One of the popular meme has been to project domestic shopping malls as an impregnable investing theme for the Philippines, based on the presumed unlimited spending prowess of the Filipino consumer[1].

As previously discussed and which I won’t elaborate further[2] there that the two common objections against my controversial case on the shopping mall bubble. They can be summed up in terms of sentiment and habit.

The first has been based on the tenuous notion that “crowd traffic” or the “public park” paradigm alone equals store revenues and thus extrapolates to shopping mall revenues. The crowd traffic equals revenue echoes on the dotcom bubble where “eyeballs” or “page views” had been used as justifications to boost stock market prices. Of course in hindsight we know how these misimpressions ended.

The second has been based on the feeble idea that habits are unchangeable or cultural ethos has made shopping malls immune from the laws of economics. Again there is no such thing as people operating in a stasis, as everyone will change in accordance to the changes in the environment or technology or influences in politics or the markets. In the early 90s mobile phones had been a rarity, today mobile phones have become ubiquitous. Such is an example of change.

The ongoing experience of the US shopping mall bust demolishes these objections.

In the US, department stores which peaked in the 2000 have long been in a steep decline. Again the decline of department stores coincided with the dotcom bubble bust.

A recent flurry of job layoffs has been announced in the US shopping mall-big retailing industry

Retail bigwigs such as Sears, JC Penny, Macy’s, Target and Best Buy among many others have announced a wave of store closures and job eliminations. A CNBC article noted of a “tsunami” of forthcoming retail store closures[3].

Moreover, an estimated 15% of shopping malls or retail spaces are expected to be demolished or converted into non retail space within the next 10 years. In addition, one expert believes that half of America’s shopping malls are doomed to fail within 15 to 20 years[4].

Five reasons for the continuing slump in US shopping mall-big retailing arena.

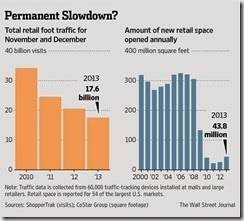

One. As heritage from the 2008 crisis. Notes the Wall Street Journal[5],

Traffic to U.S. retailers was hurt during the financial crisis and recession, when job losses soared and shoppers kept a tight grip on their dollars. But nearly five years into the recovery, it appears many of those shoppers may never be coming back.

Consumers borrowed to spend more than they can afford to pay. Eventually they had pull back as the bills came due.

Two. Uneven economic recovery. Again from the same article

A Target spokesman said shoppers are making fewer trips as "traffic has been impacted by the uneven economic environment," but are spending more when they do show up.

The FED’s implicit support on Wall Street via the Greenspan-Bernanke-Yellen Put (Zirp and QE) has driven a wedge between main street and Wall Street.

This resonates with the stagflation story for the Philippine consumers.

Three. US $ 1 trillion of legacy debt from the recent crash are coming due over the next three years which some specialty hedge funds have been trying to offer bridge finance[6].

This is the supply side angle of the first factor: Commercial Real Estate or shopping mall or big retail developers built malls or retail outlets MORE than the consumers can afford to spend on, or simply stated, an overexpansion spree financed by debt.

Again bills have been coming due. This is more relevant to the Philippine shopping mall case.

Fourth, change in consumer preference where online sales have become a major alternative channel (again from the WSJ)

Online sales accounted for just 5.9% of overall retail sales in the third quarter, according to the Commerce Department, but they have an outsize impact on how shoppers use stores and what they will pay.

While online sales have been rapidly growing they haven’t entirely been able to replace lost physical retail sales. Nonetheless online sales will cannibalize on costly physical malls or retail space. Online sales I believe will become a dominant force.

Lastly, change in consumer preference in terms of physical stores from CNBC

One big shift in store closings has come from retailers shying away from indoor malls, instead favoring outlet centers, outdoor malls or stand-alone stores. Although new retail construction completions are at an all-time low, according to CB Richard Ellis, the supply of new outlet centers has picked up in recent quarters.

Yes Filipino consumers may not be technically the same as Americans. But the point is economic conditions, technology and shifts in social preferences will impact local habits, activities and buying patterns.

Think of it, if the US, which has a nominal per capita income of $51,704 (IMF 2012) combined with her power to tap the credit from the banks and capital markets that extends her purchasing power, have not able to sustain a debt financed shopping mall boom, how could a lowly economy like the Philippines with a measly $2,611 (IMF 2012) or a mere 5% of US per capita, seemingly parading herself as a pseudo developed economy and whom has frenetically been building malls at a rate that even Americans can’t sustain, be capable of doing so?

Here is one prediction. Something will have to give.

Finally pls don’t entertain thoughts that today’s giants will remain so or that these so-called blue chips are impervious to any crisis of internal or external in origin. All one has to do is to think about the fate of former titans Lehman Brothers, Bear Stearns, Washington Mutual or General Motors or Enron all of whom ended up as the largest bankruptcy cases in the US[7].

And be reminded, even billions can go to zero in just a year or two as in the case of Brazil’s Eike Batista, who in 2012 was worth $30 billion and today or in less than two years has reportedly a “negative net worth”[8]

[1] See Philippine Economy’s Achilles Heels: Shopping Mall Bubble (Redux) January 13, 2013

[2] See Phisix: Escalating Risks from the Region and from Internal Bubbles December 9, 2013

[3] CNBC.com A 'tsunami' of store closings expected to hit retail January 22, 2014

[4] Business Insider America's Shopping Malls Are Dying A Slow, Ugly Death January 31,2014

[5] Wall Street Journal Stores Confront New World of Reduced Shopper Traffic January 16,2014

[6] Bloomberg.com Hedge Funds Preparing for $1 Trillion Property Bill: Mortgages February 6, 2014

[7] Wikipedia.org Largest cases Chapter 11, Title 11, United States Code

[8] Wikipedia.org Eike Batista