At the recent Austrian Economics Research Conference held in the Mises Institute, Economic Policy Journal's Robert Wenzel gives an excellent speech examining the real factors that led to the collapse of the Soviet Union.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Monday, March 25, 2013

Central Bank Fractional Banking System: Bank Runs or Inflation

The incumbent central bank fractional banking system means a choice between bank runs and price inflation.

The great dean of Austrian school of economics Murray N. Rothbard explained. (bold mine)

1. Why fractional reserve banks are uninsurable

The answer lies in the nature of our banking system, in the fact that both commercial banks and thrift banks (mutual-savings and savings-and-loan) have been systematically engaging in fractional-reserve banking: that is, they have far less cash on hand than there are demand claims to cash outstanding. For commercial banks, the reserve fraction is now about 10 percent; for the thrifts it is far less.This means that the depositor who thinks he has $10,000 in a bank is misled; in a proportionate sense, there is only, say, $1,000 or less there. And yet, both the checking depositor and the savings depositor think that they can withdraw their money at any time on demand. Obviously, such a system, which is considered fraud when practiced by other businesses, rests on a confidence trick: that is, it can only work so long as the bulk of depositors do not catch on to the scare and try to get their money out. The confidence is essential, and also misguided. That is why once the public catches on, and bank runs begin, they are irresistible and cannot be stopped.We now see why private enterprise works so badly in the deposit insurance business. For private enterprise only works in a business that is legitimate and useful, where needs are being fulfilled. It is impossible to "insure" a firm, even less so an industry, that is inherently insolvent. Fractional reserve banks, being inherently insolvent, are uninsurable.

2. Money Printing as camouflage. The political choice of inflation over bank runs.

What, then, is the magic potion of the federal government? Why does everyone trust the FDIC and FSLIC even though their reserve ratios are lower than private agencies, and though they too have only a very small fraction of total insured deposits in cash to stem any bank run? The answer is really quite simple: because everyone realizes, and realizes correctly, that only the federal government--and not the states or private firms--can print legal tender dollars. Everyone knows that, in case of a bank run, the U.S. Treasury would simply order the Fed to print enough cash to bail out any depositors who want it. The Fed has the unlimited power to print dollars, and it is this unlimited power to inflate that stands behind the current fractional reserve banking system.Yes, the FDIC and FSLIC "work," but only because the unlimited monopoly power to print money can "work" to bail out any firm or person on earth. For it was precisely bank runs, as severe as they were that, before 1933, kept the banking system under check, and prevented any substantial amount of inflation.But now bank runs--at least for the overwhelming majority of banks under federal deposit insurance--are over, and we have been paying and will continue to pay the horrendous price of saving the banks: chronic and unlimited inflation.

The political choice of inflation over bank runs can be seen via the loss of US dollar’s purchasing power.

Since the establishment of the US Federal Reserve in 1913, one US dollar in 1913 has an equivalent of buying power of $23.45 today according to the BLS inflation calculator. This means the US dollar have lost nearly 96% of their purchasing power. Chronic and unlimited inflation indeed.

The other implication is that the choice of inflation over bankruns means a subsidy to banks at society's expense.

3. Abolish the central banking system and ancillary regulators. Restore sound money

Putting an end to inflation requires not only the abolition of the Fed but also the abolition of the FDIC and FSLIC. At long last, banks would be treated like any firm in any other industry. In short, if they can't meet their contractual obligations they will be required to go under and liquidate. It would be instructive to see how many banks would survive if the massive governmental props were finally taken away.

Cyprus, Troika Reach Bailout Deal

So a midnight deal was struck between the Cyprus government and the “troika” consisting of unelected bureaucrats before the deadline.

From Bloomberg:

Cyprus agreed to the outlines of an international bailout, paving the way for 10 billion euros ($13 billion) of emergency loans and eliminating the threat of default.The accord between Cyprus and the “troika” representing international lenders was reached in overnight talks in Brussels and ratified by finance ministers from the 17-nation euro area.

“It’s in best interest of the Cyprus people and the European Union,” Cyprus President Nicos Anastasiades told reporters.

