The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.- Benjamin Graham

In this Issue

Phisix: Stagflation Upends Boom Time Politics as BSP’s 1Q Property NPLs Surge!

-As Predicted, Stagflation Upsets Populist Politics

-BSP’s 1Q Property NPLs Surge! From Boom Bust Economy to Boom Bust Politics

-Too Obvious Bubbles: More Authorities Jump into the Bubble Warning Bandwagon!

-IIF Warns on Global Carry Trade and Global Bond Liquidity

-Speculators Flee Junk Bonds: Has US Bubble Been Pricked?

-An Ongoing China “Pump and Dump”?

Phisix: Stagflation Upends Boom Time Politics as BSP’s 1Q Property NPLs Surge!

As Predicted, Stagflation Upsets Populist Politics

Last February, I raised the issue of how Filipinos thought themselves as becoming “poorer”. My commentary was based on two December surveys conducted by two different major domestic pollsters who saw a substantial surge in the perception of deterioration in the “national quality of life”.

I predicted that this would eventually spillover or spread into the political realm[1].

So while the government can talk about their robust statistical growth ad infinitum to ensure their access to the credit markets in order to finance their politically correct justified boondoggles, as well as, to redistribute resources from society to the small segment (politically connected elites) who benefits from the credit fuelled property and stock market bubble out of zero bound rates policies, the real economy may be pushing back.If this sentiment persist to become a trend or even deepens, then in terms of politics we can expect the political divide to widen.

Apparently this observation turned out to be prescient.

About two weeks back the same survey outfits noted of a “dive” in the Philippine President’s popularity rating. The Pulse Asia observed that “President Benigno Aquino III's approval and trust ratings plunged after the Supreme Court (SC) declared his administration's Disbursement Acceleration Program (DAP) as partially unconstitutional”[2]. The SWS likewise shared the same outlook[3]: Public satisfaction with President Benigno Aquino III took a steep plunge during the second quarter of 2014, giving the chief executive his lowest rating since he took office.

Then this week, the dramatic shift in public sentiment has been transformed into action: THREE impeachment complaints had been filed against the Philippine president. Such should have been FIVE; unfortunately the other two had been plagued by technical deficiencies or partly “lacked lawmakers who will endorse them”[4] and thus had been placed in the back burner.

Of the three impeachment complaints, two had been based on the ongoing Pork Barrel scam while the third had been premised on the Philippine-US military cooperation agreement or the Enhanced Defense Cooperation Agreement (EDCA)[5]. For the latter, I previously said that the boom has allowed the administration to “Sell nationalism to get popular approval to justify the defense agreement”[6]. Now that we are seeing the twilight of the phony boom, diminished popular approval paves way to a legal clash between executive branch and several interest groups opposed to the defense agreement.

The drastic reversal of the Philippine President’s approval rating, as well as, the three impeachment proceedings comes in the limelight of (Monday July 28, 2014) State of the Nation’s Address (SONA) before the Congress by the Philippine president.

All it takes to make such prediction is to understand the elementary dynamics of inflationism. I do not require statistics or math models to prove this point.

The causal realist logic says that when governments “confiscate, secretly and unobserved, an important part of the wealth of their citizens” and where they “confiscate arbitrarily” and in “the process impoverishes many”, while “actually enriches some”[7] will ultimately boomerang.

Said differently, when many from the political constituency begin to see themselves “poorer” while at the same time several segments of society have been perceived as having been “enriched”, then these aggrieved groups vent their angst, frustration and or ire at the political leadership whom has been expected to perform with “virtuosity”.

In the context of populist politics, there are THREE short cuts to solve every economic malaise (which I call Three Wise Monkey solution[8]); one is to THROW money at the problem. Another is to LEGISLATE prohibitions, regulations or taxes on what has been perceived politically incorrect. Lastly, to REPLACE supposed deficient political authorities or personality based politics.

So the Pork Barrel scandal has been seen as immoral actions undertaken by political agents and their private sector conspirators that has been instrumental to a deterioration in the public’s quality of life.

