In my view, a very significant divergence unfolding within the Philippine Stock Exchange over the past few weeks could highlight a pivotal development.

A Southbound Philippine Mining Index

While the local benchmark, the Phisix continues to drift at the near record highs, the biennial market leader, the mining sector, appears to have substantially weakened.

I say biennial because as I have pointed out in the past, the mining index outperformance-underperformance has been rotating every other year[1].

Year-to-date, the mining sector has plummeted by about 10%.

Yet more than half or 5.8% of such losses accrued only from this week. This makes the mining sector a dismal laggard relative to the others.

The mining sector has fundamentally spearheaded the “rising tide” or the broad based rally of the Philippine Stock Exchange since 2002. This can be seen via nominal returns. Measured by the sector’s index trough in 2002 as against recent peaks, the mining sector produced an astounding 26x as against 4x for the Phisix.

Nevertheless, the ebbs and flows or the undulations of the Phisix (green line chart) have been for most of the time, highly correlated with the mining sector (black candle) throughout this duration.

In other words, even during years where the mining sector trailed the others, the former flowed along with the rest to reflect on the same (positive or negative) directions of returns. The nuances have only been in the degree.

The correlation has not been perfect though, as there had been accounts of divergences.

This can be seen in the colored ovals in the above charts. In 2010, the Phisix outperformed (orange) as the mining index hibernated. In 2011, the mining index sprinted miles ahead (red) as the Phisix wavered. However eventually, these anomalies got smoothed out and both moved towards the same path.

In short, the rotating market leadership meant that as one index stagnated, the other index advanced.

The Mining Sector’s Divergence From the Phisix

Today there appears to be a different type of divergence; the Phisix and the Mining sector has moved in opposite directions.

Technically speaking, the mining index has already infiltrated into the bear market territory (20% loss). Based on Friday’s close and from the recent top this May, this translates to about 22% decline. Thus the year-to-date figure understates the true extent of the losses. As always, the point of reference matters.

Yet the last time the mining index fell into a bear market, which came in conjunction with a bear raid on the Phisix and on global equity markets as the public’s heavy expectations for QE 3.0 had been frustrated by the politically shackled US Federal Reserve chair Ben Bernanke[2], the mining index lost 33% peak-to-trough before recovering.

I do not expect a repeat of the same pattern as the major influence will emanate from external forces.

Besides, the technical picture likewise exhibits a bearish ‘double top’ which may only exacerbate the current negative sentiment.

There has been imputation that the recent declines have been due to issue specific related incidents. For instance, some people have speculated that political authorities may initiate investigations on an innuendo of alleged malfeasances committed by a firm as exposed by a blind item article in a popular broadsheet. This, they think, has been an important factor in the recent price declines.

It is interesting to see that many people fall prey to such scuttlebutts.

Yet it is dangerous to believe that all hearsays require government intervention. If this becomes reality then serial witch-hunting would only mean severely politicized and convoluted markets and a bloated government which only would extrapolate to chronic economic and political imbalances. Think Greece.

People seem to forget that many accounts of the financial market improprieties have operated in the shadows of the underhand of politics.

The infamous Dante Tan led BW Scandal sets a shining example of the political complicity and the failure of insider trading regulations[3]. The accused Mr. Tan has been absolved of two criminal cases for violation of The Revised Securities Act by the Supreme Court in August of 2010[4]. How about the US property-mortgage bubble crash of 2008[5]?

Worst, people seem to have developed impression of entitlements, such that the only politically correct direction for the stock market has been UP. Thus, falling markets become objects for political interventions. The unfortunate Calata episode serves an example[6].

And this is why central banking inflationist interventions have become so popular, it gives a boost to the gambling appetite and to the serotonin, all at the expense of personal accountability and responsibility.

I don’t have a clue to the truth or validity of such allegations. But as Black Swan author Nassim Taleb points out from his upcoming book[7] we easily get hooked to sensationalism.

