In this issue

Phisix 7,230: The Gaming of the System; The Real Story Behind the “Yabba Dabba Doo!!!” 3Q PSE Net Income Numbers!

-As Expected, Volatility Spiked During GDP Week; Last Week’s Controlled Decline

-Asymmetric Dispersion of Price Changes and Price Fixing Activities

-Corruption Signify Signs of Market Top, The Credit Driven PSEi and GDP

-The Real Story Behind the “Yabba Dabba Doo!!!” 3Q PSE Net Income Numbers!

-Because BSP’s Subsidies Are No Free Lunches, PSE’s Net Income Bonanza should be a Fleeting Dynamic

Phisix 7,230: The Gaming of the System; The Real Story Behind the “Yabba Dabba Doo!!!” 3Q PSE Net Income Numbers!

Because I am an avid disciple of the markets, I will either be its staunchest defender or its harshest critic when the latter is abused.

As Expected, Volatility Spiked During GDP Week; Last Week’s Controlled Decline

My suspicion had been confirmed.

The other week or the GDP week generated a huge spike in upside volatility. The week started with a 1.96% pump which apparently wasn’t sustained. It turned out that the reason for this was that 4Q GDP 6.6% and 2016’s 6.8% was revealed to be a miss. Curiously, the GDP miss didn’t trigger a selloff.

Instead, the GDP week was characterized as mainly a defense of the early gains. GDP week closed up 1.4%, which was partly down from the early upward 1.96% thrust.

Interestingly, the bidding overdrive from GDP week’s 1.4% advance piggybacked on the 9-day meltup which occurred from the end week of December through the New Year week that has spurred overbought conditions.

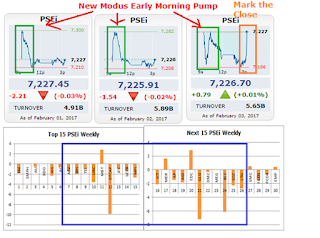

Figure 1: Market Manipulation and PSEi Price Volatility

But seemingly, there exists no overbought conditions for participants whom have learned how to game the system. That’s with the apparent auspices from authorities.

So while the headline index declined 1.46% this week, the downfall was to a great extent or substantially mitigated by operations engineered to buoy such benchmark

Perhaps stunned by Monday’s 1.46% drop, index managers spent the last 3 days attempting to ignite a whole day rally with spikes during the opening sessions. The local version of Plunge Protection Team either priced big market cap issues significantly higher right before the opening bell (Wednesday), and through the first minutes of the sessions seen in Thursday and Friday (upper window).

Remember, that’s the index benchmark, which means it would take coordinated or simultaneous or synchronized bidding on some of the biggest (usually 3-4) market cap issues. Synchronicity of actions points to collusion and not spontaneous actions by market players.

Such method had been used and worked during the 9-day meltup.

As for stimulating a follow through, the effects didn’t materialize during the last 3 days. But as to whether these actions saved the index from further decline represents a counterfactual scenario. It might have.

Asymmetric Dispersion of Price Changes and Price Fixing Activities

Market breadth gives some clues.

The dispersion of price changes has been significant. The top 5 issues where 2 Sy owned firms were unchanged this week registered an average of only -.95% decline. This compares to the next 5 issues (or ranked 6-10) which registered an average loss of -1.722%. The issues ranked 11-15 suffered an average -3.12%.

In aggregate, the top 15 issues had an average of -1.69% decline which meant that the top 5 issues, whose market cap weighting was 40%, materially diminished the effects of the big downturn in the 6 to 15 issues.

That’s how significant the top 5 issues are in terms of contribution to the performance of the headline index. And that’s also how the index has been manipulated.

Yet it is important to highlight of the huge price volatility that the PSEi 30 has been encountering despite seemingly calm surface.

For the week, 14 issues were down by 1.5% or more as against 3 issues that were up by the opposite degree or by 1.5% up. 17 issues or 57% of issues experience mercurial pricing patterns.

