Economics is the science of the post-magical age. Far from being unscientific or hoobla-hoo, it is deeply anti-magical. It keeps telling us that we cannot do it, that magic will not help. —Deirdre McCloskey

In this Issue

Phisix: BoJ’s QE 2.0 Hail Mary Pass Sends Global Stocks Skywards!

-US Stock Market Mania Goes Overdrive

-How Long will the Euphoria from ECB’s Quick Fix Last?

-Abenomics’ Hail Mary Pass: Bank of Japan’s QE 2.0

-A. Japan’s Swiftly Stumbling Economy

-B. Doubling Down on a Failed Strategy

-C. BoJ’s Hail Mary Pass: Hope is Now the ONLY Strategy

-D. Weak Yen Equals Frail ASEAN Currencies?

Phisix: BoJ’s QE 2.0 Hail Mary Pass Sends Global Stocks Skywards!

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth[1].

I open with a repeat quote from the key proponent of inflationism, John Maynard Keynes, whose ideas has been revered by the mainstream and whose policies has been widely adapted in the current setting.

In reality, wealth cannot be multiplied by dividing it.

So essentially when government arbitrarily confiscates wealth of their citizens, secretly and unobserved, through credit expansion, which debauches the currency, this has never been for the welfare of society but for the interests of the enriched some.

Despite the rip roaring market performance of risk assets during the past weeks, it would seem that the current environment has been entered a crisis. Why? Because in two consecutive weeks, TWO major central banks of the world implemented crisis management policies called as nominally called as credit easing or Quantitative Easing, the European Central Bank last October 20[2], and the Bank of Japan last Friday October 31[3].

All these have apparently coincided, if not has been in response to, October’s stock market convulsion.

Just to give some background on this scintillating week’s performance.

Japan’s Nikkei soared 7.34% this week to a 7-year high. In two weeks, the Nikkei skyrocketed by a mind boggling 12.56%! US benchmarks also flew to set new records, the Dow Jones Industrials, S&P and technology heavy Nasdaq gained a stunning 3.48%, 2.72% and 3.28%, which added to last week’s advances for a cumulative two week total of 6.08%, 6.85% and 8.57% respectively.

In Europe, United Kingdom’s FTSE jumped 2.47 for the week for a two week 3.71% return. Germany’s DAX, surged 3.77% this week where in two weeks total gains ballooned to 5.33%! France’s CAC 40 likewise spiked higher by 2.52% for a total of 4.9%.

The crisis hit European periphery had not been as jubilant this week though. Italy’s MIB added 1.48% this week for the week for a total of 5.73% in two weeks. Spain’s Madrid Index and Portugal’s PSI inched .82% and .96% up for a 4.55% and 3.46% in two weeks.

Interestingly amidst the jubilation the Greek Athens’ Index collapsed by -7.62% which more than erased last week’s 6.39% returns for a two week total of -1.23%.

Ex-Japan Asia partially partook of the Halloween trick or treat celebrations. China’s Shanghai index rocketed by 5.12% which offset last week’s loss to account for a two week gain of 3.46%. New Zealand’s NZ50 advanced 1.01% to a new record with two week gain of 4.64%. India’s BSE set new records as well following this week’s 3.87% surge for a astounding two week performance of 6.72%!

ASEAN stocks underperformed her Asian-Pacific peers with the Philippine Phisix, Indonesia JCI, Thailand’s SET and Malaysia KLSE delivering variable positive returns of 1.58%, .32%, 2.87% and 2.0% for a two week total of 3.01%, 1.2%, 3.61% and 3.7% correspondingly.

US Stock Market Mania Goes Overdrive

Why two weeks?

I believe that the past two weeks represented some milestone of sorts.

Credit Bubble Bulletin’s Doug Noland has the numbers of the record setting US stock market performance over the same period[4]: In the twelve trading sessions since the October 16th 1,813 (“Bullard”) low, the S&P500 rallied almost 11%. The semiconductors have surged about 18% from October 15th lows and the Biotechs 22%. The Nasdaq100 has jumped 12% and the Transports almost 14%. The small caps have rallied almost 13%.