And the administration’s tolerance for its existence has only galvanized public opinion against them, hence, the sudden and sharp decline in popularity and the impeachment proceedings (which may just turn out to be symbolical).

Yet the public confuses the visible or the symptoms with the disease.

Because the essence of electoral ‘social democratic’ politics has been about promising free goodies in order to generate votes for politicians to acquire political power, those promises would have to be transformed into arbitrarily determined redistributive political spending.

Thus the public hardly understands that when people engage in a system that permits Pedro, mandated with a badge and a gun, to forcibly pick on the pocket of Juan to give to Mario via legislation and taxation, it is a system of Pork Barrel politics. So whether such expenditures has been to embellish a politician’s electoral odds for reelection (e.g. social “infrastructure” projects on political bailiwicks), office improvements on branches of the government or ghost projects which has been funneled into the pockets of unscrupulous officials, they are all the same, they represent non-productive consumption spending that amounts to a deadweight loss to the economy. In the eyes of the public the difference is on what has been popularly construed as moral.

Isn’t it the easiest money to spend is to spend someone else’s money? Isn’t it the easiest way to get votes is to promise to spend someone else’s money?

As the great libertarian HL Mencken explained[9]

The government consists of a gang of men exactly like you and me. They have, taking one with another, no special talent for the business of government; they have only a talent for getting and holding office. Their principal device to that end is to search out groups who pant and pine for something they can't get and to promise to give it to them. Nine times out of ten that promise is worth nothing. The tenth time is made good by looting A to satisfy B. In other words, government is a broker in pillage, and every election is sort of an advance auction sale of stolen goods.

So when election spending even at the grassroots or Barangay levels[10] has been soaring—to even even beyond the accrued basic compensation of the entire term of local officials—it is because pork barrel has been deeply embedded into the system. In short, the pork barrel system has been the essence of the Philippine social democratic order

The nice part about the Pork Barrel scam saga has been to open the eyes of some to the duplicitous nature of populist politics and government

And as I have been pointing out here, the showbiz political economy[11] hardly realizes that the Pork Barrel controversy has been a sideshow to how inflationism corrupts and destroys society.

Yet the current deterioration in domestic populist politics seems as only an appetizer.

BSP’s 1Q Property NPLs Surge! From Boom Bust Economy to Boom Bust Politics

The Philippine central bank, the Bangko Sentral ng Pilipinas recently reported that the banking system’s consumer loans grew strongly in the 1Q 2014. This has been pegged at 13.6% from the same period last year[12].

The BSP further adds that: While the consumer finance portfolio increased, the ratio of the banks’ non-performing CLs to total CLs slightly decreased to 5.2 percent at end-March from 5.3 percent a quarter earlier. U/KBs and TBs also set aside loan loss reserves of 70.5 percent of their non-performing CLs as a safety net against consumer credit risks. Moreover, the consumer loan exposure of the banks also remained low relative to their peers in the region. At end-March 2014, the consumer credit exposure in Malaysia stood at 58.1 percent; Indonesia, 28.4 percent; Thailand, 27 percent; and Singapore, 25.7 percent.

The BSP hasn’t been forthright to say that the reason of the decline in the general non-performing consumer loans (NPL) has been due to a big collapse in the NPLs of the “Other Consumer Loans” category.

As shown in the above table, the BSP has been reticent about the big upside move in NPLs in the 1Q 2014 of Auto Loans and Real Estate Loans at 7% and 7.78% (!!!) respectively. Year on Year, the NPL growth rates has been at 9.25% and 4.41% correspondingly. As of March 2014, auto loans and real estate loans account for 26.4% and 44.47% of total consumer loans. And the surge in Real Estate and Auto Loans NPLs has been borne by Universal and Commercial Banks.

I will focus on real estate loans as they are the centerpiece of the current bubble. Nonetheless this represents a one-two punch.

To apply the 7.78% jump in real estate NPLs in 1Q 2014 in the perspective of the full year (March 2013-2014), the average 3 quarter growth for the last 3 Quarters of 2013 has been at 3.29% [based on the algebraic equation .25 (7.78) + .75(x) =4.41], this means real estate NPLs has MORE than DOUBLED!

