India's neighbour Pakistan has decided to temporarily ban the import of gold for one month, to save its foreign currency reserves and to curtail the rampant smuggling going on in the nation.On Wednesday, July 31, Pakistan imposed a temporary ban on the import of gold.Following the Indian government’s decision to discourage gold import by imposing 8% duties, buyers have reportedly shifted to Pakistan where the precious metal is allowed to be imported duty free since 2001.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, August 03, 2013

War on Gold: Pakistan Temporarily Bans Gold Imports

Saturday, January 12, 2013

Why Kashmir is Tinderbox for a Nuclear War

India and Pakistan have fought three wars and some very large battles over Kashmir. Both claim the entire mountain state. Pakistan’s intelligence service, ISI, has waged a long covert campaign to insert guerillas into Indian Kashmir to aid a series of spontaneous rebellions against Indian rule by the state’s Muslim majority…Muslim Kashmiris have been in almost constant revolt against Indian rule since 1947 when the British divided India. Today, 500,000 Indian troops and paramilitary police garrison rebellious Kashmir. Some 40,000-50,000 Kashmiris are believed to have died over the past decade in uprising.India blames the violence in Kashmir on "cross-border terrorism" engineered by Pakistani intelligence. Human rights groups accuse Indian forces of executions, torture, and reprisals against civilians. Large numbers of Hindus and Sikhs have fled strife-torn Kashmir after attacks by Muslim Kashmiri guerillas. It’s a very bloody, dirty war.The Kashmir conflict poses multiple dangers. First is the very likely chance that local skirmishing can quickly surge into major fighting involving air power and heavy artillery. In 1999, a surprise attack by Pakistani commandos into the Indian-ruled Kargil region provoked heavy fighting. The two nations, with more than one million troops facing one another, came very close to an all-out war. I have on good authority that both sides put their tactical nuclear weapons on red alert. Angry Indian generals called on Delhi to use its powerful armored corps to cut Pakistan in half. India’s cautious civilian leadership said no.Second, the Kashmir conflict also involves India’s strategic rival, China. Beijing claims the entire eastern end of the Himalayan border separating India and China, which Chinese troops occupied in a brief 1963 war. China also occupied, with Pakistan’s help, a high strategic plateau on the western end of the Himalayas known as Aksai Chin that was part of historic Tibet.China is Pakistan’s closest political and military ally. Any major Indian attack on Pakistan would risk intervention by Chinese air, ground and missiles forces in neighboring Tibet.Third, in the midst of all these serious tensions, India and Pakistan’s nuclear weapons – delivered by air and missile – are on hair-trigger alert. This means that during a severe crisis, both sides are faced with "use it, or lose" decision in minutes to use their nuclear arsenals.The strategic command and control systems of India and Pakistan are said to be riddled with problems and often unreliable, though much improvement has been made in recent years.A false report, a flight of birds, and off-course aircraft could provoke a nuclear exchange. By the time Islamabad could call Delhi, war might be on. A US Rand Corp study estimated an Indo-Pakistani nuclear exchange would kill two million immediately, injure or kill 100 million later, pollute the Indus River and send clouds of radioactive dust around the globe.

Tuesday, October 23, 2012

China and Pakistan Concludes Bond, Currency Swap Deals

Pakistan will join a growing list of central banks that will invest in China's interbank market as the world's second-largest economy opens its capital markets.The People's Bank of China announced on Monday that it had signed an agreement with the State Bank of Pakistan to help Pakistan invest in its local debt market, without providing details about the size of the investment programme.China has allowed foreign central banks to invest in its domestic interbank bond market since 2010 as part of efforts to widen investment avenues for foreign yuan asset holders and promote the international use of the Chinese currency.China and Pakistan signed a three-year currency swap deal worth 10 billion yuan ($1.60 billion) in December 2011 and companies in the two countries are encouraged to accept export and import bills in Chinese yuan.The central banks of Japan, South Korea, Singapore, Thailand, Hong Kong and Indonesia are among those who invest in China's bonds onshore.

Monday, April 30, 2012

The Philippine Financial Markets Shrugs off the Scarborough Shoal Standoff

The financial markets and politicians backed by mainstream media apparently lives in two distinct worlds.

If one goes through the daily barrage of sensationalist headlines, one would have the impression that the Philippines must be in a state of panic. That’s because media has been projecting what seems as intensifying risk of a full blown shooting war over the contested islands, the Scarborough Shoal with China. And all these should have been sending investors scrambling for the exit doors, if not the hills.

