The financial markets and politicians backed by mainstream media apparently lives in two distinct worlds.

If one goes through the daily barrage of sensationalist headlines, one would have the impression that the Philippines must be in a state of panic. That’s because media has been projecting what seems as intensifying risk of a full blown shooting war over the contested islands, the Scarborough Shoal with China. And all these should have been sending investors scrambling for the exit doors, if not the hills.

But has such alarmism represented reality?

Of course by reality we rely on expressed and demonstrated preferences and not just sentiment. Over the marketplace, people voting with their money have fundamentally treated the recent geopolitical impasse as pragmatically nonevents.

The Phisix has been little change for the week but importantly trades at FRESH record high levels.

Meanwhile the local currency the Philippine Peso posted its SIXTH CONSECUTIVE weekly gains and has been approaching February’s high, whereas local bonds ADVANCED for the week, amidst the geopolitical bedlam[1]

Contrived Risks and Real Risks

There’s a world of difference between real risk and that of a pseudo, or may I suggest concocted, geopolitical risk.

Media has slyly been luring the gullible public into oversimplified “emotionally framed” explanations based on flimsy correlations which blatantly overlooks the behind-the-scenes causal factors[2]. Emotionalism thus opens the door for politicians to prey on the public by manipulating them through the foisting of repressive policies that benefits them at the expense of the taxpayers and importantly of our liberties. The recent call for nationalism via “unanimity” by a national political figure is just an example[3].

Politicians use fear or what the great libertarian H. L. Mencken calls as endless series of imaginary hobgoblins as standard instruments of social controls meant to advance their agenda or self-interests through the political machinery.

Aside from possible factors for the standoff, such as the smoke and mirrors tactic probably employed by China to divert the world from witnessing the brewing internal political schism[4] and or the promotion of sales for the benefit of the military industrial complex, it could also be that the call for “unanimity” may be associated with the domestic impeachment trial of a key figure of the judiciary where “rallying around the president” would extrapolate to the immediate closure of the case in the favor of the administration.

In doing so, the incumbent administration will be able control three branches of government and impose at will any measures that suits their political goals with hardly any opposition, all done under the sloganeering or propaganda of anti-corruption.

Yet the brinkmanship geopolitics in Asia, has not been limited to the controversial territorial claims in Scarborough and Spratlys, as well as Japan claimed Senkaku Islands[5]. Recent events includes the recent widely condemned missile test by North Korea, as well as, missile tests of former archrivals India and Pakistan[6]

Yet market’s responses to these events have disparate.

Pakistan’s Karachi index (KSE:100 orange) trades at the highest levels since 2009 and seems on the way to knock on the doors of the 2007 highs, whereas India’s BSE (SENSEX green) has struggled since peaking late February.

Pakistan’s Karachi index (KSE:100 orange) trades at the highest levels since 2009 and seems on the way to knock on the doors of the 2007 highs, whereas India’s BSE (SENSEX green) has struggled since peaking late February.

In short, the recent missile tests by both countries hardly influenced financial markets for the two South Asian giants.

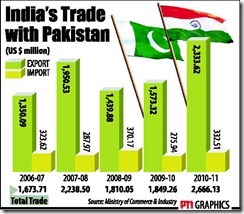

The reason for this has been due to substantially improving trade relations[7] that has dramatically eased political tensions between them.

This validates the great free trader Claude Frédéric Bastiat[8] prediction centuries ago.

if goods don t cross borders, armies will

North Korea as the Real Geopolitical Risk

The North Korea-South Korea tiff cannot be seen in the same light.

Since the North Korea’s announcement of a missile test last March 16th, South Korea’s KOSPI has been struggling. (chart from stockcharts.com)

The South Korean currency, the won, has also wobbled in the face of Nokor’s actions. (chart from yahoo.com)

Nokor’s largely embarrassing failed missile launch[9] last April 13th has not deterred the new regime under Kim Jong Un from threatening to do another nuclear blasting test[10]

The fundamental difference from the abovementioned instances, including the unfortunate Scarborough-Spratlys affair, has been the near absence or the lack of trade linkages of Nokor which has not fostered social cooperation or goodwill with other nations.

Instead, Nokor’s despotic communist government’s survival has long been dependent on the ‘blackmail diplomacy’ in securing foreign aid. Yet uncertainty shrouds on the direction of Nokor’s foreign policy under the new leadership which appears as being manifested on the markets.

The good news is that so far there has been no sign of panic. This means South Korea’s consolidating markets could be digesting or has been in the process of assessing the political and security risks from Nokor’s new regime.

Otherwise if the worst option does occur, where posturing turns into armed confrontation the ensuing violence will spillover the world markets. But again Nokor has been more of a paper tiger than a real military power considering their dire economic status. A war is likely to cause the Kim regime to disintegrate under its own weight as famished and ill equipped soldiers are likely to defect to the South or a coup will force down the leadership.

