Overconfidence is a dangerous card to play. And arrogance is as close as one can come to playing a fatal card. It’s a good idea to operate your life on the assumption that unforeseen obstacles are lurking in the shadows, just around the next bend. No matter how well things are going for you, always keep in mind that that fickle trickster known as Fortune refuses to carry anyone on her shoulders indefinitely. –Robert Ringer, self-development author

In this issue

Phisix: Watch Out, Money Supply Growth Will Fall Sharply by July!

-Has Rule Breaking Been the Essence of “Good Governance”?

-BSP’s Statistical Numbers on Property Banking Cap Exposure Does NOT Square

-BSP’s Communication Strategy: Another Bait and Switch?

-“Good Governance” Boom Means Invisible Transfers or Greater Inequality

-TWO “Marking the Close” Sessions at the Philippine Stock Exchange This Week!

-Watch Out, Money Supply Growth Will Likely Plummet in the Second Half!

-Peak Complacency: Ignoring Risks from Thailand Economic and Political Mess

Phisix: Watch Out, Money Supply Growth Will Fall Sharply by July!

Two weeks back I wrote[1]:

The real reason why the BSP refrains from either enforcing her own self-imposed rule of banking cap on real estate loans and or raising rates, is that financial repression conducted mainly through bubble blowing paradigm—that supports the government’s lifeblood through inflated taxes and repressed debt servicing rates that has been subsidized by peso holders—will be jeopardized by a bubble bust.

Has Rule Breaking Been the Essence of “Good Governance”?

In 2013, the Philippine central bank, Bangko Sentral ng Pilipinas’ 20% threshold for banking loans to the real estate sector had been effectively breached.

Let us read it from the BSP[2]: (bold mine)

The real estate exposure (REE) of universal, commercial (U/KBs) and thrift banks (TBs) stood at Php 1.006 trillion at end-2013, 7.1 percent higher than the Php 939.8 billion posted at the end of third quarter last year.

The rise in REE was mainly driven by real estate loans (RELs) which grew by 7.0 percent to Php 843 billion at end-2013 from Php 788 billion a quarter earlier. RELs accounted for 83.8 percent of the banks’ REE in December last year.

Sixty percent of the RELs was granted to commercial entities such as land developers and construction companies while the rest of the RELs was extended to borrowers acquiring residential properties.

On the other hand, investments in real estate securities grew by 7.8 percent to Php 163.6 billion at end-2013 from Php 151.8 billion during the third quarter last year. Investments in RE securities comprised the remaining 16.2 percent of the REE.

The end-2013 REE represented 21.8 percent of the banks’ total loan portfolio.

Curiously the 21.8% banking sector’s real estate portfolio exposure in 2013 represents only a paltry 4.5% in increase from the 20.86% exposure in 2012[3].

But first let us go back to the core of BSP’s self-imposed restriction on real estate exposure—the covering regulation: Circular 600 dated February 2008[4] (bold mine)

Section 1. Section 1397 on Limits on Real Estate Loans of Universal Banks/Commercial Banks is hereby amended to read, as follows: “Total real estate loans of UBs/KBs, excluding: a) Loans extended to individual households for purposes of financing the acquisition, construction, and/or improvement of housing units and acquisition of any associated land that is or will be occupied by the borrower, regardless of amount; b) Loans extended to land developers/construction companies for the purpose of development and/or construction of socialized and low-cost residential properties as defined under existing guidelines of the Housing and Urban Development Coordinating Council (HUDCC) for the implementation of government housing programs, which are intended for sale to individual households; c) Loans to the extent guaranteed by the Home Guaranty Corporation (HGC); and d) Loans to the extent collateralized by non-risk assets under existing regulations…shall not exceed twenty percent (20%) of the total loan portfolio, net of interbank loans.

These are very disturbing signs.

At the World Economic Forum, Philippine president Benigno Aquino recently crowed about a “new paradigm” in the Philippine economy stating that[5] “The transformation of the Philippines is a collective achievement, built on the shoulders of a people prepared to undertake the difficult task of reform together”

All the visible sprawling construction activities, the statistical numbers, and the massive publicity campaign employed by the establishment has obviously been the basis for this claim which the he public has been mesmerized with.

As Northern Trust chief economist Carl Tannenbaum rightly observed[6] “Policy-makers love housing. Construction is a very tangible sign of economic activity”

This is what politics is made of: symbolism

But quantity isn’t the same as quality. In the context of ethics, this means the public has been remiss to see and discern of the process and the manner by which the course of policy actions has been implemented.