But has such alarmism represented reality?

Of course by reality we rely on expressed and demonstrated preferences and not just sentiment. Over the marketplace, people voting with their money have fundamentally treated the recent geopolitical impasse as pragmatically nonevents.

The Phisix has been little change for the week but importantly trades at FRESH record high levels.

Meanwhile the local currency the Philippine Peso posted its SIXTH CONSECUTIVE weekly gains and has been approaching February’s high, whereas local bonds ADVANCED for the week, amidst the geopolitical bedlam[1]

Contrived Risks and Real Risks

There’s a world of difference between real risk and that of a pseudo, or may I suggest concocted, geopolitical risk.

Media has slyly been luring the gullible public into oversimplified “emotionally framed” explanations based on flimsy correlations which blatantly overlooks the behind-the-scenes causal factors[2]. Emotionalism thus opens the door for politicians to prey on the public by manipulating them through the foisting of repressive policies that benefits them at the expense of the taxpayers and importantly of our liberties. The recent call for nationalism via “unanimity” by a national political figure is just an example[3].

Politicians use fear or what the great libertarian H. L. Mencken calls as endless series of imaginary hobgoblins as standard instruments of social controls meant to advance their agenda or self-interests through the political machinery.

Aside from possible factors for the standoff, such as the smoke and mirrors tactic probably employed by China to divert the world from witnessing the brewing internal political schism[4] and or the promotion of sales for the benefit of the military industrial complex, it could also be that the call for “unanimity” may be associated with the domestic impeachment trial of a key figure of the judiciary where “rallying around the president” would extrapolate to the immediate closure of the case in the favor of the administration.

In doing so, the incumbent administration will be able control three branches of government and impose at will any measures that suits their political goals with hardly any opposition, all done under the sloganeering or propaganda of anti-corruption.

Yet the brinkmanship geopolitics in Asia, has not been limited to the controversial territorial claims in Scarborough and Spratlys, as well as Japan claimed Senkaku Islands[5]. Recent events includes the recent widely condemned missile test by North Korea, as well as, missile tests of former archrivals India and Pakistan[6]

Yet market’s responses to these events have disparate.

In short, the recent missile tests by both countries hardly influenced financial markets for the two South Asian giants.

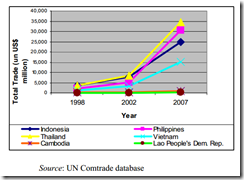

The reason for this has been due to substantially improving trade relations[7] that has dramatically eased political tensions between them.

This validates the great free trader Claude Frédéric Bastiat[8] prediction centuries ago.

if goods don t cross borders, armies will

North Korea as the Real Geopolitical Risk

The North Korea-South Korea tiff cannot be seen in the same light.

Since the North Korea’s announcement of a missile test last March 16th, South Korea’s KOSPI has been struggling. (chart from stockcharts.com)

The South Korean currency, the won, has also wobbled in the face of Nokor’s actions. (chart from yahoo.com)

Nokor’s largely embarrassing failed missile launch[9] last April 13th has not deterred the new regime under Kim Jong Un from threatening to do another nuclear blasting test[10]

The fundamental difference from the abovementioned instances, including the unfortunate Scarborough-Spratlys affair, has been the near absence or the lack of trade linkages of Nokor which has not fostered social cooperation or goodwill with other nations.

Instead, Nokor’s despotic communist government’s survival has long been dependent on the ‘blackmail diplomacy’ in securing foreign aid. Yet uncertainty shrouds on the direction of Nokor’s foreign policy under the new leadership which appears as being manifested on the markets.

The good news is that so far there has been no sign of panic. This means South Korea’s consolidating markets could be digesting or has been in the process of assessing the political and security risks from Nokor’s new regime.

Otherwise if the worst option does occur, where posturing turns into armed confrontation the ensuing violence will spillover the world markets. But again Nokor has been more of a paper tiger than a real military power considering their dire economic status. A war is likely to cause the Kim regime to disintegrate under its own weight as famished and ill equipped soldiers are likely to defect to the South or a coup will force down the leadership.

The Free Trade Factor and Geopolitical Linkages

The same premise tells us why domestic politicians and media live in a different world from the citizenry. And this is why I hardly touch on mainstream news, except when scouring for the facts. I avoid from reading “opinions”, especially from so-called experts. That’s because mainstream’s opinions blindly represents the interests of the establishment[11].

