Even more bad news for Cyprus, which now has not only a depression to look forward to but a depressionary stagflation to boot. Bloomberg has ranked countries based on their risk of stagflation based on the following methodology: First, the average real Gross Domestic Product and average Consumer Price Index was calculated for each country from 2012 to 2014. Then the Stagflation Score was determined by multiplying average real GDP by average CPI if the average real GDP was negative or by dividing average real GDP by average CPI if the average real GDP was positive. The lower the score, the greater the risk of stagflation. The winner, or loser at the case may be? Cyprus was found to be most at risk of stagflation with a Stagflation Score of -4.733, followed by Portugal (-2.671), Italy (-2.133), Spain(-1.745) and Greece (-1.366). Switzerland was ranked least at risk with a score of (7.560), followed by China (2.612) and Japan (2.446).

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, March 27, 2013

Stagflation will Add to Cyprus, Eurozone woes

Example of the Mania Phase: Awards Received by the Bank of Cyprus

The Bank of Cyprus, which is stealing up to 40% of deposits from those with more than 100k Euros, had quite a veil of legitimacy.Check out the prestigious awards that the bank recently earned:Feb 25 2011 - The Banker magazine ranked the Bank of Cyprus amongst the leading banks of the world.Apr 4 2011 - The prestigious Global Finance financial magazine honours the Bank of Cyprus with the title of Best Bank in Cyprus.Jun 15 2011 - The Bank of Cyprus has succeeded in being included in the category of «Best Banking Organizations» worldwide at the annual World Finance Banking Awards of the internationally acclaimed financial magazine World Finance.Sept 13 2011 - In the framework of its annual “Awards for Excellence 2011”, the Bank of Cyprus was named Best Bank in Cyprus by the international financial magazine EUROMONEY.Nov 1 2011 - The Bank of Cyprus was awarded the ‘JP Morgan Chase Quality Recognition Award’ for its funds transfer operations for the eleventh consecutive year.Dec 1 2011 - The Bank of Cyprus was named “Bank of the year 2011” in Cyprus by the prestigious international financial affairs publication The Banker, during its annual “Bank of the Year Awards 2011.”Feb 9 2012 - Bank of Cyprus has been named as the Best Bank for Private Banking in Cyprus, by the internationally acclaimed magazine EUROMONEY.Mar 23 2012 - The international financial magazine ‘Global Finance’ has named the Bank of Cyprus the best banking institution in Cyprus in the Developed Markets category of “World’s Best Banks Awards”.Sep 26 2012 - Bank of Cyprus has been awarded the ‘2011 Citi Performance Excellence Award’ by the world-renowned financial organization Citibank, for global electronic payments leadership and excellence.

Tuesday, March 26, 2013

How Money Oozed out of Cyprus during Negotiation of Bailout Deal

In banknotes at cash machines and exceptional transfers for "humanitarian supplies", large amounts of euros fled the east Mediterranean island before and after Cypriot lawmakers stunned Europe by rejecting a levy on all bank deposits.EU negotiators knew something was wrong when the Central Bank of Cyprus requested more banknotes from the European Central Bank than the withdrawals it was reporting to Frankfurt implied were needed, an EU source familiar with the process said. "The amount the Cypriots mentioned... on a daily basis was much less than it was in reality," the source said.Confusion over just how much money was pulled out of Cyprus' banks is illustrative of the confusion surrounding the negotiations as a whole. Representing just 0.2 percent of the euro zone economy, Cyprus nevertheless threatened to reignite the bloc's debt crisis. Cyprus' problems began in Greece - it is heavily exposed to the euro zone's first bailout casualty.No one knows exactly how much money has left Cyprus' banks, or where it has gone. The two banks at the centre of the crisis - Cyprus Popular Bank, also known as Laiki, and Bank of Cyprus - have units in London which remained open throughout the week and placed no limits on withdrawals. Bank of Cyprus also owns 80 percent of Russia's Uniastrum Bank, which put no restrictions on withdrawals in Russia. Russians were among Cypriot banks' largest depositors.While ordinary Cypriots queued at ATM machines to withdraw a few hundred euros as credit card transactions stopped, other depositors used an array of techniques to access their money.Companies that had to meet margin calls to avoid defaulting on deals were granted funds. Transfers for trade in humanitarian products, medicines and jet fuel were allowed.Chris Pavlou, who was vice chairman of Laiki until Friday, said while some money was withdrawn over a period of several days it was in the order of millions of euros, not billions.German Finance Minister Wolfgang Schaeuble said the bank closure had limited capital flight but that the ECB was looking closely at the issue. He declined to provide figures.

