The recently concluded Barangay elections reported accounts of massive and widespread vote buying (as much as 1,000 pesos per head) and a surge in the death toll from election violence (higher than national elections in 2010).

The 64 billion peso question: why all these? What drives candidates to desperately seek political office at the cost of their lives and huge amounts of expenses?

The answer of course is no stranger to most: it has been both about perks and power.

Let us examine the perks or benefits from the officials of Barangay level.

The basic perquisites are as follows:

Graph from the Rappler.

Aside from these, other benefits include Christmas bonus and cash gift, insurance coverage, as well as, benefits for accident, total or permanent incapacity, disability, death and burial.

There’s more. Barangay officials also get many subsidies in the form of “free hospitalization in government facilities, and free tuition in state schools for themselves and two of their legitimate dependent children (“legitimate” is specified in the law) during their incumbency. Based on their number of years in the service, barangay officials can get civil service eligibility”.

What are they not entitled to (for now)? 13th month pay, hazard pay, representation and transportation allowances, productivity incentive bonus, clothing and personnel and economic relief allowances.

[As a side note, the above also introduces the power aspect

National level officials have been pushing for more Barangay benefits from more funding to fare discounts. Why?

It’s all about political power

This noteworthy excerpt captures its essence

“In theory, the law says [barangay elections] should be nonpartisan,” Casiple said, referring to a provision in the Omnibus Election Code barring candidates to represent or receive aid from any political party.“But in reality, they’re important to mayors. That’s where the fight is. If you hold the barangay, it’s a ready-made machinery for ward leadership. It has become a fight by ordinary politicos,” Casiple said.Casiple said this partisanship has translated the “perks” otherwise not stated by law, granted by higher government units. Off the top of his head, Casiple cited, as example: “Here in Quezon City, all barangay captains are given a car. “

Ergo, controlling the Barangay means ensuring votes from the grassroots level. So leaders from the local to the national level compete to gain their favor. This leads us to the key of Philippine patronage politics: whoever controls the local governments, controls the machinery for the national level]

Now even if we total cash and non-cash benefits these would amount to about at best Php 500k per year. For a three year term that would accrue to P 1.5 million. At P 1.5 million, 1K peso per vote expenditures, whether direct (vote buying) or indirect costs (ads or marketing campaign, organization, network and etc..), would translate to only 1,500 voters. There are about 3,518 voters per Barangay in the National Capital Region (registered voters: 6m, no. of Barangays 1,705 NSCB)

How will candidates recoup their election expenditures “investments”?

We can only make a guess.

One, from their 20% share of the national internal revenue allotment (IRA). In 2013, the IRA budget for the 42,026 Barangays nationwide has been at P59,165,520,37.This will jump by 15% to 68.3 billion pesos in 2014.

Two, from their share of the other revenues from the allocations for local government units (ALGU) as part of the national government’s budget law, the General Appropriations Act.

In 2014, the AGLU budget has been set at 360.5 billion pesos.

Notes the Philippine Senate:

Other items in the ALGU are the shares of local governments from tobacco excise tax collections and taxes from mining and other extractive industries, and the budget of the Metropolitan Manila Development Authority, among others.

Third there are other sources of funding from the Barangay level, include (as per the Department of Budget and Management

-Service fees or charges for the use of barangay property or facilities;

-Barangay clearance fees;

- Fees or charges for the commercial breeding of fighting cocks and on cockpits and cockfights;

- Fees or charges on places of recreation with admission fees;

- Fees or charges for billboards, sign boards, neon signs and other outdoor advertisements;

- Toll fees or charges for the use of any public road, pier or wharf, waterway, bridge, ferry, or telecommunications system funded and constructed by the barangay;

- Revenues from the operation of public utilities and barangay enterprises (markets, slaughterhouses, etc.);

- Fines (not exceeding P1,000) for the violation of barangay ordinances; and,

- Proceeds from the sale or lease of barangay property or from loans and grants secured by the barangay government

In short, fees and taxes from the Barangay level

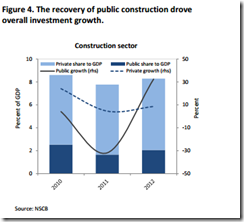

The above is the flow chart of how the Barangay establishes and supervises its budget via the DBM

So there you have it. Pork in its varied forms applied to the Barangay: from the national level: AGLU via IRA and AGLU via other shares of taxes, and from the Barangay level fees and taxes.

In essence, from top to bottom, Philippine politics operates under the Pork Barrel system

Every election, said the great libertarian H. L. Mencken, is a sort of advanced auction on stolen goods. The Barangay elections seem to validate this.

As I wrote in 2010

So essentially, the Pork Barrel culture reinforces the patron-client relations from which the Patron (politicos) delivers doleouts and subsidies, which is squeezed from the Pork Barrel projects, to the clients who deliver the votes and keeps the former in power. Hence, the Pork Barrel system is essentially a legitimized source of corruption and abuse of power seen from almost every level of the nation’s political structure, an oxymoron from its original “moralistic” intent (unintended consequences). As the saying goes “the road to hell is paved with good intentions”.As we previously noted, ``Plainly said, when we demand for more social spending or welfare based programs to resolve our problems then we increase the funds allocated to politicians for their dispensation. Essentially, Pork Barrels signify our excessive dependence on government where the correlation of government spending and the price of getting elected are direct.”

Politicization of every aspect of social life from top to bottom leads to corruption, political and wealth inequalities and economic-financial repression which means a lower standard of living. The worst effect is the violence which politics incites, and of the degradation of society’s moral fiber

While the call for the abolition of the Pork Barrel is ideal and necessary it is not sufficient.

For as long as the public thinks the Pork is a problem of personal virtuosity or what I call as personality based politics (and not of systemic defect), politicians will be able to camouflage pork into many different masks as shown by latest the speech by the Philippine president.

In other words, to abolish the Pork requires a radical change of opinion by the public. As Scottish philosopher historian and economist David Hume wrote in Part I, Essay IV OF THE FIRST PRINCIPLES OF GOVERNMENT in Essays, Moral, Political, and Literary (bold mine)

NOTHING appears more surprizing to those, who consider human affairs with a philosophical eye, than the easiness with which the many are governed by the few; and the implicit submission, with which men resign their own sentiments and passions to those of their rulers. When we enquire by what means this wonder is effected, we shall find, that, as FORCE is always on the side of the governed, the governors have nothing to support them but opinion. It is therefore, on opinion only that government is founded; and this maxim extends to the most despotic and most military governments, as well as to the most free and most popular.

And the best way to attain such change is for the public to demand a third party audit of all forms of Pork from the top to the local level (past and current), with emphasis on the top.

Only by opening the Pork's Pandora's Box will there be a bigger chance for an epiphany by the public that Pork is inherent in the nature or structure of the Philippine patronage based political system. Such that dismantling of the Pork Barrel has to occur from top to bottom.

Yes this also means demolishing Pork at the Barangay levels.