``Luck is far more egalitarian than even intelligence. If people were rewarded strictly according to their abilities, things would still be unfair—people don’t choose their abilities. Randomness has a beneficial effect of reshuffling society’s cards.”- Nassim Nicolas Taleb, The Black Swan

In a bullmarket everybody is said to be a genius. This also implies that there will be an explosion of participants masquerading as experts.

Many will be overwhelmed by the attribution bias, where success will be associated with skills rather than the general circumstance of the marketplace or in particular the rising tide or plain old lady luck.

Winnowing the quality of knowledge will thus be a very important factor for any serious investors.

Importantly, to avoid getting trapped into a false sense of security (overconfidence) we should learn how to discriminate between luck and skills.

Information needs to be processed for them to be qualified as knowledge. Yet knowledge is never equal and has individualized traits.

And knowledge becomes skills only when translated into actions. Yet in applying knowledge to actions, where luck is involved, is highly dependent on the classification of the activity.

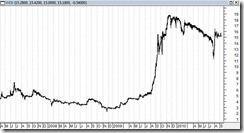

Figure 1: Legg Mason: Distinguishing Luck and Skills

Some activities have greater influence of luck than the others, as illustrated by the chart in figure 1.

Legg Mason’s Michael Mauboussin elaborates,

“Skill is “the ability to use one’s knowledge effectively and readily in execution or performance.” You can think of skill as a process, or a series of actions to achieve a specific goal. Luck is “the events or circumstances that operate for or against an individual.” Luck, in this sense, is above and beyond skill.”

The more variables involved in the nature of activity, the greater luck interplays with action.

So how does one distinguish between luck and skills?

Through mean reversion.

Legg Mason’s Mr. Mauboussin explains[1],

``One point is worth making right upfront: the outcomes of any activity that combine skill and luck will exhibit reversion to the mean. More technically, an extreme outcome (good or bad) will be followed by an outcome that has an expected value closer to the mean. Reversion to the mean is a tricky concept, and the relative contributions of skill and luck shed light on its significance for various activities.”

This is true. Predicting the market would seem like a coin toss distribution (50-50%) since markets move only in two opposite directions.

What makes forecasting activities difficult is the sustainability of accuracy. And mean reversion is what Warren Buffett would analogize as “you would only find out who is swimming naked when the tide goes out.” When luck runs out experts riding on artificial steak of predictive successes will be exposed for its facade.

For instance, some people claim that they have predicted one or two circumstances wherein the market validated their perspective.

However, if we consider the batting average of their overall predictions, their performances may accrue to be even less than the coin-toss distribution. This means that like a broken clock, they can only be right twice a day. This implies that relying on their expert opinion as basis for securing knowledge for prospective investment actions may not be worthwhile, as they could yield inferior results given their poor forecasting probability. (A noteworthy example would be a prominent University professor who had been on embraced by the media as a guru even when his streak of forecasting appears to have been tainted by a wide margin of error.[2])

Another way to say this is that one can be right for the wrong reasons or what one may call as sheer coincidence. Here, the context of the prediction would be its substance.

Luck versus Skills

Knowing to distinguish between luck and skills are important for several reasons:

1. It serves as a way to institute measurement of tradeoffs among available actions. In other words, economic calculation based on each proposed action and its attendant opportunity costs. Of course one can’t be specific, but instead rely on estimates.

In addition, one must give room or margin of error to variability, randomness and diminishing returns in terms of establishing the prospective asymmetric outcomes.

2. It provides rational feedback mechanism for assumed circumstances. Hence, contingent actions can be devised, where one won’t get caught by nasty “surprises” like a deer freezing in fear when faced headlights.

3. It filters false premises or noise from relevant information or signals.

In pointing out that the predictions of cabdrivers were at no disadvantage with very intelligent persons, Nassim Taleb wrote[3], Cabdrivers did not believe that they understood as much as learned people-really, they were not the experts and they knew it. Nobody knew anything, but the elite thinkers thought that they knew more than the rest because they were elite thinkers, and if you’re not a member of the elite, you automatically know more than the nonelite.

In short biases (economic or political) can obscure anyone from adapting the appropriate balanced or a more open perspective.

Applied to the general failure of most experts to foresee the recent crisis, economist David Colander in his written testimony submitted to the Congress of the United States, House Science and Technology Committee writes[4], (bold highlight mine)

``One of J.M. Keynes’s most famous quotes, which economists like to repeat, highlights the power of academic economists. He writes, “the ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed, the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back.” (Keynes, 1936: 135) What this quotation misses is the circularity of the idea generating process. The ideas of economists and political philosophers do not appear out of nowhere. Ideas that succeed are those that develop in the then existing institutional structure. The reality is that academic economists, who believe themselves quite exempt from any practical influence, are in fact guided by an incentive structure created by some now defunct politicians and administrators.”

The comfort of the crowd (or appeal to popularity), sheer dependence on models and presumptuousness of knowledge (or in Hayek’s term Fatal Conceit) can lead people to mental blindness which may extrapolate to severe miscalculations and eventual losses.

