The banks would be instantly insolvent, since they could only muster 10 percent of the cash they owe their befuddled customers. Neither would the enormous tax increase needed to bail everyone out be at all palatable. No: the only thing the Fed could do — and this would be in their power — would be to print enough money to pay off all the bank depositors. Unfortunately, in the present state of the banking system, the result would be an immediate plunge into the horrors of hyperinflation.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Monday, March 25, 2013

Cyprus: The Mouse that Roared

Sunday, June 10, 2012

Argentina’s Snowballing Capital Flight

This should be another slap on the face for inflationistas or people who myopically advocate inflation as economic elixir.

From Reuters,

Argentine banks have seen a third of their U.S. dollar deposits withdrawn since November as savers chase greenbacks in response to stiffening foreign exchange restrictions, local banking sources said on Friday.

Depositors withdrew a total of about $100 million per day over the last month in a safe-haven bid fueled by uncertainty over policies that might be adopted as pressure grows to keep U.S. currency in the country.

The chase for dollars is motivated by fear that the government may further toughen its clamp down on access to the U.S. currency as high inflation and lack of faith in government policy erode the local peso.

"Deposits keep going down," said one foreign exchange broker who asked not to be named. "There is a disparity among banks, but in total it's about $80 million to $120 million per day."

U.S. dollar deposits of Argentine banks fell 11.2 percent in the preceding three weeks to $11.5 billion, according to central bank data released on Friday. The run on the greenback has waxed and waned since November, after President Cristina Fernandez won a second term on promises of deepening the state's role in the economy.

From May 11 until Friday, data compiled by Reuters from private banks showed $1.9 billion in U.S. currency had been withdrawn, or about 15 percent of all greenbacks deposited in the country.

Feisty populist leader Fernandez was re-elected in October vowing to "deepen the model" of the interventionist policies associated with her predecessor, Nestor Kirchner, who is also her late husband.

Since then she has limited imports, imposed capital controls and seized a majority stake in top energy company YPF.

Earlier, Argentina’s central bank President Mercedes Marcó del Pont even mocked at the laws of economics and haughtily declared that printing money does NOT lead to inflation.

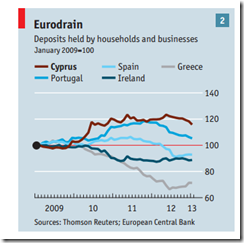

Like in the Eurozone, what governments and their minions say and what people do always clash: The prospects of intensifying devaluation worsened by concerns over capital controls and other forms interventionism have been prompting people to turn to black markets, take refuge on foreign currencies and flee the Argentine banking system altogether

Joel Bowman at the Daily Reckoning has a nice take on this…

The Argentinean government’s policy of theft via inflation has created a demand for the relative safety of US dollars. Obviously, a massive flight from pesos would create considerable headaches for the Argentine State and its efforts to control “its” people…and their taxable income. And so, even though there is no official rule preventing the purchase of US dollars (or any other foreign currency), Argentina’s equivalent to the IRS, AFIP, has made it virtually impossible to do so through regulated channels (i.e., banks).

Therefore, the informal exchange houses do a roaring trade responding to a very real and honest demand for US dollars. And there’s still enough business left over to maintain a vibrant market for the “green rate.” This exchange rate is even less official than the unofficial “blue rate.”

The “green rate” is offered by los arbolitos — i.e. “little trees” — who stand along Florida Street waving their arms (like little trees) and offering their exchange services. That rate, currently at 6.20 pesos to the dollar, is quite literally the “street price” for dollars.

The nearby chart shows the wide — and rapidly widening — gap between the official exchange rate and the blue rate, the most often quoted parallel dollar rate.

Exactly as you would expect, the more money the government prints, and the tighter the capital controls they impose, the greater the urgency to swap pesos into dollars…and the higher the unofficial exchange rates soar.

Clearly, this is a trend that cannot continue indefinitely.

The Argentine State is scrambling to outlaw the consequences of its own recklessness. For years now, Argentina’s Central Bank (BCRA) has brought forth freshly inked fiat notes by the billions to pay for unaffordable election promises. Our North American readers will recognize this crafty monetary prestidigitation as “money printing.”

The practice is nothing new, of course — neither here nor in any country where the tyranny of the mobjority — democracy — enjoys the power to decide the cost to be levied on the minority.

What seems peculiar about Argentina’s case is the government’s Herculean effort to ignore the immutable laws of economics in their pursuit of grand larceny. The country has seen five currencies in just the past century, averaging a collapse every twenty years or so. In 1970, the peso ley replaced the peso moneda nacional at a rate of 100 to 1. The peso ley was in turn replaced by the peso Argentino in 1983 at a rate of 10,000 to 1. That lasted a couple of years, and was then replaced by the Austral, again at a rate of 1,000 to 1. To nobody’s surprise, the Austral was itself replaced by the peso convertible at a rate of 10,000 to 1 in 1992. During the past four decades, when all was said and done, after the various changes of currency and slicing of zeroes, one peso convertible was equivalent to 10,000,000,000,000 (1013) pesos moneda nacional.

