Inflation is like sin; every government denounces it and every government practices it-Sir Frederick William Leith Ross

The Philippine Phisix hit a new milestone.

We are told that the “upbeat expectations” on listed companies aside from “macroeconomic” dimensions have powered the Phisix to the latest high watermark.

In reality, such comments signify as a descriptive narrative of the current events based on the self-serving or attribution bias[1]—or when people attribute success to dispositional and internal factors or skills and impute failures on external uncontrollable forces or on luck.

Here, rising stocks, in the purview of the mainstream, supposedly accrue from or has been construed as emanating from strong corporate performance and robust economic growth.

Other factors have been omitted.

Yet such comment can also be discerned as symptoms of the bubble psychology through the reflexivity theory which represents a feedback loop mechanism between people’s expectations and their attendant actions in response to the changes in the prices and vice versa as previously explained[2].

Surging equity prices, which lends to the impression of sustainability of the boom, electrifies and energizes public confidence which leads to greater and aggressive risk taking and vice versa. The bullish psychology compounds on the attendant action which accelerates on the momentum or the growing conviction phase. Such cycle occurs until the illusion unravels.

Record Highs: Things Don’t Appear as They Seem: The Venezuelan Experience

The popular wisdom, wherein valuations of stock markets have been seen as having causal relations with corporate performance and macroeconomic conditions, has been nebulous. This has been especially pronounced since the Lehman bankruptcy in 2008.

Venezuela serves as a lucid example

The award for the world’s best performing stock market in 2012 belongs to Venezuela’s Caracas Stock Exchange Stock Market Index.

With nominal gains or returns at an astounding 228% on a year-to-date basis, as of Friday’s close, the Caracas Index has been the clear runaway or unchallenged champion.

Yet, Venezuela’s economic growth as measured by the GDP has hardly been improving. Statistical economic growth has been flagrantly manipulated for political reasons and amplified through widespread price controls which essentially subdued statistical price inflation[3].

In the real world, the price of Venezuela’s currency, the bolivar, has now been trading FOUR times (!!!) the official exchange rate in the black market[4].

The public also expects the imminence of the 5th official devaluation, since Venezuela’s President Hugo Chavez imposed currency controls in 2003.

Recent bond sales by Venezuela’s central bank sank to the lowest level in two years[5], which implies that bond investors have either been waiting for the bolivar to devalue or that bond investors have been pressuring the Venezuelan government to allow market prices to reflect real economic conditions.

Worst, economic figures hardly reveals of the diminishing standards of living experienced by Venezuelans through huge shortages experienced by the broader economy, which according to reports, are at record highs[6]. So record stock market comes amidst record shortages of supply of goods.

Also, Venezuela’s US dollar reserves have fallen off the cliff. The petrodollar fund has plummeted 60% from January 2012 and 93% in 2008[7] as foreign exchange continues to get drained. The depletion of foreign currency means that importers, whom have so far has been the key source of supplies of goods for the economy, would run out of resources and that this would compound on the shortage miseries of Venezuelans.

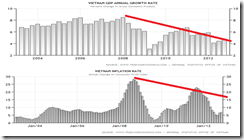

Also, the growing scarcity of foreign exchange and expanding government deficits means that financing of the Venezuelan government would increasingly depend on central bank monetization. (chart from Tradingeconomics.com)

Venezuela’s Hugo Chavez, despite having been re-elected for his fourth term[8], has been conspicuously running the economy aground with his policies based on “socialist revolution”[9].

Yet, Venezuela’s bolivar, bond and stock markets hardly chime with the official economic data.

Venezuela’s financial markets have instead been manifesting symptoms of an escalating monetary disorder from the deeply inflationist, redistributionist and interventionist anti-business regime of Mr. Chavez.

The surge in the Caracas Stock markets, thus, represents a ticking time bomb, whose continuance will lead to the eventual collapse of the bolivar and the Venezuelan economy.

