The theory of reflexivity developed by billionaire (and crony) George Soros underscores the dynamics of bubble psychology, as expressed through a feedback loop mechanism between people’s expectations and their attendant actions in response to the changes in the prices.

Mr. Soros wrote[1]

The underlying trend influences the participants' perceptions through the cognitive function; the resulting change in perceptions affects the situation through the participating function. In the case of the stock market, the primary impact is on stock prices. The change in stock prices may, in turn, affect both the participants' bias and the underlying trend.

Reflexive Theory Applied to the Phisix

The foundation of this theory seems to be anchored on the confirmation bias, where changes in prices that reinforces the underlying trend, gives confidence or strengthens the convictions of people to undertake action in the direction of the same trend. Such action feeds into the price mechanism and thus the feedback loop.

Applied to the Philippine equity market, many people will interpret the current state of the Phisix, which is at fresh record levels, as positive changes in the real economy. Believers would see this as having raised confidence levels, which that merits further actions through additional investments. Again this eventually feeds into higher prices.

An article at the Financial Times sings hallelujah to the Philippines[2],

Whisper it if you will, but the Philippines may at last be getting its act together. These are early days. But there are definite signs that the country – with its young population of nearly 100m people, the world’s 12th largest – has turned a corner…

The Philippines may still be the llama of south-east Asia. But, for the moment at least, the llama has broken into a trot.

President Noynoy Aquino has also used this opportunity to grab credit

From the Inquirer.net[3]

“Investors and Filipinos alike see what is happening: Here is a country determined to turn the corner by instituting genuine, wide-ranging, meaningful reform, and acting on its belief that good governance is the bedrock of equitable progress,” the President said.

We have had six positive ratings actions since we took over government a little less than two years ago—a stark contrast to the single upgrade and six downgrades in the nine years of the previous administration,” he added.

He said the country’s stock market also experienced 27 all-time highs in his 22 months in office.

Let’s put this into perspective.

While the Philippine equity bellwether has indeed been at record levels, such gains have not been unique or limited to the Philippines. In reality, major ASEAN bellwethers have ALL been on a bullish rampage. In other words, what has been portrayed as a special case is, in fact, a regional phenomenon.

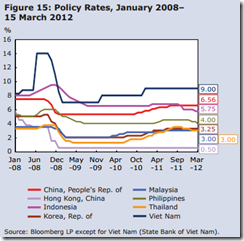

Three of the ASEAN-4 majors are in ALL time record highs, particularly Indonesia [JCI:IND, dark orange], the Philippines [PCOMP:IND, green] and the seemingly underperforming Malaysia [FBMKLCI:IND, light orange] whom has marginally encroached the 2007 highs.

Meanwhile, Thailand [SET:IND, yellow] treads at a milestone 14-year high, but has yet to breach the 1993 record.

Yet these can hardly be construed as coincidental, as the undulations of the ASEAN-4 stock markets have eerily been similar for the last 5 years.

The other way to say this is that there has been a seemingly tight correlation between the Phisix and ASEAN markets. While correlation is not causation, there has been linking factor to their parallel performances.

So if there should be any special developments this must be attributable to the region and not to specific nations.

On a year-to-date basis, the Philippine Phisix, posted a 21.17% gain as of Friday’s close, ranked third only in the Asian region.

The top spot has been Vietnam with 35% returns, while Pakistan has is in second with 28.77% gains.

Notice that except for India, equity benchmarks of Asian majors Japan, Singapore and Hong Kong have yielded over 10%.

In short, Asia in general has posted substantial gains, but emerging Asia has outperformed.

Nonetheless while it may be true that the Philippines has exhibited material improvements on the dimensions of fiscal balances and debt[4], the bulk of the improvements came prior to the incumbent Aquino administration.

In relative dimensions, the degree of progress of the Philippines has been subordinate to the ASEAN peers.

Importantly, ASEAN in general has shown similar path of improvements in both aspects.

Real Reforms? Informal Economy Says No

So admittedly while there have been noteworthy advances in the management of government finances, the question is, has the Philippines been adapting reforms to encourage investments through a business friendly environment?

Well, the World Bank figures suggest otherwise.

Out of 183 countries, the Philippine scorecard[5] for Ease of Doing Business for 2012 has seen marginal improvements in 3 aspects (getting electricity, trading across borders, and enforcing contracts) while 7 areas posted declines in 2012.

Overall, the Philippines fell from 134th ranking in 2011 to 136th in 2012, where 1 accounts for the easiest place to do business while the last rank represents the most difficult place for business.

The above diagram from Doing Business report on the Philippines for 2012[6] gives as a better view of the domestic business climate.

Fundamentally, the Philippines have long lagged the region and the world because of the manifold political hurdles that has undermined relative competitiveness and has raised the bars (or hurdle rate) for attracting investments.

