The number in question:$16,190,979,268,766.67, which is the closing number for total US public debt outstanding, which also happens to be a record closing all time high and an increase of $33 billion from yesterday courtesy of the settlement of last week's bond auctions. There is now $242 billion in debt left under the debt ceiling, which at the current recently slowed down pace of debt issuance, which is posed to pick up substantially again, will be exhausted in well under 2 months.Remember: there is never such a thing as a free lunch. The benefit of this unrepayable debt and ruinous fiscal policy is precisely what the administration is taking benefit for, namely the soaring stock market. The offset, of course, is that as Reinhart and Rogoff never tire of showing, piling up well over 100% in public debt/GDP means that there is only one way out for the host country: either a hard default, or inflating the debt away.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, October 17, 2012

US Debt at Record $16.19 Trillion!

Thursday, October 11, 2012

US States: High Debts and Labor Unionism

The debt of 30 California cities, including Oakland, Fresno and Sacramento, has been placed under review for downgrades because of economic pressures in the state, Moody’s Investors Service said.The examinations may affect $14.3 billion in lease-backed and general-obligation debt issued by the municipalities, the New York-based company said yesterday in a statement.“California cities operate under more rigid revenue- raising constraints than cities in many other parts of the country,” Eric Hoffmann, who heads Moody’s California local government ratings team, said in a statement. “Combined with steeply rising costs, these constraints mean that these cities will likely recover more slowly than their peers nationally, even if the state’s economic recovery tracks the nation’s.”Communities in California have struggled to stay afloat by cutting staff and services to make up for a drop in sales and property tax revenue in the wake of the recession. Stockton, San Bernardino and Mammoth Lakes have gone into bankruptcy court since June.Moody’s said it identified the credits as part of a broader review started in August of 95 rated cities in California.The general-obligation bond ratings of Los Angeles, now Aa3, fourth-highest,and San Francisco, Aa2, third-highest, are on review for upgrades, Moody’s said.

After discovering that the Top 10 states with the highest tax rates were all Forced Union states, it comes as no surprise that the top states with the worst debt trouble are also Forced Union states. Back in January Forbes tallied up several factors to identify which states were in the worst debt trouble (50 being the worst). The ‘Debt Per Capita and Unfunded Pensions Per Capita’ number is how much is owed per person in the state. Forbes looked at the following:The metrics we looked at for each state included unfunded pension liabilities, changes in tax revenue, credit agency ratings, debt as a percentage of Gross State Product, debt per capita, growth expectations for employment and the state economy, net migrations and a moocher ratio that compares government employees, pension burdens and Medicaid enrollees to private-sector employment.Forced Union vs Right-to-Work States:Of the top 15 states with the worst debt troubles every one listed is a Forced Union state other than Mississippi and Louisiana. These states are outliers because they have assumed larger debt due to rebuilding after the devastation of Hurricane Katrina. Of the top 15 states with the least debt troubles, all but 4 (New Hampshire, Montana, Colorado and Indiana) are Right-to-Work states. Note that in 2005 Governor Daniels of Indiana revokedthe collective bargaining rights of public sector unions. It is also notable that the Forced Union states have a higher percentage of unionized government workers than the Right-to-Work states.Read the rest here.

The very essence of the interventionist politicians' wisdom is to raise the price of labor either by government decree or by violent action on the part of labor unions. To raise wage rates above the height at which the unhampered market would determine them is considered a postulate of the eternal laws of morality as well as indispensable from the economic point of view. Whoever dares to challenge this ethical and economic dogma is scorned both as depraved and ignorant. Many of our contemporaries look upon people who are foolhardy enough "to cross a picket line" as primitive tribesmen looked upon those who violated the precepts of taboo conceptions. Millions are jubilant if such scabs receive their well-deserved punishment from the hands of the strikers while the police, the public attorneys, and the penal courts preserve a lofty neutrality…Firmly committed to the principles of interventionism, governments try to check this undesired result of their interference by resorting to those measures which are nowadays called full-employment policy: unemployment doles, arbitration of labor disputes, public works by means of lavish public spending, inflation, and credit expansion. All these remedies are worse than the evil they are designed to remove.