It’s really in the best interests of those in the seat of power and connected to them. and not for Cyprus

The content of the deal, again from Bloomberg:

The agreement calls for Cyprus Popular Bank Pcl (CPB) to be shut down and split. The Bank of Cyprus Plc would take over the viable assets of the failed bank along with 9 billion euros in central bank-provided emergency liquidity aid, according to three EU officials who asked not to be named because talks are ongoing.Deposits below the EU deposit-guarantee ceiling of 100,000 euros will be protected, and a loss of no more than 40 percent will be imposed on uninsured depositors at the Bank of Cyprus, two EU officials said. Uninsured depositors at Cyprus Popular would largely be wiped out, two other officials said.

Wow. 40% losses for uninsured deposits above 100,000 euros for Bank of Cyprus while total losses uninsured deposits for Cyprus Popular!

Who determines this? The eurocrats from the troika. They will play "god" here. They will ascertain whose assets are “viable” or assets that would be taken over by Bank of Cyprus, and whose assets will be condemned for total losses. They will decide on who are the winners and the losers. They will play the judge, jury and executioner.

I wonder how much under the table deal is going on right now for deposit accounts of 100,000 euro and above? There will a lot of grease money out there to bargain for survival.

And I also wonder how the Russians will be taking this.

Ah but while deal is reached this is subject to approval.

Again from Bloomberg:

It was the second time in nine days that Cyprus struck a deal with European creditors and the IMF. The first accord, reached in the early hours of March 16, fell apart three days later when the Cypriot parliament rejected a tax on all bank accounts on the island.

Perhaps we should pay heed to the advice of Mises Institute's founder, Lew Rockwell:

Your money is not safe in a bank..If the bank is in trouble the government will take your money…Mattress will be a better place to keep your money

Phisix Mania Phase: Been There, Done That

The Philippine Phisix suffered its second major weekly decline for the year, down 2.04%.

Two consecutive weeks of hefty losses has brought the Phisix off 4.62% from the recently etched milestone highs. Such losses have shaved the year-to-date gains to only 12.15%.

Yet the local benchmark appears to have bounced off the 50-day moving averages supported largely by domestic participants.

Two weeks of the manic bullish reprieve has translated to net foreign selling.

Yet foreign selling does not necessarily translate to fund repatriation. Selling proceeds could be held in cash at the banking system or could have been shifted to other domestic assets (local bonds or properties). The paltry decline of the Peso over two weeks from 40.68 per USD to 40.84 per USD as of Friday’s close may have manifested on such dynamics.

But so far, domestic participants seem to have used technicals to provide support on the Phisix. This seems to manifest on the “refusal to retrench” and “this time is different” mentality.

We have seen this before.

I have been writing about how I think today’s deepening of the manic phase may partly resemble 1993[1].

Then the Phisix returned an eye-popping 154% in nominal currency gains. Following a sharp run up, there had been two sporadic corrections. Ironically, over the same period today, in March and in May where the index fell 6.1% and 5.8% respectively (see 2 red ellipses).

The gist or 63% of the astounding year-to-date 154% return came during the yearend rally that began in October.

While I am not a fan of searching for patterns, whether charts or statistics, to predict the markets, I believe that the psychological framework undergirding today’s boom represents a good approximation of what may happen during a manic phase.

When the prevailing bias has been to think that the current bullrun has been about “good governance” economics, “robust earnings” and that domestic markets “are financially resilient from stresses abroad” while at the same time blissfully ignorant of the baneful impact of expansionary credit from artificially induced interest rates and other credit easing measures, all these are symptoms of “Wow I am smart” (left window) and the “new paradigm” (right window) of the deepening mania phase.

Again mania, for me, signifies as the yield chasing phenomenon that have been rationalized by voguish themes or by popular but flawed perception of reality, enabled and facilitated by credit expansion.[2]

So if I correctly pinpoint the stage of our stock market cycle, then we should expect the Phisix to use the current corrections or consolidations as potential springboard to reach the bear “capitulation” phase where the Phisix may or could reach the 10,000 level. This may happen this year or the next (2014), and again, is strictly conditional.

And the manic phase will be accompanied by an intensive accumulation of systemic credit which will most likely be supplemented by last week’s easing of the 1.86 trillion peso Special Deposit Accounts (SDA) by the BSP[3].

Remember, the BSP explicitly desires that the banking system’s money deposited at the BSP be “withdrawn” and “circulated” in the economy, since according to them SDA money will hardly extrapolate to inflation risks.