The more than doubling of the growth rates of the real estate consumer NPLs in the 1Q 2014 vis-à-vis the average of the last three quarters of 2013 can be juxtaposed to the breathtaking 8.95% 1Q 2014 spike in the prices of 3 bedroom condominium units in Makati[13], the cresting of money supply growth rates also in Q1 2014[14], the intensifying official inflation rates and the below consensus expectations of 5.7% 1Q 2014 GDP growth rates[15].

It is striking to observe that as speculators fervently bid up on Makati condos at an 8.95% inflation rate which became a world sensation (see below on IIF), other buyers of condos have become delinquent. In other words, the growth rates of real estate NPLs (bad debts) have nearly caught up with the Makati’s property inflation.

Also we can deduce that inflation’s substitution and income effect[16] has begun to hamstring on consumers spending by diminishing disposable income, thereby most possibly contributing to the 1Q rise in bad debts.

Additionally, the significant drop in private sector construction in 1Q official GDP could partly be signaling such VERY INTERESTING twist of events.

Lastly, the 1Q increase in debt delinquency rates support my theory that the culminating liquidity growth rates have been signaling the acceleration of diminishing returns of debt. This means that soaring debt levels amidst the slowing formal economy growth rates puts into spotlight the heightening of credit risks. Instead of fresh spending power from new debt issuance which represents money from thin air or digital money, much of the current borrowing may have been channeled to paying existing debt, thereby the tumbling of liquidity growth rates.

The BSP claims that there have been enough loan loss reserves on the system. For now, yes. Everything is hunky-dory when the storm is away or at a distance.

My guess is that the BSP has been overestimating on their capability to address credit risks while contemporaneously underestimating the hazards of rampant debt accumulation into the system.

The danger is that when the current NPL trends continue or even intensify, then this will not only put on a big ghastly surprise to bubble worshippers and to the consensus with regards to economic growth trends, but importantly this may even present a “shock” to the financial system. The financial sector has been playing with a credit Russian roulette founded on reckless abandon and blindness from overconfidence inspired by the BSP’s Tetangco’s PUT. The implication is a disaster in the making.

Alternatively, this means that the real test to whether the domestic banking system has sufficient cushion is when the NPL drizzle morphs into a downpour. Model based stress test will hardly ever capture the human response to systemic distress.

And in order to paint the ambiance of tranquility, the BSP resorts to the repeated communications fallacy of framing by contrast principle, i.e. depicting how Philippine debt has been “low” by contrasting with the neighbors to imply safety without noting of the penetration levels underpinning such debt levels. This is the standard Talisman effect—the notion that shouting statistics will be enough to rid of “evil spirits” in the form of economic imbalances—prominently used by authorities and by their bubble zealots

Yet one would have to wonder: How does a 4.4% statistical official inflation rate generate so much furor as to reflect on a somber public perception of becoming “poorer”, to food prices grabbing the attention of the Senate, or even to reverse the sentiment of populist politics? You see, statistical numbers will hardly ever explain the unfolding events which are real time reactions and consequences to the intertemporal or previous and current monetary manipulations.

Nonetheless, the strains in the current political environment represent manifestations of the initial phases of stagflation. And as stagflation intensifies, public dissatisfaction will likewise be reflected on political sentiment. Stagflation, thus, fuels the rise in the political risk environment.

This also means that the public hardly has been aware that that when this entire credit house of cards crumbles or collapses—whose symptoms will be debt defaults, insolvencies, soaring formals sector unemployment, economic recession and even possibly a financial crisis—the combo mix of stagflation and bursting bubble will magnify today’s political hubbub.

The appetizer has been served, the main course is coming.

Too Obvious Bubbles: More Authorities Jump into the Bubble Warning Bandwagon!

I have been saying here that financial asset bubbles have become so so so very much obvious such that officials can no longer deny them. What they do now is first to admit to it, then next, downplay the degree of its perils and or shift the burden of responsibility to the markets.