Sunday, October 07, 2012

Quote of the Day: Passing a Point of NO Return

We cannot count on problems elsewhere in the world to make Treasury securities a safe haven forever. We risk eventually losing the privilege and great benefit of lower interest rates from the dollar's role as the global reserve currency. In short, we risk passing an economic, fiscal and financial point of no return.Suppose you were offered the job of Treasury secretary a few months from now. Would you accept? You would confront problems that are so daunting even Alexander Hamilton would have trouble preserving the full faith and credit of the United States. Our first Treasury secretary famously argued that one of a nation's greatest assets is its ability to issue debt, especially in a crisis. We needed to honor our Revolutionary War debt, he said, because the debt "foreign and domestic, was the price of liberty."History has reconfirmed Hamilton's wisdom. As historian John Steele Gordon has written, our nation's ability to issue debt helped preserve the Union in the 1860s and defeat totalitarian governments in the 1940s. Today, government officials are issuing debt to finance pet projects and payoffs to interest groups, not some vital, let alone existential, national purpose.The problems are close to being unmanageable now. If we stay on the current path, they will wind up being completely unmanageable, culminating in an unwelcome explosion and crisis.The fixes are blindingly obvious. Economic theory, empirical studies and historical experience teach that the solutions are the lowest possible tax rates on the broadest base, sufficient to fund the necessary functions of government on balance over the business cycle; sound monetary policy; trade liberalization; spending control and entitlement reform; and regulatory, litigation and education reform. The need is clear. Why wait for disaster? The future is now.

Wednesday, October 03, 2012

Global Debt Default Binge: US Debt Now at $16,159,487,013,300.35

September 30 was the last day of Fiscal 2012 for the US which explains why despite the barrage of debt issuance in the past month, the year closed with total debt of just $16.066 trillion, a modest increase of just $50 billion in the month. Luckily, moments ago we got the first DTS of the new fiscal year, which eliminated any residual confusion we had. As of the first day of FY 2013, total US debt soared by $93 billion overnight, and is now a record $16,159,487,013,300.35. One can see why Tim Geithner wants to push all the debt under the coach for as long as possible (and the scariest thing is that the actual increase in Treasury cash was a mere $11 billion). But wait, there's more. As a reminder, final Q2 US GDP was recently revised lower by $20 billion, which if we extrapolate into Q3 (leading to a nominal GDP print of $15.71 trillion), means that as of today, total US Federal debt to GDP is 103%. And rising about 1.5% per month.

Wednesday, September 12, 2012

Ron Paul: US is a Constitutional Republic and Not a Democracy

Congressman Ron Paul reminds Americans that they are supposedly a constitutional Republic and not a democracy (bold emphasis mine)

Democracy is majority rule at the expense of the minority. Our system has certain democratic elements, but the founders never mentioned democracy in the Constitution, the Bill of Rights, or the Declaration of Independence. In fact, our most important protections are decidedly undemocratic. For example, the First Amendment protects free speech. It doesn't – or shouldn't – matter if that speech is abhorrent to 51% or even 99% of the people. Speech is not subject to majority approval. Under our republican form of government, the individual, the smallest of minorities, is protected from the mob.

Sadly, the constitution and its protections are respected less and less as we have quietly allowed our constitutional republic to devolve into a militarist, corporatist social democracy. Laws are broken, quietly changed and ignored when inconvenient to those in power, while others in positions to check and balance do nothing. The protections the founders put in place are more and more just an illusion.

