Prior to my quasi two weeks ago vacation due to my mom’s visit, I wrote[1],

I believe that the interim response from the FED-ECB policies, designed to prop up financial assets, will likely provide strong support to the global stock markets including the Philippine Phisix perhaps until the yearend, at least…

In a world where central bank policies become the dominant factor in establishing price levels, the new normal is to expect dramatic price swings in both directions and of the amplification of risks…

But given the projected substantial infusion of steroids, the current environment strongly favors an upswing. That’s until real problems will resurface such as concerns over the quality of credit, and or price inflation becomes more pronounced and or if politics becomes an obstacle to the central banks inflationism and or a combination of the above.

First I believe that this dynamic will continue to prevail.

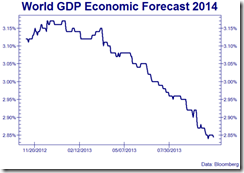

Second, so far, two weeks into the US Federal Reserve’s announcement of QE forever, the global markets have largely been mixed.

Bernanke Policies Bolsters ASEAN Markets

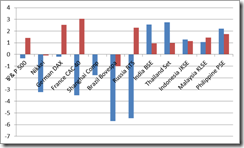

The actions of the US Federal Reserve have thus far benefited mostly ASEAN bourses, led by the Philippine Phisix. The Philippine benchmark acquired most of the two weeks of gains from this week’s phenomenal 1.75% advance (red bar-weekly advance, blue bar-two week performance).

Major emerging markets, however, like Brazil, Russia and China posted the largest losses among major markets during the said two week period. But trading in the Chinese equity markets had been abbreviated due to last week’s weeklong celebration of National Day. India, despite the flash crash on Friday[2] where the Nifty fell by 16% in 8 seconds due to a computer trading glitch, accrued weekly modest gains.

Meanwhile, the stock markets of developed economies had varied showings too. This week’s advances seen in the US S&P 500 and the German DAX clipped the losses of the other week, while Japan’s Nikkei continued to wobble.

FED policies have driven ALL major ASEAN bellwethers to a milestone breakout from which three of them, the Philippine Phisix (red orange), Indonesia’s JCI (green) and Malaysia’s FBMKLCI (orange) set FRESH nominal RECORD highs.

Only the Thai’s SET remains below the 1997 highs, still off still by about a hefty 25%[3]. Nevertheless, as of Friday’s close, Thailand’s SET has etched a 15-year landmark.

To reiterate the lessons which I mentioned two weeks ago, the Thai’s experience simply exhibits how the bursting of bubbles takes extended period to replace capital consumed from the unwinding of malinivestments.

Misallocated capital cannot be seen as “benefits” since at the end of the cycle, misdirected capital will be exposed as wasted or consumed capital through a bubble bust or a financial crisis. In short, boom bust cycles destroy capital, lowers society’s standard of living or impoverishes people.

The ASEAN outperformance, as I have also been pointing out in the past, has largely been due to the relatively fewer fiscal baggage, as consequence to the market clearing process endured by them during the post-Asian Crisis of 1997, along with the gradualist embrace of globalization.

In addition, my prognostications of a blossoming homegrown property bubble seem to be progressing. I pointed out last August[4],

One of the big factors that has, so far, worked in favor of domestic stock market, as I have repeatedly been pointing out, has been the negative real rates which has impelled for a domestic version of yield chasing dynamic.

This yield chasing dynamic in the domestic financial market and the economy has been supported by a steep yield curve, which is likely to accelerate a credit driven boom. The Philippines has the steepest yield curve in Asia

The above is an updated chart from the ADB[5] continues to exhibit that the Philippines have still the steepest yield curve in Asia.

Such steep yield curve incentivizes banks to take advantage of asset-liability mismatches or maturity transformation[6] where banks borrow short and lend long or a credit boom.

Proof of the bubble process or a credit boom in motion?

Real estate loan exposures by the domestic banking sector; particularly the universal, commercial and thrift banks, according to the Bangko Sentral ng Pilipinas (BSP) or the local central bank has “reached its highest level yet”[7]. Property loans grew by 19% annualized and 4.4% from last quarter.

Although, the BSP adds that the real estate segment of the total loan portfolio remains at 14-15%, such only implies that there has been sizeable expansion of systemic debt that matches the growth of real estate loans, and or, that loans to the property sector may have been channeled through other avenues (e.g. misdeclaration of loans use, off balance sheets and etc…)

Additional evidence of systemic debt expansion can also be seen in the vigorous expansion of Foreign Currency Deposit Unit (FCDU) mostly to the private sector which grew by 7.3% quarter-on-quarter and 23% year-on-year[8].

Thus, artificially suppressed interest rates that have brought about a domestic negative real rates regime, as well as, foreign capital flow movements influenced by external credit easing policies (negative real rates and Quantitative Easing), are likely to further inflate bubble dynamics in the country and in the region, far more than their developed economy and BRIC counterparts.