The BSP’s approach in policymaking and its enforcement represents arbitrary rather than rule-based actions. Yet such activities further reflect on governance by convenience and by the whim of the authorities. It’s simply a case of the rulemakers believing that they are above the rule which they create. This essentially is a symptom of what the great Austrian economist F.A. Hayek called as the “Fatal Conceit”[7], (bold and italics mine)

The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design. To the naive mind that can conceive of order only as the product of guidance of production from the hands of a few individuals who, whatever they may pretend, have limited knowledge, to a process, the, extended order, that makes maximum use of the knowledge of all, thereby benefiting those who do not own property nearly as much as those who do.

Should systematic violation of rules be dignified as a key virtue to the current “transformation” paradigm? Or differently put, has this been representative of the actions governing domestic political institutions? Or in short, is rule breaking the essence of “good governance”?

If the negligence of applying rules has been today’s political paradigm, then why shouldn’t the average citizen do the same? After all, in the political process called democracy, hasn’t the power vested on those at the helm spring from the consent of the governed?

A consequentialist may object, “This has been working, so their actions are justified” But what happens when boom turns into bust. Will the commissars of the monetary politburo be held accountable for the ramifications of their actions once we segue into a post-boom depression? Or will they just retreat from the limelight and slink into the private sector and be paid princely sums for speeches and write books—all directed at pinning the blame at everyone else except on their actions?

English writer Aldous Huxley wrote “That men do not learn very much from the lessons of history is the most important of all the lessons that history has to teach.” The forgotten lesson is that debt based boom which signifies as a gigantic misallocation of resources, is unsustainable. Therefore, through history, all artificial booms eventually evolve into busts. And panics, crashes and crises are the simply derivatives of the boom-bust cycle.

BSP’s Statistical Numbers on Property Banking Cap Exposure Does NOT Square

A second even very troubling sign is that the BSP may have been massaging the numbers backing the banking sector’s real estate exposure.

Going back to the BSP’s disclosure, based on quarter (3rd) to quarter (4th) changes, real estate exposure (REE) was “7.1 percent higher”, “real estate loans (RELs) which grew by 7.0 percent” and real estate securities grew by 7.8 percent. Again the 7% represents ONLY changes covering ONE quarter.

But notice that the BSP declared that real estate exposure by the banking system is at 21.8% in 2013 from 20.86% in 2012—for a niggardly 4.5% increase for the ENTIRE year.

We can assume two factors here: lending to the real estate sector fell or at least grew at a substantially smaller rate in the other quarters or loans to the banking industry have vastly underperformed growth in loans to the other sectors in the other quarters thus a loss in share—to derive at the 4.5% figure.

Well, the BSP claims and the BSP’s other numbers simply don’t square.

The BSP notes that the supply side, specifically land developers and construction companies, comprises 60% of total real estate loans. Seen in the prism of share of loans to the overall banking industry loans (left pane) the real estate sector grew from 18.82% in 2012 to 20.43% in 2013. As of March this has risen to 20.48% share. So in 2013, REL loans have GAINED in the share of the overall banking loan pie.

While year on year growth rates of REL have significantly been scaling down (right window) to presently 19-21%, from about the high of 28% in early 2013, growth rates in 2013 averaged 23.64%! Let me repeat TWENTY THREE percent.

As you can see, the growth in rate of 4.5% for 2013 for REE as a share of banks’ total loan portfolio at 21.8% severely undershoots the BSP’s figures.

Given the benefit of the doubt that some of these loans may have been excluded from the eligibility of the property banking cap rule, the point is that we still see a huge jump in the rate of loan growth. 4.5% against 20% are an ocean apart.

And here’s more, the BSP notes that 40% of real estate loans come from the demand side, particularly “borrowers acquiring residential properties”.

Yet the consumer real estate sector loans ballooned by a whopping 21.34% in 2013!! Let me repeat TWENTY ONE percent.

For 2013 Supply Side growth (y-o-y) averaged at TWENTY THREE percent. ADD to this the Demand Side growth rate at TWENTY ONE percent. How the heck did the BSP arrive with a FOUR and a HALF percent growth for the banking sector’s real estate exposure???? From the mathematical perspective, all the above doesn’t add up. Something fishy is going on.

And the buck doesn’t stop here.

For the self-imposed property banking cap rule, the BSP excludes some sectors as noted above. Such includes owner occupied properties, socialized and low-cost residential properties and even loans to infrastructure. From the BSP’s circular 600: “It shall not include loans for construction of highways, streets, bridges, tunnels, railways, and other infrastructure for public use.”

Developers with exposure on both high end and socialized housing will have the incentive to use socialized housing as loophole to obtain loans that won’t be included in the BSP watch list. The same applies with companies that have exposures on both infrastructure and conventional properties. Small developers may claim that their projects are owner occupied too.

