In our age there is no such thing as 'keeping out of politics.' All issues are political issues, and politics itself is a mass of lies, evasions, folly, hatred and schizophrenia. -George Orwell

It’s the advent of the holiday season. Since the public’s attention will likely be diverted towards the coming festivities, the common intuition is to expect less of an active market which usually has been marked by lean trading volumes.

Central Bank Actions Should Amplify Seasonal Factors

Yet still, the seasonality factor favors December.

While seasonal forces may yield some influence on the marketplace (such as triple witching hour[1] and window dressing[2]), one cannot depend on its statistical accuracy, given the manifold factors involved, particularly the politicization of the marketplace.

However, the current financial and economic environment, which has been distinguished by near record low interest rates and global central banks heavy on the pump[3], are most likely to provide continued support to, and bolster the seasonal effects, on financial assets.

Most of the world’s major economies have been operating on negative interest rates as shown by the chart above[4].

Except for Brazil, even nations with positive real rates have not significantly been above zero. And that is if the statistics used to measure inflation has been accurate. Usually measurements of inflation have been understated.

And considering the politicized nature of the present state of the global financial markets, persistent volatilities should not be discounted.

And accentuated volatility has the tendency to attract short term traders despite the holiday season.

The EU Fiscal Union Masquerade

The EU crisis will continue to partly hold sway on the developments in the global markets.

Over the week, global equity markets gyrated on vacillating expectations brought about by conflicting statements by politicians and bureaucrats.

Growing expectations for more aggressive participation by the European Central Bank (ECB) in acquiring bonds through Quantitative Easing (QE) has helped buoyed global markets. However ECB’s chief Mario Draghi dispelled the popular clamor for a carte blanche approach which doused cold water on the markets that sent commodities and equity markets tumbling[5]. This resonates with US Fed chair Ben Bernanke’s recent jilting of market’s expectations over the telegraphed QE 3.0 at the end of September which incited a mini-crash[6].

Political factors have restrained the actions of both central banks. Prior to the FOMC meeting last September, Fed chair Ben Bernanke came under fire from various political fronts, which most likely prompted for him to backtrack on his pet QE 3.0 program.

Meanwhile Mr. Draghi’s ambivalence could be seen as extracting political leverage at this week’s EU summit for EU member states to accede to a “fiscal compact”.

Despite the recent volatility, the scale of the losses has not been similar to that of the Bernanke episode last September.

Perhaps markets may have digested on the other credit easing measures adapted by the ECB, particularly, a cut in interest rate, unlimited access to two long-term refinancing operations (LTRO), a reduction in reserve requirements and the lowering of credit rating threshold which expands the eligible collateral base.

This weekend hallmarks a “fiscal compact” that would most likely reconfigure the European Union. The main points of summit agreement can be found here[7].

However, contrary to popular wisdom, the ‘fiscal union’ elixir will likely prove to be an illusion to the current EU Debt crisis.

Any political system that becomes highly dependent on the redistributive process that overwhelms on society’s productive sectors will fail.

To analogize the current developments, in the words of the illustrious Ayn Rand,

When you see that trading is done, not by consent, but by compulsion - when you see that in order to produce, you need to obtain permission from men who produce nothing - when you see that money is flowing to those who deal, not in goods, but in favors - when you see that men get richer by graft and by pull than by work, and your laws don't protect you against them, but protect them against you - when you see corruption being rewarded and honesty becoming a self-sacrifice - you may know that your society is doomed.

Great examples of failed union states would be the Soviet Union or Yugoslavia or the Roman Empire.

And considering that the major directives undertaken towards resolving the debt crisis has been to mostly raise taxes[8] and to engage in more monetary inflation, we can expect that these policies would translate to growth retardant economies that would be marked by lesser investments and sustained high unemployment rates.

Using Italy as an example, author Joe Studwell writes[9],

Meanwhile Frau Merkel and Sarko are coming up with a scheme to sanction countries like Italy that don’t stick to budget targets. This plays to German political opinion, but completely misses the point.

It treats Italy as a debt problem. But it isn’t. Italy is a growth problem that can only be resolved with legal system, bureaucratic and labour market reforms that make growth possible. Italy needs to be made to work institutionally.

Aside from misdiagnosis by EU’s politicos, the one-size-fits-all therapy would signify the proverbial cure that could be worse than the disease.

And perhaps in acknowledging these flaws, the United Kingdom has vetoed plans for her inclusion in the treaty because of the EU-wide tax on financial transactions[10] which essentially would mean a loss of control over financial regulation.

Moreover, the fiscal union shaped by current political crisis exigencies postulates that the disciplinary mechanism to uphold on the treaty will likewise be insufficient and subject to various legal loopholes.

