Sometimes people hold a core belief that is very strong. When they are presented with evidence that works against that belief, the new evidence cannot be accepted. It would create a feeling that is extremely uncomfortable, called cognitive dissonance. And because it is so important to protect the core belief, they will rationalize, ignore and even deny anything that doesn't fit in with the core belief. ― Frantz Fanon, psychiatrist, philosopher and writer

In this issue

Phisix: The Untold Story of the Two Faces of the 7,400 Historic Highs

-The Financial Market Warning Bandwagon: G-20, HKMA, ADB Joins Club

-The Pavlovian Orgasmic Scramble to September 2014’s 7,400

-The Two Faces of 7,400

-Has The Stock Market Permanently Lost Its Fundamental Function As A Discounting Mechanism?

Phisix: The Untold Story of the Two Faces of the 7,400 Historic Highs

I am not supposed to be writing this weekend but developments have been so compelling enough for me to resist sharing my contrarian and unorthodox thoughts.

The Financial Market Warning Bandwagon: G-20, HKMA, ADB Joins Club

Times have been indeed changing. There has clearly been an aura of intensifying apprehension which has been spreading to international political institutions.

Political agencies appear to be in a rush to issue warnings against market risks; although these alarm bells come with varying character.

The striking question is why the seeming concerted actions??

Remember I noted that the in their paper to the G-20 the IMF warned of “Valuations in virtually all major asset classes are stretched relative to past norms”[1]? I guess the G-20 has only partly assimilated the IMF’s position.

Here is the G-20’s official communique[2] (bold mine): We welcome the stronger economic conditions in some key economies, although growth in the global economy is uneven and remains below the pace required to adequately generate much needed jobs. Downside risks persist, including in financial markets and from geopolitical tensions. The global economy still faces persistent weaknesses in demand, and supply side constraints hamper growth…We are mindful of the potential for a build-up of excessive risk in financial markets, particularly in an environment of low interest rates and low asset price volatility. We will monitor these risks and continue to strengthen macroeconomic, structural, and financial policy frameworks, and other complementary measures, as the best response to managing risks, and meet our G20 exchange rate commitments.

In contrast to the IMF who made a declarative statement, the G-20 injected the adjective “potential” in their official statement which essentially downplays or sterilizes the risk dimension.

This would look natural from the standpoint of a conglomeration of mostly central bankers whom have been responsible for the current low interest rates regime.

Yet this validates my point when I wrote (bold and italics original)[3]: “The point is the IMF, like many other global political or mainstream institutions or establishments, CANNOT deny the existence of bubbles anymore. So their recourse has been to either downplay on the risks or put an escape clause to exonerate them when risks transforms into reality which is the IMF position.”

The admission of bubbles may not be direct, as they focus mostly on symptoms.

And a further point is that central bankers would have indulged in self-incrimination had they adapted the IMF’s position. Additionally a hardline stance would have compelled the G-20 monetary planners to reverse the current monetary zero bound policies, policies which most of them would hardly surrender.

And it has not just been the G-20, the ADB has jumped on the bandwagon with their version of sanitized financial market sirens.

Here is the ADB as I earlier noted[4]: Emerging East Asian local currency (LCY) bond markets continued to perform well as global financial conditions have remained relatively benign thus far in 2014. The region, however, should prepare for possibly tighter liquidity as United States (US) quantitative easing is expected to end in October. More expansionary monetary actions from the eurozone and Japan could offset some of the impact on liquidity conditions caused by the end of US quantitative easing. While the region’s LCY bond markets have been calm in 2014, the risks are rising, including (i) earlier-than-expected interest rate hikes by the US Federal Reserve (ii) geopolitical tensions that push up oil prices; and (iii) a slowdown in the People’s Republic of China’s (PRC) property market.

The ADB doesn’t seem to explain how Asian bond markets should be at risk from tighter liquidity. Here is my two cents, Asian economies have become overleveraged.