In other words, such dynamics signifies as symptoms of the heightening risk of a full blown hyperinflation.

The Venezuelan episode essentially demolishes populist wisdom. In other words, to see surging stock markets as accounting for favorable “macroeconomic” conditions or to impute “positive investor confidence” would tantamount to a patent misinterpretation and analysis. In reality, Venezuela’s surging equity markets exhibits policy induced pathology which has been ventilated on the financial markets.

The other moral of the story is the showcase of the nasty or ill effects from “democracy” as evinced by the “tyranny of the majority”.

As the second US president John Adams wrote to John Taylor in 1814[10]

I do not say that democracy has been more pernicious on the whole, and in the long run, than monarchy or aristocracy. Democracy has never been and never can be so durable as aristocracy or monarchy; but while it lasts, it is more bloody than either. … Remember, democracy never lasts long. It soon wastes, exhausts, and murders itself. There never was a democracy yet that did not commit suicide. It is in vain to say that democracy is less vain, less proud, less selfish, less ambitious, or less avaricious than aristocracy or monarchy. It is not true, in fact, and nowhere appears in history. Those passions are the same in all men, under all forms of simple government, and when unchecked, produce the same effects of fraud, violence, and cruelty. When clear prospects are opened before vanity, pride, avarice, or ambition, for their easy gratification, it is hard for the most considerate philosophers and the most conscientious moralists to resist the temptation. Individuals have conquered themselves. Nations and large bodies of men, never.

Hugo Chavez seems on the path to validate the admonitions former US president John Adams

Leaning Against the Wind: The Fatal Conceit

Of course, the Philippines isn’t Venezuela. But the law of economics is universal.

Philippine officials tell us that under a low interest rate environment, they “will not tolerate asset bubble formation and pricing mismatches”[11].

But this represents arrantly an absurd and a self-contradictory claim. Social policies shape people’s incentives. People react to incentives provided by policies.

Artificial suppression of interest rates punishes savers and creditors and moral behavior.

Alternatively, such policies reward rampant speculation, gambling and heightened risk taking or basically immoral activities.

People’s time preferences have subliminally been redirected to short term oriented or high time preferences activities through spending and investment via debt accumulation, on yield chasing dynamic regardless of the risks involved and on financial engineering to satisfy the financial market’s demand for vastly magnified risk appetites.

In short, low interest rates incentivize asset bubble formation and pricing mismatches.

I have met several people who expressed interest (without my prodding in fact I told them to study first) to place in the stock markets simply due to the nugatory returns from bank accounts.

That’s why negative real rates has been a major contributor to the proliferation of fraudulent activities such as Ponzi schemes (the Aman futures as discussed last week[12]) or even to the current international Ponzi financing scheme of manipulating prices of the financial asset markets (bonds and stocks) through central banking QEs.

For instance, aside from the unsustainable banking-sovereign bond buying feedback mechanism engineered by central banks and governments of crisis stricken developed economies, and the explosive growth in global derivatives exposure, the shadow banking system have reportedly ballooned to nearly 100% of the global economy[13].

In other words, negative real rates regime and various QEs by major central banks has enabled, facilitated and fomented a massive inflation of dollar financial claims complimented by a build-up in the global currency credit system.

Yet more signs of market’s reaction to bubble policies.

The financialization of the US, or the rapidly expanding share of financial industry relative to the US economy[14] (top chart), appears to coincide with the systemic credit or total credit market growth, which now stands at 369% of the US GDP (lowest pane).

This comes in the face of the decline of “buy and hold” strategy[15] employed by US asset investors which concomitantly come under a secular declining trend of interest rates.

The financial industry, which has expanded based on credit inflation, seems to have shifted investor’s attitudes where the incentives to “buy and hold” have been reduced and where shorter time frame holdings of assets, and or perhaps a high frequency of transactional churning, have been encouraged through social (monetary, financial and administrative) policies.