How many firms have gained access to credit via such loopholes, does the BSP know? Yet just because they are outside the radar screen of the BSP, does this imply that these sectors have little influence on “financial stability”?

In China, regulatory arbitrage or the use of legal loopholes to acquire debt has spawned a debt Godzilla presently known as the “Shadow Banking Industry” which has now been estimated at 80% of the GDP or US $5.9 trillion according to the Forbes[8]. The Philippines has been no stranger to this. I previously cited World Bank estimates that shadow banking here accounts for “more than one-third of total financial system assets”[9] These are not threats to financial stability?

As one would note, statistics will not accurately represent the underlying risks that has been repackaged as the new paradigm vernacular or sloganeering of “transformation”.

The point is that the BSP’s numbers severely understates the risks from the current banking exposure. And a further point is that by keeping an eye closed, the BSP has been willing to absorb more risks.

BSP’s Communication Strategy: Another Bait and Switch?

So what has been the BSP’s response to the recent infringement of the banking loan cap?

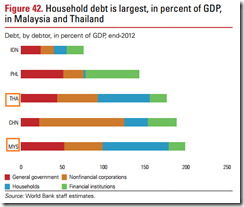

To reassure the public of the relatively low debt conditions the BSP writes, “Moreover, the banks’ consumer credit exposure of 15.8 percent remained low compared to their ASEAN 5 peers. At end-2013, the CL exposure in Malaysia was at 60.9 percent followed by Indonesia, 28.8 percent; Thailand, 27 percent; and Singapore, 26 percent. The Bangko Sentral ng Pilipinas (BSP) monitors consumer and other types of bank lending to ensure the banks’ adherence to high credit standards. This is essential to the BSP’s key objective of fostering financial stability”

The BSP fails to be forthright with the flawed statistical reference which attempts to portray national debt levels as a one size fits all dynamic.

They should reveal the other data which says that only 22 households have exposure on the formal banking industry: “Eight in ten households are unbanked…In terms of financial assets, survey results showed that only 21.5 percent of households have deposit”[10].

And this lack of financial depth by residents has been the main reason why consumer loans have been low in contrast to relatively higher penetration levels to the banking system by our neighbors.

Funny but these are all BSP’s data. The difference is that the BSP has selectively used them to project on their interests rather than lay out the reality.

So essentially the framing of statistics has been used as a magic spell or as talisman by the BSP to ward off the evil spirits called “risks”. Shout statistics, expect the public to believe and risks goes away. Duh.

The BSP seems to employ communications sophistry to camouflage the public from real conditions.

I pointed out last week that the BSP has already declared “well capitalized against risk” citing vastly inflated Tier 1 capital. This means bank stress tests which the central bank claims “part of the central bank's larger goal of keeping asset prices in check to prevent the build-up of inflationary pressures[11]” will just be a formality aimed at publicity effects. And bank stress test will be based on math models that will not capture reality.

For all the sideshows being drummed up to distract the public, the BSP staunchly refuses to address the growing risks in the system.

Yet here is another proof validating my assertion that the BSP’s reserve requirement tool has been nothing more than a travesty or the “BSP seems to have pulled one heck of bluff via the reserve requirement policy tool.[12]”

From the Bank of England[13] (bold mine)

In reality, neither are reserves a binding constraint on lending, nor does the central bank fix the amount of reserves that are available. As with the relationship between deposits and loans, the relationship between reserves and loans typically operates in the reverse way to that described in some economics textbooks. Banks first decide how much to lend depending on the profitable lending opportunities available to them — which will, crucially, depend on the interest rate set by the Bank of England. It is these lending decisions that determine how many bank deposits are created by the banking system. The amount of bank deposits in turn influences how much central bank money banks want to hold in reserve (to meet withdrawals by the public, make payments to other banks, or meet regulatory liquidity requirements), which is then, in normal times, supplied on demand by the Bank of England.

Read my lips, under today’s modern central banking system, reserve requirements will not inhibit demand for loans because they are supplied by the central bank. This is unless the BSP hasn’t been part of the modern banking system. If they are, this shows that the BSP have increasingly been resorting to theatricals to show that they are “doing something” but in reality they have been concealing the ballooning systemic risks just to extend this farcical boom.

Also one of the recent the communication maneuvers by the BSP has been to pin the blame on foreign “hot money” for domestic bubbles that has been LARGELY driven by domestic hot money.