This is why increasing importance is placed on the beliefs and views of the president. The very narrow limitations on government power are clearly laid out in Article 1 Section 8 of the Constitution. Nowhere is there any reference to being able to force Americans to buy health insurance or face a tax/penalty, for example. Yet this power has been claimed by the executive and astonishingly affirmed by Congress and the Supreme Court. Because we are a constitutional republic, the mere popularity of a policy should not matter. If it is in clear violation of the limits of government and the people still want it, a Constitutional amendment is the only appropriate way to proceed. However, rather than going through this arduous process, the Constitution was in effect, ignored and the insurance mandate was allowed anyway.

This demonstrates how there is now a great deal of unhindered flexibility in the Oval Office to impose personal views and preferences on the country, so long as 51% of the people can be convinced to vote a certain way. The other 49% on the other hand have much to be angry about and protest under this system.

We should not tolerate the fact that we have become a nation ruled by men, their whims and the mood of the day, and not laws. It cannot be emphasized enough that we are a republic, not a democracy and, as such, we should insist that the framework of the Constitution be respected and boundaries set by law are not crossed by our leaders. These legal limitations on government assure that other men do not impose their will over the individual, rather, the individual is able to govern himself. When government is restrained, liberty thrives.

Unfortunately, the “increasing importance” that will be “placed on the beliefs and views of the president” or the coming US presidential elections will be determined mostly by the following dynamics:

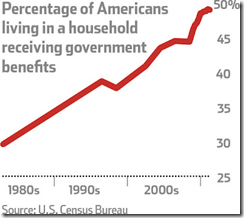

The jarring charts signifying the “epidemic” of entitlements are from Nicolas Eberstadt of the American Enterprise Institute at the Wall Street Journal

The devolution to “militarist, corporatist, social democracy” is why US fiscal conditions will continue to deteriorate.

Democracy or the rule of men rather than the rule of law self-reinforces on its own destruction.

Thursday, September 06, 2012

Quote of the Day: Fiscal Cliff: The Dangerous Idea of the Permanence of Low Interest Rates

The current national debt is about $16 trillion. This is just the funded portion — the unfunded liabilities of the Treasury, such as Social Security and Medicare, and off-budget items, such as guaranteed mortgages and student loans, loom much larger. Our recent era of unprecedented fiscal irresponsibility means we are throwing an additional $1 trillion or more on the pile every year. The only reason this staggering debt load hasn’t crushed us already is that the Treasury has been able to service it through historically low interest rates (now below 2 percent). These easy terms keep debt-service payments to a relatively manageable $300 billion per year.

On the current trajectory, the national debt likely will hit $20 trillion in a few years. If, by that time, interest rates were to return to 5 percent (a low rate by postwar standards) interest payments on the debt could run around $1 trillion per year. Such a sum would represent almost 40 percent of total current federal revenues and likely would constitute the single largest line item in the federal budget. A balance sheet so constructed would create an immediate fiscal crisis in the United States.

In addition to making the debt service unmanageable, a return to normal rates of interest would depress the kind of low-rate-dependent economic activity that characterizes our current economy. A slowing economy would cut down on tax revenue and trigger increased government spending to beleaguered public sectors. Higher rates on government debt also would push up mortgage rates, thereby putting renewed downward pressure on home prices and perhaps leading to another large wave of foreclosures. (My guess is that losses on government-insured mortgages alone could add several hundred billion dollars more to annual budget deficits.) When all of these factors are taken into account, I think annual deficits could quickly approach, and then exceed, $3 trillion. This would double the amount of debt we need to sell annually.

Currently, foreign creditors buy more than half of all U.S. debt issuance. Most of these purchases are motivated by political reasons that are subject to change. The buyers, who legitimately can be described as “investors,” extend credit to the United States at such generous terms largely because of America’s size, power and perceived economic unassailability. If those perceptions change, 5 percent could quickly become a floor, not a ceiling, for interest rates. Given that America’s balance sheet bears more than a casual resemblance to those of both Spain and Italy, it should not be radical to assume that one day we will be asked to pay the same amount as they do for the money we borrow. The brutal truth is that 6 percent or 7 percent interest rates will force the government to either slash federal spending across the board (including cuts to politically sensitive entitlements), raise middle-class taxes significantly, default on the debt, or hit everyone with the sustained impact of high inflation. Now that’s a real fiscal cliff.

