It has been a curiosity for me to see ASEAN equity markets, with the exception of Malaysia, fail to rev up along with high octane US and some European markets as the German Dax, considering an environment of falling US dollar and a reprieve from the bond vigilantes.

Global Trade Woes?

Could it be because of growing concerns on global trade particularly from export dependent Asia?

According to a Bloomberg report[1],

The Hague-based CPB Netherlands Bureau for Economic Policy Analysis estimated global trade volume fell 0.8 percent in August, eroding a 1.8 percent jump of the previous month. It was the weakest performance since a 1.1 percent decline in February and left the three-month average lagging its historical pace.

While global merchandise trade remains slightly off record highs, the rate of gains has been on a decline (quarter on quarter—left) and (quarter from a year ago—right)[2],

Much of the failing trade has been attributed to the ‘lack of demand’ from emerging markets. But the article did not bother to explain further.

Unlike mainstream view, the slowing growth in emerging markets has mainly been a product of internal bubbles, many of whom have been approaching their inflection points. The threat by the US Fed to “taper” last May only exposed on these vulnerabilities.

In addition, the adverse consequences from the largely unseen redistribution of resources from US Federal Reserve policies which has been embraced as the de facto operating standard by global central banks seem as becoming more evident.

Credit easing policies such as zero bound rates has gradually been eroding on the real savings of many Asian nations who adapted such schemes. Borrowing demand from the future financed by debt has come home to roost.

And since inflationism has been designed to transfer resources to privileged constituents or to protect certain interest groups at the expense of the rest, the corollary inequalities have led to politically charged atmosphere.

And in the realm of politics, the intuitive and the best way to divert the public’s attention from the real issue have been to blame the foreigners.

In doing so, inflationism which usually is followed by price controls eventually spawns trade, finance and labor protectionism.

So the next political actions we should expect would be travel or social mobility restrictions, higher tariffs or more non-tariff trade barriers and capital controls.

The same article suggests that we are headed in such direction.

Protectionism is also on the rise despite pledges to avoid it by the Group of 20 leading industrial and developing economies, according to Evenett. He estimates 337 measures have been imposed worldwide so far this year after 503 in 2012.

However, near record high New Zealand stocks and record high Malaysian and Australian stocks can hardly explain the global trade factor.

Credit Concerns?

The other factor causing such divergence could be slowing credit growth.

As pointed out above, internal bubbles have served as an internal hindrance to expanding credit growth.

A survey from the Institute of International Finance[3] (IIF) on Emerging Markets suggests that “bank lending conditions continued to tighten in emerging economies for the second quarter in a row.”

And while demand for loans in Asia seem to have improved, credit standards, funding conditions and trade finance have all meaningfully slowed.

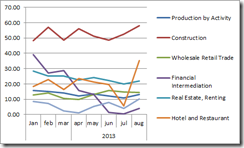

The IIF data actually mostly reflects on the credit conditions of the Philippine banking system, based on the BSP data from the start of the year until August. Except that credit growth in August appear to have rebounded, despite the “Ghost Month” which curiously the BSP incorporates as “economic” analysis.

[As a side note, the BSP’s stubborn insistence to use “Ghost Month”[4] assumes that whether Filipino or Chinese or foreign non-Chinese, all subscribe to such superstition. Based on such logic, perhaps ‘paranormal’ forces had been responsible for the credit growth last August]

I have no data yet for September to see whether the August loan rebound has been sustained or had been a blip.

I have yet to access credit data conditions for Malaysia, Australia and New Zealand, but have been limited by time constraints

Capricious Credit Rating Agencies

Credit rating agency Fitch has revised their outlook on Malaysia to Negative from Stable in July, they further warned about the growing pressure on credit profiles of Asia-Pacific Sovereigns[5]

The Standard & Poors seem to have seconded such concerns where “positive trend of Asia-Pacific sovereign ratings”, said KimEng Tan, senior director for Standard & Poor’s Ratings Services in an interview[6], “over much of the past decade looks likely to break in the next one or two years. We do not see a high likelihood of a sovereign rating upgrade during that period. Instead, three sovereign ratings in the region currently carry negative outlooks – India, Japan and Mongolia. We do not have any Asia-Pacific sovereign on a positive outlook.” (bold mine)

It is ironic how Malaysia’s July downside revision has led to new record high stocks while the trifecta of credit rating upgrades have still left the Phisix midway from the distance of the recent historic highs and the meltdown lows.

Importantly both credit rating agencies appear to be “playing safe”, such that in the event that another market meltdown episode, they would have the leeway to immediately initiate downgrades.

As pointed out before[7], credit rating agencies have essentially been reactionary. They respond to market events rather than take action in antecedence. They hardly see risks coming. Two market meltdowns appear to have altered their sanguine viewpoints on the region. Yet as a sign of dithering, they refrain from actual downgrades but instead float trial balloons by verbalizing their concerns.

In the case of the S&P, they have placed on negative outlook, for instance the S&P on India, Japan and Mongolia. Paradoxically, like Fitch on Malaysia, India’s stocks are also a breath away off from the recent landmark highs.

This also reveals of the narrowness of the span of vision of credit rating agencies has for their subjects, or in this case the sovereigns, such that they easily change sentiments.

The above also suggests of the extreme volatility of the markets as they become detached with fundamentals.

The China Wild Card: Has Inflation Reached a Critical State?

It is hard to see the Chinese card on ASEAN when Australian stocks are at record territories and when the Australian dollar have strengthened (except for the past three days)

But again, it’s hard to see a straight connection based on economic fundamentals when financial markets have been heavily distorted by excessive politicization.

My goal here will not be explain past stock market actions, but rather to anticipate the potential actions given the recent events.