4. Michael Mauboussin suggest that this is also a way to segregate outperformers and laggards, which he calls “framework for understanding whether there’s a “best” participant”

He writes[5],

Transitivity is a key concept in assessing the outcomes of one-on-one interactions. An activity has transitive properties when competitor A beats competitor B, competitor B beats competitor C, and competitor A beats competitor C. Activities dominated by skill tend to be transitive. In contrast, in an activity that is not transitive, competitor A beats competitor B, competitor B beats competitor C, but competitor C beats competitor A. This is the set up of the game rock, paper, scissors. In theory, there is no best strategy in rock, paper, scissors, and chance will dictate the winner of a game, or repeated games. (In reality, people are poor at behaving randomly. For example, in tournament play, competitors throw scissors only 29.6 percent of the time, 3.7 percentage points less than what randomness requires. 13) A number of sports show a lack of transitivity, in part reflecting the nature of match-ups.

5. Importantly, distinguishing luck from skill based action also provides a framework for managing expectations.

This is especially important because of the possibility of the contrasting nature inherent in the expectations of the agent and the principal (agency problem) which could generate tensions or conflicts.

Here Mr. Mauboussin gives a prudent advice,

``Stated differently, you want the investment professionals focused intently on finding opportunities with edge and building sensible portfolios. Career risk is also important. Investment managers seeking long-term excess returns will frequently have portfolios that are very different than the benchmark and that have high tracking error. If the time horizon of either the investment company or the clients is shorter than the time horizon necessary to see the fruition of the investment approach, even skilled managers risk getting fired.” (bold highlight mine)

So principals (investors and punters) and their agents (bankers, stockbrokers, analysts, fund managers) would need to have their expectations aligned so as to maintain harmonious relationship as well as optimize on the skill based advantages of their agents in generating above average relative returns, in spite of the vicissitudes of the marketplace.

Prediction Versus Entrepreneurial Action

For most participants, the timeframe horizon is so narrow such that they presume financial markets as being driven by popular events.

In most occasions they can be so emotionally overwhelmed that they would accept any information as having valid causal linkages to price actions. Others may be in not for the returns, but for the thrill and excitement of market gyrations (entertainment value). Some are enticed by their endemic gambling ticks.

In addition most mainstream analysis are predicated on projecting past performances into the future.

Nassim Taleb rightly points out on this blind spot[6]: when we think of tomorrow we do not frame it in terms of what we thought about yesterday or the day before yesterday. Because of this introspective defect we fail to learn about the difference between our past predictions and the subsequent outcomes. When we think of tomorrow, we just project it as another yesterday. (bold highlight mine)

The important point here is that the pattern seeking nature of most people including experts tends to neglect on the conditional asymmetries involved which led to the outcome of yesterday.

Thus, many experts will err in the belief that yesterday’s conditions will playout similarly tomorrow.

Also, plain vanilla predictions issued by experts can differ with entrepreneurial actions in the sense that analysts may have less stakeholdings in their forecasts.

In other words, experts may not have personal money involved on the markets and could be advancing the latent interests of their employers (institutions) or themselves (subscription services) rather than the interests of principals (ROI). Hence, flowing with the mainstream ideas essentially shields them from the accountability of underperformance—where any negative outcome would be ascribed to general misfortunes (reverse attribution bias).

Another difference is that where the probabilities or the frequency and the substance would serve as an imprimatur for predictive successes for prediction gurus, in the financial markets, it is the magnitude of the gains, arising from their prudent portfolio management that matters most for investors. That’s why understanding crowd psychology and the stages of the market cycles play a far more important role for any serious investors than just interpreting from economic or corporate fundamentals perspective. After all, markets are all about people, their expectations vented through their actions to fulfil certain needs.

Lastly and importantly, we should learn to accept and admit that luck will be playing a big role into shaping relative or absolute returns. It’s because the complexity of nature allows many unseen things or “randomness” to shape decisions, actions and events.

As Nassim Nicolas Taleb wrote in his best seller[7],

``Capitalism is, among other things, the revitalization of the world thanks to the opportunity to be lucky. Luck is the grand equalizer, because almost anyone can benefit from it. The socialist governments protected their monsters, and by doing so, killed potential newcomers in the womb.”

So yes, as an unabashed capitalist, I would certainly count on luck in shaping the performance of my portfolio.

[1] Mauboussin, Michael J. Untangling Skill and Luck, July 15, 2010 Legg Mason Management

[2] See Wall St. Cheat Sheet: Nouriel Roubini Unmasked; Lesson, October 22, 2009

[3] Taleb, Nassim Nicolas The Black Swan, The Impact of the Highly Improbable

[4] Colander David written testimony submitted to the Congress of the United States, House Science and Technology Committee, July 20, 2010 coordinationproblem.org, Read and React -- Colander's Testimony on Capitol Hill About Economics

[5] Mauboussin, loc. cit

[6] Taleb, Nassim Nicolas loc. cit

[7] Taleb, Nassim Nicolas loc. cit