Foreign capital has been used as a pretext as not to raise interest rates. Lately the BSP chief was quoted saying “Textbook would say if there are capital inflows, liquidity will tend to go up and, to limit the growth of liquidity, raise interest rates — you tighten…But if you do that what will happen is that you’ll attract more capital because of the interest-rate arbitrage given that capital markets are more integrated.[14]”

Yet all bubbles are internally driven. Foreign hot money flows represent largely momentum or yield chasers from various carry trades. And when we talk of momentum or yield chasing, this implies that trends have already been in place from which foreign speculators pile on. Simply said, foreigners have only been piggybacking on an existing bubble trend. Foreign hot money, thus, signify the effects or an aggravating factor rather than the primary cause of financial instability.

Austrian economist Fritz Machlup affirms my observation[15] (bold mine)

If, however, we inquire into the causes of the inflow of speculative capital from abroad which is so much objected to, we shall often find that it was the boom tendencies that were already present on the stock exchange which attracted the foreign funds. La hausse amène la hausse. The beginnings of the speculative boom originated in a flow of money from domestic sources. And as it is extremely difficult to conceive of a sudden epidemic of saving, we are once again driven back to credit expansion by the banks. It is the “domestic” creation of credit which usually produces that sentiment on the stock exchange and that movement of stock prices, which act as an invitation to foreign funds.

The BSP raised the same concerns last week. Why has the BSP chief been repeatedly zeroing in on foreign money flows? Are they sensing or even perhaps signaling trouble ahead…perhaps a reversal of the carry trades? Has the BSP been conditioning or the public to see foreign money as THE culprit? Or will foreign money be used as convenient scapegoat by the BSP?

In reading between the lines, all these cumulative actions have been because the BSP has been BOXED into a corner. The BSP have been TRAPPED from their own demand management based policies. And BSP top officials KNOW it. That’s why all these publicity stunts. They have to—not only to keep inflating (expanding credit)—but accelerate the rate of inflationism (30+% money supply growth rate) to keep the system of invisible transfers that feeds on the financing requirements of the government deficit spending going. Otherwise the boom turns into a bust. The government will be starved of funds. Yet the greater and the longer the boom, the bigger and the longer the bust.

Nonetheless the BSP will most likely resort to more massaging of statistical data and the “managing” financial markets—the peso, stocks and bonds. They will be backed by the government who will “tighten monitoring” or institute controls of consumer prices in the real economy. But again controls leads to black markets.

Yet the real economy is not about politicians and their delusional grandiose desires or plans implemented through manipulative regulations and policies but about people spontaneously producing, exchanging, cooperating, saving, consuming and investing. And that’s why these policies are destined for comeuppance. Current market actions hardly reflect on people’s real choices. Malinvestments are consequences of people being misled by the distortions from suppressed interest rates which have been exacerbated by auxiliary policies of repression such as price controls, capital controls, investment restrictions and etc…

Political braggadocio such as this “The Philippines has consistently bucked the global trend, with economic growth remaining high, and even surpassing our targets…This is partly because … external volatility and subdued global demand has not affected the country, since we are neither resource-dependent nor export-oriented” from the highest official of the land are clear signs of “This Time is Different” or a new era paradigm signifying excessive overconfidence. Unfortunately such “fatal conceit” premised in the belief of a “new order” will disintegrate soon.

This isn’t a scare story. This is economic logic if not plain common sense. Take too much booze and hangover happens. Over building/producing means oversupply. Over borrowing (or borrowing beyond the ability to pay) means credit problems that could end up with default or bankruptcy. Are these hard to absorb mentally?

Yet again the reason why “we are neither resource-dependent nor export-oriented” has been because of bubble blowing—interest rate manipulation policies which can be seen in the GDP-BSP data for 2013. The latter serves as more confirmation or evidence of the monumental 2009 pivot to a bubble economy[16].

The BSP should just scrap their pretentious property banking cap rule since this has been unenforceable and useless anyway.

“Good Governance” Boom Means Invisible Transfers or Greater Inequality

Distressing signs seem to be compounding

The BSP doesn’t realize it but their disclosure[17] has been a treasure in the context of the revelation of the fantastic redistribution from currency holders to mostly the wealthy.

Comprising the bulk of CLs at end-2013 was residential real estate loans. Figures suggest a notable increase in the purchase or rent of residences near business districts by young professionals, of luxury homes (condominiums) by high-income expatriates, and of RE properties for the use or investment by Overseas Filipinos.

Yuppies benefiting from the current supply side inflationary boom and foreigners use resources from the system financed by debt to bid up on property prices which the supply side sees as sustainable.

They forget that this invisible resource transfer—that has been enabled and channeled through financial repression policies of negative real rates—comes at the expense of the real economy. Resources used by the yuppies and foreigners are resources that have been deprived to the informal economy.

Ironically the BSP has been silent about loans by the domestic elites which I believe represents a substantial portion of “demand”.