More, while the mainstream meme has touted remittances, which signifies about 8.9% of the economy (Wikipedia.org[7]), as powering the Philippine economy, what they don’t tell you is that there has been a far far far larger of the share of the domestic economy that has a more significant influence: the informal or shadow economy.

The Philippines has one of the largest informal sectors in the world[8], which accounts for nearly half of the economy. They are the balut (fertilized duck egg), peanut and cigarette vendors, carinderias, family drivers, household helps, and etc…

People tend to ignore the obvious.

As Black Swan author Nassim Taleb posted on his facebook account[9]

We are all, in a way, handicapped in a similar way, unable to recognize ideas when presented in a different contexts. It is as if we were doomed to be fooled by the most possibly superficial part of things, the packaging, the gift-wrapping paper around the object. This is why we don’t see antifragility in places that are obvious, too obvious.

For instance, the mainstream overemphasizes on the much heralded 10% (remittances) while ignoring the 45% (informal economy). In behavioral finance, the fixation on the visible while overlooking the others is a logical error that is called the survivorship bias[10]

About a year ago, I interviewed a balut and a peanut vendor from our neighborhood. The peanut vendor told me that he earns about 400-500 pesos a day. But because he can’t read and write, he has been reluctant to open a bank account and instead keeps his money in some physical storage (I think in a can). Yet over the years, his savings has enabled him to buy 2 tricycles which he lent out to 2 relatives for business.

The balut vendor on the other hand told me that his eldest son has been self financing his college engineering education. The son rides the bike which he uses to sell balut at night, and goes to school in the late mornings until the afternoon. The balut vendor father is even in a better position than I am. He owns his house.

Even if people from the informal sectors have been beyond the radar screens of the government and of the institutions of the establishment, the money they save (capital accumulation) helps increase the standard of living of Filipinos. And amazingly these are stuffs which statistics has not been able capture and has left mainstream experts lost at explaining the consumption economy which they mistakenly attribute to “multiplier” from remittances.

And this is why I have long believed that the statistics has understated the real savings rate of Philippines. And it is from such unseen sources of savings that has enabled the Philippines to have 3 out of the 10 largest shopping malls in the world (as of 2008)[11].

Yet the informal sector is an offshoot to economies that has been unduly burdened by a labyrinth of regulations, stifling taxes, onerous social security payments, restrictions in the official labor market, mandated wage rates and other labor restrictions, maze of bureaucratic red tape, politicization of economic opportunities and the many other various forms of interventions[12].

The peanut vendor told me that because he has been a mainstay in the area where he operates, local officials have not been a menace to him, because he got acquainted with them. But other vendors have not been as fortunate, many has to shell out “under-the-table” money for them to operate even during night time, while the others operate on a dictum of “when the cat’s away the mouse will play”.

That’s precisely why informal economies have been associated with greater incidence of corruption.

A weak rule of law, which emanates from unilateral, arbitrary, partisan, repressive and selectively enforceable laws, edicts, regulations, ordinances, impels people to circumvent them, much of it through bribery. And this has been further exacerbated by weak institutions.

As Ms. Ana Eiras at the Heritage Foundation writes[13],

Informality is a response to economic repression, not to something inherently unethical in those who circumvent legislation. What is most unethical about informality is the condition in which the government forces the poor to live. Informally employed people are condemned to a standard of living that is significantly lower than that of formally employed people, who have credit access. Also, informality creates a culture of contempt for the law and fosters corruption and bribery in the public sector as a necessary means to navigate the bureaucracy.

And as the great Austrian economist Professor Ludwig von Mises reminds us[14],

Corruption is a regular effect of interventionism.

So talks about abolishing corruption have simply been misleading. That’s because informal economies, again, exist as consequences of repressive and abusive laws which fosters corruption and are symptoms of economically unfree nations.

Yet if we should give credit where credit is due, then it is the informal economy through the various domestic entrepreneurs and the silent labor force, whom has been defying all these regulatory and political obstacles, that has mostly breathed life to the Philippine economy. Otherwise, chaos would rule.

Until the government meaningfully dismantles the obstacles that inhibit commercial activities, then the “good governance is the bedrock of equitable progress” represents nothing more than a flimflam.

Remittances are Partly Symptoms of Unfree Economies

Politics has always been about distortion of the truth.

The mainstream savors the romanticized notion that OFWs are the “modern day heroes”. In a way they are. Yet hardly any of these experts deal with why OFWs thrives and why they are heroes, outside of the context of $ remittances.

People seem to have mental blackout if we point out that today’s modern day heroes, the OFWs, like their shadow economy counterparts, have been products of unfree economies.