The deepening occurrence of price instability has hardly been signs of a healthy market.

Moreover, witness last Friday where the marking the close pruned the day’s index loss from an astonishing -.36% to a positive +.01%.

For the week, end session ‘pump’ accounted for 37.01 points or .5% of the previous week’s closing prices. End session ‘dump’ signified 72.02 points or .98% of the same reference point. For both pump and dump which tallied to 109.03 points, such accounted for a stunning 1.5% of last week’s closing price. In other words, end session price fixing continues to contribute to material deformation of the pricing mechanism of the Philippine Stock Exchange

Again, all actions has (intertemporal) consequences. This means imbalances brought upon by the deliberate or engineered distortions of prices in the markets will have its day of reckoning.

While developments may move in the direction of manipulators, ultimately, there is no escaping the laws of economics.

Even if the PSE had been accorded as the “best stock market in Asia for 2016”, predicated largely on superficialities, such acclaim has been bereft of the actual health of the pricing system which unfortunately continues to be brazenly perverted.

Figure 2: PSE Topping Process and Credit Dependence of PSEi and GDP

And it doesn’t seem to be a coincidence that these price fixing schemes became a permanent feature since the 2H of 2014.

Despite the deafening meme of G-R-O-W-T-H to justify indiscriminate price bidding, since 2013, the Phisix has been on a ‘jump the rope’ dynamic with 7,400 as base (upper window). Such suggests of a massive topping process which even chart price pattern formation continues to depict.

I’m no fan of (technical) charting. That’s because most of these have not only been fixated on the past, but sees indicators such as oscillators, stochastics and other statistics as similar to econometrics—a form of scientific “math” knowledge based on flawed mechanical non-human assumptions which seem largely anchored on the efficient market hypothesis (EMH)

Moreover, charts are vulnerable to the involvement of manipulations or nonmarket (profit loss) actions. For instance, early 2016 revealed of how systematic price manipulation can destroy or unmake chart patterns. So even if these bearish patterns don’t playout, mainly because of price fixing, eventually the markets will reassert its supremacy over the established economic maladjustments.

But of course, I do not summarily dismiss charts since they are widely used.

Corruption Signify Signs of Market Top, The Credit Driven PSEi and GDP

The current pattern of market manipulations essentially dovetails with what historian Charles Kindleberger called as the “emergence of swindles”, which “occur in the mania phase and then in the panic phase”*.

Or such are the psychological hallmarks symptomatic of desperate attempts to maintain the status quo**

The supply of corruption increases in a procyclical way much like the supply of credit. Soon after a recession appears likely the loans to firms that were fueling their growth with credit declines as the lenders became more cautious about the indebtedness of individual borrowers and their total credit exposure. In the absence of more credit, the fraud sprouts from the woodwork like mushrooms in a soggy forest.

The PSEi has largely tracked, with a time lag, credit conditions of the Philippine banking system (see middle window).

Symptoms of recession, through a credit and liquidity slowdown—which followed the 10 months of 30+++% money supply growth and which the BSP chief fretted as deflation risk—appeared in 2015. And the BSP responded with a huge bond buyingspree in 4Q 2015 through 1Q 2016 which ostensibly diffused into the Phisix

While current statistical growth rate remains at a blistering pace, the banking system’s credit growth seemed to have peaked, hence the renewed price pressures on the PSEi.

This suggests of the likelihood that a considerable segment of market participants have leveraged exposure on domestic equities. And to keep their position afloat requires levitated prices. And this translates to “do whatever it takes” to keep the Phisix up, perhaps by imbuing even more leverage to conduct pumping and price fixing operations.

This only means that the oxygen the PSEi breathes has principally emanated from the credit inflation which the banking system has been generating over the past years

The same applies to GDP, or which has been publicly sold as G-R-O-W-T-H.