Obviously Argentinians haven’t learned, yet they are adversely responding to such policies via capital flight. Nevertheless sustained capital flight should help starve the beast.

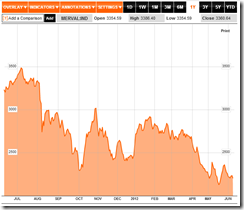

While stock markets have functioned as to flight to safety against governments going into a maximum inflation overdrive, apparently Argentina’s worsening capital controls has been sending their benchmark index the Merval into a steady downhill as Argentinians seem fearful that their savings could be seized anew like in 2001.

Inflationism constitutes part of, or a mixture of the many other repressive measures from an increasingly despotic government such as higher taxes, price controls, capital controls, nationalization, protectionism and other forms of anti-market interventions. So whatever interim gains will be offset by lower real economic growth.

Argentina seems likely headed for for another sordid chapter of hyperinflation.

The other hyperinflation candidates are neighboring Venezuela, communist North Korea or any European crisis affected nations who will severe ties with the EU.

Monday, August 15, 2011

Confiscatory Deflation and Gold Prices

This is a reply to an objection

Gold’s rise represents:

1. fear of bank failure.

My reply

With all the money being sunk into the banking system of major economies, such observation omits the current evidences that abounds (from ECB’s $1 Trilion QE, Fed’s explicit guarantee and rollover of principal payments, SNB’s and Japan’s currency interventions and bans on short sales by 4 European nations plus Turkey and South Korea)

This of course doesn’t even include the money spent for the bailouts during the 2008 crisis where the Federal Reserve audit revealed $16 trillion issued to foreign banks and or previous estimates of $23.7 trillion exposure of US taxpayer money to save the systemically important or ‘too big to fail’ banks and other politically privileged companies.

As one would note, people stuck with an ideology will tend to dismiss evidences even if these have been blatantly “staring at their faces’.

2. concerns of the "Pesofication" of hard currency accounts

My reply

Assumptions that government’s may confiscate deposits or prevent withdrawals like the Argentina crisis (1999-2002) does not translate to an increase of demand for gold, for the simple reason that such government policies promote deflation.

Austrian Economist Joseph Salerno calls this ‘Confiscatory Deflation’

Mr. Salerno explains (bold emphasis mine)

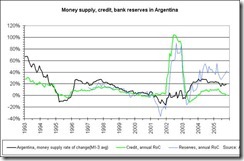

As a result, Argentina's money supply (M1) increased at an average rate of 60 percent per year from 1991 through 1994. After declining to less than 5 percent for 1995, the growth rate of the money supply shot up to over 15 percent in 1996 and nearly 20 percent in 1997. In 1998, with the peso overvalued as a result of inflated domestic product prices and foreign investors rapidly losing confidence that the peso would not be devalued, the influx of dollars ceased and the inflationary boom came to a screeching halt as the money supply increased by about 1 percent and the economy went into recession. Money growth turned slightly negative in 1999, while in 2000, the money supply contracted by almost 20 percent.

The money supply continued to contract at a double-digit annual rate through June 2001. In 2001, domestic depositors began to lose confidence in the banking system, and a bank credit deflation began in earnest as the system lost 17 percent, or $14.5 billion worth, of deposits.

On Friday, November 30, alone, between $700 million and $2 billion of deposits--reports vary--were withdrawn from Argentine banks. Even before that Friday bank run, the central bank possessed only $5.5 billion of reserves ultimately backing $70 billion worth of dollar and convertible peso deposits. President Fernando de la Rua and his economy minister, Domingo Cavallo, responded to this situation on Saturday, December 1, announcing a policy that amounted to confiscatory deflation to protect the financial system and maintain the fixed peg to the dollar.

Specifically, cash withdrawals from banks were to be limited to $250 per depositor per week for the next ninety days, and all overseas cash transfers exceeding $1,000 were to be strictly regulated. Anyone attempting to carry cash out of the country by ship or by plane was to be interdicted.

Finally, banks were no longer permitted to issue loans in pesos, only in dollars, which were exceedingly scarce. Depositors were still able to access their bank deposits by check or debit card in order to make payments. Still, this policy was a crushing blow to poorer Argentines, who do not possess debit or credit cards and who mainly hold bank deposits not accessible by check.

Predictably, Cavallo's cruel and malign confiscatory deflation dealt a severe blow to cash businesses and, according to one report, "brought retail trade to a standstill." This worsened the recession, and riots and looting soon broke out that ultimately cost 27 lives and millions of dollars in damage to private businesses. These events caused a state of siege to be declared and eventually forced President de la Rua to resign from his position two years early.

By January 6, the Argentine government, now under President Eduardo Duhalde and Economy Minister Jorge Remes Lenicov, conceded that it could no longer keep the inflated and overvalued peso pegged to the dollar at the rate of 1 to 1, and it devalued the peso by 30 percent, to a rate of 1.40 pesos per dollar. Even at this official rate of exchange, however, it appeared the peso was still overvalued because pesos were trading for dollars on the black market at far higher rates.