Yet such credit driven boom will be interpreted by the mainstream as “economic growth” when in reality they represent a bubble cycle or systemic misallocation of capital in progression.

One must be reminded that bubbles come in stages. So far the Philippines seem to be at a benign phase of the bubble cycle.

Again bubbles will principally be manifested on capital intensive sectors (like real estate, mining, manufacturing) and possibly, but not necessarily, through the stock markets.

This means that for as long as the US does not fall into a recession or a crisis, ASEAN outperformance, fueled by a banking credit boom and foreign fund flows operating on a carry trade dynamic or interest rate and currency arbitrages (capital flight I might add), should be expected to continue.

And again I will maintain that ASEAN’s record breaking streak may be sustained at least until the end of the year 2012.

Yet such streak will strictly be conditional to the political-economic developments abroad, as well as, on the monetary engagements by major central banks.

Price inflation will play a significant role of the sustainability of the bubble cycle and will also influence on the direction of domestic financial asset price movements where any signs of mounting price inflation will likely compel regional central banks, including the BSP, to initially tighten which will likely put pressure on the bullish momentum of the markets.

Sustained price inflation will likely usher in a stagflationary environment which represents an Achilles heels for emerging Asia.

High commodity prices are likely to influence emerging markets consumer price inflation more. Food makes up a large segment of consumption basket for emerging Asia including the Philippines. This would prompt for their respective central banks to reluctantly tighten. Monetary tightening will put pressure on the stock market.

Stagflation, thus, also represents both a contagion and internal (political and market) risk for the Philippines and for emerging Asia

ASEAN’s interest rate swap markets have already been signaling growing inflation risks[10] from supposed overheating or “expanding at a faster rate”—euphemism for a credit boom.

Thus stagflation or an acceleration of the region’s bubble cycle (if price inflation remains contained) will become big influences for 2013-2014.

Nonetheless, when pushed to the wall, central bankers will likely resort to fighting price inflation with even more attempts to ease credit or through executive-legislative actions of price controls. Abolition of interest rates has become an entrenched part of the central banking doctrine.

For investors, once stagflation—elevated price inflation and stagnant growth—should emerge and become a dominant variable, I expect to see a shift in the market leadership in the equities.

Sell on News, Asset Inflation is the Main Central Bank Goal

As for the lagging performance of major bourses, my guess is that this has mainly been due to the “buy the rumor sell the news” dynamic.

As I pointed out last June[11]

if markets may be temporarily satisfied with REAL actions of central banks (e.g. $1 trillion bailout) then we should see a minor or a slight “sell on news”. But this should be seen as opportunities to RE-ENTER the markets incrementally.

Remember, much of the world’s bourses have been ascending out of expectations of central banking steroids in spite of an ongoing slowdown in the real economy. I even called such events as “bad news is good news”, “detachment from reality” or even “parallel universe”.

Thus, given the confirmation of expectations from the FED-ECB actions, natural profit taking could be at work.

As proof, with the exception of China, Japan and Brazil, all other major bellwethers has registered substantial year to date gains as of Friday’s close. This means that the declines during the past two weeks hardly scratched on the surface of the extensive year to date gains.

Of course I can be wrong and global markets can go lower.

But it is very important to understand the fundamental position for the FED’s actions, which has mainly been about the promotion of the “wealth effect” through the portfolio balance channel.

To emphasize on this, I will re-quote FED chair Ben Bernanke’s statement in a TV conference, post QE Forever announcement[12]

The tools we have involve affecting financial asset prices. Those are the tools of monetary policy. There are a number of different channels. Mortgage rates, other rates, I mentioned corporate bond rates. Also the prices of various assets. For example, the prices of homes. To the extent that the prices of homes begin to rise, consumers will feel wealthier, they’ll begin to feel more disposed to spend. If home prices are rising they may feel more may be more willing to buy home because they think they’ll make a better return on that purchase. So house prices is one vehicle. Stock prices – many people own stocks directly or indirectly. The issue here is whether improving asset prices will make people more willing to spend. One of the main concerns that firms have is that there is not enough demand…if people feel their financial position is better they’ll be more likely to spend….

In the assumption that Mr. Bernanke has been forthright about the objectives of the Federal Reserves, any idea which puts into Ben Bernanke’s mouth that the FED’s policies has been about Keynesian “devaluation” to deal with “sticky wages” has been outrageously out of touch with reality or simply delirious.

Last week, Mr. Bernanke defended his policies anchored on the strong US dollar policy, as excerpted from Reuters[13]:

He also downplayed fears that the central bank's policies would damage the long-run value of the dollar, saying the stronger growth that Fed officials are trying to engender would actually support the currency.