There was even more noise coming from the media and its glorification of the anecdote. Thanks to it, we are living more and more in virtual reality, separated from the real world, a little bit more every day, while realizing it less and less. Consider that every day, 6,200 persons die in the United States, many of preventable causes. But the media only reports the most anecdotal and sensational cases (hurricanes, freak incidents, small plane crashes) giving us a more and more distorted map of real risks. In an ancestral environment, the anecdote, the “interesting” is information; no longer today. Likewise, by presenting us with explanations and theories the media induces an illusion of understanding the world.

Yet from the big picture perspective, the appeal to innuendos represents the cognitive fallacy of availability heuristic[8] or judgment based on information that can easily be remembered. This may even the account as the logical Post Hoc “after this therefore because of this” fallacy which mistakes coincidences as causes[9].

How do I say so? Because of the synchronized actions of the mining issues.

From the one year chart, we can note that the Phisix and the mining index suffered from the recent post-Operation Twist and Euro crisis selloff this May.

However in contrast to the broader markets, which piggybacked on the swift resumption of the RISK ON environment primed by serial promises by major central banks of interventions, the rally in the domestic mining index have faltered.

What is in front of us or have been self-evident we have frequently overlooked in favor of those narrated, the tangible or the personal.

Again some behavioral lessons from Nassim Taleb[10]

people tend to concoct explanations for them after the fact, which makes them appear more predictable, and less random, than they are. Our minds are designed to retain, for efficient storage, past information that fits into a compressed narrative. This distortion, called the hindsight bias, prevents us from adequately learning from the past.

Yes coincidentally, a day AFTER Philippine president Benigno Aquino III affixed his signature on the much ballyhooed Mining-Tourism compromise via Executive Order 79[11], stock prices of MOST of the mining issues began to deteriorate.

Except for Semirara Corporation [PSE:SCC, black candle] prices of the mining heavyweights—Philex Mining [PSE: PX, blue], Lepanto Consolidated [PSE:LC, light green], Atlas Mining [PSE:AT, orange] and Manila Mining [PSE: MA violet]—have all been suffering from synchronized decline.

Such seemingly coordinated downturn have been no different from the second tier issues, whose string of losses has exceeded the majors: Nihao Minerals [PSE: NI black candle] Nickel Asia [PSE: NIKL, green] Geograce Resources [PSE:GEO, blue] and Oriental Peninsula [PSE:ORE, red].

Oil issues, whether as component of the mining index or not, have not been spared: Oriental Petroleum [PSE:OPM, black candle] and PetroEnergy [PSE:PERC, red] seem to have stagnated while The Philodrill Corporation [PSE:OV, green], and Philex Petroleum [PSE: PXP, blue] have exhibited signs of contagion based selling pressures.

Yet current infirmities in the domestic mining-oil sector may represent a belated response to the falling prices of products which underpins the operations of these companies: Gold, copper and industrial metals (GYX) have been on a slump for at least a last year. Oil (WTIC) on the other hand, still trades below the May 2011 high.

The state of the commodities has apparently been replicated on the benchmarks of global mining issues. These can be seen in the performance of US mining stocks [XME—SPDR S&P Metals & Mining Index], global mining stocks [CMW.TO—iShares S&P/TSX Global Mining Index Fund], emerging market mining stocks [EMT—emerging global shares dow jones emerging markets metals/mining titans], and US oil stocks [$DJUSEN Dow Jones US Oil & Gas Index]

In short, falling commodity prices may have been interpreted as crimping on the operating leverage[12] of these resource companies, thereby reducing profitability[13] whose consequence has been the year-long torpor of global mining equities.

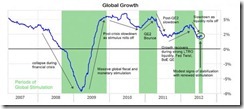

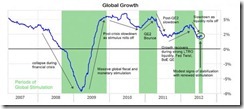

Ironically, however, global mining and oil issues seem to have staged a rally despite the languid state of commodity prices.

This perhaps could have been prompted by snowballing anticipations of the possible “grand bazooka” to be launched by the European Central Bank and or the US Federal Reserve.

Implications of Divergences and of Philippine Mining Political Trends

There are several insights from the above: In defying global market trends, domestic mining and oil equities may have overextended gains. Perhaps current the correction phase exhibits the market process of regression to the mean or similarly defined in psychological terms[14] or in finance[15] as the tendency of the markets to average out.