In other words, the BSP’s recent SDA policies will account for as providing implicit support to the domestic asset markets, in addition to its current record low interest rates.

So unless domestic monetary officials make a reversal on these credit easing policies, there is a strong likelihood for the Phisix to playout on the final stage of the boom phase of the domestic bubble cycle.

Let me be clear, I am not suggesting that the Phisix will yield 154% this year. Instead I am saying that since social policies ultimately shapes bubble cycles, we are likely to see current policies sustain the domestic bubble process, unless the BSP reverses current policies—most possibly in response to the market signals, e.g. price inflation pressures—or if exogenous “shock” events will be substantial enough to undermine the current prevailing bias.

[1] see Global Financial Markets Party on the Palm of Central Bankers January 21, 2013

[2] see Phisix Amidst the Global Pandemic of Bubbles February 18, 2013

[3] see Phisix and the BSP: This Time is Different? March, 17, 2013

Labels:

bubble cycles,

bubble psyche,

mania phase,

Phisix,

Phisix 10

Thailand’s Officials Flexes Muscles on Domestic Stock Market Bubbles

To deny that today’s asset market prices have been mainly driven by social policies is to see only a segment or an incomplete picture of reality.

I mentioned last week that Thailand’s SET has overtaken the Philippine Phisix as the latter saw the bulls hibernate. Yet in a snap of a finger, dramatic changes occurred.

Thailand’s SET nosedived 7.5% this week, with Friday’s huge 3.3% losses accounting for nearly half of the week’s quasi panic selling. This week’s “biggest slump since 2008” basically halved the SET’s year-to-date gains: yes, 7.5% losses in one week.

News reports say that the mini crash accounted for “forced sales on margin accounts”[1] in response to expectations over an increase on “margin requirements on trading”.

The Thai bourse said that the level of collateral for account holders will be increased to 20% of the credit line from 15%[2] or an additional 5% of collateral will be required for every credit line used.

We are not even talking about market responses to a bubble bust or from interest rate spikes, but from an arbitrary edict by the Thai bourse aimed at allegedly reducing “risks to the clearing system” as well as to “help reduce volatility”.

The Stock Exchange of Thailand (SET) seem to be a government agency, since it is a “juristic entity set up under the Securities Exchange of Thailand Act, B.E. 2517 (1974)”, according to the wikipedia.org[3].

Yet if markets have all been about “fundamentals” and “earnings”, then why the aggregate brutal reaction to what appears as a tightening directed by political officials on stock market participants?

The vehemence of selling pressures incited by the “forced sales on margin accounts” only goes to demonstrate how leveraged Thai’s equity markets have been.

Importantly, this also reveals how policymakers can act unilaterally at the expense of the politically unconnected public.

Thai officials seem to sense of a bubble in progress, then precipitately decides tighten.

But their campaign appears to be hinged on a piecemeal approach targeted at a specific asset class.

The actions by the SET essentially reflect on the recent statements by Deputy Governor of the Bank of Thailand, Mr Pongpen Ruengvirayudh, who I recently cited[4].

The Thai official seems to have a good basic comprehension of the nature of bubbles and has recently acknowledged of the considerable growth of the nation’s systemic credit. But he ambivalently dismissed the prospects of the risks of a bubble in presupposing that their actions will successfully contain them.

So I would read the SET’s recent activities in the context of Mr Pongpen Ruengvirayudh’s declarations; where Thai officials will target specific asset markets for bubble containment measures.

Yet it is unclear if the SET’s latest policies will fundamentally impair the prevailing bias.

This will really depend AGAIN on the prospective actions of SET and other regulators, particularly the Bank of Thailand (BoT).

Interventions basically engender uncertainty. And markets disdain uncertainty. However this axiom would only be true if interventions don’t cover monetary easing or credit expansion. The global financial markets have thus far slobbered over central banking stimulus.

In corollary, the contemporary steroids addicted financial markets detests interventions that are based on “tightening” or “withdrawal”

For the meantime, the recent decree on margin trades will translate to an adjustment window from the policy induced uncertainty made by SET’s latest “tightening”. Thus Thai equities are likely to struggle.

Market participants will then assess if SET officials will continue to foist uncertainty through more ‘tightening’ interventions, or if the authorities will allow markets to function. If the former, then Thai’s equity markets would have more downside bias going forward. If the latter, then Thai’s mania may catch a second wind.