By foolishly borrowing so heavily when interest rates are low, our government is driving us toward this cliff with its eyes firmly glued to the rearview mirror. Most economists downplay debt-servicing concerns with assertions that we have entered a new era of permanently low interest rates. This is a dangerously naive idea.

This is from Peter Schiff at the Washington Times.

My impression is that once a recession becomes a reality, the likely actions by the US government will be to undertake bailouts of the politically favored institutions similar to 2008.

Such rescue efforts will easily bring to fulfillment Mr. Schiff’s $20 trillion debt target in no time.

Eventually the US will default directly (most likely path; read Gary North and Jeffrey Hummel) or attempt to default first indirectly through monetary inflation.

Keynesians, who look to the Great Depression and the Japan lost decade as model, fails to see or are blinded to the fact that today’s problem has not only been a banking based financial crisis but compounded by sovereign debt crisis which has been unprecedented.

The root of the problem hasn't been the lack of aggregate demand but from the sustained consumption of capital which mostly has been burned through serial political rescues, malinvestments from easy money policies and worsened by unsustainable welfare warfare systems.

Sunday, July 01, 2012

Obamacare’s 21 New or Higher Taxes for the US economy

The Supreme Court’s upholding of Obamacare will translate to 21 new or higher taxes for the US economy.

Ryan Ellis enumerates them (hat tip Bob Wenzel)

1. Individual Mandate Excise Tax(Jan 2014)

2. Employer Mandate Tax(Jan 2014)

3. Surtax on Investment Income ($123 billion/Jan. 2013)

4. Excise Tax on Comprehensive Health Insurance Plans($32 bil/Jan 2018)

5. Hike in Medicare Payroll Tax($86.8 bil/Jan 2013)

6. Medicine Cabinet Tax($5 bil/Jan 2011)

7. HSA Withdrawal Tax Hike($1.4 bil/Jan 2011)

8. Flexible Spending Account Cap – aka“Special Needs Kids Tax”($13 bil/Jan 2013)

9. Tax on Medical Device Manufacturers($20 bil/Jan 2013)

10. Raise "Haircut" for Medical Itemized Deduction from 7.5% to 10% of AGI($15.2 bil/Jan 2013)

11. Tax on Indoor Tanning Services($2.7 billion/July 1, 2010)

12. Elimination of tax deduction for employer-provided retirement Rx drug coverage in coordination with Medicare Part D($4.5 bil/Jan 2013)

13. Blue Cross/Blue Shield Tax Hike($0.4 bil/Jan 2010)

14. Excise Tax on Charitable Hospitals(Min$/immediate)

15. Tax on Innovator Drug Companies($22.2 bil/Jan 2010)

16. Tax on Health Insurers($60.1 bil/Jan 2014)

17. $500,000 Annual Executive Compensation Limit for Health Insurance Executives($0.6 bil/Jan 2013)

18. Employer Reporting of Insurance on W-2(Min$/Jan 2011)

19. Corporate 1099-MISC Information Reporting($17.1 bil/Jan 2012)

20. “Black liquor” tax hike(Tax hike of $23.6 billion)

21. Codification of the “economic substance doctrine”(Tax hike of $4.5 billion).

Read the explanation or details here

All these will negatively impact corporate profits, business investments, employment and productivity.

Yet all these means more bureaucracy, greater government spending, MORE Fiscal DEFICITS and SURGING DEBTS.

Add Obamacare to the existing welfare, warfare and other growing spending programs, a Greece crisis seems like a destiny.

This means that the US Federal Reserve will only continue to pump massive amounts of money to system into prevent interest rate from rising. An upward trend of interest rates will jeopardize funding for all these social spending programs.