The left window chart of the S&P 500 from the Zero Hedge which I have improvised reveals how US stocks have made the fabulous two week run as guided by central bank officials from the FED, actual actions by the ECB, BoJ and even Japan’s pension fund the Government Pension Investment Fund (GPIF)

Since 2009 I have never seen the S&P recovered so swiftly from a correction. It took ONE month for the S&P to retrench this October, whereas the recovery needed only TWO weeks (see right window where recovery I measure from previous peak to recovered peak)! In the psychological aspect covering stock market trading, fear has been said to be “much greater than the reaction to the greed”[5], but definitely not this time where greed has supplanted fear, thanks to central bank puts!!!

It’s even more than that. Except for this October, the depth of correction in the S&P has been conspicuously diminishing, and for recoveries—a fantastically narrowing of time period (this includes the last two weeks)! What this demonstrates has been the deepening conviction by punters to see US stocks fated for only one direction—up up and away! Overconfidence, brought about by moral hazard policies, at its prime moment.

Some bulls aver that this has been about ‘earnings growth’. So what does current market volatility reflect on? Are these about market’s expectations of volatility in earnings growth? Or has this been a manifestation of sharp gyrations from egregious mispricing of assets such that they are highly sensitive to changes in political setting and politically influenced marketplace that sets stage for emotionally driven dramatic responses?

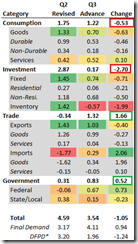

True, a big majority of S&P companies has beaten earnings expectations, to quote Factset[6], “With 72% of the companies in the S&P 500 reporting actual results for Q3 to date, the percentage of companies reporting actual EPS above estimates (78%) is well above historical averages”. But the caveat has been that the earnings beat has largely been a function of downgrades in earnings expectations, again from Factset, “This marks the 7th time in the past 12 quarters that the bottom-up EPS estimate has decreased while the price of the index has increased during the first month of the quarter”. In short, rising earnings came from deliberate markdowns in forward earnings expectations and this has led to prices growing far faster than earnings which equate to multiple expansions.

The distance between price changes in the S&P vis-à-vis changes in Forward 12 month eps has widened far more than the apex of the pre 2007 bubble highs.

But nominal earnings alone don’t tell the entire story. That’s because zero bound rates have enabled debt funded financial engineering that has prompted for a boost in earning via record buybacks, M&As and LBOs. This can be seen from a big number of blue chips or Dow Jones Industrial component issues engaged in massive buybacks[7] that has been responsible for the recent earnings outperformance.

This is aside from zero bound influenced artificial “boost” in demand that has inflated profits, earnings and income (as well as taxes) again due to credit expansion.

What these massaging of earnings via buybacks has done has been to erode the capital base of companies by diverting profits to speculative shareholders at the expense of organic business growth via future business expansions and this has been especially accentuated by debt financing of such activities.

And with the bulls running berserk, whatever happened to the warnings made by US President (POTUS)[8] on excessive risk-taking across the financial system, and by the Fed Chairwoman Janet Yellen[9] where she said last July that “some sectors do appear substantially stretched—particularly those for smaller firms in the social media and biotechnology industries…Moreover, implied volatility for the overall S&P 500 index, as calculated from option prices, has declined in recent months to low levels last recorded in the mid-1990s and mid-2000s, reflecting improved market sentiment and, perhaps, the influence of “reach for yield” behavior by some investors”?

Well since Ms. Yellen’s substantially stretched statements the biotech industry (as measured by the Nasdaq biotechnology index $NBI) has zoomed by about 22% as of Friday’s close while Nasdaq composite has bulged by 4.6%.