It would also be misguided to assume that assaulting stock markets will extrapolate to the suppression of bubbles. Such actions represent as dealing with the symptoms rather than the disease.

China’s stock market, as measured by the Shanghai Stock Exchange Composite[5], remains in consolidation at the bear market troughs.

But the object of manias via rampant speculation and credit expansion has only been diverted to the property markets.

Stock market bubbles seem as easier to control politically compared to property bubbles. That’s because the former operates on centrally organized regulated platforms as against the latter which represents a localized, diversified and fragmented market.

In servicing the financial needs of the highly dispersed property sector, banks frequently engage in off-balance sheet transactions combined with other nonbank entities or intermediaries. They are resorted to by many firms in order to circumvent or skirt regulations. These companies represent the shadow banking industry[6].

Such phenomenon hasn’t been limited to China[7] and the US[8] but has evolved to cover much of the major economies of the world[9].

The global pandemic of bubble policies has mainly fueled their rise. Also, shadow banking has been a function of regulatory responses by markets as well as political entities (like the local governments of China). Yet the more the regulations, the bigger the shadow banks.

It’s been an incessant cat mouse game between regulators and market forces.

As I recently pointed out, the feedback on the newly imposed property restrictions on China’s property markets has prompted people to exploit legal loopholes. Incidences of divorce have skyrocketed as married couples use the divorce route to bypass new regulations[10].

Another example, Malaysia’s string of legal restrains likewise has failed to prevent the recent surge in property prices[11] which the IMF admitted they failed to see beforehand.

So Thailand’s tepid approach in dealing with her bubbles will hardly meet the objectives of managing them. The bubble caused by easy money policies isn’t likely to stop; they will only shift, unless the authorities deal with the real cause.

Officials may deny that bubbles pose as public risk. But they are beginning to tinker with the markets in order to rein them. This means they are admitting indirectly to the menace which they publicly reject. We call this demonstrated preference or action speaks louder than words.

Nonetheless, Thailand’s experience shows how highly sensitive or fragile markets are to the prospects of tightening.

The attack on Thailand’s stock market by their authorities to quash homegrown bubbles is a lesson that should be relevant for world markets or for the Phisix.

[1] Reuters.com SE Asia Stocks-Down; Thailand underperforms on forced sales, March 22, 2013

[2] Bloomberg.com Thai Stocks Post Worst Week Since 2008 on Margin Rule Change March 22, 2013 SFGate.com

[3] Wikipedia.org Operations Stock Exchange of Thailand

[4] see Phisix’s Mania: We’re Still Dancing March 11, 2013

[5] tradingeconomics.com CHINA STOCK MARKET (SSE COMPOSITE)

[6] Wikipedia.org Shadow banking system

[7] see More Signs that China’s $2.4 Trillion Shadow Banking System is in Big Trouble September 14, 2012

[8] see 2008 US Mortgage Crisis: The US Federal Reserve and Crony Capitalism as Principal Causes May 31, 2011

[9] see Financial Bubble: Shadow Banking System Soar to US $67 Trillion or 100% of World GDP November 20, 2012

[10] Finance Asia Property tax exposes Chinese pragmatism March 20, 2013

[11] see More Signs of Manic Phase in The Phisix, ASEAN and the US, March 4, 2013

Cyprus: The Mouse that Roared

Unfolding events in Cyprus may or may not be a factor for the Phisix or for the region over the coming days.

This will actually depend on how the bailout package will take shape, and importantly, if these will get accepted by the “troika” (IMF, EU and the ECB), whose initial bid to force upon a bank deposit tax indiscriminately on bank depositors had been aborted due to the widespread public opposition.

So far, the Cyprus parliament has reportedly voted on several key measures[1] as nationalization of pensions, capital controls, bad bank and good bank. Reports say that the Cyprus government has repackaged the bank deposit levy to cover accounts with over 100,000 euros with a one-time charge of 20%[2]!

The troika demands that the Cyprus government raise some € 5.8 billion to secure a € 10 billion or US $12.9 billion lifeline.

If there may be no deal reached by the deadline on Monday, then Cyprus may be forced out of the Eurozone. Then here we may see uncertainty unravel across the global financial markets as a Cyprus exit, which will likely be exacerbated by bank runs and or social turmoil, may ripple through the banking system of other nations.