Aside from the Bank of International Settlements (BIS) and the US Federal Reserve’s Janet Yellen[17] here are recent accounts of the bubble warning bandwagon…

The CNBC on German Bundesbank President Jens Weidmann[18]: ECB policymaker and President of the German Bundesbank Jens Weidmann warned on Thursday that the stimulus policies being delivered by the ECB could - over time - lead to financial risks such as exorbitant gains on real estate markets. (bold mine)

The Channelnewsasiaa.com on German Finance Minister Wolfgang Schaeuble[19]: German Finance Minister Wolfgang Schaeuble warned the European Central Bank just days ago that its loose monetary policy risked inflating markets to dangerous levels with cheap money. (bold mine)

This Bloomberg article noted of the actions recently taken by some European based central banks[20]: Last month, the Bank of England introduced measures to limit riskier mortgages, while the Swiss government in January forced banks to hold additional capital to protect them against a real estate crisis. In Denmark, the central bank has been pushing to reduce borrowers’ ability to defer principal repayments. (bold mine)

Simon Black on Monetary Authority of Singapore’s Lim Hng Kiang[21]: the deputy chair of the Monetary Authority of Singapore (Lim Hng Kiang) said last night at a dinner that “an uneasy calm seems to have settled in markets” and that “we remain in uncharted waters.” t was pretty amazing, really, to see such pointed language from a central banking official. Mr. Lim jabbed at the “obvious” risks and said there would be “bumps on the road” ahead. That’s putting it mildly. (bold mine)

The Australian on Treasury secretary Martin Parkinson[22]: Treasury secretary Martin Parkinson has warned low interest rates can “only do so much”, with the build-up of risks requiring the use of other tools to stimulate the economy… “Monetary policy needs to continue to play a supportive role,” Mr Parkinson said during a speech in London overnight. “Of course, there is a certain point at which the build-up of undesirable risks becomes a concern. In such instances, there is a need to consider what other tools are available.

Some very important highlights from former Fed Chief Alan Greenspan interview with Marketwatch.com[23] (bold mine)

Asked about the Fed’s recent stock market valuations concerns, Greenspan responded: You can’t get around the fact that asset values have a major impact on economic activity, and no central bank can be oblivious to what is happening, not only in credit markets, which is, of course, the Fed’s fundamental mandate, but in asset markets, as well. As a central banker, in addition to evaluating stock prices, you have to cover commercial-real-estate markets, commodity markets and the price of owner-occupied homes, as well. Without asset-market surveillance, you do not have an integrated view of how the economy works. How to respond to asset-price change is a legitimate issue. But not to monitor it, I think, is clearly a mistake.

As Fed Governor, I wonder why he didn’t practice what he preached today.

Mr Greenspan on bubbles: When bubbles emerge, they take on a life of their own. It is very difficult to stop them, short of a debilitating crunch in the marketplace. The Volcker Fed confronted and defused the huge inflation surge of 1979 but had to confront a sharp economic contraction. Short of that, bubbles have to run their course. Bubbles are functions of unchangeable human nature. The obvious question is how to manage them. All bubbles expand, and they all collapse. But how they are financed is critical. The dot-com boom [of 1994 to 2000] produced a huge financial collapse with almost no evidence of economic impact. You will be hard pressed to see it in the GDP figures of the early 2000s. Similarly, on Oct. 19, 1987, the Dow Jones Industrial Average fell 23% — an all-time one-day record, then and since. Goldman was contemplating withholding a $700 million payment to Continental Illinois Bank in Chicago scheduled for the Wednesday morning following the crash. In retrospect, had they withheld that payment, the crisis would have been far more disabling. Few remember that crisis because nothing happened as a consequence. But it was the scariest experience I had during my 18 years at the Fed.

My comment: Human nature or the behavioral side of asset bubbles and access to finance are two different but indispensably interrelated aspects that contributes to asset bubbles. The self-reinforcing process of bubbles is hardly a function of human nature alone but one critically intertwined with access to financing. Think of it, even if everyone would like to ride or piggyback on a specific bubble bandwagon, but if there will be limited or no access to (cheap) credit/money to finance this yield chasing phenomenon, then bubbles would barely come into existence. In short, human nature is a necessary but not a sufficient condition for the formation of bubbles. The question is what motivates or goads on the human tendency to chase bubbles? The answer would be profits financed by cheap credit. And who is responsible for cheap credit? Mr. Greenspan sees such relationship in a vacuum.