As I have been saying manias take a life of their own[10]

Manias, which operate around the principle of the “greater fool”, signify a self-reinforcing process.Rising prices induce more punts which lead to even higher prices as the momentum escalates. Suckers draw in more patsies into a mindless wild and frenetic chase to scalp for marginal “yields” and or from the psychological fear of missing out and or from peer pressures all predicated on the belief of the eternity of a risk-free one way trade. The intensifying hysteria will continue to be egged on by the beneficiaries from such invisible political redistribution both in public and private sectors, supported by bubble ‘expert’ apologists and media cronies.Therefore, recklessness will compound on the accrued recklessness. Again this isn’t just a problem of overvaluations (from which the BSP’s perspective has been anchored) which merely is a symptom, instead this represents deepening signs of intensive misallocations of capital expressed through the massive contortion of prices and the disproportionate distribution of resources on a few sectors at the expense of the others that which has mostly been financed by debt accumulation, thereby elevating risks of financial instability or an economic meltdown…And like typical Ponzi schemes, the manic process goes on until the ‘greater fools’ run out, or that every possible ‘fool’ has already been “IN” (crowded trade), or that borrowing costs has reached intolerable limits to expose on foolhardy speculative activities

Markets may have interpreted the US Federal Reserve’s market buoying statement by Mr. Williams and Bullard as the representing a possible change of heart by the US Federal Reserve—the Yellen Put.

All these reaffirm my theory of the politics of monetary easing policies: I recognize the problem of addiction but a withdrawal syndrome would even be more cataclysmic.

Global political authorities have shown intense aversion of any significant decline in the marketplace or asset deflation such that they will resort to market boosting measures.

Yet market boosting measures are NOT free lunches. Since these signify as hidden or invisible taxes they will be paid for by the real political economy.

How Long will the Euphoria from ECB’s Quick Fix Last?

Yet here’s more interesting insight to the most likely reason for the ECB’s recent QE.

The US Federal Reserve has partly been supporting US based European banks via Interest on Excess Reserves (IOER)[11] and the impliedly through the Fed’s QE.

European banks have been benefiting from arbitraging through funds borrowed at the money market which it deposits to the New York Fed and which they earn from profit spreads between the two. The arbitrage opportunities have been enabled because foreign banks are free from levies in support of deposit insurance programs.

Additionally, since the FED’s injection of $1.3 trillion of reserves with via QE 3.0, the major beneficiaries of the FED’s transfer have been foreign banks (mostly European banks) which accumulated some $700 billion, according to Zero Hedge[12]. So the closure of QE 3.0 means that the FED spigot on foreign European banks will diminish (which should leave European banks to rely on the IOER).

Another possible reason for the ECB’s QE has probably been the ongoing massive outflows of fixed income funds from the Eurozone, which according to a report from the Bloomberg[13], has tallied 187.7 billion euros or $239 billion from the start of the year through August.

Have these been signs of a brewing furtive run in the parts of the Eurozone? Has this been the reason why the fired up European stocks immediately faltered after the first ECB’s QE announcement a week back to only get reignited when rumors of the inclusion of corporate bonds in the ECB’s QE had been floated[14] the following day?

Has this been reason behind why Greek stocks (Athens Index) and bonds (10 Year yields) remained under pressure despite the ECB’s latest QE and in spite of the ECB-BOJ incited risk ON moment? Or why has the euphoria not been transmitted to Greece’s financial markets?

The market meltdown provided the window of opportunity for the ECB to embark on the sustained financing for European banks, as well as, to possibly stanch outflows on ECB’s bond markets. Question is, how far will this band aid remedy go? Once the euphoria fades, what happens when reality seeps in?

Ironically last Friday as the German equity benchmark DAX and the French CAC 40 exploded by 2.33% and 2.2%, respectively, both their real economies has manifested significant signs of strains: German retail sales in September suffered their biggest monthly slump since May 2007, falling 3.2% in inflation-adjusted terms, notes the Wall Street Journal[15], as French consumer spending fell a sharper-than-expected 0.8% in September from August, marking a weak end to the third quarter.

So stocks FLY on vital bad news!

In a world of inflationism, parallel universes occur. Here is another great example.

Civil war torn Ukraine’s economy collapsed 5.1% during the third quarter, which marks the third consecutive quarter of decline which technically means a recession. How does this get reflected stocks? Well, Ukraine’s PFTS index has .06% up this week, and year to date has been higher by a whopping 45.49%!!!

