East Asia, Southeast Asia, and Latin America have also plummeted. And despite the Iraq, Afghan, Somalia and Yemen conflicts, the Center argues that wars in the Muslim world are rarer too, reporting a decline of 70 percent in the scale of conflict in these regions.

Great-power wars are rare: No war has pitted great powers -- meaning any of the world's 10 biggest economies -- against one another since the Sino-Soviet clashes of 1969. No war among Asian states has broken out since the Sino-Vietnamese war of 1979; the last war among European big powers is now 65 years in the past. All three intervals -- the great-power, the European, and the Asian -- are the longest periods of peace in the historical record.

Wars are less bloody: The report, reviewing the grimmest statistics, finds that the average war in the 1950s killed 20,000 soldiers and/or guerrillas each year, with war deaths averaging 155,000 in each year of the decade. Figures for the 1960s, 1970s and 1980s were similar. In the new millennium's first decade, the casualty rate was about 3,000 per war; the average for all wars combined, having fallen to 95,000 by the 1990s, has been 27,000 (and 17,000 annually since 2002, with an all-time low of 11,000 in 2005.)

The identified socio-political reasons: (all bold emphasis mine)

Some are political and military: (a) decolonization and the end of the Cold War mean there are fewer nationalistic or ideological reasons to fight, (b) the spread of democracy may produce less belligerent governments, (c) today's great powers are both less bellicose and less vulnerable than they used to be, with armies, air forces and navies strong enough to deter potential aggressors, (d) lots of international activism, from peacekeeping missions to sanctions on potentially aggressive states; and (e) with notable exceptions in East and South Asia, fewer border and land disputes.

And importantly, the economic driver...(all bold emphasis mine)

Economic issues too may play a part: lower trade barriers, more open economic policies, more efficient logistics industries and better communications technology speed up and deepen integration across borders through trade and investment, strengthening mutual interests and reducing reasons for conflict. The report suggests that a 10 percent increase in FDI reduces a nation's chance of international or civil war by about 3 percent, and that globalization reduces the reasons a country might want to fight:

"[T]he most effective path to prosperity in modern economies is through increasing productivity and international trade, not through seizing land and raw materials. In addition, the existence of an open global trading regime means it is nearly always cheaper to buy resources from overseas than to use force to acquire them."

Since politics is ultimately about economics (allocation of scarce resources), where the great Bastiat once said if goods don’t cross borders then armies will, then the improvements in the economic sphere has preceded the marked progress in the socio-economic dimensions. This has been manifested by the apparent lesser degree of political interest towards nationalism, and conversely, a greater tolerance for democracy.

[As an aside, it would be greatly misplaced to suggest that markets operates under the auspices or the graces of governments as markets have existed even prior to the advent of governments. The fact that markets also exists in spite of manifold government regulations, or what is known as as regulatory arbitrage, or circumventing (going around) regulations, is a testament to the innate dominance of markets over politics.]

Of course, technology has also played an important role by vastly enhancing social connectivity. Yet the innovation in technology front has likewise been a product of free market forces.

In short, the deepening trends of free markets (globalization) buttressed by technology has influenced the evolving geopolitical institutional framework, in spite of the recent crisis.

Importantly, the market economy (or capitalism) and war represents as two antipodal forces from which mankind can only choose one.

As the great Ludwig von Mises wrote in Omnipotent Government, (bold highlights mine)

Social coöperation and war are in the long run incompatible. Self-sufficient individuals may fight each other without destroying the foundations of their existence. But within the social system of coöperation and division of labor war means disintegration. The progressive evolution of society requires the progressive elimination of war. Under present conditions of international division of labor there is no room left for wars. The great society of world-embracing mutual exchange of commodities and services demands a peaceful coexistence of states and nations. Several hundred years ago it was necessary to eliminate the wars between the noblemen ruling various countries and districts, in order to pave the way for a peaceful development of domestic production. Today it is indispensable to achieve the same for the world community. To abolish international war is not more unnatural than it was five hundred years ago to prevent the barons from fighting each other, or two thousand years ago to prevent a man from robbing and killing his neighbor. If men do not now succeed in abolishing war, civilization and mankind are doomed.

Bottom line: The world appears to be on the path to a deepening degree of acceptance of the politics of free trade (capitalism) than from militant (nationalistic) politics, as Professor von Mises predicted. The only major counterbalance to this is inflationism.

Merry Christmas!

Tuesday, July 06, 2010

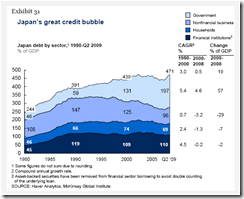

Japan’s Lost Decade Wasn’t Due To Deflation But Stagnation From Massive Interventionism

Many of you may be familiar with the idiom to “fit a square peg to a round hole”. This simply means, according the Free dictionary, “trying to combine two things that do not belong or fit together.”