Even mathematician author Nassim Taleb understands the risks from the present predisposition to inflate GDP***

As to the growth in GDP (gross domestic product), it can be obtained very easily by loading future generations with debt—the future economy may collapse upon the need to repay such debt. GDP growth, like cholesterol, seems to be a Procrustean bed reduction that has been used to game systems. So just as, for a plane that has a high risk of crashing, the notion of “speed” is irrelevant, since we know it may not get to its destination, economic growth with fragilities is not to be called growth, something that has not yet been understood by governments. Indeed, growth was very modest, less than 1 percent per head, throughout the golden years surrounding the Industrial Revolution, the period propelled Europe into domination. But as low as it was, it was robust growth—unlike the current fools’ race of states shooting for growth like teenage drivers infatuated with speed.

Of course, governments DO understand the merits of GDP. It is why GDP has been also “gamed”. Governments are not only interested to survive or maintain power, but to increase such political power through expanded control of their constituent’s resources. Hence, governments are instinctively short term oriented.

Debt provides the government an easy way to attain such momentary financial-political objectives. And the expression provided for by the GDP helps facilitate expanded access to the public’s present and future resources.

High-speed GDP represents a subsidy to the government through inflated taxes. In addition, through stamp pads of credit upgrades mostly from high-speed GDP, the government can have easy access in cheap credit. So given such motivations, any government would have the predilection for gaming their GDP just to advance their political agenda.

Unfortunately, credit creation is no free lunch. Or as Taleb rightly notes, speed is dangerous.

As much as the PSEi breathes on credit, Philippine GDP nourishes and feeds on credit (see lowest window). GDP represents nothing more than money supply expansion from credit growth. And this is why the BSP chief calls the current state of monetary accommodation “trickle down”. They tweak rates and undertake bond buying operations to spur credit growth from which spending delivers the glorified GDP.

Note that access to formal debt has been limited to only a few segment of the Philippine economy.

So if markets have been gamed, then just how could the same dynamic not serve as a blight to the real economy?

Perhaps through the accounting books of listed and non-listed firms, which are likely to carry significant skeletons in the closet through off balance sheet leveraging. And price fixing of assets could have helped in the spiffing up of accounting books of many levered firms.

Also through false signals, economic agents are motivated to chase returns via a pile up on speculative rather than productive endeavors that lead to capital consumption.

One should realize that gaming of a system translates to an artificial state.

Applied to the PSE, one can hope for the best only if markets are allowed to efficiently function or do what they are supposed to do.

Or framed differently, how can one be an optimist when markets are systematically prevented from performing its natural or fundamental economic operations?

* Charles P. Kindleberger and Robert Z. Aliber, Manias, Panics, and Crashes A History of Financial Crises Fifth Edition p.20, nowandfutures.com

** ibid p 165

***Nassim Nicolas Taleb Chapter 11, Never Marry a Rock Star, Antifragile: Things That Gain from Disorder p 160

The Real Story Behind the “Yabba Dabba Doo!!!” 3Q PSE Net Income Numbers!

Yabba dabba doo!!! G-R-O-W-T-H!!!! G-R-O-W-T-H!!!! G-R-O-W-T-H!!!!

Figure 3: Gross Revenues, Net Income, GRPI, CPI and Bond Buying

The PSE released the nine month performance of its listed companies including the key benchmark in their December report.

It is almost certain that the mainstream will read and project into the future, the remarkable surge in the 3Q net income by listed companies at 21.7% and by the PSEi at 15.5% as a reason to wantonly justify a buying spree! This marks an enormous turnaround since 2014 (see left blue rectangle).

Yabba dabba doo!!! Buy hands over fists!!!

But hold your horses.

There’s always the question of how and why those earnings appeared.

Second, were those earnings organically generated??

Interestingly, gross revenues climbed by only 5.7% for listed companies and 5.1% for PSEi firms.

Notice that gross revenues had starkly different numbers over the last three years!

In 2014, gross revenues of listed firms soared by 27.9% and PSEi firms by 10.1%.