In other words, the policies of low interest and negative real rates have been instrumental in spurring debt driven bubble cycles.

The fact that many people in the Philippines resort to superficial justifications, such as the Pollyannaish outlook predicated on claims of supposed macroeconomic progress, are indications of a bubble afflicted yield chasing mindset.

To suggest that low interest environment will not lead to asset bubbles is based the fallacious doctrine that views people as behaving like automatons, and where rules, regulations, edicts and decrees, have neutral effects on individuals.

This can be analogized to the self-exculpation act by Pontius Pilate[16] on the ordering the execution of Jesus by washing his hands.

This is also like arguing that getting drunk or intoxicated is not caused by swilling of alcohol.

Also Philippine authorities presume that they can identify or “lean against the wind” and put a freeze in due time, by pricking the formative bubbles. This presumes they have a full understanding of how everybody thinks and acts. They pretend to possess omniscience.

In addition, such authorities fail to explain how a reversal of such policies will impact the local political economy and the marketplace.

The Venezuelan experience shows that policymakers would rather tinker with, and manipulate statistics, to advance the Potemkin village of economic growth, instead of addressing the real concerns.

There are political aspects from which such policies have been targeted at or have an effect on (intended or otherwise). And reversals of such policies will likely go in conflict and produce undesired effects that may put in jeopardy the interests of the political powers that be.

Example, if raising interest rates will hurt the stock and bond markets, how will this affect the electoral odds for the incumbent’s handpicked members of his political party during the 2013 elections?

Said differently, could today’s boom been designed as part of the incumbent’s political strategy to increase the odds of an electoral victory for his party?

The Inflationary Boom, Telecom Smear Campaign, Gold’s Revival

The reality is that the fresh landmark high attained by the Philippine Phisix this week has been propelled by a tailwind which brought about a 2.08% advance.

Unknown to most, Philippine central bank’s, the Bangko Sentral ng Pilipinas (BSP), has been the most aggressive in the campaign onslaught against domestic interest rates or in implementing credit easing among the ASEAN peers.

I previously wrote that Asia’s stock market trends have reflected on the direction of interest rates[17]

On the back of this week’s gains, the Phisix has overtaken Thailand’s SET with a 27% year-to-date return as of Friday’s close, and has been Asia’s third best, behind Pakistan’s Karachi 100 up 43.09% year to date and Laos’ Laos Securities 37.09%

Again, the Philippines among the major ASEAN contemporaries has been the most aggressive in adapting credit easing policies via interest rate cuts.

Many have even been speculating that the BSP will further cut interest rates to reduce the strength of the Peso[18].

As a side note, I think that the pronouncements by establishment experts on the prospective actions of the BSP acts seem more about implied lobbying through disinformation channeled through mainstream media.

The desire for credit expansion seems like narcotic addiction, which only will deepen the malinvestments which will have adverse repercussions overtime.

As the great Ludwig von Mises warned[19],

The point of view prevails generally among politicians, business people, the press and public opinion that reducing the interest rates below those developed by market conditions is a worthy goal for economic policy, and that the simplest way to reach this goal is through expanding bank credit. Under the influence of this view, the attempt is undertaken, again and again, to spark an economic upswing through granting additional loans. At first, to be sure, the result of such credit expansion comes up to expectations. Business is revived. An upswing develops. However, the stimulating effect emanating from the credit expansion cannot continue forever. Sooner or later, a business boom created in this way must collapse.

Recently, the Philippine government seems to be harassing or has been putting select industries in negative spotlight either for political reasons (2013 elections) or for financing or as political charade of “doing something” to generate approval ratings. Such actions doesn’t seem to signal “promoting competitiveness” contra mainstream suggestions.