Credit Bubble Bulletin’s ever meticulous Doug Noland provides some of the details[5] (emphasis mine)

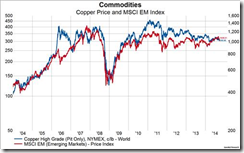

Total EM International (“external”) Borrowings increased almost $1.9 TN (59%) in five years to surpass $5.0 TN. Never have EM governments, corporations and banks piled on so much debt, much of it denominated in dollars or other foreign currencies. And keep in mind that this borrowing and lending binge unfolded in a world anticipating aggressive Federal Reserve stimulus, ongoing dollar devaluation, rising commodity prices and a general global reflationary backdrop. It just didn’t play out as expected, so there will now be a huge price to pay.

Looking first to Asian data, outstanding Asia (ex-Japan) external bonds jumped 112% in five years to $921bn. By country, we see China’s external bonds were up $194bn, or 421%, to $240bn. Including bank international forex borrowings, total China external debt jumped $642bn, or 310%, since the end of 2008 to $849bn. Hong Kong external bonds jumped $49bn, or 71%, to $117bn (total up $223bn, 63%). Elsewhere in Asia, Indonesian external bonds jumped 197% to $70bn (total up $67bn, 101%), Singapore 82% to $93bn, Malaysia 59% to $53bn, South Korea 58% to $179bn and India 73% to $74bn (total up $86bn, 54%).

That’s just bonds alone.

And ADB’s concerns have partly been manifested by the Hong Kong Monetary Authority (HKMA) who curiously has also piggybacked on the warning chorus stating at the Hong Kong economy faces “very high" risks from rising interest rates.

The HKMA’s apparent aversion to increases in interest rates once again validates the central bank conundrum which I analogize as “I recognize the problem of addiction but a withdrawal syndrome would even be more cataclysmic.”

HKMA’s problem hasn’t really been high interest rates, but rather the “near-historic levels of credit growth”.

Interest rate increases would only expose on the massive malinvestments spawned, nurtured and accumulated from the US Fed’s zero bound rates which has been imported by Hong Kong’s economy and financial markets via the US dollar peg.

Zero bound rates has allowed marginal unviable projects, that would have NOT existed under normal conditions, to exist. In short, zero bound has democratized credit activities which has spread to include a vast number of subprime or less credit worthy borrowers.

And because subprime borrowers have been DEPENDENT on zero bound, an increase in interest rates will expose on such financial vulnerability.

And when credit concerns become an issue on a wider scale (or affects many firms), this may cause systemic liquidity to ebb as borrowers delay payments or if they default, while lenders suffer balance sheet and capital losses.

So the HKMA problem has been one of credit risk, where raising rates will undermine marginal subprime borrowers that causes a liquidity contraction that risks a spillover to the other parts of the economy.

And why wouldn’t the HKMA be disturbed? About a year ago they raised the issue of deteriorating quality of the fast expanding corporate debt[7]. That’s even at zero bound. What more when interest rates increase!

Hong Kong’s property bubbles are taking toll not just in finance, but most importantly in social stability terms. Bubbles have recently fueled anti-market sentiment, and as of this writing the once peaceful city state has now been rattled by violent riots, as the Hong Kong government attempts to quash the swelling pro-democracy movement.

Why the torrent of warning from the establishment?

I guess since we are talking of political institutions as well as their technocratic supranational supporters, the increasing account of cautionary communications, aside from escape valve function, can also be interpreted as manifestations of increasing apprehension from the politically influential financial elites.

Here’s a clue, a recent report suggests that world billionaires have been hoarding boatloads of cash. Notes the CNBC[8]: According to the new Billionaire Census from Wealth-X and UBS, the world's billionaires are holding an average of $600 million in cash each—greater than the gross domestic product of Dominica. That marks a jump of $60 million from a year ago and translates into billionaires' holding an average of 19 percent of their net worth in cash…Indeed, billionaires' cash holdings far exceed their investments in real estate. Their real-estate holdings average $160 million per billionaire, or about one-fifth of their cash holdings… "The apparent safety of cash, reinforced by the painful psychological experience of the 2008-09 global financial crisis and the subsequent troubles within the European Monetary Union, likely reinforces the tendency to favor this cautious allocation strategy," Smiles said in the report.