Monday, March 25, 2013

Cyprus, Troika Reach Bailout Deal

Cyprus agreed to the outlines of an international bailout, paving the way for 10 billion euros ($13 billion) of emergency loans and eliminating the threat of default.The accord between Cyprus and the “troika” representing international lenders was reached in overnight talks in Brussels and ratified by finance ministers from the 17-nation euro area.

“It’s in best interest of the Cyprus people and the European Union,” Cyprus President Nicos Anastasiades told reporters.

The agreement calls for Cyprus Popular Bank Pcl (CPB) to be shut down and split. The Bank of Cyprus Plc would take over the viable assets of the failed bank along with 9 billion euros in central bank-provided emergency liquidity aid, according to three EU officials who asked not to be named because talks are ongoing.Deposits below the EU deposit-guarantee ceiling of 100,000 euros will be protected, and a loss of no more than 40 percent will be imposed on uninsured depositors at the Bank of Cyprus, two EU officials said. Uninsured depositors at Cyprus Popular would largely be wiped out, two other officials said.

Wow. 40% losses for uninsured deposits above 100,000 euros for Bank of Cyprus while total losses uninsured deposits for Cyprus Popular!

It was the second time in nine days that Cyprus struck a deal with European creditors and the IMF. The first accord, reached in the early hours of March 16, fell apart three days later when the Cypriot parliament rejected a tax on all bank accounts on the island.

Your money is not safe in a bank..If the bank is in trouble the government will take your money…Mattress will be a better place to keep your money

Cyprus: The Mouse that Roared

The banks would be instantly insolvent, since they could only muster 10 percent of the cash they owe their befuddled customers. Neither would the enormous tax increase needed to bail everyone out be at all palatable. No: the only thing the Fed could do — and this would be in their power — would be to print enough money to pay off all the bank depositors. Unfortunately, in the present state of the banking system, the result would be an immediate plunge into the horrors of hyperinflation.

Sunday, March 24, 2013

The Anatomy of the Cyprus’ Bubble Cycle

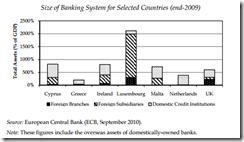

Before joining the euro, the Central Bank of Cyprus only allowed banks to use up to 30 percent of their foreign deposits to support local lending, a measure designed to prevent sizeable deposits from Greeks and Russians fuelling a bubble.

When Cyprus joined the single European currency, Greek and other euro area deposits were reclassified as domestic, leading to billions more local lending, Pambos Papageorgiou, a member of Cyprus's parliament and a former central bank board member said."In terms of regulation we were not prepared for such a credit bubble," he told Reuters.Banks' loan books expanded almost 32 percent in 2008 as its newly gained euro zone status made Cyprus a more attractive destination for banking and business generally, but Cypriot banks maintained the unusual position of funding almost all their lending from deposits.

"The banks were considered super conservative," said Alexander Apostolides an economic historian at Cyprus' European University, a private university on the outskirts of Nicosia.When Lehman Brothers collapsed in the summer of 2008, most of the world's banks suffered in the fallout, but not Cyprus's."Everyone here was sitting pretty," said Fiona Mullen, a Nicosia-based economist, reflecting on the fact Cypriot banks did not depend on capital markets for funding and did not invest in complex financial products that felled other institutions.

