Media says that today’s successful debt auction, which had a "solid demand" for 20-year JGBs, signifies the return to stability.

Japanese government bond prices gained after a solid 20-year-bond auction indicated returning stability in the market after weeks of turbulence in the wake of the Bank of Japan's launch of its massive bond-buying program in April….

Solid demand for the 20-year auction helped fuel the rises in bond prices in the secondary market.

The finance ministry sold ¥1.1 trillion of 20-year bonds with a 1.7% coupon and a lowest price of 100.10, yielding 1.693%, in line with street forecasts.

Current yield actions hardly suggests of any meaningful improvements despite the supposed “solid demand” as 10 year JGBs has been rangebound for the past 3 days.

Again this reveals of a seemingly complicit media whose bias has been to promote Abenomics. Unfortunately, Japan's latest populist economic policies basically represents “doing the same things over and over again and expecting different results”.

The three day consolidation period by the JGBs has evidently given a reprieve to Japan's embattled stock markets. Japan's major benchmark, the Nikkei 225, has bounced off its recent lows.

The seeming equanimity in major bond markets has also allowed many Asian bourses to recover significantly from the recent selloffs. The question is-- if the current serenity is sustainable or not?

Even abroad, mainstream media seem as either lost in confusion or purposely diverting or misleading people’s attention from real issues.

The mainstream attributes rising bond yields to “communications failure”

What central banks may have the world over is a failure to communicate.

Officials are struggling to spell out their visions for monetary policy, often amid a chorus of competing views. Chairman Ben S. Bernanke is trying to manage expectations about when the Federal Reserve will slow asset purchases and raise interest rates. Bank of Japan Governor Haruhiko Kuroda’s reflation-push is backfiring by driving up bond yields. European Central Bank President Mario Draghi is dashing investors’ hopes he once kindled for extra stimulus.

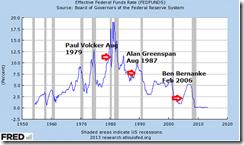

Does the rising yields of 10 and 30 year US treasuries since July 2012 (as discussed last weekend) look like a “communications failure”?

Remember that Bernanke's FED implemented unlimited QE 3.0 in September of 2012, where yields has already been on the rise. Ironically QE 3.0 only had a rather short-lived 3-month effect of lowering rates.

Yet Bernanke’s "Taper Talk' last May 22nd occurred when yields had already been soaring.

Rising yields from the above chart looks more like the diminishing returns from monetary policies. Or that they exhibit symptoms of the unraveling of current policies. In short such are signs of policy failures, and hardly from communications deficiency.

Oh by the way, US President Obama seems to be hinting of a Ben Bernanke retirement in January 2014.

President Barack Obama said Federal Reserve Chairman Ben S. Bernanke has stayed in his post “longer than he wanted,” one of the clearest signals the central bank chief will leave when his current term expires next year.

“Ben Bernanke’s done an outstanding job,” Obama said in an interview with Charlie Rose that aired yesterday, when asked about nominating him for another term subject to Senate approval. “He’s already stayed a lot longer than he wanted or he was supposed to.”

Obama likened Bernanke’s tenure to that of outgoing Federal Bureau of Investigation Director Robert Mueller, who stayed on for two years after his term expired in 2011 and is leaving his post in September. Bernanke’s second four-year stint at the central bank ends Jan. 31.

Not to worry, Mr. Bernanke’s replacement will most likely be another money printer.

Nonetheless I suspect that Mr. Bernanke's seemingly crafty move represents the proverbial passing of the “hot potato” or the unintended effects from his policies to his successor. If true then this would be a nice escape job for Mr. Bernanke.