This possibly extrapolates to continuation of the US Federal Reserve as the buyer of last resort.

Put differently, inflationism will function as the lipstick on the pig for these economically unsustainable programs. One would already note that interest on debt already exceeds many spending programs. (charts from Heritage Foundation)

Sometimes you’ve got to wonder: Are these purposely designed to destroy society?

Updated to add: Since the Heritage chart embed didn't work out as I expected, I had to redo the entire post.

Thursday, May 31, 2012

Nassim Taleb: Worry about the US more than the EU

My favorite author iconoclast Nassim Taleb says that the US and not Europe should be the source of concern

From Bloomberg,

Nassim Taleb, author of “The Black Swan,” said he favors investing in Europe over the U.S. even with the possible breakup of the single European currency in part because of the euro area’s superior deficit situation.

Europe’s lack of a centralized government is another reason it’s preferable to invest in the region, said Taleb, a professor of risk engineering at New York University whose 2007 best- selling book argued that history is littered with rare events that can’t be predicted by trends.

A breakup of the euro “is not a big deal,” Taleb said yesterday at an event in Montreal hosted by the Alternative Investment Management Association. “When they break it up, there will be a lot of fun currencies. This is why I am not afraid of Europe, or investing in Europe. I’m afraid of the United States.”

The budget deficit as a proportion of gross domestic product in the U.S. amounted to 8.2 percent at the end of 2011, government figures show. That’s twice the 4.1 percent ratio for euro-region countries, according to data compiled by Bloomberg.

“Of course Europe has its problems, but it’s in much better shape than the United States,” Taleb said. He voiced similar concerns about U.S. prospects at a conference in Tokyo in September…

Rising interest rates would make things worse for the U.S., said Taleb, a principal at hedge fund Universa Investments LP who also serves as an adviser to the International Monetary Fund.

“We have zero interest rates,” Taleb said. “If interest rates go up in the United States, you can imagine what the deficit would be. Europe is like someone who is ill but is conscious of it. In the United States we are ill, but we don’t know it. We don’t talk about it.”

In my view, decentralization of the EU will likely be the outcome from the collapse of the welfare states where Greece may likely to set the precedent.

And like Dr. Marc Faber and Professor Taleb, for the EU, after the storm comes the calm.

I would venture a guess that the tipping point for the US dollar as global currency reserve, is when the US economy run smack into another recession or into another financial crisis, where the knee jerk or intuitive response will likely be trillions of money printing by the US Federal Reserve. Under such condition, I think Professor Taleb’s risk scenario may unfold.

Tuesday, May 22, 2012

The Implications of China’s Direct Access to the US Treasury

Here is more proof that the Scarborough Shoal issue has been a sham

From Reuters

China can now bypass Wall Street when buying U.S. government debt and go straight to the U.S. Treasury, in what is the Treasury's first-ever direct relationship with a foreign government, according to documents viewed by Reuters.

The relationship means the People's Bank of China buys U.S. debt using a different method than any other central bank in the world.

The other central banks, including the Bank of Japan, which has a large appetite for Treasuries, place orders for U.S. debt with major Wall Street banks designated by the government as primary dealers. Those dealers then bid on their behalf at Treasury auctions.

China, which holds $1.17 trillion in U.S. Treasuries, still buys some Treasuries through primary dealers, but since June 2011, that route hasn't been necessary.

The documents viewed by Reuters show the U.S. Treasury Department has given the People's Bank of China a direct computer link to its auction system, which the Chinese first used to buy two-year notes in late June 2011.

China can now participate in auctions without placing bids through primary dealers. If it wants to sell, however, it still has to go through the market.

This only reveals how the US is in such dire financial straits to grant China's government a privileged DIRECT access to the US Treasury. This is tantamount to BILATERAL financing which now eludes the crony Wall Street “too big to fail” firms.

Cutting the middle man means Wall Street will earn less and will have less info on China-US financing deals.