Increased uncertainty functions as the crucial incentive for people to hold onto cash. As Austrian economist Hans-Hermann Hoppe[9] explains: If a person then adds to his cash balance, he does so because he is confronted with a situation of (subjectively perceived) increased uncertainty regarding his future. The addition to his cash balance represents an investment in presently felt certainty vis-à-vis a future perceived as less certain. In order to add to his cash balance, a person must restrict his purchases or increase his sales of nonmoney goods (producer or consumer goods). In either case, the outcome is an immediate fall in certain nonmoney goods' prices.

So if world billionaires have been giving us hints on the direction of financial markets or of the real economy, then optimism, which the Pavlovian consensus expects, isn’t likely the outcome.

And perhaps acting as proxies, the political establishment has been expressing the elite’s sentiments.

If you haven’t noticed, it’s odd that more and more of the establishment have been jumping into my bandwagon. Eventually these concerns will be parlayed into policy actions. Changes always happens at the margins

Oh by the way, the BSP chief in a speech last week[10], once again raised sanitized alarm bells on the domestic financial markets and the economy with foreigners being conditioned as scapegoat: “Having said these, I will be the first to say that risks to growth remain. External factors -- including the uneven growth in major economies, uncertainties surrounding monetary policy in the advanced countries, and geopolitical concerns -- could impact the Philippine economy through trade and volatilities in domestic financial markets. Here at home, weather disturbances and recurring concerns about power rates and supply could also affect growth.”

The BSP governor’s consistent warnings looks very much like the G-20 statement above, e.g. “global economy is uneven” and “downside risks persist, including in financial markets and from geopolitical tensions”. Has this been scripted?

And given the increasing frequency of the citation of a heightened risk environment, is the BSP chief really expecting fireworks soon???

The Pavlovian Orgasmic Scramble to September 2014’s 7,400

In referring to the Pavlovian classical conditioning response, which I analogized with World War Z zombies, I explained that instead of zombies having been conditioned to seek out humans for them to infect through the latter’s noise, the conditioning for domestic stock market participants has been to hear the utterance of G-R-O-W-T-H from public officials or from industry leaders to spark a buying stampede.

Market participants has not only been disregarding risks and flagrantly overpaying for excessively overvalued securities predicated on the “g-r-o-w-t-h” signals, importantly markets appear to have been conditioned to believe that prices will not only rise forever but will EXPLODE to the firmament soon. At any rate, the snowballing psychology from the 'fear-of-missing out' has been prompting for an orgasmic scramble to bid up prices AT ANY LEVEL!

Wednesday’s actions look very much like a Pavlovian World War Z zombie stampede.

The one day 1.15% post lunch break push practically brought the bulls near the May 2013 threshold historic high of 7,400.

It has been interesting to see that the one day (plus the carry over) push had essentially been again led by the property sector, buttressed by the Industrial and Holding sectors. This means that the bidding frenzy was hardly an across the board phenomenon but a seemingly concerted action targeted at some heavyweight market caps leaders of the said sectors. Yet the following day, selling had been broad based.

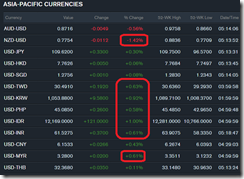

And the most interesting development was the day’s fantastic irony— yes the Phisix finally touched the 7,400 level anew alright, but at the same day, the peso endured a .7% meltdown!

Because most of the region’s currencies fell modestly, this may be partly attributed to the rising dollar. But the peso was the day’s worst performer by a mile! And the gist of this week’s loss came also from the day the Phisix reclaimed the old highs.

This is just one of the many paradoxes between the 7,400 highs of May 2013 and September 2014.

The Two Faces of 7,400

It’s interesting to see that Phisix 7,400 in September 2014 has starkly been different with its earlier counterpart May 2013.

The daily quote from the PSE of the two milestones sheds some light on the character of the recent stock market blitz, particularly on the peso volume.

