IN mid-January, I enumerated reasons why HB 10963 (Tax Reform for Acceleration and Inclusion Act) will fail. [See Four Reasons Why R.A. 10963 or the TRAIN (Tax Reform) Legislation Will Be Derailed January 15, 2018]

I wrote that since the government thinks in the context of statistics, it disregards the fundamental economic laws. I also noted since the tax reform operates on the supply side premise of having to tax consumption only, the government has scant understanding of how such policies would spawn material distortions and dislocations in the economic system

Coca-Cola’s predicament is a testament to these.

Coca-Cola Femsa Philippines Inc announced it would scale down on workers amid changes in the beverage industry and the business environment, calling it a “very difficult decision.” The decision emerged “after a careful assessment of various factors, such as operational efficiency, and the evolving regulatory environment” The estimated number of affected employees would be around 600, according to the Inquirer. [Inquirer.net Coca-Cola PH laying off workers February 6, 2018] (bold added)

The official statement was “In light of recent developments within the beverage industry and in the business landscape as a whole, the Coca-Cola System is undergoing an organizational structure assessment. This involved a comprehensive review of the roles and responsibilities within Coca-Cola FEMSA.” Furthermore, “This restructuring has been a very difficult decision. It was carried out only after an exhaustive and conscientiousassessment of the evolving regulatory environment, our operational efficiency, and consequent performance in the market.”

The Inquirer noted that the company “deferred from expounding beyond what the statement said”.

As an aside, this statement is proof of the political correctness of bubbles (credit bubble that has fostered a government bubble). To avoid from being excoriated or mob lynched or politically harassed or ostracized, evading the truth is the du jour comportment!

Back to Coca-Cola

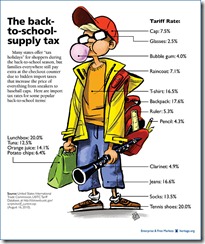

Since the Train law imposes a P6/liter tax on beverages using caloric and noncaloric sweeteners and P12/liter on beverages using high fructose corn syrup (HFCS), industry sources previously told the Inquirer that this would hamper demand, especially since consumers would be shouldering the added cost.

The company had earlier announced of plans to invest around close to $1 billion in the country up to 2022. However, in an interview last year with Juan Lorenzo Tañada, company director for legal and corporate affairs, “a decrease in consumption rates would push the company toreevaluate its plan to have an additional investment in the country, warning that this was what any other business would do”.

To the mainstream, market prices have little relevance to the economy. That is, with the exception of real estate and the stock market. For them, tax hikes on consumption would simply be compensated by statistical GDP (whatever that means).

Coca-Cola’s dilemma validates the back-shifting effects of the excise tax. The great dean of the Austrian School of Economics, Murray N. Rothbard, I quote anew

[Murray N Rothbard, B. Partial Excise Taxes: Other Production Taxes, 4. Binary Intervention: Taxation > 3. The Incidence and Effects of Taxation Part...Power and Market: Government and the Economy Mises.org]

The general sales tax, of course, distorts market allocations insofar as government expenditures from the proceeds differ in structure from private demands in the absence of the tax. The excise tax has this effect, too, and, in addition, penalizes the particular industry taxed. The tax cannot be shifted forward, but tends to be shifted backward to the factors working in the industry. Now, however, the tax exerts pressure on nonspecific factors and entrepreneurs to leave the taxed industry and enter other, non-taxed industries. During the transition period, the tax may well be added to cost. As the price, however, cannot be directly increased, the marginal firms in this industry will be driven out of business and will seek better opportunities elsewhere. The exodus of nonspecific factors, and perhaps firms, from the taxed industry reduces the stock of the good that will be produced. This reduction in stock, or supply, will raise the market price of the good, given the consumers’ demand schedule. Thus, there is a sort of “indirect shifting” in the sense that the price of the good to consumers will ultimately increase. However, as we have stated, it is not appropriate to call this “shifting,” a term better reserved for an effortless, direct passing on of a tax in the price.

Since the consumer’s purchasing power is limited, Coca-Cola can hardly afford a price pass through. Hence, the primary effect of the excise tax is to raise the firm’s cost of production, thereby squeezing its profits.

The ramification of the excise tax on Coca-Cola is to force the streamlining of the company’s production structure, part of which is to cut down on their workforce, as well as, to “reevaluate its plan to have an additional investment”. Such measures effectively “reduce the stock of the good that will be produced”. Consequently, “the reduction in stock, or supply, will raise the market price”, “given the consumers’ demand schedule”. That is to say, distortions from excise taxes are bound to spread.

If political circumstances compelled Coca-Cola to make a “very difficult decision”, how much more would such taxes affect the marginal firms or firms with lesser operational efficiencies in the industry? Will the marginal firms not be driven out of the business? And how will this impact the industry’s upstream and downstream supply chains? Would the natural course of action be an investment slowdown, as the Coca-Cola officialwarned, “this was what any other business would do”?

So Coca-Cola validates the back-shifting penalty theory from excise taxes.

That is not all.

Unless the laid-off workers find immediate replacements, there would be less consumption from them. Moreover, with higher prices in the economy*, the consumer’s purchasing power will diminish. So consumer will be faced with a perfect storm, lesser income**, and diminished consumption!

So the excise tax would be a double whammy: it will reduce investments and consumption.

When you tax something you get less of it.

Now some questions:

If investments and consumption decline, who will use the roads and the other forms of infrastructure that the government will build?

And with insufficient taxes, just how will these massive government expenditures (not limited to infrastructure) be funded? Will it be through debt or through inflation?

Grinding from higher prices, will there be enough spending power for consumers to satisfy the race the to-build supply of retail outlets, shopping malls, real estate projects and hotels?

Remember, the new economic paradigm: BYE BYE CONSUMERS, HELLO BIG GOVERNMENT!

*The BSP reported January CPI at 4% which it attributed to the TRAIN:

Year-on-Year headline inflation increased to 4.0 percent in January from 3.3 percent in December. The higher inflation outturn was at thehigh end of the Government’s target range of 3.0 percent ± 1.0 percentage point for 2018. Likewise, core inflation—which excludes certain volatile food and energy items as a means to depict underlying price pressures—rose to 3.9 percent from 3.0 percent in the previous month. Month-on-month seasonally-adjusted headline inflation also increased to 0.7 percent in January from 0.3 percent in December.

The uptick in headline inflation for January was traced mainly to higher prices of food and non-alcoholic beverages, alcoholic beverages and tobacco items, and domestic petroleum products. Food inflation went up as most food commodities, particularly corn, meat, and milk, cheese, and eggs, posted higher prices during the month. Meanwhile, weather-related production disruptions pushed up prices of rice, fish, and vegetables in many regions. Similarly, non-alcoholic beverages and alcoholic beverages and tobacco inflation rose as a result of the implementation of the Tax Reform for Acceleration and Inclusion (TRAIN) Law. At the same time, transport inflation also increased due to adjustments in gasoline and diesel prices, largely influenced by higher international prices of crude oil and the excise tax on petroleum as prescribed by the TRAIN Law.

These numbers looked understated.

**More interesting data.

The Philippine Statistics Authority reported that “The national median monthly basic pay for 2016 was posted at P12,013, an increase of P257 (2.2%) from P11,756 in 2014”.

Since the annual CPI rates from 2014-2016 were at 4.1%, 1.4% and 1.8%, from the basic pay perspective, workers suffered NEGATIVE growth in real wages!

Wow! If the PSA’s number is right then the race to build supply has been operating on negative wage growth! Why wouldn’t there be serious overcapacity issues?