4. Overconfidence and Mania

Marios Mavrides, a finance lecturer and government politician, says his warnings about the detrimental impact on the economy of so much extra lending fell on deaf ears."I was talking about the (property) bubble but nobody wanted to listen, because everyone was making money," he said. (sounds strikingly familiar today—Prudent Investor)The fact that the main Cyprus property taxes are payable on sale made people hold onto property, further fuelling prices, Papageorgiou added…Michael Olympios, chairman of the Cyprus Investor Association that represents 27,000 individual stock market investors, said he too criticized the central bank for "lax" regulation that facilitated excessive risk taking.

A depositor would have earned 31,000 euros on a 100,000 euros deposit held for the last five year in Cyprus, compared to the 15,000 to 18,000 euros the same deposit would have made in Italy and Spain, and the 8,000 interest it would have earned in Germany, according to figures from UniCredit.Bulging deposit books not only fuelled lending expansion at home, it also drove Cypriot banks overseas. Greece, where many Cypriots claim heritage, was the destination of choice for the island's two biggest lenders, Cyprus Popular Bank -- formerly called Laiki -- and Bank of Cyprus.

The extent of this exposure was laid bare in the European Banking Authority's 2011 "stress tests", which were published that July, as the European Union and International Monetary Fund (IMF) were battling to come up with a fresh rescue deal to save Greece. (reveals how bank stress tests can’t be relied on—Prudent Investor)The EBA figures showed 30 percent (11 billion euros) of Bank of Cyprus' total loan book was wrapped up in Greece by December 2010, as was 43 percent (or 19 billion euros) of Laiki's, which was then known as Marfin Popular.More striking was the bank's exposure to Greek debt.At the time, Bank of Cyprus's 2.4 billion euros of Greek debt was enough to wipe out 75 percent of the bank's total capital, while Laiki's 3.4 billion euros exposure outstripped its 3.2 billion euros of total capital.The close ties between Greece and Cyprus meant the Cypriot banks did not listen to warnings about this exposure…

Whatever the motive, the Greek exposure defied country risk standards typically applied by central banks; a clause in Cyprus' EU/IMF December memorandum of understanding explicitly requires the banks to have more diversified portfolios of higher credit quality."That (the way the exposures were allowed to build) was a problem of supervision," said Papageorgiou, who was a member of the six-man board of directors of the central bank at the time.The board, which met less than once a month, never knew how much Greek debt the banks were holding, both Papageorgiou and another person with direct knowledge of the situation told Reuters.

Saturday, March 23, 2013

Cyprus President Warned Friends of Crisis

Cypriot president Nikos Anastasiades 'warned' close friends of the financial crisis about to engulf his country so they could move their money abroad, it was claimed on Friday.The respected Cypriot newspaper Filelftheros made the allegation which was picked up eagerly by German media.Germans are angry at the way their country has been linked to the Nazis and Hitler by Cypriots angry at the defunct rescue deal which called for a levy on all savings.The Cyprus newspaper did not say how much money was moved abroad but quoted sources saying the president 'knew about the possible closure of the banks' and tipped off close friends who were able to move vast sums abroad.Italian media said the 4.5 billion euros left the island in the week before the crisis.

As hundreds of demonstrators faced off with riot police outside parliament late into Friday night, lawmakers inside voted to nationalize pension funds, pool state assets for a bond issue and peel good assets from bad in stricken banks.

Friday, March 22, 2013

Cyprus: From Deposit Taxes to Capital Controls; Russian Intervention Next?

The European Union gave Cyprus till Monday to raise the billions of euros it needs to secure an international bailout or face a collapse of its financial system that could push it out of the euro currency zone.In a sign it was at least preparing for the worst, the Cypriot government sought powers on Thursday to impose capital controls to stem a flood of funds leaving the island if there is no deal before banks reopen following this week's shutdown.

