Mainstream "experts" continue to dish out bromides about forthcoming rate cuts for the Philippines and her ASEAN peers without recognizing that impact of the FED-ECB-BoJ-SNB-BoE inflationists policies will heighten the risks of stagflation for the region.

Yet current market signals seems pointing to such direction.

From Bloomberg (bold emphasis added)

Interest-rate swaps in Malaysia and Thailand are signaling central banks will start to tighten monetary policy next year for the first time since 2011, as fighting inflation takes precedence over economic growth.Malaysian and Thai contracts in which investors exchange a fixed payment for a floating rate for two years climbed to four- month highs of 3.18 percent and 3.08 percent, respectively, in September. Societe Generale SA recommends clients pay the swaps in Malaysia targeting an increase to 3.35 percent. Goldman Sachs Group Inc. raised its forecasts for five-year rates in both countries on Sept. 19.Southeast Asian nations are expanding at a faster pace than economists predicted this year, even as Europe’s debt crisis and unemployment in the U.S. reduce export orders. Analysts including Societe Generale’s Wee-Khoon Chong and central banks are starting to flag inflation risks for next year, driven by rising domestic demand and funds pumped into the European and U.S. financial systems.

What the mainstream imputes as ASEAN’s “growth dynamic” represents no less than a concealed credit driven boom.

Indonesia (IMF)

ASEAN M3 and Claims on private sector credit (IMF)

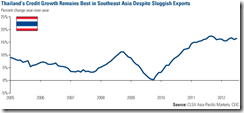

Thailand (US Global Investors)

These dynamics seem in the process of validating my prognostications

Capital inflows coupled with domestic negative real rates regime will likely translate into serial bubble blowing dynamics.So yes, the risks of bubbles in Asia will become more enhanced. Even the local central bank or the Bangko Sentral ng Pilipinas (BSP) has recently acknowledged of such risks which they arrogantly claim they can control.In addition, domestic and global bubbles will increase the risks of a global stagflation which is likely slam emerging markets harder.The risks of ballooning bubble or stagflation will likely become evident in 2013-2014.

Remember that emerging Asia (ASEAN) is highly vulnerable to inflation risks, as I also wrote earlier,

High commodity prices are likely to influence emerging markets consumer price inflation more. Food makes up a large segment of consumption basket for emerging Asia including the Philippines. This would prompt for their respective central banks to reluctantly tighten. Monetary tightening will put pressure on the stock market.Stagflation, thus, also represents both a contagion and internal (political and market) risk for the Philippines and for emerging Asia.

A stagflationary environment will prove to be a spoiler for stock market bulls.

But the effects of monetary inflation via stagflation will not be the same, there will select sectors that may surf the stagflation tide.

For now, these incipient signs of price inflation won’t be much of a headwind for central bank sponsored stock market and financial asset boom...until next year.

1 comment:

If the interest rates fall below the set rate the amounts payable under the loan will fall but you will make up the difference by paying the bank under the swap. The net off-set of payments means that you will always have the same contingent liability for the repayments under the underlying loan facility and swap.

Post a Comment