If the supply side has been aggressively ramping up on capex which I estimate at a very conservative $250 billion largely on mid-to-high end projects for 2013[18], why shouldn’t the demand side respond in such a manner?

Such transfers are NOT value added. The elite (few) benefits through inflated assets that extrapolates to higher profits, income and earnings, while the real economy (most) suffers from high consumer prices (scarce resources). So small and medium scale enterprises hardly can expand as resources have been corralled by the bubble sectors. That’s the reason for the lingering predicament of high level of joblessness.

1 minus 1 DOES NOT equal to 2

This is how social policies drive a wedge on the class divide or the controversial inequality theme.

Yet once the bust surfaces the joblessness will balloon.

As for OFWs they represent a minority[19]. Nonetheless part of the OFW joining the bandwagon is another worrying sign of contagion

TWO “Marking the Close” Sessions at the Philippine Stock Exchange This Week!

Even more unsettling signs

Speaking of financial market massaging, the Phisix posted two remarkable accounts of “marking the close” this week.

Marking the close, according to US Legal.com is “the practice of buying a security at the very end of the trading day at a significantly higher price than the current price of the security.”

The two session “marking the close” sessions emerged as the Phisix attempted to profit-take this week. Despite the sharp pendulum swings, the major Philippine benchmark ended the week almost surprisingly unchanged.

This is interesting because during the real boom of January-June 2013, there was only one major marking the close session which came at the month end of February.

In the current denial rally, last week’s marking the close marks the third and fourth incidents. The earlier two were in February and April.

In other words, the end-of-the-session massaging of the index seem to be increasing in frequency. Some entities must be getting so restless or so desperate to see the index higher immediately. Do they want to make the chart?

Four times can’t be a coincidence.

And this again not only is a sign of a manic ONE WAY trade, but importantly, this signifies worrying signs of attempts to prevent the stock markets from functioning normally.

As mentioned earlier, the much exhausted Phisix made another attempt to correct this week. Wednesday, the major local benchmark stumbled 1.75%. However the giant gains in US stocks influenced the trading session on Thursday. Following a strong opening, intraday gains by the benchmark eroded as the session matured. Near the close the session the Phisix even almost reversed the day’s gains. But at the closing bell, the operators ensured that the Phisix closed at the day’s high with a 1.01% gain. You can see the chart here. Simply amazing.

I estimate that about 40% of the day’s advances—based not from the low but from the afternoon’s high—came from the last minute pump[20]. If we consider the low, that would mean about all the gains of the day.

Basically three sectors participated in the last minute ramp, the biggest being the holding sector, next is the industrials and finally the service sector. Since I have no access to the intraday charts of the specific issues, I can only make a hunch where 6 companies which delivered extraordinary returns for the day from these sectors had been responsible for the push.

As you can see, all the stock market operator needs is to push a few companies comprising the heavyweights of different sectors for the Phisix to move higher.

Friday, the Phisix (upper right pane) spent most of the session looking for a reprieve from the recent unwavering charge by the bulls (chart from colfinancial.com). Approaching the close of the session, the benchmark was off by about .72%. But the stock operators would have none of this. So as the closing bell rang, 3 industries led by the financials (upper right pane), the service sector (lower left pane) and the industrials (lower right pane) contributed to the fantastic evaporation of 60% of the session’s losses.

Notice that Thursday’s interventions failed to lift up Friday’s profit taking, so stock market operators went into action again. But still the day ended at the red. The point here is interventions will likely have short term effects.

It seems inconceivable that profits are the objective for the index massaging operations.

First, if the operators want to create a bandwagon effect, such actions should have been done sometime within the day for the effect to find traction. Obviously this hasn’t been the purpose.

Second, given that the issues being pushed are the among the biggest market caps of the composite index, which means they are the most liquid, such operations command a lot of money. Yet money alone will not suffice. Again since they are dealing with the most liquid issues, if there will be parties at the opposite (selling) side that has equally sizeable shares to sell, then the latter may defeat the intended objective of the operator. This implies coordination, which means that the stock market operator is unlikely a lone wolf but may involve other parties.

If the objective is to just make money, then they could simply push lesser liquid issues or just trade at market prices. But again the objective seems directed at where the Phisix should stand at the end of the day or price fixing.

Third, these stock market operators are buying at a premium above market prices. That’s the reason it’s called “marking the close”. So for them to profit means stocks should significantly move higher from the purchase point. Given today’s outlandishly overvalued stocks (30,40,50,60 PERs, 4,5,6,7,8 PBVs), this means these stock market operators have been playing with fire.