Similar to the current failings of the EU, errant member states of the EU such as Greece, who fudged her statistics to gain entry to the EU via complex currency and credit derivatives, and of other reports of creative accounting and manipulated statistics[11] by other EU nations, will possibly continue to plague an even more centralized European Union. We don’t expect Germany to send her army to delinquent members to enforce such penalties.

And any sign of temporary stabilization will result to political leaders of the EU states to relax on attaining fiscal balance which represents the moral hazard of the bailouts.

Further, treaty provisions and regulations will likely be arbitrary and predisposed towards the interests of politicians and bureaucrats.

And instead of dealing with the lack of competitiveness and impediments to economic growth as a result of bureaucratic red tape, welfare state, high tax regime and obstructive regulations, the political direction has essentially been to apply the same set of policies that has brought them to the current state of the crisis.

At the end of the day, the proposed remedies for a fiscal union, along with the additional money loaned by the EU to the IMF[12] to be lent to EU’s crisis affected nations (sort of an escrow arrangement), will only represent cosmetic changes that serves as veneer for the ECB to engage in more monetary inflation, and to transfer and expand the political power to EU technocrats at Brussels at the expense of the freedom and civil liberties of citizens of the EU member states.

The ECB’s balance sheets has rapidly been ballooning as shown by the chart from Danske Bank[13]. A new EU will likely prod the ECB to increase purchases.

This band aid approach may provide an ephemeral calm to the financial markets from which the effects of inflatonism will likely become more visible.

Bearish Chart Patterns Nearing Reversal

The Philippine benchmark, the Phisix has been in a consolidation phase and seems on the path to reverse the bearish technical indicator known as the ‘death cross’.

Following the September-Bernanke shakeout, the Phisix has been rangebound since the rally which climaxed last November.

The 50 day moving average (blue) has worked to narrow on the 200 day moving averages (red). Once the 50 day regains the upperhand or successfully crossover the 200 day moving averages then the bearish death cross transitions into a bullish golden cross.

Many use technicals, as the above, to analyse and predict the phases of markets. Yet it seems likely that “death cross” may not be living up to its putative billing. The current death cross has not led to a bear market.

And a reversal would mean a whipsaw or a chart pattern failure. This only would prove my point that sole reliance on chart patterns would translate to inaccurate reading of the markets.

Mechanical chart reading fundamentally ignores the vast differentials between past conditions with the present and future conditions. Also, mechanical charting has dubious statistical accuracies in terms of prediction success rates, as well as, feeding upon our mental impulse to seek patterns, or cognitive bias known as clustering illusion—seeing a pattern in what is actually a random sequence of numbers or events[14]

Most importantly, mechanical charting fails to account for the indispensable role of people’s action which ultimately determines price trends.

In the current case, negative interest rates and intensive money pumping by global central banks and the politicization of markets aimed at propping up asset prices, to keep banks and governments afloat, will continue to influence people’s reading, evaluation, interpretation and analysis of prices and their attendant actions to allocate scarce resources via the money medium.

As I previously wrote[15], (emphasis original)

The prospective actions of US Federal Reserve’s Ben Bernanke and European Central Bank’s Jean-Claude Trichet represents as the major forces that determines the success or failure of the death cross (and not statistics nor the pattern in itself). If they force enough inflation, then markets will reverse regardless of what today’s chart patterns indicate. Otherwise, the death cross could confirm the pattern. Yet given the ideological leanings and path dependency of regulators or policymakers, the desire to seek the preservation of the status quo and the protection of the banking class, I think the former is likely the outcome than the latter.

And any further material uptick by the Phisix will likely accelerate such reversal process.

To add, people who say that the Phisix will remain rangebound could be taken in for a big surprise.

If I am not mistaken, even the US markets could be on a path similar to the Phisix. The US version of the ‘death cross’ could be reversed once the S&P slams past the resistance portal of 1,262-1,285 and beyond.

And given the continuing growth in monetary aggregates and material signs of improvement in the US credit markets, we should expect these conditions to be reflected on equity prices.

Bank Loans and Credit as measured by activities in all US commercial banks[16] as well as commercial and industrial loans have been ramping up.

Outside any shocks from the EU or China, US equities seem poised to move higher.

Charts are useful when used as guide rather than as principal determinant in the evaluation of the risk-reward tradeoff and the accompanying actions to attain portfolio management goals.

And the further point is that a chart pattern reversal should add to the bullish sentiment as many technically based traders or investors will most likely reenter the markets. At least you have been ahead.

Regional Activities and Market Internals Exhibit Upside Potentials

Since every financial asset competes to attract one’s money, then a functional correlationship exists with all other asset markets around the world.

Then observing price actions of other asset markets especially those which are closely related should be a worthy exercise.

Given the price action of our neighbors, I think it would be a folly to write off a potential yearend run.

The chances for an emergent upside seem to increases once we examine the developments in the region’s markets and of the market internals in the Philippine Stock Exchange.