On the other hand China is likely to be given special deals which won’t be known by the public.

This also exhibits the dimension of relationship between China and the US, which implies of deepening interdependencies on economic, financial and geopolitical aspects.

Of course the inference from the above statement is that the Scarborough Shoal controversy has been mostly a false flag. What you see isn't really what has been. Politicians and media has taken the public for a ride at the circus.

Thursday, November 17, 2011

US Debt Passes $15 Trillion or Over 100% of GDP

From Zero Hedge,

Too sad for commentary, but here is some math: total US debt has increased by 41.5%, or $4.4 trillion, from $10,626,877,048,913 on January 20, to $15,033,607,255,920, under Obama as president.

(as a reminder the most recently updated debt ceiling is $15.194 trillion)

Some sectors think that the growing US debt dynamic, which has now gone past 100% of the GDP ($14.582 trillion in 2010), won’t pose as a major concern since US debt has been underwritten on their own currency, the US dollar, which means the US can simply monetize her own debts.

Yet as author Adam Fergusson recently said, in citing his experience with the Weimar Germany, this would tantamount to playing with fire.

The unwieldy US debt dynamic is like a ticking time bomb.

Thursday, October 06, 2011

US Debt up $162 Billion in Three Days; now 98.9% Debt/GDP

The US government is on a spending spree.

Quoting the anonymous writer who comes by the name of Tyler Durden of the Zero Hedge (bold highlights original)

total debt is now at, obviously, a new record high of $14,856,859,498,405.73, which is a $20 billion increase overnight, $67 billion in the past two days, and $162 billion in the last three days. We will repeat the last part: total US debt has increased by $162 billion in three days. Said otherwise, total US Debt/GDP is now 98.9%.

Politicians and their allies believe they can spend their way to prosperity. They believe in the Santa Claus principle.

They have to be reminded that, to quote Ludwig von Mises,

An essential point in the social philosophy of interventionism is the existence of an inexhaustible fund which can be squeezed forever. The whole system of interventionism collapses when this fountain is drained off: The Santa Claus principle liquidates itself.

In a world of scarcity, there is simply no such thing as a free lunch. Eventually markets will expose such tomfoolery.

Tuesday, August 09, 2011

Has the S&P’s Downgrade been the cause of the US Stock Market’s Crash?

Hardly so, it would seem.

Since the announced downgrade last Friday, coupon yields of US sovereign issues have been collapsing across the yield curve.

This has HARDLY been signs of an intuitive market response to a credit rating downgrade, where interest rates should be surging higher!

Instead, this looks likely a typical market reaction when the confronted with the prospects of recession.

What has been happening has been a rotation away from equities to bonds, since the debt downgrade crisis episode surfaced.

The currency market hardly exhibits the same downgrade reaction too. Instead of a selloff, we see the US dollar consolidating for the past two sessions. Over the span of two weeks, the US dollar has been inching higher.

Overall, the US dollar has not outperformed (as the previous bear market) or functioned as safehaven currency but has not collapsed either.

Yet gold prices continues to spike to record levels, which is now at 1,740s! (goldprice.org)

Of course gold prices has been suggestive of aggressive activism by central bankers to counteract this ongoing meltdown.

And with the appearance that ECB’s Bazooka (QE), estimated at $1.2 trillion, has fizzled out or has sputtered, more QEs could be in the pipeline.

Such market dissonance is telling.

Misleading Discussion on US Debt Downgrade Crisis

Here is my open letter to broadcasters Paolo Bediones and Cherry Mercado

Dear Paolo Bediones and Cherry Mercado,

Last night, I overheard your supposed cerebral discussion about the US debt downgrade crisis on your radio program while on the way home, on a cab with my family.

I would like to make significant corrections on the litany of false information that had been disseminated on air.

First you claim that after with America’s downgrade, only New Zealand is left with AAA ratings.

This in patently incorrect as shown by the chart from the New York Times

There are 13 countries still with AAA ratings.