Yet one cannot discount that such valuations overreach may also represent symptoms of excessive speculations or the unwinding of mini-bubbles.

Add to these the elements of political and regulatory uncertainty introduced by the new executive order by the President and on the suggestion by the IMF for the Philippine government to hike taxes on the mining industry[16].

Reports say that a tax increase in the mining industry for President Aquino may momentarily not be a priority “for the next year or two”. But prospects of it may have also compounded on the current uncertainties considering the proposed doubling of excise taxes from “the current 2% to a range of 5-7%”, as well as “a 5% royalty in future mining contracts and areas to be declared as mineral reservations”[17].

Of course given that the mining sector has been one of the industries that have the biggest potential to boost President Aquino’s obsession with approval ratings through statistical economic growth, I believe the political burdens of the mining industry will likely be mitigated.

The compromise between mining and tourism industry via EO 79 and tax deferment seems like evidences of these. I might add that the same instances also serve as wonderful proof public choice theory at work, where vested political interest groups have a significant sway or influence or logrolling on policymaking[18]. Yes tourism industry has their share of political concentrated group interest too.

While the Executive Order has been meant to placate on these squabbling groups, the major beneficiary here is the Philippine government whose attendant edict extrapolates to more control and discretion of choosing winners and losers and bigger budgets for the bureaucracy for the supervision and enforcement of such fiat, all at the expense of society through prospective higher taxes and politicized distribution of economic opportunity.

Of course another major beneficiary will be the cronies who will get the gist of the license to explore and operate mines.

This means that the increased politicization of the mining industry will favor the entrenched groups at the expense of small scale miners and other professional miners.

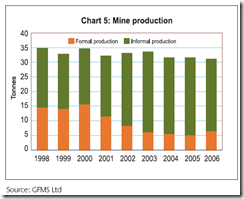

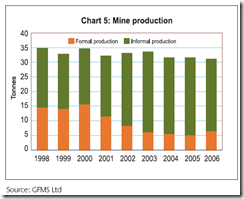

Yes despite the massive scale of regulations by the Philippine government, the informal gold mining sector has fundamentally become the dominant contributor to the nation’s gold production output.

Such statutory compromise will hardly bring such informal sector to the surface for the reasons stated above.

And yet part of the growth of the informal sector, ironically, has been facilitated by the Bangko Sentral ng Pilipinas (BSP), through their gold buying program.

As the World Gold Council notes[19]

Looking at informal production, it is understood that the bulk of this is sold at buying stations maintained by the central bank. This is due to the fact that gold is normally bought on a noquestions-asked basis, and on very attractive terms. Nevertheless, there remains a small portion of informal production, mainly from the province of Mindanao, that is not sold to the central bank.

It is important to impress to readers that mining per se has not been responsible for environmental degradation. If such allegations were true then Chile, the US, Australia, Canada would have been transformed into howling wilderness.

In reality, environmental preservation and optimizing revenues from the mining industry are strongly associated with the resource curse dilemma[20], that which is the politicization of the resource industry.

As the World Bank a 2002 study notes[21],

Fighting corruption, self-interested rent-seeking, and a general deterioration in the quality of governance in the face of large revenue streams is no doubt a challenge for countries with otherwise short histories of sound and competent institutions. There is no easy panacea to managing this challenge. At the same time, there is simply no other way to manage a mining sector successfully, and indeed a successful economy in general, than to engage in the challenging task of building effective political and economic institutions and finding competent individuals to run them. This is the essence of the development process.

Informal economy, corruption, rent seeking and a general deterioration in the quality of governance are symptoms or are products of asphyxiating regulations, bureaucracy, high burdens from taxes and the cost of compliance[22], insecure property rights and involuntary exchanges or the intense politicization of the industry.

Nevertheless also do expect more massive illegal and wildcat mining in the 78 areas that has been prohibited from mining which should lead to environmental degradation. The people who will undertake the fly by night mining operations will likely be wards of politicians.

In the realm of politics, natural laws of economics simply vanish or will submit to the will of politicians.