The point of the above is to demonstrate how officials here and abroad have been painted to corner. There is no way out of a bubble bust.

IIF Warns on Global Carry Trade and Global Bond Liquidity

And speaking of apprehensions of bubbles the Janus faced global association of financial institution, the Institution of International Finance, with 450 members from 70 nations in their latest outlook seems deeply concerned with the Fed’s tapering.

They write[24]: Against this background, a key potential trigger for a correction in asset prices could be an acceleration in the expected path of the Fed funds rate currently priced in by futures markets—which is now much more relaxed than the median estimate of FOMC members. Uncertainty in the interpretation of new economic data and the FOMC’s intentions is likely to create more uncertainty about the timing and pace of the Fed's tightening moves, probably leading to a correction in the currently low levels of volatility. This would set the stage for a potentially large correction in asset valuations when short-term rates rises since asset valuation is quite lofty relative to fundamentals—i.e. economic and earnings growth. Moreover, such a correction could be substantial due to significant "one-way" positioning by market participants in various asset classes —including emerging market carry trades and mature market equities. (bold mine)

Absolutely a stunning picture of bubbles (left window)!

The "one-way" positioning in Emerging Market-Developed Market carry trades looks like one of the major time bombs set to detonate soon.

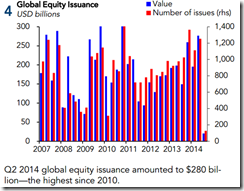

To see how such carry trades has goosed up financial markets we look first at stock market performances.

The year-to-date stock market returns for the major beneficiaries Brazil 12.26%, Indonesia 19.06%, India 23.26% and Turkey 24.21%. Paradoxically, these four carry trade beneficiaries (excluding in the above South Africa) have been part of the newly coined “fragile 5 economies” whose markets had been hammered in 2013 due to large current account deficits. So the greater the risks, the bigger the gains. This means larger risks has attracted more frenzied speculative activities

We are not only witnessing spectacular record carry trades, this week alone emerging market sovereign debt issuance hit a record. Sovereign debt sales of emerging market exclusive of China according to the Financial Times[25], reached $69.47bn in the first six months of the year, a jump of 54 per cent on the same period in 2013.The increase makes 2014 a record year for emerging market government debt issuance so far, according to data from Thomson Reuters. (bold mine)

So record carry trades must have diffused into speculations on emerging market debts as well!

And the spectacular debt buildup can be seen in the furious growth of banking assets in emerging market economies. You can see the chart here. For instance, banking assets as % to gdp for the Philippines has about doubled from 2005-2013.

Global home prices are also at record highs. This has been spearheaded by emerging markets as housing prices of mature markets underperform.

The fragile 5 has also been one of the biggest gainers in terms of housing price inflation in 1Q 2014.

This is a sign where carry trades have filtered not only to currency trades, stock and bond markets but also to the eye-popping speculative run on housing.

And guess which EM country topped the housing in 1Q 2014 (right window)? No bubble eh?

And this is also a sign where almost every part of the world has been entranced to zero bound (quasi permanent boom) rates that have spawned asset bubbles.

And sadly, this signifies further evidence of the MOTHER of all Bubbles.

I called the IIF Janus Faced because in this week’s report, the global financial trade association seems to have been oblivious of what they wrote in their monthly report.

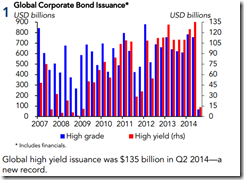

Nevertheless going back to the IIF’s monthly report they raise concerns over the shrinking liquidity in the global bond markets even as bond issuance swell.