The Chinese government has reportedly suspended three consecutive sessions of reverse repurchase operations.

This has supposedly impelled a spike in the Chinese interest rate markets. Shibor rates (Shanghai Interbank Offered Rates[8]) interest rates representing unsecured short term interbank money markets have soared across the maturity spectrum. The overnight (left most), the 6 months (middle) and 1 year (right most)[9] have all surged.

Friday, yields of China’s 10 year bonds hit 4.23% but closed back at 4.16% the highest since November 2007 when it peaked at 4.6%[10]

Part of the cause has been attributed to “financial and tax paid in October” which contributed to tightening conditions.

While the Chinese government has taken new steps to liberalize interest rates last week where banks rather than the PBOC would set benchmark[11], I don’t think the new interest rate regime has anything to do with the turmoil.

One domestic google translated English article[12] noted that the market is said to be worried about "money shortage", since “excessive tightening of liquidity could lead to systemic risk”. The article mentioned money shortage thrice.

Another google translated English article[13] noted of the same “market money shortage recurrence concerns”, but this time, the quoted expert raised inflation rate and housing prices as contributing to the tightening.

When people complain about “shortages of money”, they could be expressing signs of acceleration of inflation, where changes in the supply of money have been deemed as insufficient to meet changes in money prices. Put differently such represents an advance phase of inflationism.

As the dean of the Austrian school of economics, Murray Rothbard explained[14] (bold mine)

At first, when prices rise, people say: "Well, this is abnormal, the product of some emergency. I will postpone my purchases and wait until prices go back down." This is the common attitude during the first phase of an inflation. This notion moderates the price rise itself, and conceals the inflation further, since the demand for money is thereby increased. But, as inflation proceeds, people begin to realize that prices are going up perpetually as a result of perpetual inflation. Now people will say: "I will buy now, though prices are `high,' because if I wait, prices will go up still further." As a result, the demand for money now falls and prices go up more, proportionately, than the increase in the money supply. At this point, the government is often called upon to "relieve the money shortage" caused by the accelerated price rise, and it inflates even faster. Soon, the country reaches the stage of the "crack-up boom," when people say: "I must buy anything now--anything to get rid of money which depreciates on my hands." The supply of money skyrockets, the demand plummets, and prices rise astronomically. Production falls sharply, as people spend more and more of their time finding ways to get rid of their money. The monetary system has, in effect, broken down completely, and the economy reverts to other moneys, if they are attainable--other metal, foreign currencies if this is a one-country inflation, or even a return to barter conditions. The monetary system has broken down under the impact of inflation.

If the Chinese government really thinks that inflation has gotten out of control then the thrust to tighten may continue. However such tightening could mean bursting of many highly leveraged businesses. This also means that credit woes will spread via the periphery to the core dynamic, given China’s highly leveraged the formal and informal banking system. In short boom could turn into a massive bust.

It is unclear how determined and how much pain and pressures the Chinese political leadership can withstand.

But if it is true that China’s system has reached an advanced phase in terms of inflation and if the Chinese government accommodates the demand for money to ease the shortages then China may experience a Venezuela.

This has been the second time the Chinese government has attempted to curb liquidity.

The first time was in June where China’s credit turmoil caused a stir in Asian markets (blue lines).

While global markets as Australia appears to have discounted the Chinese turbulence as perhaps just another typical quirk, we will have to see or ascertain if the economic conditions has really deteriorated. Japan’s Nikkei appears to be weakening again coincidental with the Chinese benchmark.

The following days will be critical.

If the problems in China have turned unwieldy then another round of a market meltdown can’t be discounted.

As I have been lately saying, there are many flashpoints or minefields around the world that could spell the difference between one’s return ON investments as against return OF investments.

[1] Bloomberg.com Global Trade Flows Show Exports Are No Magic Bullet October 26, 2013

[2] CPB Memo CPB Netherlands Bureau for Economic Policy Analysis October 23, 2013

[3] Institute of International Finance Emerging Markets Bank Lending Conditions Survey - 2013Q3 October 24, 2013

[4] BSP.gov.ph Foreign Portfolio Investments Yield Net Inflows in September October 17, 2013

[5] Reuters.com Asia-Pacific Sovereigns Face Growing Pressure on Credit Profiles October 17, 2013

[6] FinanceAsia.com Credit outlook cooling for Asia-Pacific sovereigns as risks endure October 16, 2013

[7] See Phisix: Moody’s Sees Bubbles as Structural Shift to Higher Growth October 7, 2013

[8] Wikipedia.org Shanghai Interbank Offered Rate

[9] Shibor.org Shanghai Interbank Offered Rate

[10] See PBoC Tapers: China’s Interest Rate Markets Under Pressure, October 25, 2013

[11] Bloomberg.com China Starts Prime Loan Rate as New Benchmark in Market Push October 25, 2013

[12] Stockstar.com Shibor rose 102.2 basis points, said the industry shortage of money will not come again October 26, 2013

[13] China times "Highlights of the newspaper" bank money shortage trouble? Shanghai jumped Shibor, October 26, 2013

[14] Murray N. Rothbard, 2. The Economic Effects of Inflation Government Meddling With Money What Has Government Done to Our Money?

![[image%255B11%255D.png]](http://lh3.ggpht.com/-joEOVXg42uQ/UibdF2H9NUI/AAAAAAAAWGQ/oFPeVpcFiRU/s1600/image%25255B11%25255D.png)

![[clip_image009%255B3%255D.png]](http://lh5.ggpht.com/-kfbo0Uaxtyc/UmQXuMj8IqI/AAAAAAAAXXw/8jxf9KFMp1A/s1600/clip_image009%25255B3%25255D.png)