The inadequacy or insufficiency of economic opportunities (particularly for investments which has been diffused into jobs, yes about 4 out of 10 college graduates have been unemployed), have been prompting Filipinos to seek livelihood or greener pastures abroad (13% of graduates go abroad[15]).

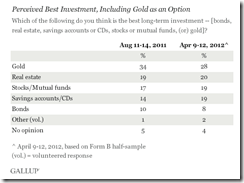

Emerging economies whom have been highly dependent on remittance contributions have mostly been unfree economies.

Of the 30 countries on the table, 20 are mostly unfree if not repressed economies. While others like Lebanon, Samoa, El Salvador, Kyrgyz Republic, Jamaica, Albania, Guatemala, Cape Verde, Armenia and the Domincan Republic are moderately free according to the rankings based from Heritage Foundation[16]. Yet many of these “moderately free” nations are on the “borderline”.

The remittance phenomenon serves as an incredible paradox: The lack of economic opportunities as manifested by high unemployment which has been the outcome of the towering walls of arbitrary regulations and the politicization of markets, has been offset through migration and overseas employment. Yet politicians and media glorify what in reality has been exposing on their flagrant mistakes of collectivization.

Yet the heroic part of the OFW is this; oppressive laws have not prevented them from finding ways and means to survive. So they go abroad and elude domestic government. This has been the part not seen by the mainstream. What has been mostly seen has been the dollars sent and social costs of parting ways with the family, a theme that has been assimilated in media (tv series or movies).

To wit, individuals work to find ways to survive and thrive through circumventing laws by either going to the informal sectors, by corruption (bribery) or by voting with their feet through working abroad as OFW or emigration.

This is the real world and not a figment of someone’s political alter ego (in psychology these are dissociative identity disorders[17] where people live in their dreams and to have a life of what they had always wanted.[18]). Yet it has been inherent for politicians to engage in semantical abstractions to hoodwink the gullible public.

Bottom line: For Filipino politicians to deservingly claim credit for their deeds, we need to see three outcomes from the thrust to promote a business friendly environment or economic freedom: an explosion of legitimate small medium scale businesses, a natural decline in the informal economy out of the reduction of politicization of commerce and a voluntary repatriation of OFWs as a result of the increased economic opportunities at home.

The Disconnect: Stock Market and the Economy

This brings us back to the reflexivity theory.

Whatever “progress” that is largely being interpreted from buoyant financial markets has not yet been representative of the actual performance of the real economy.

If we go by the simple theory where corporate earnings growth has been a part of GDP[19] the implication is that stock prices should be somehow reflect on the expected GDP growth trend.

But the volatility of prices of the Phisix simply does not match with such measures. [As a side note, aside from earnings, a portion of GDP growth[20] also comes from capital increases such as new share issuances, rights issues, or IPOs].

Take note that the Phisix fell by over 50% in 2007-2008 yet the GDP growth hardly turned negative.

Also, note that in the same context GDP growth fell from 8% in 2010 to a little less than 4% yet in late 2011 yet the Phisix continued to set record after record.

In other words, such disconnect simply means either one of the two measures (the Phisix or the GDP) has been emitting false signals or that reality simply defies conventional wisdom.

And where “a flaw in the participants’ perception of the fundamentals” becomes recognized and escalates, this “sets the stage for a reversal of the prevailing bias”[21].

In short, the artificially embellished boom transforms into an ugly bust.

[1] Soros George The Alchemy of Finance p.53 John Wiley & Sons

[2] Pilling David South-east Asia’s llama breaks into a trot, April 25, 2012 Financial Times

[3] Inquirer.net Aquino tells ADB: Corruption over, May 5, 2012

[4] HSBC Global Research Step by step October 11, 2011

[5] Doingbusiness.org Ease of Doing Business in Philippines

[6] Doingbusiness.org Economy Profile: Philippines 2010

[7] Wikipedia.org Philippines Remittance

[8] Pyramid Research Emerging Market Operators Go Underground, January 29, 201

[9] Taleb Nassim Nicholas Facebook

[10] Wikipedia.org Survivorship bias

[11] See A Nation Of Shoppers??!!, April 9, 2008

[12] See Does The Government Deserve Credit Over Philippine Economic Growth? May 31, 2010

[13] Eiras Ana, Ethics, Corruption, and Economic Freedom December 9, 2003 Heritage Foundation

[14] Mises, Ludwig von 6. Direct Government Interference with Consumption XXVII. THE GOVERNMENT AND THE MARKET

[15] See College Isn’t For Everybody, February 3, 2011

[16] World Bank Migration and Remittances: Top Countries Migration and Remittances Factbook

[18] Healthguidance.org Alter Ego Definition

[19] Wikipedia.org Relationship with GDP growth Earnings growth

[20] MSCI Barra Is There a Link Between GDP Growth and Equity Returns?, May 2010

[21] Soros, op. cit. p.57