Readers of this post has repeatedly been warned: market crashes and magnified volatility has been occurring real time. And this has been a global phenomenon which appears to be spreading and intensifying.

The consensus G-R-O-W-T-H theme seems in SERIOUS jeopardy. They are in BIG trouble not because the local stock markets slumped BIG today. They are in BIG trouble because today’s spike in short term yields in the domestic bond markets which adds to last week’s surge, may have more than been indicative of tightening liquidity or a mad dash for cash, they are in BIG trouble because today’s spike looks like manifestations of embryonic signs of a developing CREDIT CRUNCH!

Yields of these short term domestic treasuries have either vaulted to past June “taper tantrum” highs in 2013 or have reached such levels. Remember that the June “taper tantrum” sent the Phisix into bear market levels.

Yields of 10 year treasuries climbed too. But the uptick has been less than the short term yields. This indicates of a dramatic flattening of the yield curve.

From this perspective I offer a different explanation. The two week spike in short term yields represents a scramble for liquidity!

The short term rates 3 month, 6 month and 1 year have all reached June 2013 highs. To recall, June 2013 was when the taper tantrum PLUS BoJ’s QE 1.0 triggered turbulence in global financial markets, so the spike in short term rates then has been consistent with concerns over liquidity.

There have been little signs of turmoil (yet). The peso has been nearly unchanged for the year even as the neighboring currencies have been severely buffeted on likely heavy interventions by the BSP. The Phisix remains above 7,000. Despite failing to meet consensus expectations, statistical growth remains above 5%. In addition, media and experts continue to serenade economic hallelujahs even as neighboring financial markets have been roiling from weak currencies.

So this, in my view, may have been about debt IN debt OUT that may have reached proportions whereby demand for short term loans have become greater than long term loans, thus the spiraling demand equates to the public willing to pay for higher short term rates. And demand for such short term loans may have been reflected on the yields of short term treasuries.

And demand may have originated from cash constrained borrowers who may be competing to secure funds to oversee the completion of their capital intensive based projects on mostly bubble sectors, and or from highly levered asset speculators (real estate and stock markets) who may be jostling to acquire short term funds in order to settle existing liabilities as returns have not been sufficient to cover levered positions. Could this be the reason behind the obsession over managing of the stock market index?

It remains to be seen if the current developments represent an aberration or if my suspicions are right where short term yields have been about emergent signs of liquidity strains.

But if my suspicions are correct, where short term rates continue to climb, this will affect many businesses via higher financing costs. There will be a cut back in expansions as losses will mount.

And if the rise in short-term yields engenders an inverted yield curve–where short term rates are higher than longer term rates—then the consensus will even be more startled because inverted yield curves have mostly been reliable indicators of recessions!

An inversion will likely occur when a credit crunch has become evident.

I asked in the above “Could this be the reason behind the obsession over managing of the stock market index?”

In support of the index, market manipulators have been buying stocks at either record highs or near record highs, so with the market’s recent declines, losses have been mounting.

If taxpayer money has been used, then political agencies will soon see losses and deficits. Losses will also hound private institutions even if they used only surplus/reserve cash for stock market speculation.

Yet the more important factor is leverage. If the market manipulator/s pumped up stocks with credit, then current losses will render them, not only losses, but with inadequate funds to pay the existing debt. The lack of funds will compel levered institutions to scramble to borrow short term money even at higher rates.

I think this applies also to heavily geared ‘bubble’ institutions (real estate, shopping malls, hotel and financial intermediaries) or levered firms that have not been generating enough cash flows.

So these cash flow deficient heavily leveraged firms may have been desperately competing to borrow money to cover the funding gaps that has sent yields to the present 2013 taper tantrum levels!

If my suspicions are right, then not only will stock market manipulators have impaired balance sheets, but they will be NET sellers of stocks (at vastly lower prices)!

The same liquidations will be resorted to by cash strapped bubble industries (keep an eye on casinos, and the property industry)

So the populist G-R-O-W-T-H theme will transmogrify into LOSSES and eventual LIQUIDATIONS.

Yet the feedback loop between accruing losses and increasing credit strains will extrapolate to higher demand for short term loans which should drive short term yields to even higher levels relative to the longer end.

If such dynamic is sustained then this will eventually lead to a yield curve inversion. The inversion will now signal a recession, if not a crisis!

The consensus better supplicate from the Almighty that these short term rates be immediately tempered or pacified soon otherwise hell may break loose.

It’s also important to emphasize that magnified volatility won’t merely signify as contagion from external events but also in response from internal imbalances generated by credit fueled artificial booms from financial repression policies channeled through zero bound rates.

Perhaps foreigners smells something fishy with current conditions, thus today’s stock market plunge.

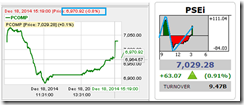

The Phisix got crushed by 2.71%!

Apparently stock market operators seems to have lost control. They had been repelled yesterday, where the Phisix tanked 1.58% and today. And for the second successive day stock market operators had been treated with a dose of their own medicine. Or might I say karma.

Attempts to shield the Phisix from reality by rigging the index seem to have only worsen the profit taking activities or the market slump.

The portrayal that domestic stocks would be immune to global events has been demolished by the actions of the last two days.

The two day loss, which accrues to 4.29%, sends the Phisix to about the October lows. A breakdown from October lows will trigger the bearish portent from the double top formation.

Today’s stock market bloodbath comes with heavy foreign selling which amounted to P 2.035 billion. This marks the third day of heavy (Php 1 billion above) net foreign selling. Again, are foreigners sensing the trouble from the sharp increases in short term yields and from the drastically flattening yield curve?

Again this isn’t just about contagion but also about domestic imbalances that are about to unravel.

Misery loves company. The Phisix today has been accompanied by another rout in Vietnam’s equity market. The freefalling Ho Chi Minh Index sank 3.16% and may be the first regional equity benchmark to reach a bear market having been down 19% since the September highs.

As a final note, the Philippine Stock Exchange announced the imposition of a maintenance fee of 50,000 pesos a month on all inactive trading participants which will commence in January 2015.

Given that the shorting facilities have hardly been functional but mostly symbolical, this leaves trading participants to rely on bullmarkets to become "active".

Yet such ruling assumes stock markets only go up! That’s because in bear markets volume usually dries up. So trading participants will have to either sell false (bull market) premises just to induce "active" trading or pay fines.

No wonder the principal-agent problem that beleaguers the industry.