From Oftwominds.com

I think this expediently characterizes mainstream’s misplaced notion about Japan’s long held predicament: deflation.

Because of the mammoth boom-bust cycle seen in Japan's property and stock markets, which led to Japan’s economic “lost decade”, the image of the Great Depression of the 1930s has frequently been conjured or extrapolated as the modern version for it.

Of course, there is a second major reason for this, and it has been ideologically rooted, i.e. the bubble bust has been used as an opportunity to justify the imposition of theoretical fixes by means of more interventionism.

Has a deflationary depression blighted Japan?

If the deflation is measured in what mainstream sees as changes in the price level of the consumer price index, then the answer is apparently a NO.

As you would notice from the graph from moneyandmarkets.com, deflation isn’t only episodic (or not sustained), but likewise Japan’s intermittent economic growth (blue bars) came amidst the backdrop of negative or almost negative CPI (red line)! In other words, economic growth picked up when prices where in deflation--this translates to real growth.

And if measured in terms of changes in monetary aggregates, then obviously given that the changes in Japan's M2 has been steadily positive, as shown by the chart above from Northern Trust, all throughout the lost decade, then we can rule out a "monetary deflation".

Of course, the next easiest thing for the mainstream to do is to pin the blame on credit growth.

chart from McKinsey Quarterly

While there is some grain of truth to this, this view isn’t complete. It doesn’t show whether the lack of credit growth has been mainly from demand or supply based. It doesn't even reveal why this came about.

We can even say that such generalizations signify as fallacy of division. Why? Because the problem with macro analysis is almost always predicated on heuristics-or the oversimplification of variables involved in the analytic process.

Banks have not been the sole source of Japan’s ‘credit’ market. In fact, there are many as shown below.

According to Promise.co.jp (bold emphasis mine)

According to Promise.co.jp (bold emphasis mine)

``Providing credit to consumers is generally referred to as "consumer credit." This can be classified into two types. The first is providing credit to allow consumers to buy specific goods and services, which is called "sales on financing," and the second is providing credit in cash, which is called "consumer finance." There are many types of financial service companies that offer consumer finance, including banks, but compenies which specialize in providing small loans to consumers are referred to as "consumer finance companies."

Further promise.co.jp describes the function of consumer finance companies as providing credit

``including loans but, unlike banks, do not take deposits are referred to as "non-banks." Leasing companies, installment sales finance enterprises, credit card companies, and consumer finance enterprises belong to the non-bank category.”

So how has Japan’s alternative financing companies performed during the lost decade?

Promise provides as an especially noteworthy chart. It shows of the following:

Promise provides as an especially noteworthy chart. It shows of the following:

1) During the lost decade or from 1989-2007, the share of consumer financing companies (yellow-orange bar) has exploded from 15.6% to 41.9%!

2) Other forms of credit (apple green bar) also jumped from 13.4% to 30.1% during the same period.

3) The bubble bust has patently shriveled the share of 'traditional bank' based lending or the share of lending from commercial financial institutions collapsed from 48% to 12.4%.

4) The sales financing companies likewise lost some ground from 22.4% to today’s 15.6%.

All these reveals that while it is true that nominal or gross lending has declined, there has been a structural shift in the concentration of lending activities mainly from the banking to consumer financing companies and "other" sources.

And importantly, it disproves the idea that Japanese consumers have “dropped dead” or that the decline in lending has been from the demand side.

Obviously banks were hampered by the losses stemming from the bubble bust. But this wasn’t all, government meddling in terms of bailouts were partly responsible, as we wrote in 2008 Short Lessons from the Fall of Japan

``One, affected companies or industries which seek shelter from the government are likely to underperform simply because like in the Japan experience, productive capital won’t be allowed to flow where it is needed.

``Thus, the unproductive use of capital in shoring up those affected by today's crisis will likely reduce any industry or company’s capacity to hurdle its cost of capital.

``Two, since capital always looks for net positive returns then obviously capital flows are likely to go into sectors that aren't hampered by cost of capital issues from government intervention.

``This probably means a NEW market leadership (sectoral) and or money flows OUTSIDE the US or from markets/economies heavily impacted by the crisis.”

Apparently, our observation was correct, the new leadership had shifted to the financing companies.

But there is more.

Because the banking system had been immobilized, which conspicuously tightened credit access, the explosive growth of the financing companies emerged as result of demand looking for alternative sources of supply.

In addition, financing companies, who saw these opportunities circumvented tight regulations or resorted to regulatory arbitrage, in order to fulfill this role.

According to the Federal Bank of San Franscisco, (bold emphasis mine)

``Prior to the passage of the new legislation, Japan had two laws restricting consumer loan interest rates. The Interest Rate Restriction Law of 1954 set lending rates based on the size of the loan, with a maximum rate of 20 percent. The Investment Deposit Interest Rate Law, last amended in 2000, capped interest rates on consumer loans at 29.2 percent on the condition that any rate exceeding 20 percent requires the written consent of the borrower. Most Japanese CFCs have been operating in this “gray zone” of interest rates, charging rates between 20 and 29.2 percent.