I don't see any inconsistency with our policy and maintaining a strong dollar," he said.

While it is true that FED policies will naturally lead to a weaker dollar if taken on their own, the fact is that the entire world has basically mimicked the FED, and where the difference lies on the degree of balance sheet expansions.

Even the Philippines and her major ASEAN peers have been massively growing their balance sheets over the past decade[14].

A recent paper from the Bank of International Settlements notes that currency interventions have had similar effects to central bank’s Large Scale Asset (bond) Purchases (LSAP) in lowering long term interest rates in a wide range of countries including Japan. This according to the authors[15] was triggered by the investment of the intervention proceeds in US bonds and that a global portfolio balance effect spread the resulting decline in US yields to other bond markets, thus easing global monetary conditions.

Essentially Ben Bernanke’s principles have been assimilated as the de rigueur central banker’s policy dogma.

And it is further a ludicrous claim by some to suggest that the FED’s actions represent “beggar thy neighbor” policies which has been designed to undermine the world by transmitting inflation where such policies would eventually allow for a repricing of US wages.

Such mechanistic-mercantilistic perspective with a singular focus or obsession on the levels of wages fails to account of the reality where central bankers have standardized the “beggar thy neighbor” approach to deal with present crisis.

Devalue against whom (see chart[16] above)? Everyone has been racing to devalue.

Proposals for further financial repression would only nurture domestic bubble cycles and or price inflation. Compounded by the arbitrary imposition of restrictive regulations, centralization or dilution of market forces and confiscatory taxes, all these extrapolate to the weakening of the productive capacities of the world economies which undermines capital formation. .

Inflating of supposed “sticky” and “overvalued” wages will not solve the issue of productivity obstacles from the politicization of the business environment.

But this has not even been the issue for the FED. Proof?

Writing at the Wall Street Journal Senior fellows of the Stanford Univesity’s Hoover Institution[17] Professors George P. Shultz, Michael J. Boskin, John F. Cogan, Allan H. Meltzer and John B. Taylor aptly warns of the conditions established by the FED,

The Fed has effectively replaced the entire interbank money market and large segments of other markets with itself. It determines the interest rate by declaring what it will pay on reserve balances at the Fed without regard for the supply and demand of money. By replacing large decentralized markets with centralized control by a few government officials, the Fed is distorting incentives and interfering with price discovery with unintended economic consequences.

Did you know that the Federal Reserve is now giving money to banks, effectively circumventing the appropriations process? To pay for quantitative easing—the purchase of government debt, mortgage-backed securities, etc.—the Fed credits banks with electronic deposits that are reserve balances at the Federal Reserve. These reserve balances have exploded to $1.5 trillion from $8 billion in September 2008.

With the FED centralizing control of the financial markets, these not only leads to the distortion of the markets (price signals, coordination process and the allocation of resources) but likewise increases systemic fragility.

To add, burdens from policy uncertainty, overregulations and compliance costs—which all boils down to an assault on private property through regime uncertainty—the same experts write,

Did you know that funding for federal regulatory agencies and their employment levels are at all-time highs? In 2010, the number of Federal Register pages devoted to proposed new rules broke its previous all-time record for the second consecutive year. It's up by 25% compared to 2008. These regulations alone will impose large costs and create heightened uncertainty for business and especially small business.

Oversimplifying the nature of economic problems leads to misdiagnosis and to wrong prescriptions. Labor reforms could start with the emancipation from regulations and welfare statutes such as minimum wage law and unemployment insurances and other laws that unilaterally protects labor unionism at the expense of non-union labor and the consumer.

In reality, all these collective central bank measures basically signify as price controls or price manipulations designed to curtail short selling (liquidity injections leads to the burning of short sellers) and or to avoid price discovery which would expose on massive insolvencies of public and politically connected private institutions. Hence, relative devaluation represents a side-effect rather than a principal objective for them.

And this is why gold for instance is at either record highs or near record highs against ALL major currencies[18] which is why it would be misleading for political dogmatists to allege that there has been “no visible sign of inflation”, when even the OECD admits to emergent price inflation pressures[19].

Common sense tells us that if central banks will admit to the threat of price inflation then this essentially eliminates all justifications to inflate the system. Like a philandering spouse caught red handed in tryst with a paramour, the intuitive reaction by the guilty spouse has been to deny the existence of an illicit relationship.

The bottom line is that financial asset inflation signifies as the true objective of du jour central bank policies.

And as indicated two weeks back, both the FED and ECB through QE forever will likely be expanding their combined balance sheets by $2 trillion or more, from last month until sometime 2015.

QE forever means that based on political objectives, central banks can be expected to simply add to the quantity of asset purchases.

This also suggests that any foregoing weaknesses in asset prices will prompt the FED, the ECB and other central banks to increase the amount of steroid dosages.