From the IIF[26] (bold mine): Global secondary bond market liquidity appears to be in less than perfect health. In emerging markets, turnover has been decreasing while at the same time, bid -ask spreads have been increasing. Both measures are indicating jointly an impairment in secondary market liquidity. This problem appears to be present in mature markets as well: recent studies on market liquidity in the Euro Area and Japan suggest similar problems with liquidity. In the U.S., turnover has been decreasing and not been able to keep up with issuance. Trade sizes and block trades have fallen, while primary dealer inventories have been decreasing. There is a risk of market disruptions with the Fed exit: on one side, there is a large number of investors who may potentially try to sell their bond positions. On the other side of the trade there may not be a sufficient number of willing counter-parties. In fact, there are fewer willing market makers and those willing hold less inventory. As mentioned at the outset, market depth—a critical dimension of market liquidity—is contingent on the risk bearing capacity of market makers and their number. Higher capital charges and stricter regulatory requirements have made the secondary bond market making business less economically viable to market makers, increased their level of risk aversion and reduced their numbers. This may lead to an undesirable situation where the unwinding of the long bond trade runs into a one-way market, potentially creating disruptions, and disorderly adjustment.

Aside from higher capital charges and stricter regulatory requirements, I believe that for the US[27] and Japan[28] their respective central bank’s Quantitative Easing has played a substantial role in the siphoning liquidity out of their respective bond markets.

Government interventions to manipulate yield curves through bond purchases have only reduced the available securities for trade. And the bigger bid-ask spreads and reduced turnover amplifies risks of sharp volatility.

Nonetheless, the US Federal Reserve may be increasingly using its reserve repo facility to fill in the void. However the deepening reliance on the very short term repo market also accentuates the risks of runs.

Former chairwoman of the Federal Deposit Insurance Corp Sheila Blair writing at the Wall Street Journal warns[29] (bold mine): the reverse repurchase program doesn't look like a temporary experiment. Large institutional investors, notably including money-market funds and government-sponsored entities (such as Fannie Mae and Freddie Mac ) are using it regularly. The facility hit an overnight high of $242 billion at the end of the first quarter of 2014. The Fed has raised the overnight allotment cap for individual buyers from $500 million in September to $10 billion today. The mere existence of this facility could exacerbate liquidity runs during times of market stress. Borrowers in the short-term debt markets will have to compete with it for investment dollars and all, to varying degrees, will be viewed as higher risk than lending to the Fed. Even a relatively minor market event could encourage a massive flow of funds to the Fed while contributing to a flow away from other short-term borrowers. Nonfinancial companies could find themselves unable to find buyers for their commercial paper. Banks could confront a sudden outflow of deposits, particularly those which are uninsured. Even the U.S. Treasury—traditionally viewed as the safest harbor—could see its borrowing costs spike as investors decide that the Fed is even safer. Ironically, faced with a more acute liquidity crisis, the Fed would likely have to use the funds it is borrowing through reverse repos to provide a lifeline to the very markets that suffered. For investors seeking safety, the Fed would become the borrower of first resort. For borrowers affected by the resulting diversion of funding, the Fed would become the backstop lender.

In short, private borrowing and lending activities will diminish as most participants would likely focus their trade with the Fed. The Fed’s more engaged presence translates to sizeable distortions among counterparties, thus amplifies the risks of a run.

I believe that the US government may have anticipated this as to allow money market funds to impose restrictions on withdrawals or charge fees on securities redeemed[30].

As one would observe, in the attempt at suppressing volatility, interventions beget interventions. Yet deepening of interventions creates more complexities that give rise to even more uncertainties and risks.

Such sows the seeds for a Black Swan. As my favorite math iconoclast Nassim Taleb explains[31] (bold mine)

The problem with artificially suppressed volatility is not just that the system tends to become extremely fragile; it is that, at the same time, it exhibits no visible risks. Also remember that volatility is information. In fact, these systems tend to be too calm and exhibit minimal variability as silent risks accumulate beneath the surface. Although the stated intention of political leaders and economic policy makers is to stabilize the system by inhibiting fluctuations, the result tends to be the opposite. These artificially constrained systems become prone to Black Swans. Such environments eventually experience massive blow-ups…catching everyone off guard and undoing years of stability or, in almost all cases, ending up far worse than they were in their initial volatile state. Indeed, the longer it takes for the blowup to occur, the worse the resulting harm to both economic and political systems.