Fourth, it’s always easier to gamble—not with one’s personal account—but with someone else’s money. So I suspect that the money used in the operations may have been third party resources, from taxpayers (if public companies) or depositors (if private companies whether resident or non-resident). If my guess is accurate, then this covert operations involves a massive transfer of risks from operators to the resource owners for whatever objectives designed for such actions. But when the going gets tough, the tough becomes a sissy and runs away. This is an example of Keynes’s sound banker approach: lead the crowd during the boom, hide under the skirt of the crowd during the bust. But WOE to the resource owners!

Yet could it be that part of the money involved has been from margin trade or bank loans? If yes then this amplifies the problem.

Fifth, if indeed this has been a healthy bullmarket, it’s a curiosity to see why the seeming desperate need to manage the index? Besides a bullmarket should be a long term trend, so what’s the rush?

Obviously managing the index runs to the contrary to the essence of a real bull market. Instead such are increasing evidences that the current rally has been artificial.

Watch Out, Money Supply Growth Will Likely Plummet in the Second Half!

Could it be that the “bring the curtain down” time for the phantasmagoric boom has arrived?

The current boom has been pillared from the accelerating money supply growth that appears to have climaxed with the 30+% growth rate.

The grand BSP pivot of 2009 has shown money supply already accelerating. But as one would note from the lower pane of the chart from tradingeconomics.com, money supply virtually zoomed in July 2013, highlighted by the 30+% growth rate.

The mainstream hardly understands the role of money supply for them to patently disregard the risks from such dramatic increases. Remember banking loans represent 68% of the money supply.

Credit creation (money from thin air) from the banking system translates to additional nominal spending power. Borrowed money are largely spent or reallocated in the real economy. In other words, when money streams into the economy these affect prices, economic coordination and the production process.

Injected money represents new demand. If supply doesn’t grow at the rate to meet the new demand, we either would see higher prices (price inflation) or shortages. The latter is hardly relevant yet, because of the import option.

Yet importations to service the growth of new demand will affect the balance of trade. A wider trade deficit puts pressure on the local currency. Pressure on local currency will affect domestic prices. So domestic supply has either to grow in proportion to match demand or prices will rise.

If the rate of credit expansion expressed in money supply growth will be sustained eventually price inflation will grow in proportion to the rate of money supply growth. Rising price inflation will affect interest rates that will spillover to credit conditions.

No statistical smokescreens or manipulation of markets will undermine this basic economic theory.

The current “demand” that has fueled this boom has largely been due debt financed supply side dynamics underpinned by profit arbitrages from changes in relative prices over time, debt financed capital expansions anchored from such profit arbitrages, whose borrowings from the banking sector has been collateralized by inflated asset valuations.

Remittances from OFW and BPOs are just a side show.

The credit funded juiced up boom likewise inflated incomes (e.g. Yuppies shown above) and earnings of the bubble sectors (the ephemeral “earnings growth” story). All these have cumulatively inflated “demand”, which has likewise been transformed into consumption spending (mainly shopping mall, hotel) and speculation (residential and commercial real estate). The BSP GDP data for 2013 has been demonstrative of such phenomenon.

Yet this is the model that undergirds the bluster “not affected the country, since we are neither resource-dependent nor export-oriented”. This is really nothing but the Keynesian Philosopher stone of turning lead to gold “Thus the remedy for the boom is not a higher rate of interest but a lower rate of interest! For that may enable the so-called boom to last. The right remedy for the trade cycle is not to be found in abolishing booms and thus keeping us permanently in a semi-slump; but in abolishing slumps and thus keeping us permanently in a quasi-boom.”[21]

And the above dynamic has been lost on mainstream ‘experts’ whom largely thinks social activities “just happens”.

Thus participants in the bubble sectors continue to jump into the bandwagon by funneling more and more resources for projects aimed at catering to these demand in the belief that this will go on in perpetuity (permanently in a quasi-boom). The increasing concentration of use resources funded by debt translates to greater fragility for the formal economy.

This belief will now come under intense scrutiny soon.

And it’s about time to reveal of the seemingly developing slack in money supply growth.

Notice in the top pane that since January nominal money supply appears to have plateaued.

This is interesting because BSP banking loans continue to be robust. In other words, these new bank loans have hardly transformed into “new spending power” or “new demand”.

If the sluggish growth in money supply for the past 4 months hasn’t been an anomaly, then money supply growth during the first anniversary at July 2014 will slump to anywhere 20-25% (perhaps 22%) and will continue to fall!

I anticipate that the BSP will claim credit for this. But they have done practically nothing but to support this fictional boom. In fact, the BSP’s first reserve requirement actions[22] took effect in April 4, 2014. That’s three months well into the lackluster money supply growth.

And besides, as stated above, since in the modern banking system reserve requirements are “supplied” by the central bank, then this policy of raising the reserve requirements has all been a sham or a bluff unless the BSP operates in an archaic model

The question now is why the money supply slowdown? What’s happening?

