Thai’s former prime minister adores Abenomics. He claims that a rising currency the Thai baht may spark a crisis.

Former prime minister Thaksin Shinawatra warned yesterday that a lack of cooperation between the central bank and the Finance Ministry in reining in the strengthening baht could lead to a new financial crisis for Thailand.

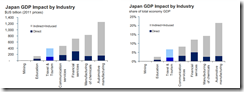

Thaksin said the current economic indexes were worrying. "I like looking at different indexes and often get alarmed," he said."During the crisis, only the paranoid survived," he added, quoting Andrew Grove, former chief executive of computer-chip maker Intel.The latest message on his Facebook account (www.facebook.com/thaksinofficial) posted yesterday afternoon said that Japan was able to achieve a GDP growth of 3.5 per cent in the first quarter because the Bank of Japan works directly with the Japanese government. He said Thailand's problem was that the Bank of Thailand was independent, and he accused the central bank of refusing to listen to the government."They [the Japanese] have a holistic approach to dealing with their economic problems. Their monetary policy and their fiscal policy are united," Thaksin said.

I have previously pointed out that Thailand has been nursing and blowing a bubble. Here is an update

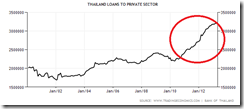

Thailand’s loans to the private sector has spiked by nearly 40% since 2010 chart from tradingeconomics.com. That’s about 17%+ annual growth in the last 2 years + in a economy that has recently grown by an annual rate of 5.3%

Thailand’s debt to gdp in 2011 was at 132%. Current the explosive growth of loans imply that Thailand’s debt to gdp ratio nears or is at the 1997 highs of 166%.

And since banks has accounted for the gist of lending, domestic credit sourced from the banking sector in 2011 was at 150.78. This should be much larger today, perhaps near or at the 1997 levels of 177%

The credit boom in Thailand has led to swelling trade deficits. This implies that the Thais have been spending more than they have been producing, such that the consumption boom has been financed through credit expansion. This also implies reduced productivity as resources are being squandered on yield chasing and rampant speculative activities.

The former Thai PM sees the Japan’s model as a worthy paradigm to emulate. But the Thai government has already been doing an Abenomics but at a modest rate.

The Thai’s government budget has swung from surpluses to deficits over the last few years, which means government spending has increasingly been outpacing revenues.

And given the rate of increase in spending, the Thai government-debt to gdp has marginally risen the recent years. The subdued effect from rising government expenditures has been due to the bloated denominator from credit driven boom

And where does the Thai government get its funding to finance government’s accelerated spending? Well like the private sector, through debt expansion.

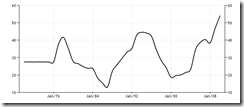

The following chart hasn’t been updated. But it shows that the short term debt segment of the external debt, in 2010 constituted 54% share, which may be higher today.

This ratio has already topped the 1997 levels. And this also means Thailand’s debt profile makes it highly vulnerable to short term interest spikes.

Slower statistical economic growth have already been whetting the steroid addicted financial markets of another rate cute. This should further aggravate the ongoing credit bubble seen in Thai’s private sector and government.

Like Philippines, policy induced bubbles have led Thailand's stock markets to boom. The SET now fast approaches the 1997 highs.

Bottom line: Former PM Shinawatra has his reasoning backward. The rising baht has not been the disease. Rather the rising baht, like the strong Philippine peso accounts for as symptoms. The disease is that of the manipulated boom financed by a credit bubble, fired up by zero bound rates (as shown by explosive growth in private sector loans) and of the intensifying government outlays (which is being funded by ballooning) external debt.

So if Thailand’s government does an Abenomics, a surge in short term interest rates could trigger a debt crisis

Thailand’s credit bubble seems as in a very much advanced state than the Philippines. And this could become the catalyst for a regional contagion.

Déjà vu 1997?