Speculators Flee Junk Bonds: Has US Bubble Been Pricked?

Could it be that the US credit and stock market bubble may have already been pricked?

Junk bonds have reportedly hit the wall on signs of distressed outflows.

From the Wall Street Journal (bold mine)[32]: Investors are selling junk bonds at the fastest pace in more than a year, as fresh interest-rate fears and geopolitical turmoil amplify valuation concerns following a long rally. Prices on bonds issued by lower-rated U.S. companies tumbled to a three-month low this week, according to a Bank of America Merrill Lynch index. Investors yanked $2.38 billion from mutual funds and exchange-traded funds dedicated to junk bonds in the week ended Wednesday, the largest weekly withdrawal since June last year, said fund tracker Lipper. That came on the heels of $1.68 billion that poured out the week before…Yields closed at 5.29% on Wednesday, meaning the bonds now offer just 3.65 percentage points in extra yield above comparable Treasurys. That spread rarely has gone below four points and in recent years has at times doubled that figure and more. Investor worries don't stem primarily from fear that borrowers will default. U.S. employment and industrial output are expanding, and U.S. companies are as cash-rich as they have been in recent memory.

A lot of these junk bonds have used to fund buybacks, dividends and LBOs. If junk bonds continue to fall does this mean the end to buybacks too? How will these affect other credit markets both domestic and international?

As for U.S. employment and industrial output’s sustained expansion, I won’t bet on it.

The US Department of Commerce’s Bureau of Economic Analysis is slated to release the advance estimates of US second quarter GDP on July 30. Remember the US economy shrunk by 2.9% in the first Quarter.

Will the US economy bounce strongly from the early slump? As I pointed out last week, there has been a rush to pare down on growth estimates from mainstream analysts. Or will the US show little growth or stagnation?

Or at worst, will the US enter a technical recession? If the latter holds, how will the markets and authorities respond? Will bad news be interpreted as good news? Will the Fed end the taper? Will there be fireworks?

A very interesting week ahead.

An Ongoing China “Pump and Dump”?

I am supposed to write lengthily about the recent sparkle in China’s stock market (which jumped 3.28% over the week) grounded on the government’s digging herself deeper into debt hole with the recent runup in debt levels. But I seem to have reached my limits for the day so I will make a short note on this instead.

China’s overall debt levels have now reportedly reached 251% of GDP[33] which has been a few percent off the US at 260%. China’s statistical growth recovered to 7.5% in 2Q but this has emerged out of bigger than expected loan growth that had been reflected on her money supply growth. China’s credit growth has vastly been outperforming the economic growth rate which means debt levels will continue to mount. This is simply unsustainable

Additionally debt hasn’t just been about statistics, as borrowed money gets to be allocated somewhere. Chinese fixed asset investment posted a 17.3% growth during the first half of 2014, where has all the borrowed money been spent on? Will the recent increase in debt add to her laundry list of ghost projects?

Chinese officials seem to have opted to focus on the short term at the expense of the long term, shelved supposed reforms and appear to be desperately attempting to buy time from a full blown debt crisis.

Besides Chinese data appears inconsistent with her external trade data when measured from China’s trading partners as Dr Ed Yardeni notes: Indeed, total imports (using the 12-month sum in US dollars) is down 0.7% in June from its record high in February. On a yearly percent change basis, it has been growing around 5% since late 2012, well below the double-digit pace of the previous three years. I also track Chinese imports by country of origin. The recent slowdown in imports to China has been widespread among these countries, with the exception of the European Union, which is at a new record high. Australia and Brazil, the big commodity exporters to China, are flat-lining. So are Japan, South Korea, and Taiwan, which tend to ship capital equipment and technology goods to China. Chinese imports from emerging countries have been submerging a bit in recent months from February’s record high.

The spike in Chinese stock market comes as a local government has bailed out what could have been the first commercial paper default in Huatong Road & Bridge Group[34].