Stocks are about growth of earnings or the economy???

Abenomics’ Hail Mary Pass: Bank of Japan’s QE 2.0

This brings us to the main event

I have previously written[16] about how stock markets have been transformed into propaganda instruments by governments in support of their political agenda or objectives.

In particular, stock markets are deliberately being pushed higher to portray G-R-O-W-T-H in which would titillate the animal spirits in order for people to spend from which the economy would grow. The underlying theory is spending ramification from the wealth effects. That’s the purported mission.

The unstated mission has been the arbitrary confiscation, “secretly and unobserved, an important part of the wealth of their citizens” which “while the process impoverishes many, it actually enriches some”—or redistribution of wealth in favor of asset holders (politically connected banking sector and non-banking sector and other allied enterprises), at the expense of the currency holder.

The Japanese government just launched what may seem as the Hail Mary Pass—a desperate attempt to resolve a serious problem at the last minute.

Bulls never ask why the need for QE in the first place? They only see the initial phase where QE bolsters asset markets. They see the blissful “tripping” or the intoxication phase from the ingestion of the stimuli but never the putrid facet of addiction.

A. Japan’s Swiftly Stumbling Economy

Let me put to perspective some of the latest unfounded euphoria.

First of all, the Bank of Japan’s QE has been part of the PM Shinzo Abe’s program tagged as Abenomics. Abenomics got implemented at the start of 2013, but BoJ’s Kuroda’s doubling of monetary base commenced in April 2013[17].

In one year and six months, the goal to combust inflation in order to supposedly jumpstart economic growth has led to the opposite—economic conditions have sharply deteriorated having been compounded by a surge in tax rates aside from other government interventions.

Japanese household spending has collapsed since the consumption tax was raised in April and unlike her stock market has hardly recovered (left).

Add to this the policy to depreciate the yen which has sold exports as panacea to the economy by the mainstream.

Unfortunately the yen’s weakening has miserably failed to meet its objectives as Japan’s exports have stagnated (in real terms) or has been range bound (in nominal terms), unable to grow more than the pace of imports. The result of which has been an extended deficit in Japan’s trade balance since the initiation of the BoJ’s inflationism mid-2013. This is a wonderful real time demolition of the deeply held mainstream belief of the myth that cheap currency equals strong exports.

In addition, despite the recent rebound, Japan’s manufacturing has been declared by Japan Macro Advisers as in a recession for having declined in two consecutive quarters[18].

Compounding PM Abe’s predicament has been a doubling of accounts of corporate bankruptcies as consequence to Abe-Kuroda policies. Reports the Bloomberg[19], “Bankruptcies due to the weak yen more than doubled to 214 in the first nine months of 2014 compared with the same period a year ago, Tokyo Shoko Research Ltd. said this month”.

The 140% surge in bankruptcies from the yen devaluation has hit small companies most[20]. Another vivid example of how government’s arbitrary confiscation “impoverishes many”.

The same Bloomberg article notes of the diplomatic call of Panasonic Corp’s President Kazuhiro Tsuga for a stable yen where “business groups within the company that benefit from currency strength or weakness are roughly balanced, and that long-term exchange-rate stability is more important than short-term yen depreciation.” (bold mine)

The desire by Panasonic’s Tsuga-san for a stable currency reverberates with earlier calls from business leaders from Western Japan to stabilize the yen, since a weak yen has been eroding on corporate profits as producers have been unable to pass increases in production costs to the consumers[21].

I have warned about the dilemma of Japanese producers at the start of the year[22]

In short, corporations appear to be very hesitant to raise prices perhaps in fear of demand slowdown. Thereby this means a squeeze in corporate profits. Abenomics has only worsened such existing conditions.

Moreover, I warned that tinkering with price signals via currency devaluation distorts the economy that would have a nasty aftermath[23]

It’s a wonder how the Japanese economy can function normally when the government destabilizes money and consequently the pricing system, and equally undermines the economic calculation or the business climate with massive interventions such as 60% increase in sales tax from 5-8% (yes the government plans to double this by the end of the year to 10%), and never ending fiscal stimulus which again will extrapolate to higher taxes.