The Argentine government recognized this, and instead of permitting the exchange rate to depreciate to a realistic level reflecting the past inflation and current lack of confidence in the peso, it intensified the confiscatory deflation imposed on the economy earlier. It froze all savings accounts above $3,000 for a year, a measure that affected at least one-third of the $67 billion of deposits remaining in the banking system, $43.5 billion in dollars and the remainder in pesos.

Depositors who held dollar accounts not exceeding $5,000 would be able to withdraw their cash in twelve monthly installments starting one year from now, while those maintaining larger deposits would not be able to begin cashing out until September 2003, and then only in installments spread over two years. Peso deposits, which had already lost one-third of their dollar value since the first freeze had been mandated and faced possible further devaluation, would be treated more liberally. They would be paid out to their owners starting in two months, but this repayment would also proceed in installments. In the meantime, as one observer put it, "bank transactions as simple as cashing a paycheck or paying a credit card bill remained out of reach of ordinary Argentines."

Mr. Lenicov openly admitted that this latest round of confiscatory deflation was a device for protecting the inherently bankrupt fractional reserve system, declaring, "If the banks go bust nobody gets their deposits back. The money on hand is not enough to pay back all depositors." Unlike the bank credit deflation that Lenicov is so eager to prevent, which permits monetary exchange to proceed with a smaller number of more valuable pesos, confiscatory deflation tends to abolish monetary exchange and propel the economy back to grossly inefficient and primitive conditions of barter and self-sufficient production that undermine the social division of labor…

Unfortunately, things were to get even worse for hapless Argentine bank depositors. After solemnly pledging when he took office on January 1 that banks would be obliged to honor their contractual commitments to pay out dollars to those who held dollar-denominated deposits, President Duhalde announced in late January that the banks would be permitted to redeem all deposits in pesos. Since the peso had already depreciated by 40 percent against the dollar on the free market in the interim, this meant that about $16 billion of purchasing power had already been transferred from dollar depositors to the banks.

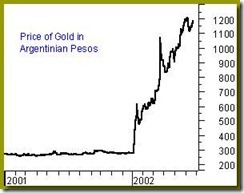

Prices of gold vis-à-vis the Argentinean Peso only surged after the Argentine government allowed the Peso to be devalued.

Chart from Nowandfutures.com

Devaluation had been the outcome of an explosion of money supply

Chart from Nowandfutures.com

As the bust cycle of the imploding bubble culminated (explained above by Dr. Salerno above) inflation fell (see red ellipse below).

Chart from tradingeconomics.com

More of the Argentine Crisis from Wikipedia,(bold emphasis mine)

After much deliberation, Duhalde abandoned in January 2002 the fixed 1-to-1 peso–dollar parity that had been in place for ten years. In a matter of days, the peso lost a large part of its value in the unregulated market. A provisional "official" exchange rate was set at 1.4 pesos per dollar.

In addition to the corralito, the Ministry of Economy dictated the pesificación ("peso-ification"), by which all bank accounts denominated in dollars would be converted to pesos at official rate. This measure angered most savings holders and appeals were made by many citizens to declare it unconstitutional.

After a few months, the exchange rate was left to float more or less freely. The peso suffered a huge depreciation, which in turn prompted inflation (since Argentina depended heavily on imports, and had no means to replace them locally at the time).

The economic situation became steadily worse with regards to inflation and unemployment during 2002. By that time the original 1-to-1 rate had skyrocketed to nearly 4 pesos per dollar, while the accumulated inflation since the devaluation was about 80%; these figures were considerably lower than those foretold by most orthodox economists at the time. The quality of life of the average Argentine was lowered proportionally; many businesses closed or went bankrupt, many imported products became virtually inaccessible, and salaries were left as they were before the crisis.

Since the volume of pesos did not fit the demand for cash (even after the devaluation) huge quantities of a wide spectrum of complementary currency kept circulating alongside them. Fears of hyperinflation as a consequence of devaluation quickly eroded the attractiveness of their associated revenue, originally stated in convertible pesos. Their acceptability now ultimately depended on the State's willingness to take them as payment of taxes and other charges, consequently becoming very irregular. Very often they were taken at less than their nominal value—while the Patacón was frequently accepted at the same value as peso, Entre Ríos's Federal was among the worst-faring, at an average 30% as the provincial government that had issued them was reluctant to take them back. There were also frequent rumors that the Government would simply banish complementary currency overnight (instead of redeeming them, even at disadvantageous rates), leaving their holders with useless printed paper.

Bottom line:

The above experience from Argentina’s crisis shows that when government adapts policies to confiscate private property through the banking system, demand for gold does NOT increase or gold prices don’t rise.

It is when the Argentine government decided to devalue and inflate the system where gold prices skyrocketed.

Both confiscatory deflation and the succeeding inflation lowered the standard of living of the Argentines. The antecedent to the above events had been a prior boom.

In short, policies that promote boom-bust or bubble cycles represent as net negative to a society and even promotes more interventionist policies that worsens the prevailing social predicaments.

Lastly record gold prices today points to inflationism NOT confiscatory deflation.