However, if Cyprus gets to be rescued at the nick of time, then problems in the EU will be pushed for another day.

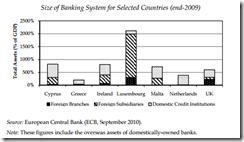

Nonetheless unfolding events in a 1 million populated Cyprus, but whose banking system has been eight times her economy[3] has so far had far reaching effects.

The Cyprus “bail in” has already ruffled geopolitical feathers.

Germans are said to been reluctant to provide backstop to Cyprus due to nation’s heavy exposure to the Russians, where the latter comprises about a third of deposits of the Cyprus banking system. Much of illegal money from Russia has allegedly sought safehaven in Cyprus.

The Cyprus-Russia link goes more than deposits. They are linked via cross-investments too.

Some say that the Germans had intended to “stick it to the Russians”[4].

On the other hand, Russians have felt provoked by what they perceive as discrimination.

Meanwhile events in Cyprus have also opened up fresh wounds between Greeks and the Turkish over territorial claims[5].

The other more important fresh development is of the bank deposit taxes.

Where a tax is defined[6] as “a fee levied by a government on income, a product or an activity”, deposit taxes are really not taxes, but confiscation.

Some argue that this should herald a positive development where private sector involvement takes over the taxpayers. Others say that filing for bankruptcy would also translate to the same loss of depositor’s money.

Confiscation is confiscation no matter how it is dressed. It is immoral. Private sector involvement is forced participation.

Bankruptcy proceedings will determine how losses will partitioned across secured and unsecured creditors and equity holders. Not all banks will need to undergo the same bankruptcy process. Yet confiscation will be applied unilaterally to all. For whose benefit? The banksters and the politicians.

And one reason bondholders have been eluded from such discussion has been because Cyprus banks have already been pledged them as collateral for target2 programs at the ECB[7].

The more important part is that events in Cyprus have essentially paved way for politicians of other nations, such as Spain and New Zealand[8], to consider or reckon deposits as optional funding sources for future bailouts.

With declining deposits in the Eurozone[9], the assault on savers and depositors can only exacerbate their financial conditions and incite systemic bankruns.

So confidence and security of keeping one’s money in the banking system will likely ebb once the Cyprus’ deposits grab policies will become a precedent.

This is why panic over bank deposits have led to resurgent interest on gold and strikingly even on the virtual currency the bitcoin[10]. The growing public interest in bitcoin comes despite the US treasury’s recently issued regulations in the name of money laundering[11].

Such confiscatory policies will also redefine or put to question the governments’ deposit insurance guarantees. Not that guarantees are dependable, they are not; as they tend increase the moral hazard in the banking system as even alleged by the IMF[12].

Deposit guarantees are merely symbolical, as they cannot guarantee all the depositors. Given the fractional reserve nature of the contemporary banking system, if the public awakens to simultaneously demand cash, there won’t be enough to handle them. And obliging them would mean hyperinflation. That’s the reason the dean of the Austrian economics, Murray Rothbard calls deposit insurance a “swindle”[13].

The banks would be instantly insolvent, since they could only muster 10 percent of the cash they owe their befuddled customers. Neither would the enormous tax increase needed to bail everyone out be at all palatable. No: the only thing the Fed could do — and this would be in their power — would be to print enough money to pay off all the bank depositors. Unfortunately, in the present state of the banking system, the result would be an immediate plunge into the horrors of hyperinflation.

So governments will not only resort to taxing people’s savings implicitly (by inflation), they seem now eager to consider a more direct route: confiscation of one’s savings or private property. Note there is a difference between the two: direct confiscation means outright loss. Inflation means you can buy less.

Finally, losses from deposit confiscation, and its sibling, capital controls will lead to deflation.

Confiscatory deflation, as defined by Austrian economist Joseph Salerno, is inflicted on the economy by the political authorities as a means of obstructing an ongoing bank credit deflation that threatens to liquidate an unsound financial system built on fractional reserve banking. Its essence is an abrogation of bank depositors' property titles to their cash stored in immediately redeemable checking and savings deposits[14].

The result should be a contraction of money supply and bank credit deflation and its subsequent symptoms. This will be vented on the markets if other bigger nations deploy the same policies as Cyprus.