The chicken has come home to roost

And now for the proverbial straw that broke the camel’s back from which the Abe-Kuroda dismissed all appeals for price stability to launch the BoJ’s version of QE 2.0 ,from the Wall Street Journal[24], “the nationwide core consumer-price index rose 1.0% from a year earlier in September, after climbing 1.1% in the previous month, the government said. The figure is the lowest in 11 months, moving further away from the central bank’s price target of 2%.”

B. Doubling Down on a Failed Strategy

There you go: the BoJ’s ¥50 trillion a year down the drain. Now if one fails with ¥50 trillion, perhaps will 60% more or ¥80 trillion serve as a magic number and do the trick?

Since the BoJ commenced on the bold policy of doubling the monetary base through JGB purchases in the second quarter of last year (left window), the pinnacle of her money supply growth (as measured by the monetary base in %, middle window) came during the first quarter of 2014. This reflects on the lagging effect from the earlier JGB purchases and this comes as the BoJ’s assets have ballooned to nearly 60% of her GDP (right window), something which has been unprecedented in terms of modern day central banking and with respect to her peers (green US, gray Eurozone, blue UK and orange Japan).

It is noteworthy to observe that both household spending and industrial production peaked almost at the same time as with the climax of the money supply growth rate. Thus the deceleration of money supply growth has likewise manifested on the real economy.

Speaking of magic or numbers, BoJ Kuroda’s QE 2.0 seem to be banking on the number ‘three’ as perhaps sign of luck (crossing his finger).

Three, as the Wall Street Journal Real Times Economics notes, was used to highlight the key elements of the latest policy change: tripling annual purchases of equity and real estate funds, extending the average maturity of its bond holdings by three years to 10 years, and increasing its annual buying of government bonds by 30 trillion yen[25].

Since the Japanese government’s econometric models has failed to live up to the politicians and bureaucrats expectations then perhaps numerology will do the job.

The Japanese government did a ONE-TWO punch to send global stock markets into a frenzied bid.

Ok those lucky three numbers as officially proclaimed by the Bank of Japan[26].

1 The BoJ will add JGBs at annual pace of about 80 trillion yen (an addition of about 30 trillion yen compared with the past). This includes the extension the average remaining maturity of the Bank's JGB purchases to about 7-10 years (an extension of about 3 years at maximum compared with the past).

2 The Bank will purchase exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs)…at an annual pace of about 3 trillion yen (tripled compared with the past) and about 90 billion yen (tripled compared with the past), respectively. The Bank will make ETFs that track the JPX-Nikkei Index 400 eligible for purchase.

Don’t you love that…aside from JGBs designed to further compress interest rates via bond yields, the BoJ’s actions will now be openly directed at supporting Japanese stocks and real estate!

Forget the warnings of the Bank for International Settlements, the OECD and the IMF’s warnings on the ballooning risks of financial instability[27]: excessive risk taking, excessive valuations, risk being mispriced and low volatility!!!

So just go inflate more bubbles.

By the way, BoJ’s governor Haruhiko Kuroda paradoxically sits as one of the board of directors of the BIS.

To ensure that global stock markets get into the shindig, the Japanese government has successfully persuaded the government’s Pension fund, the world’s largest, Government Pension Investment Fund (GPIF) with about 130 trillion yen ($1.18 trillion) to overhaul her portfolio allocation by dangling the carrot…GPIF buying of international stocks and bonds!

Here is the official GPIF promulgation[28]

1 Allocation of domestic bonds will shrink from 60% to 35% (permissible deviation* ± 10%)

2 Allocation of domestic stocks will DOUBLE from 12% to 25% (permissible deviation ± 9%)

3 Allocation of international bonds will expand from 11% to 15% (permissible deviation ± 4%)

4 Allocation of international stocks will DOUBLE from 12% to 25% (permissible deviation ± 8%)

*Permissible deviation means tactical asset allocation within permissible ranges of deviation

-The GPIF targets a 1.7% “Real Investment Return” (plus nominal wage increase)

-While the GPIF does not assume short-term assets but are included in the new policy asset mix based on actual asset operation

The GPIF is being flexible here.