In May 15 when 7,403 was reached, the traded volume was at a stunning Php 21.4 billion. Last week’s ramp to 7,413 had only Php 9.5 billion. This represents only 44% of the May 2013 highs!

The path towards these landmark highs shares the same story. The volume of the current run has been significantly less than its antecedent as I previously observed[12], “The average Daily Peso volume has been about 30-35% off the 2013 average.”

Think of it, if those who bought at the previous (2013) peak haven’t sold and awaits for the 7,400 level to be reached before they sell just to even out, then this would translate to a massive resistance level.

And based on the closing prices of 15 May 2013 and 25 September 2014, it appears that only two sectors that has gone beyond or surpassed May 2013 levels.

This gives us two insights on the quality of the journey to Phisix 7,400:

First, between the two highs only two sectors, the Industrials and the Service have outclassed its predecessors. This means that the Phisix 7,400 circa September 2014 has largely been due to them.

And like the 24 September Pavlovian one day vault, 7,400 has been reached because of targeted actions on some key heavyweight issues.

This isn’t a conspiracy theory but the numbers (volume, sectoral performances or even the increased frequency or even the regularity of “marking the close”) implies that 7,400 may have been stage managed. Why the concentration? Why the fixation on some key market index heavyweight issues?

As of Friday’s close, the year to date the sectoral returns are as follows

Finance

|

18.63%

|

Industrial

|

31.2%

|

Holding

|

17.4%

|

Property

|

29.34%

|

Service

|

16.7%

|

Mining

|

48.35%

|

All Shares

|

19.01%

|

Composite

|

23.29%

|

Those numbers are a fantastic sight. Yet only the mining, industrial and property sector have generated returns above the composite index which means the industrials and the property have been responsible for September’s Phisix 7,400. The outperformance of the mining industry has been in a response to last year’s crash, so I wouldn’t include them, besides they have a miniscule weighting in the PSE basket.

Yet if we match the year to date returns with that of the 7,400s of May 2013-September 2014 performance, the damage caused by the June 2013 bear market strike has been striking! Except for the industrials, those marvelous year to date returns have hardly filled the void caused by the bear market as finance, holding and ironically even the property sector still has underperformed the May 2013 run. You see, more ironies.

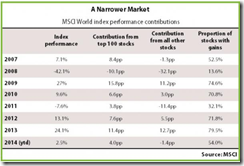

Alternative to the concentration of gains perspective, the current 7,400 exposes the underbelly of the current run-up a weak market breadth relative to the 2013.

I would add that if one looks at the disparity in the performance of the service sector between two time frames, one may discern that the sector’s outperformance vis-à-vis May 2013 has been a result of its underperformance during the first romp to 7,400.

So we have substantially low volume plus underperformance by major sectors suggesting of the inferior quality of the September 7,400 with that of its May 2013 counterpart.

I mentioned earlier that the peso has been pummeled even as 7,400 has been reached.

When the May 2013 milestone 7,400 high was crafted, the peso, which was largely on a firming trend, closed on the same day at 41.2 relative to the US dollar. (see upper window)

Based on Friday’s official close of USD PHP 44.72, between the two Phisix highs of 7,400 in 2013 and 2014, today’s peso has been down by about 8% against the May 2013 version! Just amazing. But that's an example of divergence or one of the many other ironies between the two 7,400s.

While the correlation has not been perfect, the Phisix used to rise ALONG with the peso. This has been true even during 2014 (see lower window). Since September when the peso came under duress, such correlation appears to have been ‘broken’, as the Phisix hit 7,400 on a WEAK peso. Strange.

It is as if a weak peso WON’T have any impact on earnings and profits or the economy. Juxtaposed with still hefty money supply growth, the weak peso serves as a one-two punch that would compound on domestic inflationary pressures whose nasty side effect includes a demand slowdown and higher business costs. Add to this the issue of debt servicing where more peso will be required to finance foreign denominated liabilities.

In a hysteric world of G-R-O-W-T-H who cares about reasoning.

