Is something important because you measure it, or is it measured because it's important? Seth Godin

Some market observers have rightly pointed out to China as a possible principal source of concern.

Given the more mature stage of China’s inflation cycle, for me, she is more prone to a bust than her developed economy contemporaries. A China bubble bust would have a far reaching effect on many economies and on financial markets.

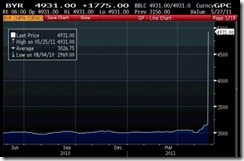

China’s major bellwether the Shanghai index [SHCOMP] has been on a rapid downswing (chart courtesy of Bloomberg) after a major bounce off a key resistance level last April.

The Shanghai index seems on path to test its critical support levels on what seems as a pennant chart formation.

The SHCOMP has been on tight trading range since its meltdown from the October 2007 peak at the 6,000 levels. From the said zenith, the index trades at loss of about 52% based on Friday’s close.

And following this week’s 5% rout, the Shanghai index has been down 3.5% on a year to date basis.

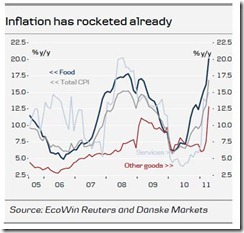

Chinese authorities have been tightening monetary policies to curb heightened risks of inflation.

According to a Bloomberg report[1],

The government has increased reserve requirements for banks 11 times and boosted interest rates four times since the start of 2010 to cool consumer prices

And if we go by the conditions of money supply as potential barometer to China’s economic directions, then it would appear that these compounded efforts against further ballooning of the evolving bubble may have began to affect the economy.

China’s falling money supply (right) appears to have triggered a slowdown on import growth, while consumer prices are also expected to decline according to a Danske Bank report[2].

As an aside, another option which China seems to have used on her fight against inflation has been to reduce her holdings of US treasuries for the fifth month[3] (but added on Japanese debts) and subsequently allowed for her currency the yuan to appreciate[4]. All these could also have added to the China’s process to “normalize” her monetary environment which translates to a potential slowdown.

In a discourse about current state of the US economy Austrian economist Dr. Frank Shostak writes[5],

Ultimately it is fluctuations in the growth momentum of the money supply that set in motion fluctuations in the pace of formations of bubble activities. As a result, various bubble activities that emerged on the back of the rising growth momentum of the money supply will come under pressure — an economic bust will be set into motion.

The above tenet has a universal application which means this applies to China as well.

And a possible evidence of such dynamics could be signs of deceleration in some segments of China’s property sector.

Residential sales in the elite or first tier cities have been on a downtrend.

According to the US Global Investors[6],

Residential house sales are seeing a slowdown in major Chinese cities this year. With the tightening of lending to property developers and restriction of purchases by the governments in China, developers are forced to raise money by selling at lower prices.

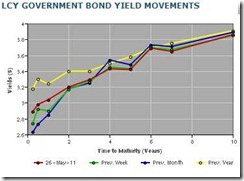

However, the current slowdown has not been apparent on China’s yield curve (as shown below[7]), which appears to have even steepened—manifesting signs of further inflation ahead.

Unlike Vietnam, whose unfolding stock market crash[8] appears to have dramatically flatten her yield curve over a short time span and seem to emit early signs of tipping over to an inversion (where long term interest rate are lower than the short term)—which could presage a recession over the coming year or so.

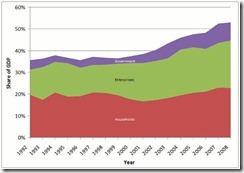

China’s immensely high rate of savings (as shown in the below chart[9]), has contributed substantially to the deferment of the unraveling of its policy induced homegrown bubble.

For as long as these savings would be able to finance economic activities that are both productive or not, the bubble activities may continue.

Nonetheless continued exposure to non-productive activities or malinvestments will eventually lead to wealth or capital consumption or the erosion of the pool of real savings which will force a painful adjustment via crisis or recession.

For now, predicting a bursting of China’s bubble may seem tricky. And I won’t tread on this path yet.

Aside from the yield curve, commodities prices appear to be rebounding, which according to the global-emerging market consumption demand story[10], China plays a significant role in the setting of prices.

Besides, the BRIC (Brazil Russia India China) story seems to share quite a strong correlation (except for Russia) in terms of stock market performance. The vertical lines exhibits the near simultaneous important turns on their respective benchmarks.

With signs that Brazil (BVSP), India (BSE) and Russia (RTSE) recently bouncing off their lows along with the current signs of recovery in commodity prices, China could as well experience an oversold rebound and return to its trading range.

Nevertheless I would need to see more signs or evidences of accelerated deterioration on several markets or economic indicators from which to predict (and take necessary action) on the imminence of a recession or a bubble busting environment.

For now, China’s market volatility could just be representative of the correction phase seen in many of the key global equity markets.

[1] Bloomberg.com China Stocks May Extend Slump, ICBC Credit Suisse, Goldman Say, May 24, 2011

[2] Danske Research China: Growth slows but inflation eased less than expected, May 11, 2011

[3] People’s Daily Online China trimmed holdings of US debt again, May 18, 2011

[4] Bloomberg.com Yuan Completes Weekly Gain on Signs Appreciation to Be Allowed, May 27, 2011

[5] Shostak Frank The Effects of Freezing the Balance Sheet, Mises.org, May 20, 2011

[6] US Global Investors Investor Alert, May 27, 2011

[7] asianbondsonline.adb.org, China, People’s Republic of

[8] See Vietnam Stock Market Plunges on Monetary Tightening, May 24, 2011

[9] Chamon, Marcos Liu, Kai Prasad, Eswar The puzzle of China’s rising household saving rate voxeu.org, January 18, 2011

[10] See War On Commodities: China Joins Fray, Global Commodity Politics Intensifies, May 14, 2011