Next, you alleged that the Philippine economy mostly depends on the remittances. This is again far from truth. (The downgrade of which you deduce would hurt the OFWs.)

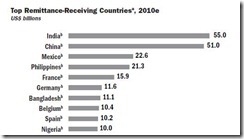

While the Philippines ranks 4th among the largest remittance recipients in the world (US $21 billion in 2010)…

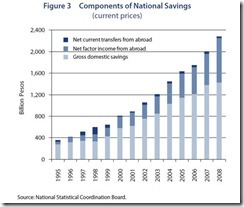

…the share of remittances to our economy is only 12% (see below). This means there are 88% more of non-OFW sectors to consider. Mathematically speaking, 88 should be greater than 12, or am I missing something?

Charts from World Bank’s Migration and Remittance Factbook 2011

True, the multiplier for remittance contribution could mean a lot more share of the economic pie, but this is certainly far from the exaggerated claim that the Philippines entirely or mostly depend on remittances.

The above chart from ADB shows that while the growth of net factor income from abroad (NFIA) has indeed been substantial, remittances has only been part of this. NFIA also includes contributions from exports and investment inflows. Importantly, gross domestic savings still accounts for the largest share.

So you seem to be pandering to the OFW voting class/audience by overestimating their contributions and underestimating the role of the local economy.

You further moralize on the problem of the 'debt crisis' to Americans as one of having spent too much on things which they didn’t “need”, in as much as they ate in “excess”.

Again both of you seem to be missing out the root of the problem.

Today’s US debt crisis has been mostly about skyrocketing US government spending emanating from promises to her citizenry from which the US government won't be able to finance (chart from Wall Street Journal)

(chart from Heritage Foundation)

If you think that McMansions and SUV’s are “not” needed by Americans, then that would represent fait accompli thinking.

And yet how do you determine what is needed and what is not? And similarly by what measure would you know what or which levels signify as “enough” for each person? If I value beer most and you value coffee most, should my preferences be forced to conform to you or should I sacrifice my beer for your coffee? On what grounds-because most of the people will agree with you?

You see, the fundamental problem has mainly been about the addiction to acquire debt (not only by the American public but MOSTLY by the government).

Moreover while I applaud you for saying that Filipinos should stay clear from incurring debt, I reject your prescription that 'safety nets' should be provided for by the Philippine government to the OFWs in the face of this crisis.

Such safety nets has exactly been the (borrow and spend) formula which has caused the downgrade of the US

Proof?

This is the press release from the Credit rating agency S & P, whom downgraded the US, (bold highlights mine)

The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government’s medium-term debt dynamics.

More broadly, the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges to a degree more than we envisioned when we assigned a negative outlook to the rating on April 18, 2011.

Since then, we have changed our view of the difficulties in bridging the gulf between the political parties over fiscal policy, which makes us pessimistic about the capacity of Congress and the Administration to be able to leverage their agreement this week into a broader fiscal consolidation plan that stabilizes the government’s debt dynamics any time soon.

None in the above says that this has about excess consumption of food and the needless expenditures on material personal needs. Instead, the above shows that this crisis has been representative of the overdependence on government.

Finally, both of you only see the negative side of the downgrade. The bright side is that these events could mean more investment funds for countries willing to embrace investors.

As a saying goes, money flows to where it is treated best. If the US government can’t treat their resident investors adequately, then the Philippines can offer them an alternative venue.

This will happen only if we make the right policy reforms of embracing greater economic freedom.

Ideas have consequences, especially the bad ones. Spreading half-truths could mislead people into doing something that they shouldn’t have politically.

I hope to see public personalities engage in responsible expositions of our society’s problems than just utter rubbish and unfounded statements, especially directed to gullible audiences who mostly don’t understand the situation and who would easily fall prey to demagoguery which they may assimilate as “truth”.

In short, I hope that that both of you practice responsible journalism.

Hope this helps,

Benson