Well, if banks create money through credit, then paying down credit destroys money.

Banks can also destroy money in two other ways. Banks can as agents sell government securities and or banks can issue and sell bonds or equity[23] to the public.

I doubt the latter two has played significantly.

Data from Asian Bond Monitor indicate that out of the 33 domestic borrowers in the bond market, 10 banks issued local currency bonds worth Php 125.2 billion during the first quarter[24] . This represents 22.66% of the overall Php 552.4 billion issuance which is a drop in the P 3.46 trillion bucket of total banking loans for March.

There has been no major bank IPOs during the first quarter based on PSE’s IPO updates

The Philippine government issued $1.5 billion in foreign denominated bonds last January in the global market which has little significance to the latest slowdown in money supply growth as we are concerned of domestic banks money creation and destruction.

Philippine outstanding debt by Php 41.8 billion from January to March, outstanding debt has declined Php 71.1 billion from December to March.

By process of elimination, with government securities and bank bonds and equities out of the picture, this leaves the money supply dilemma a function of the relationship between the banking sector and the non-bank borrowers.

The pace of bank lending continues to blaze. The average growth in banking loans from January to March has been 17.46%, more than double the economy.

For bank borrowing not to find their way to the real economy as manifested through money supply conditions, this implies that a growing number of firms borrow to ONLY PAYBACK their existing loans.

If this analysis is on spot, then this possibly means three scenarios; First: debt loads have grown excessively for the firms and or Second, the recent increases in 10 year domestic treasuries have begun to impact on the balance sheets of the highly levered firms…or Third it could even be both.

Yet borrowing to ONLY PAYBACK their existing liabilities possibly means the increasing recourse to DEBT IN, DEBT OUT or Ponzi financing—where companies can hardly pay for both principal and interests and now increasingly rely on rolling over of debt by accelerated borrowing and or by sales of assets in order to settle liabilities.

Remember there have been a limited number of companies with liberal access to the formal banking system. And if the 1st quarter money supply stagnation hasn’t been an anomaly, this means credit expansion may have hit their natural “speed limits”, despite the BSP’s sustained accommodation.

So the idea that a sustained easy money environment will extrapolate to a “free pass” for the bubbles or the Keynesian paradigm of “lower rate of interest…may enable the so-called boom to last” will now be tested.

Based on the above assumptions we don’t have to rely on many statistics to tell us that systemic debt burden may already have reached a ‘saturation’ or ‘tipping’ point for debt absorption. And 2013’s diminishing returns for debt on bubble areas has already given us some clues[25]. For every one peso of growth delivered by the real estate, construction and hotel industries, they borrowed 2-3 pesos.

As I pointed out last week, HSBC call this dynamic “credit intensity” in implying Asia has been caught in an addiction to debt[26]. The same dynamic appears to plague the domestic bubble sector now.

And current developments will slam the local economy in two ways, money inflation percolates into the economy in a time lag, or it takes time for the increases of money supply to show up in relative prices. Price increases will not be equal as some will rise ahead and or faster than the rest.

This means the huge 30+%% money growth in the second half of 2013 will continue to exert pressure on prices. So companies will see an increase in input prices which may begin to strain profits.

Second, the recent slowing of money supply growth will mean lesser support for the bubble activities. If it is true that a growing segment of borrowing are being rechanneled just to payback existing loans then Debt in-debt out will mean added strains on balance sheets of firms as cost of servicing debt rises.

And slowing money supply will now put pressure on profits derived from the narrowing window of price arbitrages from previous money supply expansion. This will begin to negatively impact capital expansion, thereby slowing increases in income that will be reflected on reduced demand or consumer spending. As the supply side growth skids, malinvestments will begin surface in terms oversupply and debt burdens. This means that the process of diversion of resources—from productive to non-productive speculative capital consuming sectors—will slowdown. There will be a feedback loop between debt burden and growth. And once the problems become evident, the process of market clearing via liquidations and asset value mark downs will accelerate. Boom will morph into a horrific bust.

This doesn’t just happen. This is a process. January to April’s money supply brake, if sustained, will begin the process reversing this illusory boom.

I expect the Philippine government to use the same massaging of markets to force down Philippine treasury yields. Forcing down yields will buy sometime for those afflicted by debt.

Remember Philippine treasury markets are not only illiquid but have been controlled by the government and by the banking industry[27]. Yields of 10 year treasuries have declined by 18.3 basis points last week, last quoted at 4.146%

The Philippine government will try to keep the Potemkin Villages standing even when the foundations have been fraying fast.