China ballooning trade with ASEAN, which includes the Philippines[12], represents a very important deterrent from aggression.

As the great Professor Ludwig von Mises wrote in his magnum opus[13],

Man curbs his innate instinct of aggression in order to cooperate with other human beings. The more he wants to improve his material well-being, the more he must expand the system of the division of labor. Concomitantly he must more and more restrict the sphere in which he resorts to military action. The emergence of the international division of labor requires the total abolition of war.

So aside from her thrust to use the yuan as region’s foreign currency reserve as evidenced by the push for wider Free trade zone (including the ASEAN China Free Trade Agreement which began operations in 2010[14]) hardly squares with the bellicosity that has been publicly portrayed.

Free Trade agreements in Asia has exploded since China’s Deng Xiaoping opened China to the world bannered by the famous catchphrase “To get rich is glorious” (which according to some has been misattributed to him)[15]

Claude Barfield of the American Enterprise Institute points out that[16]

In 1975 there was one free trade agreement in the region but in 2011, there are now currently 245 free trade agreements that have been proposed, under negotiation or concluded.

Besides it is naïve to see events in the lens of a single prism.

An outbreak of military conflagration will likely draw in various major players that could lead to a world war, an event which hardly any party would like to indulge in (despite the politicians arrogant rhetoric), considering the today’s age of NUCLEAR and DRONE warfare, standing armies have been rendered obsolete, and mutually assured destruction[17] will likely be the outcome.

So aside from some missile tests by Asian countries, recently Vietnam hosted a joint naval exercise with US[18] while on the other hand China and Russia also recently completed naval war games[19]. While these may look like a show of force for both parties, they could also just be pantomimes.

Yet for me all these seem like watching a movie that gives you the vicarious effect, especially from the 3D vantage point. However when the closing or end credit appears or when the curtains fall, we come to realize that this has been just a movie.

So far the financial markets seem to be exposing on the exaggerations of the so called gunboat diplomacy, or perhaps too much of yield chasing activities may have clouded people’s incentives that has led them to underestimate such a risk.

While I believe the yield chasing factor has functioned as a substantial contributor to the current state of markets domestically and internationally, I also think that the local market has rightly been discounting the territorial claims issue for reasons cited above.

So unless politicians here or abroad totally losses their sanity, the issue over territorial claims will eventually fade from the limelight.

So be leery of politicians calling for patriotism or nationalism, that’s because as English author Samuel Johnson famously warned on the evening of April 7, 1775[20]

Patriotism is the last refuge of a scoundrel.

[1] Bloomberg.com Philippine Peso Completes Sixth Weekly Gain on Growth Outlook, April 27, 2012

[2] See The Scarborough Shoal Standoff Has Not Been About Oil April 16, 2012

[3] See Scarborough Shoal Dispute: The Politics of Nationalism April 28, 2012

[4] See China’s Political System Reeks of Legal Plunder, April 20 2012

[5] See From Scarborough Shoal to Senkaku Islands April 19, 2012

[6] Globalspin.blogs.time.com Will Pakistan and India’s Back-to-Back Missile Tests Spoil the Mood?, April 25, 2012

[7] Thehindubusinessline.com Pak may be allowed to invest in India February 16, 2012

[8] The Freeman.org Claude Frédéric Bastiat

[9] See See North Korea’s Failed Missile Launch Reflects on Dire Economic Status, April 14, 2012

[10] Bloomberg.com North Korea Poised to Rattle Region With Nuclear Blast April 27, 2012

[11] See The Toxicity of Mainstream News March 13, 2012

[12] networkideas.org China, India and Asia: The Anatomy of an Economic Relationship (Draft Copy) 2009

[13] von Mises Ludwig 4. The Futility of War XXXIV. THE ECONOMICS OF WAR Human Action

[14] Wikipedia.org ASEAN–China Free Trade Area

[15] Wikipedia.org Deng Xiaoping

[16] Barfield Claude TAIWAN AND EAST ASIAN REGIONALISM American Enterprise Institute, November 10, 2011

[17] Wikipedia.org Mutual assured destruction

[18] Telegraph.co.uk Vietnam begins naval exercises with the US, April 23, 2012

[19] Abs-cbennews.com China, Russia end naval exercises, April 27, 2012

[20] Wikipedia.org The Patriot Samuel Johnson's political views