That’s why events in Cyprus bear watching.

[1] See Cyprus President Warned Friends of Crisis March 23, 2013

[2] New York Times Cyprus Makes Plan to Seize Portion of High-Level Deposits, March 23, 2013

[3] Constantinos Stephanou The Banking System in Cyprus: Time to Rethink the Business Model? 2011 World Bank

[4] Investopedia.com The Cyprus Crisis 101 March 19, 2013

[5] See Will Events in Cyprus Trigger a War? March 22, 2013

[7] Mark J Grant Why Cyprus Matters (And The ECB Knows It) Zero Hedge March 23, 2013

[8] John Aziz Guest Post: Whose Insured Deposits Will Be Plundered Next? Zero Hedge March 21, 2013

[9] The Economist Infographics March 23, 2013

[10] See Bitcoins: Safehaven from Cyprus Debacle and Officially Recognized by the US Treasury March 21, 2013

[11] International Business Times, US Treasury Department: Virtual Currencies (Read: Bitcoins) Need Real Rules To Curb Money Laundering March 22, 2013

[12] Buttonwood What does a guarantee mean? The Economist March 19, 2013

[13] Murray N. Rothbard Taking Money Back January 14, 2008 Mises.org

[14] Joseph Salerno Confiscatory Deflation: The Case of Argentina, February 12, 2002 Mises.org

RBS: Asia Has a Credit Bubble!

Like Thailand, Philippine officials will likely continue to stubbornly contradict publicly on the risks of bubbles, yet as I recently pointed out, recent events in Cyprus only reinforces the perspective of how regulators can hardly see or anticipate bubbles until fait accompli or until the ex-post materialization of the advent of a crisis[1].

And it would seem that more from the mainstream are becoming aware of elevated risks of Asia’s credit expansion. (yes, I am not alone)

The Royal Bank of Scotland (RBS) practically notices all the symptoms I have been elaborating as effects or symptoms of bubbles.

They note that bank deposits have not kept the pace with rate of credit growth. They also noticed that the focus on domestic consumption coincides with rising credit levels and the loosening of credit conditions (left window). Savings have also been in a conspicuous decline.

Remember consumption is a function of income. Outside income, more consumption can only be attained by virtue of borrowing and by running down of savings. Borrowing represents the frontloading of consumption. Expanded consumption today eventually leads to lesser consumption tomorrow as the borrowers would have to pay back on the interest and principal of debts.

As I previously noted[2]

My explanation revolved around examining the 3 ways people to consume; productivity growth (which is the sound or sustainable way) and or by the running down of savings stock and or through acquiring debt (the latter two are unsustainable).

So the decline in deposits and savings as credit expands are signs of capital consumption.

The RBS also observed that the ballooning of credit have come amidst the backdrop of falling labor productivity while the region’s balance of payments had rapidly been deteriorating.

Declining savings and the diversion of household expenditure towards debt financed consumption goods leads to capital consumption, thus the decline in productivity.

Artificially suppressed interest rates, which penalizes savers and encourage speculation in the financial markets and other unproductive uses of capital, mainly through the concentration of speculative investments or gambles on capital intensive projects, e.g. property, shopping mall, casinos, are symptoms of malinvestments. So instead of promoting productive investments, low interest rates serve as another source of productivity losses.

The RBS equally notes that India, Indonesia and Thailand have become balance of payment ‘deficit’ countries whereas Malaysia’s surplus has been sharply declining. The regions banks’ loan-deposit ratios have likewise substantially increased to uncomfortable levels (right window).

When nations spend more than they produce, then such deficits occur. And deficits would then need to be financed by foreigners or as I previously noted “would need to be offset by capital accounts or increasing foreign claims on local assets”[3].

And with more countries posting deficits, then the increased competition for savings of other nations will translate to increased pressure for higher domestic interest rates. Yet greater dependence on foreigners increases the risks of a sudden stop or of a slowdown or reversal of capital flows.

On the same plane, when domestic spending is financed by domestic debt then deficits grow along with rising local debt levels.

The deterioration of real savings or wealth generating activities and the expansion of bubble activities only increases the risks of a disorderly adjustment (bubble bust) which may be triggered by high interest rates or by interventions to reverse the untenable policies or by sudden stops or by plain unsustainable arrangements or even a combination of these.

