Following Monday’s trading halt due to the 7% stock market crash, the Chinese government spent the next two days managing or propping up the stock market. Yesterday, the Shanghai index even surged 2.25%

The Chinese government have been desperately attempting to cosmetically embellish its economy from its imploding bubble by price fixing market signals: interest rates (SHIBOR), the stock market and the currency.

Apparently, the market has been complexly porous and more powerful than the authorities wished them to be. [As side comment: The Chinese government increasingly looks like the supercilious version of King Canute.]

So as they bolstered stocks, the selling pressures manifested elsewhere, this time on the currency markets or the yuan...

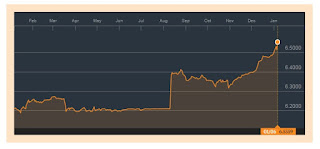

Most of the currency losses can be seen via the offshore yuan or the surging USD CNH

The USD CNH quote as of this writing...

The downside revaluing offshore yuan has likewise been reflected on the onshore yuan (USD CNY)...

but the rise of the USD CNY has been at a lesser scale relative to the USD-CNH

So the gap between the freer offshore yuan (CNH) has been widening relative to the tightly government controlled onshore yuan (CNY). This implies that the Chinese government appears to be losing control!

Yesterday's pressure on the yuan has has prompted US and European stocks to close significantly down.

The spillover effects from the battered yuan eventually boomeranged back to the source!

Barely 30 minutes from the opening bell, Chinese stocks cratered to over 7%!

And this automatically triggered the circuit breakers…which suspended trading anew for the second this first week of 2016!

The Bloomberg reported (this time attributing today's action to the yuan which they omitted last Monday)

Chinese stock exchanges closed early for the second time this week after the CSI 300 Index plunged more than 7 percent.

Trading of shares and index futures was halted by automatic circuit breakers from about 9:59 a.m. local time. Stocks fell after China’s central bank weakened the currency’s daily reference rate by the most since August.

“The yuan’s depreciation has exceeded investors’ expectations,” said Wang Zheng, Shanghai-based chief investment officer at Jingxi Investment Management Co. “Investors are getting spooked by the declines, which will spur capital outflows.”

Under the mechanism which became effective Monday, a move of 5 percent in the CSI 300 triggers a 15-minute halt for stocks, options and index futures, while a move of 7 percent close the market for the rest of the day. The CSI 300 of companies listed in Shanghai and Shenzhen fell as much as 7.2 percent before trading was suspended.

Chinese stocks in Hong Kong, which doesn’t have circuit breakers, slumped 4.4 percent. The offshore yuan fell to a five-year low before erasing losses

Defending the US dollar soft peg required access to US dollars. Unfortunately, such window has been closing for the Chinese economy. Moreover, outflows and or capital flight have been compounding on the supply conditions of an already scarce US dollar. Finally, domestic credit expansion to save the stock markets translates to relatively more money supply vis-a- vis the US dollar (whether the Fed tightens or keeps policies at current levels). This implies supply side influences on the yuan’s weakness.

Hence, inflationism PLUS the scarcity of US dollar supply reveals why the US CNY soft peg cannot be sustained. Acting like a relief valve, China’s central bank, the PBOC, simply relented on the building pressures on the peg. The PBoC responded by allowing the markets to partially revalue the yuan. Hence the devaluation! ...

And it may not just be about capital flight but likewise, imploding bubbles should translate to money supply destruction. And this can be seen through the slack in money supply (M2) growth, slumping growth of CPI and deepening deflation in manufacturing input prices or the PPI

Importantly, considering China’s immense US dollar debt exposure, borrowing to pay back debt will only reduce US dollar supply. How much more when highly leverage companies default?

And this compounds on the US dollar dilemma which has now become a global phenomenon.

So while the USD CNY’s advance may not have been as steep as last August, the USD-CNY broke out from its allotted bandwidth.

The last time the USD-CNY materially advanced (again last August), the USD Php spiked, and global financial markets tremored.

Déjà vu August 2015? Or was August an appetizer or the blueprint of the things to come (for 2016)?

No comments:

Post a Comment