Also another trust company China Credit Trust whose trust product Credit Equals Gold 2 warned last Friday that they might be unable to repay investors. Such concerns had been impetuously written off by the stock markets. Why so? Because earlier on, a delinquent trust product, Credit Equals Gold 1, from the same company has been bailed out by the Chinese government[35].

So the Chinese government seems to be orienting the public that impending credit problems would mostly be dealt with by the government through bailouts. This implies a Xi-Zhou PUT (from China’s President Xi Jin Ping and PBoC governor Zhou Xiaochuan) in motion.

Perhaps the Chinese government may be attempting to mimic her US and European contemporaries by igniting a stock market boom in order to paint a picture of recovery. If so, then expect consumer price inflation to soar. This would put a cap on the boom.

China’s “pump and dump” anyone? [Templeton's Mark Mobius says yes]

[1] see Phisix: Will the Global Risk OFF Environment Intensify? February 4, 2014

[2] GMANetwork.com PNoy’s ratings drop after DAP ruling —Pulse Asia July 13, 2014

[3] ABSCBSNews.com Public satisfaction with PNoy plunges: SWS July 14, 2014

[4] GMANetwork.com 2 impeachment complaints vs. PNoy left unfiled for lack of endorsements July 24, 2014

[5] GMANetwork.com 3rd impeach complaint vs. PNoy to be filed Thursday over EDCA July 23, 2014

[6] See Showbiz Politics: The Myth of US-Philippine Defense Pact Promoting Regional Peace April 29, 2014

[7] John Maynard Keynes, The Economic Consequences of the Peace pp. 235-248. PBS.org

[8] see Mainstream’s Three “Wise” Monkey Solution To Social Problems April 26, 2010

[9] Henry Louise Mencken Prejudices First Series (1919) Wikiquote

[10] See Philippine Politics: Barangay Elections and the Pork Barrel System, November 1, 2013

[11] See Phisix: The Showbiz Political Economy and the Showbiz Financial Markets April 28, 2014

[12] Bangko Sentral ng Pilipinas Banks' Consumer Loans Continue to Grow July 22, 2014

[13] See Daddy’s Day [Abridged] Edition: Phisix: The Climaxing Philippine Property Bubble! June 15, 2014

[14] See Phisix: Watch Out, Money Supply Growth Will Fall Sharply by July! May 25, 2014

[17] See Phisix: What Janet Yellen’s “Irrational Exuberance” Speech Implies July 21, 2014

[18] CNBC.com Bubble fears mean split opinions at ECB July 4, 2014

[19] Channelnewsasiaa.com Asset bubbles could deflate global recovery: analysts July 27,2014

[20] Bloomberg.com German Thrift Damps Lending as Cheap Money Is Distrusted July 25, 2014

[21] Simon Black Singapore official discusses ‘uneasy calm’, tells banks to prepare for financial collapse Sovereign Man June 25, 2014

[22] The Australian Treasury secretary Martin Parkinson July 25, 2014

[23] Marketwatch.com Greenspan says bubbles can’t be stopped without ‘crunch’ July 24, 2014

[24] Institute of International Finance, Monetary Policy Uncertainty and Low Volatility July-August 2014 Capital Markets Monitor and Teleconference p. 4

[25] Financial Times Emerging market debt issuance hits record high July 20, 2014

[26] IIF op cit p.8

[27] See Phisix: Will the Fed’s Spiking of the Punchbowl Party Be Sustainable? September 23, 2013

[28] See How Abenomics distorts the JGB markets April 15, 2014

[29] Sheila Blair The Federal Reserve's Risky Reverse Repurchase Scheme Wall Street Journal July 24, 2014

[30] See US Government to Control Money Market Fund Redemptions July 24, 2014

[31] Nassim Nicholas Taleb, Antifragile Things that Gain from Disorder p. 106

[32] Wall Street Journal Investors Retreat From Junk Bonds July 24, 2014

[33] Business Insider China’s total debt surges to 251% of GDP Economic Times July 23,2014

[34] IFR Asia Default scare for China bonds July 27, 2014

[35] See China Rescues Troubled Trust Product January 28, 2014