Chinese

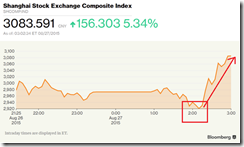

stocks have hardly recovered from a bear market, yet today’s losses

have brought the key benchmark to a secondary bear market from the

December 2015 peak.

Yes,

a bear market within a bear market.

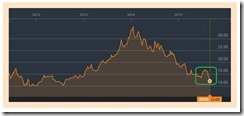

The decline in the Shanghai index today, aggregated with all the losses from the

December 22 high (green rectangle), has totalled 20.56%. Again this represents the second bear market.

The major bear market trend (blue trend line) now tabulates to a hemorrhagic loss of 43.85% from the June 12,

2015 apogee. (images

from Bloomberg and stockcharts.com)

Yet 20% down in three weeks represents a stunning collapse!

From

Bloomberg,

Chinese stocks fell into a bear market for the second time in seven months, wiping out gains from an unprecedented state rescue campaign as investors lose confidence in government efforts to manage the country’s markets and economyThe Shanghai Composite Index sank 3.5 percent to 2,900.97 at the close, falling 21 percent from its December high and sinking below its nadir during a $5 trillion rout in August. Friday’s decline was attributed to persistent investor concerns over volatility in the yuan and a report that some banks in Shanghai have halted accepting shares of smaller listed companies as collateral for loans.“The market entered a disaster mode at the start of the year and it’s still in that pattern now,” said Wu Kan, a fund manager at JK Life Insurance Co. in Shanghai. “The market has completely no confidence and the basic reason is that stocks are expensive, particularly those small caps,” he said, adding that he plans to swap large-cap shares for small caps.The selloff is a setback for Chinese authorities, who have been intervening to support both stocks and the yuan after the worst start to a year for mainland markets in at least two decades. As policy makers in Beijing fight to prevent a vicious cycle of capital outflows and a weakening currency, the resulting financial-market volatility has undermined confidence in their ability to manage the deepest economic slowdown since 1990.While China’s high concentration of individual investors makes the nation’s stock market notoriously volatile, losses in the Shanghai Composite have become one of the most visible symbols of waning investor confidence in the world’s second-largest economy.After cheerleading by state media helped fuel an unprecedented boom in mainland shares last summer, the market crashed as regulators failed to manage a surge in leveraged bets by individual investors. A state-sponsored market rescue campaign sparked a 25 percent rally in the Shanghai Composite through December, but those gains were wiped out on Friday as the index closed at its lowest level since late 2014. Losses this year were fueled by the controversial circuit-breaker system, which authorities scrapped in the first week of January after finding that it spurred investors to rush for the exits on big down days.

So

where the heck has the massive Xi

Jinping Put been?

What

happened to all the collective repression—the ban on short selling, the

intimidation and the arrests of ‘malicious’ short sellers, the

disappearance of top industry officials, the censorship of media,

postponement of IPOs, the prohibition of sales by majority

holders—the subsidies, the mandate by state enterprises to bolster

the stocks—and the coaxing of the public to mortgage their houses

or any assets just to buy stocks?

And

speaking of mandates on state enterprises by the government, Goldman Sachs estimated

that the government bought stocks

worth 1.8 trillion yuan (USD 273 billion) between June and

November last year. This should be a lot larger considering

government buying from December through yesterday. Original

estimates of government support were at $483 billion when the Xi Jinping Put was put into motion. Some put it

somewhere near a trillion.

Think

of all the losses now state owned companies now suffer from. If they

have insufficient working capital or cash reserves, then they would

have to be funded by the central government.

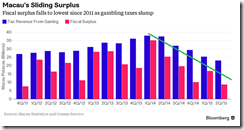

And

considering that tax revenues should be down given the rapidly

slowing economy, then just where will government be getting these funds to

support the companies that have been supporting stocks?

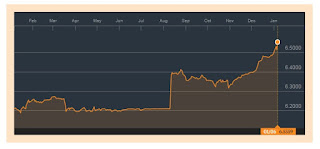

And

part of that answer could be seen in the widening of the gap between the

government controlled onshore

yuan (USD

CNY

right) and the offshore

yuan (USD

CNH

left).

It’s

not that

the

Chinese government has been purposely devaluing, rather, previous

actions to contain the internal bubbles has only found an exit or

outlet via the currency. And compounded by the deflating property and

industrial bubble, the backlash from recent interventions has only accelerated the unraveling of the Chinese soft peg.

It's simply

market forces prevailing over the government. Or bluntly said, the Chinese

government has been losing control!

And

the attempt this week to fight currency “speculators” by the

draining of liquidity as manifested in the skyrocketing of the HIBOR only had a very short term or one day

effect.

The

moral is: There is no free lunch forever. The cost of political actions will surface.

As

I previously wrote

The point is that the Chinese government may have spread their resources thin, or has started run out of resources to mount further rescues, or simply that, all attempts by the Chinese version of King Canute has failed to stop the tsunami of selling.

The

more the government intervenes, the nastier the side effects or the

unintended consequences.

Now

that with BOTH Chinese currency and stocks under pressure, what’s

next? The spread and escalation of strains on the property sector, the banks and the bond

markets? Will there be cascading defaults?

Perhaps kick the can down the road policies by the Chinese government has met a dead end?

Or

how about a China triggered Asian crisis circa 2016 (as predicted in 2014)???!!!