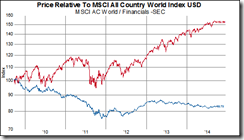

Has The Stock Market Permanently Lost Its Fundamental Function As A Discounting Mechanism?

And speaking of peso and inflation, the May 2013 high was carved out of declining official inflation rates. Today’s run up has been the opposite, the Phisix has ascended in the face of official inflation rates at the upper end of official target.

Additionally, in the May 2013 highs such era highlighted on falling interest rates. Today the BSP has been panicking to tighten, two weeks back the BSP imposed its sixth and seventh tightening measure in only SIX months[13].

All these reveal of the antipodal nature of the 7,400 of September 2014 and May 2013. In 2013 the Phisix rose on the tailwind of EASY money as against TODAY’s relatively TIGHTENING monetary environment. I would bet on the former and not the latter, as the former signifies a key ingredient for an asset bubble collapse.

Meanwhile the inability to push many major caps back to the former highs has instead prompted for wild punts across second and third tier issues. The average daily trades reveals of the increased turnovers by participants on lower volume relative to 2013.

Average total traded issues suggest of the breadth of the euphoric wagering which has bulged to include many illiquid issues. This reveals of the intensity of the build up of the adrenaline to gamble

The 2013 7,400 was mainly due to major caps. The 2014 7,400 was mainly due to SELECT major caps PLUS second and third tier euphoric mindless scramble for yields.

Finally the 7,400 September 2014 edition has been part of the manic transition process which I called the “denial rally” and the déjà vu

During the appearance of the bear in June I wrote[14], “Denial” rallies are typical traits of bear market cycles. They have often been fierce but vary in degree. Eventually relief rallies succumb to bear market forces. The denial rally of 2007 virtually erased the August bear market assault but likewise faltered and got overwhelmed.

And as the 2014 rally progressed early in the year to take a similar shape of the early 2013 dynamic I observed[15], Well, actions in the Philippine stock exchange seem like a déjà vu of the manic phase of February to early March of 2013

The consensus may think that a crossover of the 7,400 marks a nirvana pillared by “this time is different”, history tells us this isn’t so.

| Old high | New high | % gains | 2014 equivalent (base: 7,400) |

| August 1969-January 1979 | 482.24 | 531.13 | 10.14 | 8,150 |

| Jan 6, 1994-Feb 3, 1997 | 3,293.33 | 3,447.6 | 4.68 | 7,746 |

| July 5 2007-October 9, 2007 | 3,791.42 | 3,873.5 | 2.16 | 7,560 |

The two generational or secular highs (1969-79 and 1994-97) during the topping process showed how previous highs had been exceeded. The cyclical top of 2007 likewise reveals of the same dynamic but at a more muted dimension.

As I have been saying the issue is about financial instability rather than of reaching specific price levels. The two generational/secular stock market bubble cycles did not only result to a stock market crash but metastasized into financial crises.

The cyclical top of 2007 only resulted to a stock market crash but not to an economic event. But the 2007 top which has been a cyclical phenomenon has connected with current developments from which originated in 2003. 2003-2014 marks the secular bull market to the topping phase.

In the economic context, 2014 has been associated with 2007 because the policies implemented then (automatic stabilizers) to forestall a recession on the formal economy and the ensuing shift to aggregate demand (monetary easing)[16] paved way for both the 7,400s of 2013 and 2014 undergirded by the property and property related bubbles.

In short, the higher the price levels, the greater the financial instability.

Logic also tells us why the current stock market conditions are unsustainable: Has the stock market permanently lost its fundamental function as a discounting mechanism for it to permit or tolerate a perpetual state of severe mispricing as seen by excessive valuations of securities???

If the answer is YES, then PEs of 30, 40,50, 60 and PBVs 3,4,5,6,7 can reach, in the words of cartoon Toy Story character Buzz Lightyear “to infinity and beyond”!!!

If the answer is NO, then the obverse side of every mania is a crash.

My bet is on theory, logic and history.

[5] Doug Noland, What We Know Credit Bubble Bulletin Prudentbear.com September 26, 2014