Markets frenetically into the opaque GPIF strategy of doubling of stock allocation when the GPIF may just add at minimum of 4% for domestic and 5% for international stocks based on permissible deviation.

Meanwhile President Takahiro Mitani said that the GPIF has not "decided" when to complete the asset shift[29]

C. BoJ’s Hail Mary Pass: Hope is Now the ONLY Strategy

So like all politics, the GPIFs actions look likely a smokescreen designed to seduce the Pavlovian conditioned gamblers to spruce up Japan’s fast sinking economy by drawing them to supposedly front-run both the GPIF and the Bank of Japan in expectations of the latter twos buying.

The GPIF and the BoJ has essentially presented to the public that they would act as the ‘Greater Fool’ or ‘buyer of last resort’ for stocks and REIT.

This is how the Japanese government has perverted Japan’s stock market. The public now will buy stocks in the hope that the BoJ and the GPIF will buy from them at higher rather than base one’s allocation from the cap rate of stock market and property investments. The public has been buying stocks out of moral hazard, someone (Japan’s taxpayers) will pay the price for the recklessness of a few.

Realize that the expected allocation shifts may not be as significant as the consensus has expected by way of manically bidding up of stock markets last Friday. The significance comes with the surprise of the shock and awe in the scale of the announcement rather than reality.

Even if they are allocated as declared this will have short term effects.

Let us place the GPIF in numerical proportions: with assets at $1.2 trillion a 25% allocation for would imply $300 billion apiece for Japanese and international stocks.

At the current 12%, this means the GPIF holds $144 billion of stocks, so the difference $156 billion has been what all these mad scramble has been about.

Global equity markets has a market cap of $64 trillion as of the end of 2013 World Federation of Exchanges) which means at current rate of expansion this should have at least meaningfully surpassed $65 trillion and fast approaching $70 trillion.

The US Dow Jones US Total Stock Market with 3,768 issues has a market cap of $23.65 trillion as of the end of September 2014 (Dow Jones Index) and Japan’s Tokyo Stock Exchange has a market cap of $ 4.5 trillion as of November 2013 (Wikipedia). Even at $300 billion this will amount to only 7% or a speck of TSE’s market cap or an even more a drop in the ocean for US or global equity markets.

The BoJ’s 3 trillion yen support for ETFs at latest conversion is at $26.7 billion which is even smaller than the GPIF. Meanwhile the BoJ’s REIT program at 90 billion yen signifies only $801 million. Even if we combine both the BoJ’s and the GPIF their buying will add to $330 billion for Japan’s stocks.

I know that stock markets are priced at the margins or the marginal buyers and sellers set the price as seen on the ticker tape.

But again the trickle of money to be allocated can only periodically influence prices, which again means the effects are temporary.

Just look at the GPIF’s non commitment by leaving the doors open (not decided) for its completion. It’s a sign that the GPIF only accommodated PM Abe’s wishes rather than of what seems as the intent to fully comply with its new policy.

I don’t think that the GPIF may be loony enough to absorb market risks just for PM Abe. Doing so means that Japan’s aging pensioners will serve as the ‘greater fool’ when stock market collapses.

So I think the seeming ambivalent stance by the GPIF president reflects on this subtle political accommodation.

As for the BoJ, my guess is that the BoJ will bid up stocks only when under pressure similar to their recent 1% rule. The BoJ intervenes when domestic equity markets have been down by 1% or more.

Yet despite all the interventions, Japan’s equity markets has been rattled by the October tremors. So there is no clarity that the record break in Japan’s stocks may be sustained, especially if Japan’s economy falls into a recession.

And speaking of recession, I believe that the BoJ’s has positioned itself to cover the added fiscal deficits from a possible economic downturn. This is what the BoJ’s QE 2.0 has been about. The 2% inflation rate target is just a camouflage.

