There has been a brewing grassroots discontent at Wall Street, and they are partly right, Wall Street has been party to America’s social woes.

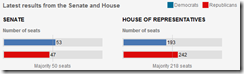

But the political solution to this has been divided; on the one hand, one camp blame Wall Street as inextricably tied to the US government and the US Federal Reserve. The other believes in the socialist resolution.

As Anthony Gregory writes,

Although there is no single ideology uniting the movement, it does seem to have a general philosophical thrust, and not a very good one at that. OccupyWallStreet.org has a list of demands, and while the website does not represent all of the protesters, one could safely bet that it lines up with the views of most of them: A "living-wage" guarantee for workers and the unemployed, universal healthcare, free college for everyone, a ban on fossil fuels, a trillion dollars in new infrastructure, another trillion in "ecological restoration," racial and gender "rights," election reform, universal debt forgiveness, a ban on credit reporting agencies, and more power for the unions. Out of over a dozen demands there is only one I agree with — open borders — and, ironically, many on Wall Street probably favor that as well.

All in all, this wish list is a terrible recipe for moving far down the road toward socialism. On the way to achieving these goals, totalitarian controls on the population would be necessary. Some of these demands are merely horrible ideas that would injure the economy severely — such as the huge expansion of public infrastructure. But others are so fancifully utopian — such as a living wage guaranteed to all, especially when combined with free immigration — that their attempted implementation would confront the many disasters and horrors we have seen in every nation that has seriously attempted socialism. Such policies would vastly expand the government, including its manifestations in the corporate state and police power that these protesters find so unsavory. All of the corruption and brutality they think they oppose are symptoms of the same essential political ideology they favor.

It must NOT be forgotten that Wall Street’s political and economic privileges emanates from the role it plays in the current political economy of the US.

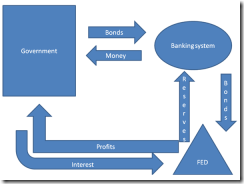

Fundamentally, Wall Street functions as the major conduit in the financing of the US government.

As explained by Professor Philipp Bagus,

For governments, the mechanism works out pretty well. They usually spend more than they receive in taxes, i.e., they run a deficit. No one likes taxes. Yet, most voters like to receive gifts from their governments. The solution for politicians is simple. They promise gifts to voters and finance them by deficits rather than with taxes. To pay for the deficit, governments issue paper tickets called government bonds such as US Treasuries.

An huge portion of the Treasuries are bought by the banking system, not only because the US government is conceived as a solvent debtor, thanks to its capacity to use violence to appropriate resources, but also because the Fed buys Treasuries in its open-market operations. The Fed, thereby, monetizes the deficit in a way that does not hurt politicians.

In other words, the incumbent architecture of the welfare state applies Financial Repression by channeling the savings of the private sector to the US government via the banking system which has been backed, coordinated and supervised by the US Federal Reserve.

I would like to add that capital adequacy laws have likewise been designed to designate US sovereign liabilities as ‘risk free’ which ‘incentivizes’ banks to hold government securities as its main assets.

Not only that, major Too Big to Fail Banks of Wall Street are the chief conductors of the US Fed’s monetary policy, which goes to show the depth of their intertwined relationships. A list of Primary dealers here.

And further proof that Wall Street benefits from the welfare state is the example of JP Morgan’s role as processor of food stamp benefits.

From the Economic Collapse Blog

JP Morgan is the largest processor of food stamp benefits in the United States. JP Morgan has contracted to provide food stamp debit cards in 26 U.S. states and the District of Columbia. JP Morgan is paid for each case that it handles, so that means that the more Americans that go on food stamps, the more profits JP Morgan makes. Yes, you read that correctly. When the number of Americans on food stamps goes up, JP Morgan makes more money.

And it is no doubt that such cozy relationship represents a classic text book example of regulatory capture —when a state regulatory agency created to act in the public interest instead advances the commercial or special interests that dominate the industry or sector it is charged with regulating (Wikipedia.org)

And an ostensible symptom of this has been the revolving door relationships—the movement of personnel between roles as legislators and regulators and the industries affected by the legislation and regulation and on within lobbying companies (Wikipedia.org)—between Wall Street and the US government.

The Business Insider shows 29 famous revolving door cases where Wall Street personalities went on to work for the government and vice versa, and the list includes Hank Paulson, Robert Rubin, Lawrence Summers, Martin Feldstein and many more

Bottom line: While it would seem right to put the load of the blame to the financiers of the government, solutions that further socializes Wall Street would only serve to perpetuate the current malaise or even worsen them.

And given the penchant of the emerging grassroot’s movement for bigger government, it would seem that such actions could signify as a stealth political strategy to promote President Obama’s re-elections. After all, Wall Street as scapegoat has been used before and at the end of the day had been settled amicably.

Looks and smells like the same old trick.