Short Term Bearish, Long Term Bullish

Have recent events signaled the end for the bullmarket in Philippine mining? I guess not. This looks more cyclical than structural as explained above. The momentum suggests that the ongoing retrenchment phase could or may likely continue.

Although I also think, over the interim, the mining industry’s divergence signals two major routes:

One, the leveling out of the divergences through

A. A sustained rally in the global equity markets or a prolonged RISK ON environment that will eventually percolate to prices of general commodities and thus would likely truncate the current correction phase of the local mines or

B. The Mining sector’s bear market could spillover to the general market.

Second, that the divergence becomes a lasting feature. This eventually paves way for stagflation. In such scenario, I expect the mines to go opposite ways with the general stock market. But this will likely become a global phenomenon too. So actions in the local markets should be in sync with the world. So far there has been little evidence on this.

I lean on condition (B) or where the bear market of the mining sector will likely percolate into the general market, due to growing risks of contagion.

However everything really depends on how and what future policies will be conducted, especially in the US, as previously discussed.

So far, gains from the global equity markets have emerged from intensifying hopes and prayers of rescue (if not narcotics) from central banks. The Bank of America estimates that the markets has already priced or factored in a humungous 80% of QE 3.0[23] which implies of the enormous pressure on policymakers to deliver. And market now becomes highly sensitive or susceptible to changes in expectations which may be swift and dramatic.

Central banking stimulus continues to exhibit diminishing returns[24].

This also suggests that in order to have a meaningful effect, central bank steroids would need to have a “shock and awe” in scale or a far larger than the current dosage. Failure to satisfy the markets could switch sentiment to a RISK OFF volatility.

This is why current environment seems so uncertain and so vulnerable to instability.

Yet given that political election season approaches in the US, one cannot discount that markets may be boosted by political authorities for political goals[25].

But at the same time, market risks from a global slowdown contagion have continuously been escalating.

Trade cautiously.

[1] see Graphic of the PSE’s Sectoral Performance: Mining Sector and the Rotational Process, July 10, 2011

[2] see Bernanke Jilts Markets on Steroids, Suffers Violent Withdrawal Symptoms September 22, 2011

[3] See Insider Trading: What is Legal isn’t Necessarily Moral, November 17, 2011

[4] Supreme Court of the Philippines SC Clears Dante Tan of BW Charges

[5] See 2008 US Mortgage Crisis: The US Federal Reserve and Crony Capitalism as Principal Causes, May 31, 2011

[6] See Phisix: Managing Through Volatile Times August 6, 2012

[7] Taleb Nassim Nicolas NOISE AND SIGNAL Facebook (May 21)

[8] changingminds.org, Availability Heuristic

[9] nizkor.org Post Hoc Fallacy

[10] Taleb Nassim Nicholas Learning to Expect the Unexpected, New York Times April 8, 2004

[11] ABS-CBN News PNoy's Mining EO No. 79, July 9, 2012

[12] Investopedia.com Operating Leverage

[13] Wikipedia.org Investment vehicles, Gold as an Investment

[14] Alleydog.com Regression Toward the Mean Psychology Glossary

[15] Wikipedia.org Mean reversion (finance)

[16] Abs-cbnnews.com Mining companies in PH not paying enough taxes: IMF August 9, 2012

[17] Abs-cbnnews.com Raising taxes on mining not a priority: Aquino July 18, 2012

[18] See Public Choice in Action: Logrolling in the Philippine Mining-Tourism Policy, June 21, 2012

[19] World Gold Council Central Bank case studies: The Philippines

[20] Wikipedia.org Resource curse

[21] World Bank Treasure or Trouble? MINING IN DEVELOPING COUNTRIES, WORLD BANK AND INTERNATIONAL FINANCE CORPORATION 2002 p.14

[22] See Does The Government Deserve Credit Over Philippine Economic Growth? May 31, 2010

[23] Real Time Economics Blog, BofA Sees 80% Chance of QE3 Priced Into Markets Wall Street Journal, August 10, 2012

[24] Zero Hedge It's A Centrally-Planned World After All, With Ever Diminishing Returns August 11, 2012

[25] See Has Ben Bernanke Been Working to Ensure President Obama Re-election, February 5, 2012