With fiscal deficits expected to widen, where debt servicing is now equivalent to 25% of government budget and where the difference between taxes and social spending leaves Japan’s 2015 budget in a 7 trillion yen hole[30]…all of which has been based on optimistic expectations, this leaves the BoJ as the only major source of financing for government or their JGBs.

So the BoJ may have expanded her QE to accommodate more monetization of fiscal deficits aside from possibly including the possible shift by GPIF out of domestic bonds. Of course the latter could function as a decoy as to shield the Japanese government from revealing its anxieties. Time will tell. As September has passed, Japan’s quarterly GDP should be out anytime soon.

BoJ’s absorption of JGBs has also entered uncharted proportions. Japan Macro Advisors expects[31] the BoJ to own close to 30% of the JGB market by the end of 2015, and by 2018 50% of the JGB.

This would be an incredible development. As I noted again last June,

the BoJ has practically vanquished liquidity in the JGB markets. In other words the BoJ manipulates the JGB markets in order to keep interest low to sustain the humongous debt levels and by banishing the ‘shorts’ (or the windowmaker trade). This simultaneously builds on financial instability as JGBs, which are supposedly risk free assets and core holdings of financial institutions, becomes illiquid and inaccessible.

Inflationism has never been a standalone policy. Aside from the BoJ and the GPIF, the Ministry of Finance (MOF) has opened the doors for fiscal stimulus, as the MOF considers a supplementary budget worth ¥3 trillion to ¥4 trillion[32].

Finally there is no free lunch even to the Japan’s seemingly desperate duo PM Abe and BoJ’s Kuroda.

PM Abe cabinet has recently been wracked by resignations due to scandals[33]. Importantly the growing opposition to price destabilization from BoJ’s Kuroda’s yen devaluation policies has reared its head as seen through the gnawing division among the BoJ leadership where the governor’s policies prevailed by a slim 5-4 margin.

As this Wall Street article duly observed: Mr. Kuroda also has been facing growing political heat over the costs of easing. He had been grilled for hours in parliament in recent days over, among other things, concerns that the weaker yen resulting from the central bank’s stimulus was pinching businesses by raising costs of imported goods. Those worries will likely only intensify. (bold mine)

This is why the BoJ’s QE 2.0 represents a Hail Mary Pass. The possibility of a realization of recession would likely fuel a pushback on BoJ’s easing and the ouster of Kuroda or even possibly PM Abe.

Manipulation of stock markets has been one way to keep intact the floundering popularity ratings of Japan’s leadership—a public relations campaign strategy with little economic impact and whose benefits are limited to a few (stocks account for only 9.1% of household assets as of June 2014)

So it has been getting clearer why numerology seem to play an accentuated role now for the BoJ governor

For the Abe-Kuroda duo, hope is now the ONLY strategy.

D. Weak Yen Equals Frail ASEAN Currencies?

Is it a wonder why the ASEAN equity markets have underperformed the latest rally? Part of the answer could be seen in the charts above.

When the BoJ initiated its first bond buying in April 2013, ASEAN currencies staggered. Since the yen has repeatedly been pushed down as part of the strategy to ignite inflation, ASEAN currencies followed suit.

The rising US dollar vis-à-vis the yen helped pumped up the US dollar index. The yen has 13.6% share of the US dollar index. Together with the ECB’s QE (57% share of the US dollar index) and crumbling commodities this entails strong US dollar index which should spillover to other currencies as well.

Some will propound that the yen weakness may promote a currency war to defend a nation’s respective export markets. Perhaps. But exports would subordinate to the consequences from previous actions which today represent a burden. And that burden is called debt denominated in US dollars[34].

This means that I’d rather give weight on the US dollar shorts or the massive US dollar debt exposures by both public and private sector of Asian-ASEAN nations that had been acquired in the past which has been used to finance domestic boom.

So instead promoting a weak currency, which risks triggering a regional debt crisis, I expect ASEAN central banks to defend their currencies. This will be revealed by diminished foreign exchange reserves[35].

Will Friday’s collapse of the yen percolate into ASEAN currencies overtime?