Since central banks have been “all in” with their chips, the next prudent step is to observe how all these tsunami of new money would diffuse into the asset markets and eventually into the real economy.

Finally the view where the destruction of the world economy via inflation, as having to benefit the US, is not only irrational but represents a miasmic mentality contaminated by brain deadening politics.

If economic isolation represents as the elixir to prosperity, then North Korea and Cuba would be one of the world’s wealthiest nations, and perhaps only next to the Stalinist USSR and China’s Mao’s “Cultural revolution” which would still have been in existence. Incidentally, North Korea suffered hyperinflation in 2009-2011 according to Cato’s Steve Hanke[20]. This should even make North Korea prosperous based on the inflationists doctrine.

Besides, how moral can it be to wish and pray for the misery of others?

A race to devalue would not bring about economic wealth. To the contrary this will hasten the collapse of the incumbent currency system that would not only create domestic social instability but likewise heightens the risks of World War III.

Will the Mining Index Recapture Leadership in 2013?

Perhaps one day, people will learn to see the mining sector as blessing than a populist political curse. That’s probably just around the corner or when people awaken to Voltaire’s rule—“Paper money eventually returns to its intrinsic value — zero.”

These will likely become a reality if the belief in the salvation from money printing becomes a self-fulfilling political dynamic where the unexpected effect, a crack-up boom, would mean a general stampede towards commodities and perhaps to mining issues.

Lately some commodities of late have been under selling pressure.

Take oil, despite ongoing geopolitical turmoil at Middle East which should give oil a higher premium, over the past two weeks oil prices plunged from nearly $100 a barrel to $89.98.

The dramatic decline may have been due to crowded trade where a huge volume of large speculators have piled up massive positions[21] or to the “buy the rumor sell the news”, or some unexpected downside developments on the global economy.

Over the interim lower oil prices may have been drag to other commodities, such as gold.

Yet if central banks aim to manage asset prices by throwing into the pot over $2 trillion over the next year or so, then some of these monies will likely find their way into the commodity markets. And this is why I don’t believe any selling pressure will last. Although given the massive distortions in the marketplace, sharply volatile environment should be the norm.

Usually an inflationary boom means a rising tide lifts all boats. But this hasn’t been the case today in the Philippines. The boom in the general markets has yet to filter into the domestic mining index.

Yet I think that mainstream’s fascination with chasing prices leaves a great opportunity to position for the mining renaissance.

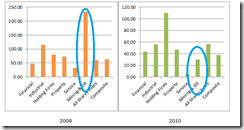

I have plotted again[22] the annual returns of each sector since 2007.

The following will show the alternating leadership by the mining sector.

In 2007, mining issues returned by a lopsided 80% relative to other sectors while the great recession of 2008 prompted the sector to fall most by about 60%.

The mining index spearheaded the recovery post great recession with a monster 234% return. In 2010, the resource based sector lagged anew but closed on the positive.

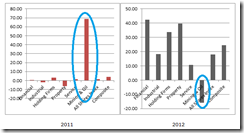

Last year, the mines proved to be a runaway winner with a 68.52% return leaving all other sectors biting the dust.

While 2012 hasn’t ended, the resource based sector has struggled anew, but unlike before, the mines has posted substantial losses of more than 10%.

Much of the current sluggishness in the industry has been traced to Philex Mining’s tailing leakage controversy[23], as well as, to the surrounding controversies on the supposed ambiguities of Executive Order 79. The latter have been revised by the Philippine president to partially accommodate the pleadings of the industry[24].

The 32% year to date decline of Philex Mining has practically reduced the gold mining company’s weightings on the sector’s index where the free float market cap now accounts for just 15.02% of the index as of Friday’s close.

I would add that outside the popular explanations which for me has been more of an aggravating circumstance than of the real cause, the alternating annual leadership of the mining sector are driven by three factors: one rotational process, two Wall Street’s axiom “no trend moves in a straight line”, and or lastly, the reversion to the mean.

In terms of charting, the mining index may be signaling a bullish falling wedge which could imply of a rebound soon. But again chart patterns are subordinate to the real drivers—human action.

While I am also not a fan of seasonal performances, I believe that the mining alternating annual leadership pattern fits, what I see as the fundamental drivers of the big picture, to a tee.

Moreover, the political and legal hurdles, faced by the industry which are based on technicalities, will likely be overturned not only due to the political interests of the incumbent government[25] to see statistical growth (among other political reasons), but most importantly, by the unfolding developments in the global monetary and financial sphere.

So why chase prices lofty prices when opportunity presents a great potential from an industry largely ignored and dumped by the public?

Disclosure: I have been gradually accumulating on the sector.

[21] Ed Yardeni Wicked, September 25, 2012 Dr. Ed’s Blog