Intense global market volatility continues. Today’s ambiance seems conducive for adrenaline seeking high rollers.

The Philippine Phisix has been experiencing sharp volatility too. But contrary to my expectations, gyrations has swung mostly to an upside bias.

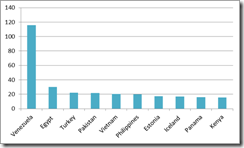

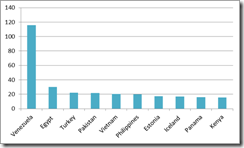

Along with Pakistan, the local benchmark has been outperforming the rest of the Asian region. The Philippine Phisix ranks as the sixth best performer based on year-to-date nominal currency benchmark returns.

Of the 71 international bourses on my radar screen, about a hefty majority or 67% posted gains on a year-to-date basis as of Friday’s close.

This hardly has been representative of a bearish mode.

In addition, the Phisix is just about a fraction or spitting distance away (1%) from the May record highs at the 5,300 level. And considering that equity markets of the US and European markets skyrocketed Friday, a new Phisix milestone record seems to be a “given”.

Repeated Doping of the Markets Triggered a RISK ON Environment

Yet global stock markets appear to be detached from real world events.

Bad news has prominently been discounted and bizarrely treated as good news. It’s a sign of abnormal conditions, as well as, the amazing complexity of the nature of markets behaving in response to massive price distortions from political actions.

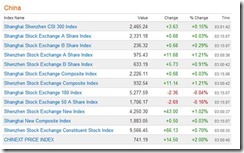

Global equity markets began with their creeping ascent in June. This excludes China’s Shanghai (SSEC) index though.

Each week since, global equity markets rose on a barrage of bailout related developments. The evolving events can be categorized as actualized bailouts and events that accommodated a prospective bailout.

Spain’s bailout[1], the extension[2] of Operation Twist by the US Federal Reserve and the latest EU summit[3] could be seen as examples of the actualized bailouts. They account for as promises made good through actions.

The culmination of the Greece elections[4], the easing of collateral rules[5] and pledges for stimulus[6] signifies as both market conditioning, and of the prospective accommodation for future bailouts. People saw these events as indicators of prospective political actions

I drew and noted of the timeline of the actualized bailout events along with the chart of the major indices. Clearly we see Europe’s STOX 50, the US S&P 500 and Dow Jones Asia (P1Dow) responding to political actions.

Friday’s supposed “breakthrough” from the EU summit sent global markets into a frenzied RISK ON spiral.

The deal reportedly[7] facilitates a direct injection mechanism into stricken banks by EU’s rescue funds, particularly the temporary European Financial Stability Facility (EFSF) and the permanent European Stability Mechanism (ESM). The rapprochement also included the option of intervening in the bond markets, the waiving of preferred creditor status on ESM’s lending to Spanish banks and the creation of a “single banking supervisor” which marks the first step towards a banking union and an allegedly a backdoor route towards a fiscal union.

Since the deal has been seen as a “shock and awe” policy, and went beyond market’s expectations and partly fulfilled the mainstream’s yearnings for a union, global financial markets went into a shindig

The soaring Phisix has given some the impression of decoupling. This hasn’t been accurate. While there have been some instances of short-term divergence, decoupling or lasting divergence may not be in the cards.

What has distinguished the Phisix is her OUTPERFORMANCE. The repeated doping of the markets which has been inciting the current “recovery” benefited the Phisix and the top performers most.

Yet both developed economy markets and ASEAN markets (Thailand’s SETI, Malaysia’s MYDOW and Indonesia’s IDDOW) have virtually and coincidentally “bottomed” during the start of June and ascended in near consonance from then. The point is that the underlying trend has been similar but the returns have been different.

And since shindig from Friday’s EU summit has yet to be priced in on ASEAN markets, perhaps Monday’s open will likely reflect on the newfound euphoria.

The elation from the EU Summit deal has not been limited to the global stock markets but was likewise ventilated on the commodity markets and on the currency markets.

Gold, Oil (WTIC), Copper and the benchmark CRB or an index accounting for a basket of 17 commodities all scored hefty one day gains.

Non-US dollar currencies like the Euro likewise posted a huge one day 1.83% gain. The Philippine Peso also firmed by .7% to 42.12 to a US dollar. The Peso is likely to break the 42 levels if this momentum continues.

Overall, this is your typical RISK ON environment.

EU Summit’s Honeymoon: Sorting Out the Cause and Effects

The ultimate question is does all these represent an inflection point that favors the bulls?

Candidly speaking this “rising tide lifting all boats” scenario are the conditions that would make me turn aggressively bullish. BUT of course, effects shouldn’t be read as the cause.