As a quick note, for the Phisix to gain 1.58% this week which incidentally came at unimpressively low volume, this required substantial massaging of the index from stock market operators during three of the five trading days[36]. Amazing!

[1] John Maynard Keynes The Economic Consequences of the Peace, 1919. pp. 235-248. PBS.org

[2] See ECB Embarks on QE, European Stocks Fall October 21, 2014

[3] See HOT: Bank of Japan EXPANDS Stimulus October 20, 2014

[4] Doug Noland Kuroda, Bubbles and King Dollar Credit Bubble Bulletin October 31, 2014

[5] Adam Milton Why Markets Fall Quicker Than They Rise About.com

[6] Factset.com Earnings Insight October 31 2014

[7] See Dark Clouds for America’s Blue Chips? NO Worry, Stock Buybacks Saves the Day October 24, 201

[8] See US President Obama Joins Chorus, Warns on Wall Street’s excessive risk-taking October 8, 2014

[9] See Phisix: What Janet Yellen’s “Irrational Exuberance” Speech Implies July 21, 2014

[10] See Phisix: As Mania Rages, BSP Chief Warns on “Complacency” and “Chasing the Market”!!, August 24, 2014

[11] See US Federal Reserve’s Bailout of Eurozone Banks via the OIER August 23, 2014

[12] Zero Hedge And The Biggest Beneficiary Of QE3 Is... October 29, 2014

[13] Bloomberg.com Euro Outflows at Record Pace as ECB Promotes Exodus October 29, 2014

[14] See Rumors of ECB Expanded QE on Corporate Bonds Sends Global Stocks into a Buying Orgy October 22, 2014

[15] Wall Street Journal German, French Retail Sales Slump in September October 31, 2014

[16] See Phisix: As Mania Rages, BSP Chief Warns on “Complacency” and “Chasing the Market”!! August 24, 2014

[17] See BoJ’s Kuroda’s Opening Salvo: 7 trillion yen ($74 billion) of Bond Purchases a Month April 4, 2013

[18] Japan Macro Advisors Japanese manufacturers are officially in recession! October 29, 2014

[19] Bloomberg Yen Anxiety Rises as Tumble Sparks Bankruptcy Surge: Currencies Businessweek.com October 29, 2014

[20] See Abenomics: Weak Yen Takes Toll on Small Japanese Companies October 9, 2014

[21] See How Abenomics' Yen Devaluation Destroys Corporate Profits September 18, 2014

[22] See Japan’s Ticking Black Swan February 24, 2014

[23] See Phisix: Understanding the Dynamics Behind ‘Pump and Dump’ June 29, 2014

[24] Wall Street Journal Japan’s Inflation, Job Creation Slowdown a Blow to Abenomics October 30, 2014

[25] Wall Street Journal Real Times Economics blog Three May Be Bank of Japan’s New Magic Number October 31, 2014

[26] Bank of Japan Expansion of the Quantitative and Qualitative Monetary Easing October 31, 2014

[27] See Phisix: ASEAN Currencies Dive as the BIS, IMF, OECD Warns About Bubbles! September 22, 2014

[28] Government Pension Investment Fund Adoption of New Policy Asset Mix

[29] Nikkei Asia Japan's pension megafund bets on stocks to boost returns November 1, 2014

[30] See Abenomics: Government Economic Downgrade Sends the Nikkei Flying September 19, 2014

[31] Japan Macro Advisors Kuroda knows when to go ALL in October 31, 2014

[32] Wall Street Journal Real Times Economics blog Japan Policy Makers Act in Unison As Sales-Tax Decision Looms October 31, 2014

[33] See Japan's Nikkei Flies 3.98% Yesterday as PM Abe’s Two Ministers Resigns October 21, 2014

[34] See Emerging Market $2 trillion Carry Trade: The Pig in the Python February 24, 2014

[35] See Phisix: Real Time Market Crashes and The S&P Smells Domestic Credit Bubbles October 14, 2014

[36] See Phisix: Another Remarkable Low Volume Index Massaging Day October 30, 2014, See Phisix: Month End Afternoon Delight Pump Helped by BoJ October 31, 2014

.png)

.bmp)