The RBS also comments that household debt ratios particularly in Hong Kong Malaysia and Singapore have increasingly transformed into a fragile state, accounting for over 65% of GDP. Worst is that household wealth has nearly been concentrated in property, which makes the region’s wealth highly vulnerable to higher interest rates and a decline in property prices.

Overreliance on debt which has been used for unproductive and consumption activities only increases people’s sensitivity and susceptibility towards upward changes in interest rates that are likely to affect asset prices and economic performance.

This is known as the bubble cycle.

The RBS as quoted by the Reuter’s Sujata Rao[4],

What is however worrying is the pace of credit growth. …The combination of rapid credit disbursals and more importantly, the on-going divergence between credit disbursals and GDP growth implies that the system is becoming more vulnerable to income and interest rate shocks.

Again while such imbalances may not have reached a tipping point or the critical mass yet and which may not likely impact the region over the interim, everything will depend on the “pace of credit growth”.

And a manic phase will likely goad more debt acquisition in order to chase yields.

[1] see The Anatomy of the Cyprus’ Bubble Cycle March 24, 2013

[2] see Shopping Mall Bubble: The Quibble Over Statistics January 29, 2013

[3] See E-Vat 15%: Possible Consequence from Current Quasi Boom Policies December 10, 2012

[4] Sujata Rao Asia’s credit explosion, Global Investing Reuters.com March 22, 2013

Labels:

asia banking system,

asian economies,

asian markets,

bubble cycles,

credit bubble,

sudden stop

Sunday, March 24, 2013

The Anatomy of the Cyprus’ Bubble Cycle

The following article from the Reuters has a concise chronicle of the boom bust cycle which today has been plaguing Cyprus via a banking crisis and which I dissect.

(all bold highlights mine, occasional side comments of mine in italics)

1. The Pre-EU setting.

Before joining the euro, the Central Bank of Cyprus only allowed banks to use up to 30 percent of their foreign deposits to support local lending, a measure designed to prevent sizeable deposits from Greeks and Russians fuelling a bubble.

2. The Moral Hazard from EU’s economic convergence policies

When Cyprus joined the single European currency, Greek and other euro area deposits were reclassified as domestic, leading to billions more local lending, Pambos Papageorgiou, a member of Cyprus's parliament and a former central bank board member said."In terms of regulation we were not prepared for such a credit bubble," he told Reuters.Banks' loan books expanded almost 32 percent in 2008 as its newly gained euro zone status made Cyprus a more attractive destination for banking and business generally, but Cypriot banks maintained the unusual position of funding almost all their lending from deposits.

3. How bubble policies reshaped the public’s behavior.

"The banks were considered super conservative," said Alexander Apostolides an economic historian at Cyprus' European University, a private university on the outskirts of Nicosia.When Lehman Brothers collapsed in the summer of 2008, most of the world's banks suffered in the fallout, but not Cyprus's."Everyone here was sitting pretty," said Fiona Mullen, a Nicosia-based economist, reflecting on the fact Cypriot banks did not depend on capital markets for funding and did not invest in complex financial products that felled other institutions.

Note of the "this time is different" mentality and the attitudes of "invincibility".

4. Overconfidence and Mania

4. Overconfidence and Mania

Marios Mavrides, a finance lecturer and government politician, says his warnings about the detrimental impact on the economy of so much extra lending fell on deaf ears."I was talking about the (property) bubble but nobody wanted to listen, because everyone was making money," he said. (sounds strikingly familiar today—Prudent Investor)The fact that the main Cyprus property taxes are payable on sale made people hold onto property, further fuelling prices, Papageorgiou added…Michael Olympios, chairman of the Cyprus Investor Association that represents 27,000 individual stock market investors, said he too criticized the central bank for "lax" regulation that facilitated excessive risk taking.

Ex-post, people always look for someone to pass the blame on. They forget the responsibility comes from within.