``Non-bank consumer finance companies in Japan comprise a ¥20 trillion industry, averaging 4 percent annual loan growth over the past decade while bank loan growth was negative. Most of the approximately 14,000 registered lenders are small, with the largest seven operators-which include the consumer finance arms of GE Capital and Citigroup- having a 70 percent market share. The significant growth in this industry can be traced directly to the collapse of the asset bubble in the early 1990s when consumers whose collateral had dwindled in value turned to CFCs offering uncollateralized loans. Adding to the success of the industry was the fact that CFCs were more service-oriented than the retail operations of Japanese banks, offering a wider network of loan offices, 24-hour loan ATMs, and faster credit approval.”

In short, banking regulations and policies proved to be an important obstacle to credit access.

Yet, the Japanese government worked to rehabilitate on these legal loop holes. This led to further restrictions to credit access.

According to Yuki Allyson Honjo, Senior Vice President, Fox-Pitt Kelton (Asia), [bold emphasis mine]

``The Supreme Court made a ruling in 2006 to make it easier for individuals to collect repayment of interest in excess of that allowed under the Interest Rate Restriction Law (grey zone interest). The court ruling called into question the legality of the grey zone. This prompted revisiting of the rules governing money lending and forced companies to create grey zone reserves. People were entitled to claim the "extra" interest they paid from their lenders.

``Revisions to the money lending laws were passed, and by June 2010, the maximum lending rate will be unified to rates specified under the Interest Rate Restriction Law, thereby eliminating the grey zone. Loans will be limited to a third of borrowers' annual income. For loans exceeding 1 million yen, moneylenders would be obligated to inquire about the applicant's annual income. Implementation is still ambiguous. Regulators are to have more power, such as the ability to issue business improvement orders.

``The rate decline held various consequences for the industry. Margins were lowered as lenders were forced to lower their lending rates. There was a reduction in volume, with loans to current borrowers no longer being profitable, some customers were deemed too high-risk to borrow at the lower rates. Customers could borrow less due to new legislation restricting total loans as a percentage of income. Also, there has been a rise in write-offs.

``The result of all of this is that the number of registered money lenders has dropped precipitously since regulation began in 1984. The loan market is an oligopoly with 60% of the total loan balance with the Big Four, and 90% percent with the top 25 firms. This oligopoly was created in reaction to regulation.

``Stock prices for money lending companies began to drop steadily in 2006, predating the current economic crisis. The necessity for grey zone reserves has caused problems in money lenders' balance sheets. In March 2007, there are many large negative numbers visible in the balance sheets of Aiful, Takefuji, Acom and Promise. Loans approval rates crashed around 2006, with Aiful only accepting 7% of loans recently, down from over 50% before the 2006 Supreme Court rulings. Every month, 25-30 billion yen is paid out by money lenders to customers in grey zone claims, increasing steadily since 2006. Grey zone refunds have begun to pick up recently as a result of the recent economic crisis.

``The consequences of the court ruling and the re-regulation are that the Big Four companies found direct funding difficult. Credit default swaps have increased dramatically for Takefuji and Aiful, who are now essentially priced to fail. Bond yields also increased and going to market is difficult for these companies.

``From the regulator's perspective, re-regulation has been largely a success, given their aims. The size of the industry and the number of players have been reduced. The government has greater control on the industry and over-borrowing has been reduced. In regard to this last goal, its success is unclear as black market statistics are not reliable. In fact, anecdotes suggest that black market lending demand has increased.”

So aside the aftermath bubble bust, the bailouts of zombie institutions and taxes we discovered that government diktat have been the instrumental cause of supply-side impairments in Japan's credit industry.

Moreover, the other consequences has been to restrain competition by limiting the number of firms which led to the persistence of high unemployment rates, and fostered too-big-to-fail "oligopolies" institutions.

So we can conclude two things:

1. Japan’s economic malaise hasn’t been about deflation but about stagnation from wrong policies.

2. The weakness in Japan’s credit growth essentially has also not been about liquidity preference and the attendant liquidity trap, or the contest between capital and labor, or about subdued aggregate demand, but these has been mostly about the manifestations of the unintended consequences of the Japanese government's excessive interventionism.

As Ludwig von Mises wrote,

``The various measures, by which interventionism tries to direct business, cannot achieve the aims its honest advocates are seeking by their application. Interventionist measures lead to conditions which, from the standpoint of those who recommend them, are actually less desirable than those they are designed to alleviate. They create unemployment, depression, monopoly, distress. They may make a few people richer, but they make all others poorer and less satisfied.”

And it is here that we see how the mainstream can't seem to fit the square peg (deflation) to the round hole (stagnation).