As Europe wakes up to what could be a tumultuous day, Handelsblatt reports that the ECB has decided that, due to the "great danger" of a bank run once they reopen next week, it will enforce capital controls independently of Cypriot (elected) officials. With perhaps a nod towards negotiating some ELA funding for Cypriot banks next week (if the government accepts this ECB-enforced 'program'), the rather stunning restrictions on people's private property include:-Freezing Savings - no time-frame (it's not your money anymore)-Make bank transfers dependent on Central Bank approval (a money tzar?)-Lower ATM withdrawal limits (spend it how we say?)The capital controls will be designed "so that citizens have access to sufficient cash to go about their lives." So, there it is, a European Union imposed decision on just how much money each Cypriot can spend per day. Wasn't it just last week, we were told Europe is fixed?

One Russian bank, Alfa Bank, estimates that $70 billion of illegal capital flight from Russia in the past two decades may have found its way to Cyprus.Moody's rating agency said last week Russian banks had about $12 billion placed with Cypriot banks at the end of 2012 and has estimated that Russian corporate deposits at Cypriot banks could be around $19 billion."We think that the $19 billion exposure is mostly wholesale - ie corporate," Eugene Tarzimanov, Senior Credit Officer at Moody's in Russia, told Reuters.Some of Russia's largest banks have some credit exposure to Cyprus. VTB, Russia's second-largest bank by assets, had $13.8 billion in assets and $374 million through its Cypriot subsidiary, Russian Commercial Bank, at the end of 2011.

From latest reports, the Cypriot banks might open on March 26th at the earliest. That’s two weeks after being shut down. That’s two weeks of unmet financial obligations, ie government employee salaries, public works financing, unpaid pensions etc etc…Expect unrest on the streets of MoscowThe EU/Germany are certainly aware that 95% of all Russian money goes through the Cypriot banks. Certainly they were well aware of the consequences this would lead to. Is this the first salvo in the new world war??

Will Events in Cyprus Trigger a War?

But there’s much more to the Cyprus crisis than its dubious banks. Cyprus has bedeviled Europe and world diplomacy since 1974, then Greek Cypriot far rightists staged a coup and sought union – or "enosis" – with mainland Greece. Turkey promptly intervened with 30,000 troops to protect Turkish Cypriots in the north. Many Greeks fled or were expelled to the south.Europe and the UN have been trying to sort out the Cyprus mess ever since. After decades of mind-numbing negotiations, former UN chief Kofi Annan proposed a sensible deal in 2004 for a Greek-Turkish federation. Turks accepted, but Greek Cypriots blocked it. Britain, which has two important air bases in Cyprus, backed the status quo.In the same year, the EU committed the grave error of admitting Cyprus as a member without first insisting that Greek Cypriots agree to a peace deal and Greek-Turkish federation.Northern Cyprus was left in limbo while the south became part of the EU, assuring the island’s ugly dispute would be come part of the European Union. Cyprus should never have been admitted to the EU.Europeans who opposed Turkish membership in the EU used Cyprus as a pretext to delay admission, infuriating Turkey.After decades of patient work developing normal relations after centuries of conflict, Greece and Turkey are again up in arms again over Cyprus. Their dangerous problem of overlapping air and sea claims in the Aegean has revived - just when Greece must slash its bloated military budget.

Thursday, March 21, 2013

Bitcoins: Safehaven from Cyprus Debacle and Officially Recognized by the US Treasury

Since Sunday, a trio of Bitcoin apps have soared up Spain’s download charts, coinciding with news that cash-strapped Cyprus was planning to raid domestic savings accounts to pay off a $13 billion bailout tab. Fearing contagion on the other end of the Mediterranean, some Spaniards are apparently looking for cover in an experimental digital currency.“This is an entirely predictable and rational outcome for what’s happening in Cyprus,” says Nick Colas, chief market strategist at ConvergEx Group. “If you want to get a good sense of the stress European savers are feeling, just watch Bitcoin prices.”The value of the virtual currency has soared nearly 15 percent in the last two days, according to the most-recent pricing data. “One hundred percent of that is due to Cyprus,” says Colas. “It means the Europeans are getting involved.”