Last week, the government through the industry regulator accused the top 2 private telecom firms as having “overcharged” consumers[20], stemming from last year’s directive to reduce interconnection charges which were supposedly meant as “pass through to consumers”. This has alleged been by part of “the directive to make text messaging more affordable to the public, pursuant to directives from the Office of the President”

The reality is that the Office of the President has nothing to do with “affordable text messaging”, claims of which represents no less than unalloyed propaganda. The laws of economics cannot be controlled by mere fiat.

The real reason why prices of text messaging and other mobile services have been plunging worldwide has been because of productivity enhancements from market based competition[21] aided by technological advances.

The fact is that the domestic industries’ inefficiencies have been rooted from interventionism mostly via overregulation[22].

Yet if the Philippine government sincerely desires to promote consumer welfare as publicized, the way to do is to abolish foreign ownership restrictions, the congressional franchise and the National Telecom Commissions (NTC) all of which constitutes anti-competitive laws and regulations and of the protection of the entrenched groups connected with political elite.

Previously stateless Somalia, ironically, has garnered the acclaim of having the “best telecommunications in Africa”, with about 10 “fiercely competitive telephone companies” providing wireless technology, charging "the lowest international rates on the continent” and the “cheapest cellular calling rates”[23]

Stateless yes, but highly progressive telecom industry.

The real point has been to discredit the telecoms company as part of the smear campaign to create a popular moral backlash against the telecom industry in order to justify the SMS tax, promoted by the IMF[24].

Telecoms, like the mining sector, have been used by the political class as a milking cow. And the government has been conjuring up phony moral excuses to forcibly extract more taxes from private companies.

Moreover, printing money or credit expansion will never solve a problem caused by regulatory inhibitions or anti-business policies regardless of what statistics say. Such views naively oversimplify a rather complex world.

Importantly, overcharging shouldn’t be just applied to the telecom companies, the table should be turned where overcharging should also be pinned on the extravagance and insatiability of governments to incessantly work on extorting more taxes from the entrepreneurs, capitalists and investors by using “social justice” as pretext to benefit political boondoggles.

As the late libertarian economist and founder of Foundation for Economic Education Leonard Read[25] pointed out as quoted by Professor Gary Galles[26],

In the practice of so-called social justice, the individual is ignored…Social justice is the game of “robbing selected Peter to pay for collective Paul.” This form of political behavior seeks the gain of some at the expense of others… it is the thwarting of justice that begs our censure.

Industries persecuted by the government have apparently struggled, been at the tailend or became laggards.

So far, the inflationary boom which has been conspicuous through the outstanding advances by the Financial, Property and holding sectors, has failed to give these sectors a lift.

Nevertheless, much of what I have been predicting seems to be taking hold, as global financial markets shift into high gear towards a risk ON environment. The yearend rally seems in motion.

As I wrote last September[27],

I believe that the interim response from the FED-ECB policies, designed to prop up financial assets, will likely provide strong support to the global stock markets including the Philippine Phisix perhaps until the yearend, at least.

The mining index, which has underperformed all sectors, will likely expunge its year to date losses at least by the yearend.

I believe that the complexion of relative performances will change as the upside momentum deepens and should imply for a spillover if not a rotation.

Given last week’s strong rally by gold relative to the S&P 500, including the seeming recovery of the S&P GSCI Industrial Metal (GYX) Index and the broad based Reuters-CRB (CCI) index, gold mining issues in the US as the Philadelphia Gold & Silver mining Index (XAU) should likely find revitalization soon.

This also extrapolates to the possible inflection point by the domestic mining sector which should just be around the corner.

While no trend moves in a straight line, which means there should be interim corrections, we are likely to see a reinforcement of the yearend rally which perhaps may get extended until the first quarter of 2013.

Again, all will depend on the actions of central bankers in the face of market’s ever fluctuating conditions.

[15] Charts of the Average Holding period and total credit markets are from Dr. Marc Faber’s Deflationary Bust or Government Profligacy and Money Printing via Zero Hedge, Marc Faber's Chart Porn November 23, 2012