In the understanding that the markets have thrived throughout June on REPEATED infusions of bailouts and rescues, my question is what happens if markets are allowed to float on its own? What happens when the effect of the bailouts fade? Or outside real political actions of bailouts, will markets continue to rise on the grounds of mere pledges or from hopes of further rescues?

The current environment seems so challenging.

Yet there seems to be many kinks or obstacles to the supposed EU deal.

First, while the premises of the EU deal have been outlined, the details remain sketchy.

Second, a change in the lending conditions of Spain’s bailout may also trigger demand for changes of other bailed out nations to seek similar terms. This may lead to more political squabbling.

Third, the ESM has yet to be ratified[8] by members of the Eurozone

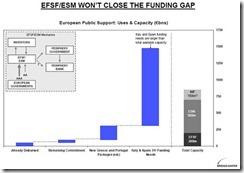

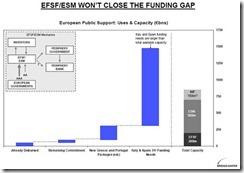

Fourth, EU’s combined capacity for the EFSF and ESM, even if complimented by the IMF, represents a little over half of the total funding requirements[9]. Thus, the proposed therapy from the EU summit will likely only buy sometime.

Fifth, the controversial deal rouse a popular backlash against Germany’s “surrender” or “blackmailed” into accepting the conditionality set by the EU. Such views have been ventilated by major media outfit[10].

Even after the German parliament immediately passed bailout pact, several German lawmakers along with opposing political groups responded swiftly by filing suites to challenge the accord at the Federal Constitutional Court[11]. Since the German President President Joachim Gauck said that he would withhold the passage of the new laws pending the resolution of lawsuits, the rescue mechanism may suffer risks of delay, or at worst, a reversal from the courts.

Sixth, the preferred path towards centralization will likely exacerbate the problems caused by regulatory obstacles and by deepening politicization of the marketplace[12]. Politicians don’t seem to get this. They have been inured to treat the symptoms and not the causes.

Yet the problems have not been confined to the EU. There remains uncertainty over China’s seemingly intensifying economic woes. The local Chinese government have reportedly resorted to selling cars to raise finances[13]. As of this writing, a new report shows that China’s manufacturing conditions have been worsening[14]. Most importantly Chinese authorities seem to be in dalliance over demand by the media for more rescues.

Developments in the US have not been upbeat either. The Supreme Court’s upholding of the Obamacare will have massive impacts to the economy and to US fiscal balances[15]. “Taxmaggedon” or massive tax increases[16] slated for 2013 out of the expiration of tax policies may also impact the economy. There is also the contentious US debt ceiling debate. All three are likely to become critical issues for the coming US elections, this November.

Importantly the rapid deceleration of money supply is likely to pose as a headwind for the US markets as well as the economy.

Bottom line:

Yes momentum may lead global markets climb the wall of worry over the interim. But the dicey cocktail mix of political deadlock, escalating economic woes and the uncertain direction of political (monetary) policies contributes to the aura of uncertainty that may induce a fat tail event.

[1] See Expect a Continuation of the Risk ON-Risk OFF Environment June 11, 2012

[2] See US Federal Reserve Extends Operation Twist, Commodities Drop June 21, 2012

[3] See Markets in Risk ON mode on Easing of EU’s Debt Crisis Rules June 29, 2012

[4] See Shelve the Greece Moment; Greeks are Pro-Austerity After All, June 18, 2012

[5] See ECB Eases Collateral Rules as Banking System Runs out of Assets, June 23, 2012

[6] See From Risk OFF to Risk ON: To Stimulus or Not?, June 7, 2012

[7] Reuters.com EU deal for Spain, Italy buoys markets but details sketchy, June 29, 2012

[8] Wikipedia.org, Ratification European Stability Mechanism

[9] Zero Hedge Last Night's Critical Phrase "No Extra Bailout Funds", June 29, 2012

[10] Telegraph.co.uk EU Summit: How Germany reacted to Merkel's 'defeat', June 30, 2012

[11] Bloomberg.com Germany’s ESM Role, EU Fiscal Pact Challenged in Court June 30, 2012

[12] See What to Expect from a Greece Moment, June 17, 2012

[13] See Out of Cash, Local Chinese Governments Sell Cars, June 27, 2012

[14] See Deeper Slump in China’s Manufacturing, Will Bad News Become Good News? July 1, 2012

[15] See Obamacare’s 21 New or Higher Taxes for the US economy, July 1, 2012

[16] Heritage Foundation Taxmageddon: Massive Tax Increase Coming in 2013, April 4, 2012