The Free Trade Factor and Geopolitical Linkages

The same premise tells us why domestic politicians and media live in a different world from the citizenry. And this is why I hardly touch on mainstream news, except when scouring for the facts. I avoid from reading “opinions”, especially from so-called experts. That’s because mainstream’s opinions blindly represents the interests of the establishment[11].

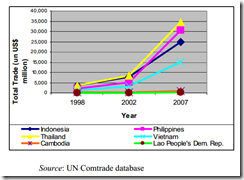

China ballooning trade with ASEAN, which includes the Philippines[12], represents a very important deterrent from aggression.

As the great Professor Ludwig von Mises wrote in his magnum opus[13],

Man curbs his innate instinct of aggression in order to cooperate with other human beings. The more he wants to improve his material well-being, the more he must expand the system of the division of labor. Concomitantly he must more and more restrict the sphere in which he resorts to military action. The emergence of the international division of labor requires the total abolition of war.

So aside from her thrust to use the yuan as region’s foreign currency reserve as evidenced by the push for wider Free trade zone (including the ASEAN China Free Trade Agreement which began operations in 2010[14]) hardly squares with the bellicosity that has been publicly portrayed.

Free Trade agreements in Asia has exploded since China’s Deng Xiaoping opened China to the world bannered by the famous catchphrase “To get rich is glorious” (which according to some has been misattributed to him)[15]

Claude Barfield of the American Enterprise Institute points out that[16]

In 1975 there was one free trade agreement in the region but in 2011, there are now currently 245 free trade agreements that have been proposed, under negotiation or concluded.

Besides it is naïve to see events in the lens of a single prism.

An outbreak of military conflagration will likely draw in various major players that could lead to a world war, an event which hardly any party would like to indulge in (despite the politicians arrogant rhetoric), considering the today’s age of NUCLEAR and DRONE warfare, standing armies have been rendered obsolete, and mutually assured destruction[17] will likely be the outcome.

So aside from some missile tests by Asian countries, recently Vietnam hosted a joint naval exercise with US[18] while on the other hand China and Russia also recently completed naval war games[19]. While these may look like a show of force for both parties, they could also just be pantomimes.

Yet for me all these seem like watching a movie that gives you the vicarious effect, especially from the 3D vantage point. However when the closing or end credit appears or when the curtains fall, we come to realize that this has been just a movie.

So far the financial markets seem to be exposing on the exaggerations of the so called gunboat diplomacy, or perhaps too much of yield chasing activities may have clouded people’s incentives that has led them to underestimate such a risk.

While I believe the yield chasing factor has functioned as a substantial contributor to the current state of markets domestically and internationally, I also think that the local market has rightly been discounting the territorial claims issue for reasons cited above.

So unless politicians here or abroad totally losses their sanity, the issue over territorial claims will eventually fade from the limelight.

So be leery of politicians calling for patriotism or nationalism, that’s because as English author Samuel Johnson famously warned on the evening of April 7, 1775[20]

Patriotism is the last refuge of a scoundrel.

[1] Bloomberg.com Philippine Peso Completes Sixth Weekly Gain on Growth Outlook, April 27, 2012

[2] See The Scarborough Shoal Standoff Has Not Been About Oil April 16, 2012

[3] See Scarborough Shoal Dispute: The Politics of Nationalism April 28, 2012

[4] See China’s Political System Reeks of Legal Plunder, April 20 2012

[5] See From Scarborough Shoal to Senkaku Islands April 19, 2012

[6] Globalspin.blogs.time.com Will Pakistan and India’s Back-to-Back Missile Tests Spoil the Mood?, April 25, 2012

[7] Thehindubusinessline.com Pak may be allowed to invest in India February 16, 2012

[8] The Freeman.org Claude Frédéric Bastiat

[9] See See North Korea’s Failed Missile Launch Reflects on Dire Economic Status, April 14, 2012

[10] Bloomberg.com North Korea Poised to Rattle Region With Nuclear Blast April 27, 2012

[11] See The Toxicity of Mainstream News March 13, 2012

[12] networkideas.org China, India and Asia: The Anatomy of an Economic Relationship (Draft Copy) 2009

[13] von Mises Ludwig 4. The Futility of War XXXIV. THE ECONOMICS OF WAR Human Action

[14] Wikipedia.org ASEAN–China Free Trade Area

[15] Wikipedia.org Deng Xiaoping

[16] Barfield Claude TAIWAN AND EAST ASIAN REGIONALISM American Enterprise Institute, November 10, 2011

[17] Wikipedia.org Mutual assured destruction

[18] Telegraph.co.uk Vietnam begins naval exercises with the US, April 23, 2012

[19] Abs-cbennews.com China, Russia end naval exercises, April 27, 2012

[20] Wikipedia.org The Patriot Samuel Johnson's political views