In 2015, gross revenues fell -.6% and -1.2%, respectively.

In reality, changes in gross revenues almost resonated with the changes in General Retail Price Index GRPI and CPI (upper right window).

When half of the 10 month of 30%+++ money supply expansion occurred in 2014, GRPI and CPI exploded higher. Such numbers became apparent in the year’s gross revenues. And because of higher inflation, which affected input costs, despite big G-R-O-W-T-H headline numbers, net income had been subdued.

In the same year, the BSP went into a tightening mode. It raised policy interest rates twice, reserve requirements twice and SDA rates twice. It even required the banking system to undergo a stress test.

The BSP’s action combined by the market’s limited capacity to absorb inflation pushed back on credit conditions. So credit growth decelerated. And this was reflected on the collapse of the M3 (see figure 2).

Such credit, and subsequently liquidity slowdown became apparent again in gross revenues which registered contractions for both listed and PSE firms in 2015.

The BSP’s tightening likewise percolated on net income which stagnated for both sectors that same year.

Recall again that the BSP chief lectured journalists to even talk about deflation risks early 2015—a topic which was alien to a crowd hardwired to think only of inflation.

In 2H 2015, just when CPI and GRPI simultaneously plummeted to below 1%, the BSP embarked on a government debt monetization program or a colossal Php 250 billion+++ government bond buying spree (lower right window)

Through bond purchases, the BSP injected billions of reserves into the banking system. BSP’s assets exhibit such expansion.Banks responded by flooding the system with debt. Credit moderation turned its heels into aggressive credit expansion. Domestic liquidity soared from high single digits (8-9%) back to 12% range. Credit revival reflected on the sharp upturn in GRPI and CPI. (see Figure 3, upper right pane)

The outsized net income growth from the PSE firms represented the Cantillon effect in motion. Money injections into the system are neither equal nor neutral. Such emerge in specific areas and benefit specific people. In particular, borrowers of bank money signify as the first recipients of the banking system’s money creation. Bank borrowers spend the money on goods and services at today or at current prices. The subsequent chain of spending as a result of the initial injection (demand subsidy) eventually raises relative inflation rates (for specific items). Or non-bank borrowers pay for higher costs of goods and services as a result of the initial bidding up of goods by bank borrowers. The ensuing price differentials or the price spread from the point of injection to the transmission of the spending chain translates into the inflated “net income” or the profit boom.

In short, PSE listed firms, which were mostly key borrowers of the banking system profited handsomely from the price differentials caused by the BSP induced bank credit expansion.

Let me illustrate via a basic example, PSE firms bought goods with credit when CPI was .6% to 1% (2015) and then sold when CPI was at 2% (2016). The BSP essentially delivered inflated profits to the PSE firms, through cost subsidies and through partial inflation of aggregate demand (NGDP).

What has been narrated here could account for as a textbook example of how stimulus from credit subsidies (or business cycle) has worked in the Philippine setting.

But too much alcohol intake can lead to a hangover.

Because BSP’s Subsidies Are No Free Lunches, PSE’s Net Income Bonanza should be a Fleeting Dynamic

Notice that the BSP not only bought bonds in the 4Q 2015 and 1Q 2016. They have bought bonds again last December. Has the BSP been trying to force down rising interest rates pressures being expressed by climbing 10 year bond yields?

And notice too that the BSP’s 2014 tightening through policy rates had been REVERSED in June 2016. The BSP used the interest rate corridor as pretext for easing. Hence, policy rates are at the LOWEST level in history!

Again, history is in the making!

Also notice that the spread in inflation indicators or specifically government’s GRPI (consumer prices at the retail level) and policy sensitive CPI (consumer prices at buyer’s price) has been DRAMATICALLY WIDENING!! December’s GRPI which spiraled at 4.3% has cleared the August 2014 high of 3.68% even as CPI was only at 2.6% during the same period.