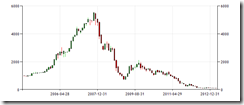

The Cyprus General Index from Tradingeconomics.com

Notice: The losses from the bust had been more brutal than the gains from the boom

5. The yield chasing dynamic fueled by monetary-credit expansion

A depositor would have earned 31,000 euros on a 100,000 euros deposit held for the last five year in Cyprus, compared to the 15,000 to 18,000 euros the same deposit would have made in Italy and Spain, and the 8,000 interest it would have earned in Germany, according to figures from UniCredit.Bulging deposit books not only fuelled lending expansion at home, it also drove Cypriot banks overseas. Greece, where many Cypriots claim heritage, was the destination of choice for the island's two biggest lenders, Cyprus Popular Bank -- formerly called Laiki -- and Bank of Cyprus.

6. The Knowledge problem: Regulators didn’t see the crisis coming. Also the transmission mechanism: From the periphery (Greek crisis) to the core (Cyprus crisis)

The extent of this exposure was laid bare in the European Banking Authority's 2011 "stress tests", which were published that July, as the European Union and International Monetary Fund (IMF) were battling to come up with a fresh rescue deal to save Greece. (reveals how bank stress tests can’t be relied on—Prudent Investor)The EBA figures showed 30 percent (11 billion euros) of Bank of Cyprus' total loan book was wrapped up in Greece by December 2010, as was 43 percent (or 19 billion euros) of Laiki's, which was then known as Marfin Popular.More striking was the bank's exposure to Greek debt.At the time, Bank of Cyprus's 2.4 billion euros of Greek debt was enough to wipe out 75 percent of the bank's total capital, while Laiki's 3.4 billion euros exposure outstripped its 3.2 billion euros of total capital.The close ties between Greece and Cyprus meant the Cypriot banks did not listen to warnings about this exposure…

Artificial booms are often interpreted as validating the policies of the incumbent political authorities. It's only during fait accompli where people recognize of the failures of politics. This is an example of time inconsistency dilemma

Yet the blame will always be pinned on the victims (private sector, e.g. depositors, the speculators) rather than the promoters of the bubble.

7. More regulatory failure.

Whatever the motive, the Greek exposure defied country risk standards typically applied by central banks; a clause in Cyprus' EU/IMF December memorandum of understanding explicitly requires the banks to have more diversified portfolios of higher credit quality."That (the way the exposures were allowed to build) was a problem of supervision," said Papageorgiou, who was a member of the six-man board of directors of the central bank at the time.The board, which met less than once a month, never knew how much Greek debt the banks were holding, both Papageorgiou and another person with direct knowledge of the situation told Reuters.

Note that imbalances accrued swiftly and where hardly anyone saw the imminence of today's crisis. What used to be "Conservative" banks suddenly transformed into aggressive banks.

Yet another interesting point is that the events in Cyprus proves my thesis that crisis are essentially "unique". There is no definitive line in the sand for credit events. Cyprus had its own distinctive thumbprint or identity, particularly her "unusual position" of reliance on deposits, compared to their peers.

Wonderful learning experience

Saturday, March 23, 2013

Video: Murray Rothbard on the Six Stages of the Libertarian Movement

(hat tip Lew Rockwell Blog)

Cyprus President Warned Friends of Crisis

Events in Cyprus have been demonstrative of the wide distinction between how the pubic perceives governments are supposed to operate (the romantic view where government looks after the interest of the general welfare) with how governments truly operate (self interests).

In reality governments operates around the cabal of insiders, again take it from the events in Cyprus.

From the Daily Mail, (hat tip lewrockwell.com)

Cypriot president Nikos Anastasiades 'warned' close friends of the financial crisis about to engulf his country so they could move their money abroad, it was claimed on Friday.The respected Cypriot newspaper Filelftheros made the allegation which was picked up eagerly by German media.Germans are angry at the way their country has been linked to the Nazis and Hitler by Cypriots angry at the defunct rescue deal which called for a levy on all savings.The Cyprus newspaper did not say how much money was moved abroad but quoted sources saying the president 'knew about the possible closure of the banks' and tipped off close friends who were able to move vast sums abroad.Italian media said the 4.5 billion euros left the island in the week before the crisis.

As an update on the swiftly unfolding events in Cyprus, Russia has rejected a deal with Cyprus. Also the Cyprus parliament approved of instituting capital controls aside from other measures passed.

From Reuters:

As hundreds of demonstrators faced off with riot police outside parliament late into Friday night, lawmakers inside voted to nationalize pension funds, pool state assets for a bond issue and peel good assets from bad in stricken banks.

We live in very interesting times.

Subscribe to:

Posts (Atom)