Only Malaysia (FBMKLCI; light orange) has been (3.9%) down on a year-to-date basis, while Indonesia (JCI; green), Phisix (PCOMP; red) and Thailand (SET; dark orange) have been marginally higher 1.52%, 2.17% and .12% respectively as of Friday’s close.

So far Thailand’s SET, among the three, has been the most aggressive having risen by nearly 7% over the past 2 weeks.

Given the seemingly tight correlations (based on trend undulations rather than numerical coefficients), one can’t discount the same belated actions on the Phisix, on Indonesia’s JCI and Malaysia’s KLSE. On the other hand one may argue that Thailand may fall along the line with rest.

However given that Southeast Asia’s relatively lesser debt exposed or leveraged economies, the region’s financial markets are likely to be more receptive towards negative real rates policies which should induces speculative activities.

So far, Indonesia and the Philippine banking sector has the least exposure to real estate loans in the region[17]. This implies that the region’s bubble cycle could be in the formative stages, and may have more room to climb.

Yet the price actions of the region’s bourses seem to be replicated or mirrored in the sectoral performance of the Phisix or the Philippine Stock Exchange.

All sectors appear to be in a consolidation phase. However there seems to be emergent signs of restiveness. The banking sector (black candle) has been the best performer over the past two weeks as revealed by the recent attempt to gain higher grounds.

This has been followed by mining (light orange) and the property sector (violet) while services (red), holding (teal) and the Commercial Industrial (blue) have moved almost in tandem with the Phisix.

Additionally, market internals appear to be also manifesting some signs of notable improvements which may compliment the sectoral activities.

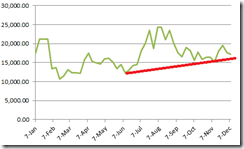

Net foreign buying averaged on a weekly basis seems to be on a sustained upswing since June of this year.

If net foreign buying will accelerate or improve further, then much of these fund flows will likely be directed to elite Phisix member components.

A boost on the Phisix is likely to buttress general sentiment.

Average daily trade on a weekly basis also has been incrementally improving. This sentiment indicator seems to be exhibiting signs of confidence gaining momentum.

Any sustained rally in the Phisix which may come during the yearend or during the first quarter of 2012 will likely translate to a broad market rally.

Bottom line:

While the holiday season may lead to less active markets which could be manifested by leaner volume of trades, they could also serve as windows to accumulate or position. But this is no certainty as current market volatility may induce more trading activities.

Nonetheless given the concerted global credit easing efforts and the predominantly negative real rates worldwide, I think current conditions may suggest of a potential sizeable upside swing in the equity markets of the region and in the Phisix.

My guess is that such moves may also be reflected on commodity markets.

Again global market activities will hold sway or materially affect activities in the regional and local financial markets. And the conventional “kick the can down the road” policies by major developed economies and by China may generate heightened demand for risk assets over the interim.

[1] Investopedia.com Triple Witching

An event that occurs when the contracts for stock index futures, stock index options and stock options all expire on the same day. Triple witching days happen four times a year on the third Friday of March, June, September and December.

[2] Investopedia.com, Window Dressing

A strategy used by mutual fund and portfolio managers near the year or quarter end to improve the appearance of the portfolio/fund performance before presenting it to clients or shareholders. To window dress, the fund manager will sell stocks with large losses and purchase high flying stocks near the end of the quarter. These securities are then reported as part of the fund's holdings.

[3] See Global Central Banks Ease the Most Since 2009, November 28, 2011

[4] US Global Investors Investor Alert - You Can’t Print More Gold, usfunds.com December 9, 2011

[5] See ECB’s Draghi Balks at More QE, Global Equity Markets Tumble, December 9, 2011

[6] See Bernanke Jilts Markets on Steroids, Suffers Violent Withdrawal Symptoms, September 22, 2011

[7] Guardian.co.uk European Union summit agreement: the main points, December 9 2011

[8] See European Debt Crisis: Taxing the Economy to Prosperity December 10, 2011

[9] Studwell Joe Wrong Menu, Joestudwell.com, December 5, 2011

[10] DailyMail.com A day for Britain to salute Mr Cameron, December 9, 2011

[11] Wikipedia.org National statistics, European Sovereign Debt Crisis

[12] Bloomberg.com IMF Seeks Funds for European Debt Crisis, December 11, 2011

[13] Danske Bank Euro tensions to continue, Weekly Focus, December 9, 2011

[14] Rationalwiki.org Clustering illusion

[15] See How Reliable is the S&P’s ‘Death Cross’ Pattern?, August 14, 2011

[16] Federal Reserve Bank of St. Louis, US Financial Data Economic Research Bank Loans and Credit and Commercial and Industrial Loans

[17] Worldbank.org Navigating Turbulence, Sustaining Growth WORLD BANK EAST ASIA AND PACIFIC ECONOMIC UPDATE 2011, VOLUME 2