In mid-2014 through early 2016, there had hardly been any price variance between the two. The divergence has only emerged in 2Q 2016. Why??? Has such actions been attempts to hide or suppress real inflation rates?

Yet lowest interest rates in the face of surging inflation! One of the two opposing forces will eventually have to give way!

A fast-track or shortcut version of the 2009-2014 process seems to have been compacted into current dynamics. If so, then the effects will likely be similar. However, the difference will be in the narrowed time space of the impact.

Reason for present BSP actions? Simple. The government has been starved of funds.

Let us go back to 2016 PSE’s gross revenues or the NGDP equivalent.

Listed firms’ NGDP rose by only 5.7%. Meanwhile, official 9 month NGDP growth rate was at 8.6%. In short, the PSE’s gross revenues accounted for only 66.3% of the official NGDP.

So where has the missing gross revenue/NGDP of 2.7% been????

Figure 4: Balance Sheet Strain and Concentration Risks

The government balance sheet resonates with the 2016 PSE NGDP story.

Government revenues grew by only 2.6%, astonishingly despite the huge profits by PSE firms! Expenditures surged by 11.04% over the same period.

Nota Bene: For the 11 months of 2016, the revenue-expenditure numbers were at 4.4% and at 11.24% respectively. Yessome improvement but hardly enough to fill in the ocean wide deficit.

Or, apparently, the inflation generated by the BSP and banking system has not been sufficient to cover the growth clip of expenditures. The result should be wider annual deficit for 2016, if December numbers don’t improve.

To apply actual PSE data to the largely survey based NGDP, with gross revenues at Php 5,207 billion, PSE listed firms comprised 50.2% or about half of the Php 10,358 billion 9 month NGDP. Therefore it can be deduced that non-listed firms contributed about 11.5% gross revenue growth to arrive at the 8.6% (9-month) NGDP!

Yet just how realistic will the non-listed firms generate such kind of growth rates? Non-listed firms, which include SMEs, could be reckoned as the farthest from the banking system’s monetary system’s injection points (as they are likely to be relatively less leveraged). They are likely to benefit the least from the price inflation transmission chain

So either the government has vastly exaggerated GDP or there has been a big leakage in the collection of government revenues. Given that PSE’s numbers have been closer to that of the Philippine treasury, it looks as if the former (exaggerated GDP) has been more the case.

Hence, present BSP’s actions may have likely been engineered to fuel more credit inflation so as to fill the gap in the financing of surging government spending. Has the BSP adapted NGDP targeting?

However, again there is no free lunch; rampaging inflation (regardless of whether GRPI and CPI represent the more accurate number) will eventually translate into lesser spending power for the average resident and of higher input costs for firms. Both should contribute to the narrowing of profit margins.

And this comes in the face of mounting systemic leverage that has been used to finance the rabid race to build capacity particularly in the real estate, construction and retail sectors. The combined sector’s share of GDP has exploded from a third to two fifths of the GDP since the new millennium (see figure 4 lower window)! A big part of these has been due to the liberalization of the sector. However, the BSP’s 2009’s zero bound policies have only escalated its share of GDP.

Understand that these sectors are most interest rate sensitive. Alternatively seen, these sectors are the most vulnerable to rising rates! This only reveals how leveraged, via concentration risks aside from credit risk—the Philippine economy have been.

Ascendant GRPI and CPI are already being manifested via higher bond yields. This will eventually either force the BSP to tighten or will spur the peso to fall significantly. One way or another current trends point to a TIGHTENING of money or liquidity conditions.

One can add the FED’s actions to such dynamic, but this should be a MINOR influence.

Applied to the PSE’s (Yabba dabba doo!!!) net income, this entails that that the subsidies that the BSP handed with a silver platter to the PSE listed firms in 2016 will most likely be short lived!

Yet just how much more balance sheet leveraging and real (not statistical) inflation can the Philippine economy absorb before the entire artificial edifice comes crumbling down???

No comments:

Post a Comment