Financial Crimes Enforcement Network (FinCEN) is the bureau of Treasury that enforces the Bank Secrecy Act (which requires banks to spy on their customers for the government).FinCEN Issues Guidance on Virtual Currencies and Regulatory ResponsibilitiesTo provide clarity and regulatory certainty for businesses and individuals engaged in an expanding field of financial activity, the Financial Crimes Enforcement Network (FinCEN) today issued the following guidance: Application of FinCEN’s Regulations to Persons Administering, Exchanging, or Using Virtual Currencies. The guidance is in response to questions raised by financial institutions, law enforcement, and regulators concerning the regulatory treatment of persons who use convertible virtual currencies or make a business of exchanging, accepting, and transmitting them. Convertible virtual currencies either have an equivalent value in real currency or act as a substitute for real currency. The guidance considers the use of virtual currencies from the perspective of several categories within FinCEN's definition of MSBs.News Release: http://www.fincen.gov/news_room/nr/pdf/20130318.pdf

Bitcoin is the beginning of something great: a currency without a government, something necessary and imperative.

Monday, March 18, 2013

Video: Humor: Hitler on Cyprus Bailout

Sunday, March 17, 2013

War on Savers: Cyprus’ $13 Billion Bailout to be Funded by Taxing Depositors

Euro-area finance ministers agreed to an unprecedented tax on Cypriot bank deposits as officials unveiled a 10 billion-euro ($13 billion) rescue plan for the country, the fifth since Europe’s debt crisis broke out in 2009.Cyprus will impose a levy of 6.75 percent on deposits of less than 100,000 euros -- the ceiling for European Union account insurance -- and 9.9 percent above that. The measures will raise 5.8 billion euros, in addition to the emergency loans, Dutch Finance Minister Jeroen Dijsselbloem, who leads the group of euro-area ministers, told reporters early today after 10 hours of talks in Brussels. The International Monetary Fund may contribute to the package and junior bondholders may also be tapped in a so-called bail-in, the ministers' statement said.Officials have struggled to find an agreement that would rescue Cyprus, which accounts for just half of a percent of the euro region’s economy, without unsettling investors in larger countries and sparking a new round of market contagion. Finance Minister Michael Sarris said the plan was the “least onerous” of the options Cyprus faced to stay afloat.

The decision prompted a run on cashpoints, most of which were depleted by mid afternoon, and co-operative credit societies closed to prevent angry savers withdrawing deposits.Almost half Cyprus's bank depositors are believed to be non-resident Russians, but most queuing on Saturday at automatic teller machines appeared to be Cypriots.

Tuesday, June 26, 2012

EU Summit Faces Political Deadlock, Cyprus Seeks Bailout

Political impasse at the EU, amidst a global economic slowdown, continues to hound the markets…

From Bloomberg,

Chancellor Angela Merkel hardened her resistance to euro- area debt sharing, setting Germany on a collision course with its allies at a summit starting on June 28.

In signs the debt crisis is worsening, Cyprus said it will seek a financial lifeline from the euro area’s firewall funds, and Greek Prime Minister Antonis Samaras consented to the resignation of his finance minister, Vassilios Rapanos.

Moody’s Investors Service downgraded 28 Spanish banks, citing the country’s sovereign debt and rising losses on real- estate loans. The lenders’ long-term debt and deposit ratings were cut by one to four notches, Moody’s said yesterday in a statement. The New York-based rating company also downgraded 16 Spanish banks on May 17.

Italy and Spain will sell debt today amid concern Europe’s fiscal crisis is infecting bigger economies.

The EU crisis adds a new victim: Cyprus. This only translates to the worsening of the crisis in the face of internecine political squabbling.

Political stalemate has also been a scourge to China and the US.

I have been saying that political pledges will eventually yield to the law of diminishing returns and that financial markets will eventually DEMAND real action.

It appears that financial markets are beginning to see through the façade of political fables or seems to have initiated the discounting of these phony promises.

Be careful out there.