Again the debt based “something for nothing” boom will not end well, as the late Austrian economist and international banker and editor of the “The Richebächer Letter”, Kurt Richebächer warned[28] (bold mine)

You can’t build lasting stock market gains or solid GDP growth on debt. Because debt cannot expand forever. Sooner or later it must stabilize and then it must contract. When that happens, all the positive features of debt become negative features. Instead of borrowing and spending more, people must spend less and pay off past debt. Instead of adding to corporate sales and profits, they subtract from them. Instead of driving up asset prices, they push them down.

Peak Complacency: Ignoring Risks from Thailand Economic and Political Mess

I find it very interesting to see how ASEAN markets have practically been ignoring the risks from neighboring Thailand.

Thailand’s military has initially declared martial law early last week[29], but holding on to the ring of power seems so tempting for the military to finally declare a coup about a day after.

The putsch has been the “second time in a decade” and the “12th military takeover since Thailand abandoned the absolute monarchy in 1932” has been supposed to favor the elite whom have “grown disillusioned with popular democracy” according to the New York Times[30].

Amidst the power struggle, Thailand’s economy continues to struggle and has posted a contraction of -.6% during the first quarter. Thailand’s economy have been in a declining trend through 2013 even prior to the escalation of the political crisis in November of 2013[31]

Thailand’s tourism, which accounts for 9% of the economy, the highest ratio in Asia after Hong Kong has plummeted by 5% from January to April, a most likely victim of the political impasse. Ironically Bangkok was ranked as the top tourist destination last year[32]. The sharp reversal in sentiment is showcase of how capricious confidence is.

As one would note from the World Bank chart, Thailand has a large exposure on debt. The Bank of Thailand (BOT) have sought to ward off credit risks by slashing interest rates even as consumer price inflation has been mounting. The BOT cut official rates last March[33]. Yields of Thai’s 10 year bonds have been on a decline along with central bank policies of reducing interest rates since 2012. The BOT policies essentially have bought time for Thailand’s debt problem.

I quote here one article which I believe highlights the ongoing bubble in Thailand.

Knight Frank Chartered (Thailand), a property consultancy firm, says there is a brisk demand for condos in Khon Kaen. The city and the surrounding province saw the market come alive five years ago, and it has accelerated over the past three years. Over 6,802 condo units were launched in 2011-13, and last year 3,284 units were launched, the highest number ever to enter the market. All this in a city of only 100,000 people. It’s hardly what you would expect from a quiet provincial town… but it’s happening all over Thailand. The cities are changing because the citizens are changing. Khon Kaen, for example, is home to a thriving university and in recent years, it has seen a massive surge in enrolment. Many of the buyers of these apartments are students or staff at Khon Kaen University (KKU). I have a friend whose nephew studies there. The young man has dreams of becoming a photographer with his own studio and although he comes from a simple background, he won a place at the university.

The article is from a stock market newsletter selling Thailand[34]. But what the author sees as a bullish theme is actually bearish if we apply economics to it.

For a city of 100,000 people and condo supplies at nearly 10,000 units, the economic balance would be about 1 unit for every 10 people. But a city of 100,000 would mean households rather than just people. If there are 5 people for every households, then there would be 20,000 households. This implies 1 condo unit for every 2 households. And most likely the much of the 20,000 households may have their existing abode. So unless there will substantial immigration from residents or foreigners much of this means massive oversupply.

But the author says it’s happening all over Thailand! Gosh. Then that would mean one heck of a gigantic oversupply!

And who’s buying but students. If parents are buying in behalf of them then this will be just fine. But what if students buy on margins paid by allowances?

If Thailand’s economy continues to slow or even contract for a prolonged period and if the plunge in tourism will mirror foreign investors in terms of FDI and portfolio flows, then debt concerns that has finance all these massive condo units will surface. And this will magnify on Thailand’s economic and financial risks. And Thailand’s political mess will just be an enhancer to what seems as a bubble bust already in progress.

During last week’s coup, the USD-Thai baht rose .67 and Thailand SET fell by only .6%

Complacency at its peak! Caveat emptor.

[7] Friedrich August von Hayek, THE FATAL CONCEIT Chapter 5 p.76 The Errors of Socialism THE COLLECTED WORKS OF Friedrich August Hayek Volume 1 libertarianismo.org

[23] Bank of England, Loc. cit

[24] Asian Development Bank ASIA BOND MONITOR March 2014 Adbbondsonline.org. Philippine National Bank 30.9, BDO Unibank 23.0, RCBC 19.0, Security Bank 13.0, Metrobank 10.0, United Coconut Planters Bank 9.5, Allied Banking 8.0, Union Bank of the Philippines 6.8, Bank of the Philippine Islands 5.0