Facts do not cease to exist because they are ignored. ― Aldous Huxley, Proper Studies

The seeming irony is that gains in the US financial markets appear to be narrowing down to the stock markets.

As previously explained[1] in 2009-2011, global stock markets, bond markets and commodities synchronically boomed. This broad based Risk ON environment started falling apart as BRICs began to weaken in 2011. This has been followed by swooning commodity prices over the same year.

Recently, market infirmities have spread to the global bond markets and ex-US stock markets.

As US stocks surged Friday due to “strong jobs”, which had been accompanied by a huge spike in bond yields, select American benchmarks such as Canada’s S&P TSX, Brazil’s Bovespa, Mexico’s IPC and Argentina’s Merval index took on the opposite direction[2].

Instead of cheering along with Wall Street, these ex-US American markets seem to be haunted by soaring bond yields.

In the US, rising interest rates seems incompatible with a sustained stock market boom.

I have noted of reactions of the S&P 500 to every incidences of rising 10 year UST yields since the bond bull market began in 1980s.

The Wile E. Coyote Moment

I call rising stock markets, in the face of mounting systemic leverage and rising yields as the Wile E. Coyote moment. When stock markets become objects of rampant and excessive speculation fueled by bubble policies, and whose boom has been financed by leverage, stock markets undergo or endure boom-bust cycles.

The recent US 2003-2007 bubble cycle should be a noteworthy example. The booming S&P 500 (red) had actually been a symptom of a blossoming mania in the US housing markets. The latter peaked in early 2006.

Yet the stock market continued its ascent despite increasing signs of cracks in the housing amidst climbing 10 year UST yields (blue line).

The S&P’s rise has been partly financed by cheap credit as evidenced by the record net margin debt (see below)

Eventually the periphery to the core dynamic via the broadening implosion of the US housing markets slammed the banking system hard. A banking and financial crisis ensued. The S&P got crushed. The one year plus bear market cycle reached its trough in 2009.

Net margin debt (green ellipses) has been in near record territory today as it had been in 2007 and in 2000 or during the dotcom bubble[3]. The two prior episodes of bubble cycles, including today, shares the same characteristic: debt financed stock market boom.

A further implication is that today (or soon) will likely share the similar dynamic as in the past: a forthcoming bubble bust.

When rates of return from speculation are overwhelmed by the cost of servicing margin trading debt, the eventual result is either a margin call or forced liquidations. Boom turns into bust.

I would further add that much of the recent stock market growth has been via stock buybacks which has reached a “record”[4].

And a lot of these buybacks has been financed via the bond markets due to distortions from tax laws and from the allure of easy money, as previously discussed[5]

Rising bond yields will put to test the interdependence of stock markets with the bond markets.

In the dotcom bubble days[6], again the same dynamic can be seen: rising stocks powered by expanding debt eventually had been terminated by elevated 10 year bond rates.

The dotcom bubble bust bottomed in 2002 two years after the bear market cycle surfaced.

A more interesting case is the Black Monday stock market crash of October 19, 1987[7]. This fateful day occurred just a little over two month after the assumption of Mr. Alan Greenspan as former US Federal Reserve chairman in August of 1987[8]. Mr. Greenspan’s action of cutting down Fed Fund Rates to produce negative real yield became the operating standard of financial market rescues that earned such policy, the moniker of the “Greenspan Put[9]”

Prior to the crash, the S&P soared along with the 10 year UST yield. The end result was a horrific one day 22% crash for the Dow Jones Industrials.

According to an investigative study by the US Federal Reserve on the 1987 crash[10]: (bold mine)

However, the macroeconomic outlook during the months leading up to the crash had become somewhat less certain. Interest rates were rising globally. A growing U.S. trade deficit and decline in the value of the dollar were leading to concerns about inflation and the need for higher interest rates in the U.S. as well

A case of déjà vu?

In short, rising stocks and rising bond yields again signify as a deadly cocktail mix.

Not every incidence of rising yields led to a stock market crash though.

1994 was known for a harrowing bond market crash. 10 year yields fell by more than 200 bps. Because there has hardly been a preceding stock market boom, there was neither a bear market cycle nor a stock market crash. The S&P traded sideways then.

What the bond market crash instead claimed had been Mexico’s Tequila or 1994 economic crisis[11], California’s Orange County bankruptcy[12] and partly the culmination of the Savings & Loans Crisis[13].

Nonetheless the post bond market collapse fuelled a trailblazing run in the stock market.

Finally, the conclusion of the stagflation days of the 1980s ushered in the golden days of US financial asset markets as both bonds and stocks boomed for three and two decades respectively.

When former Fed chief Paul Volcker wrung out inflation in the system by reducing money supply which sent 10 year UST yields to over 15%, the stock markets tanked as the US economy succumbed to a recession.

The S&P rallied by almost 70% from late 1982-84. Unfortunately rising UST yields again took a toll on stock market which went on a brief downside mode. And as 10 year yields fell, the S&P 500 took off.

Lessons of History

As pointed out in last week, we can get some clues from history since cycles are products of people’s short memory.

As English writer Aldous Huxley once wrote in the “Case of Voluntary Ignorance in Collected Essays (1959)”

Most human beings have an almost infinite capacity for taking things for granted. That men do not learn very much from the lessons of history is the most important of all the lessons of history.

Today is different from the past.

Global debt levels are at unprecedented scale and continues to compound. G-4 central bank expansion of balance sheets has gone way past $10 trillion as central bankers turn dovish in the face of rising yields.

Just last week, Mario Draghi, the president of the European Central Bank tossed out his non-committal stance and declared that interest rates would “remain at present or lower levels for an extended period of time” and further signalled a “downward bias” in interest rate.

Meanwhile, Mark J. Carney’s inaugural act, as governor of the Bank of England was to introduced a supposedly new tool called “forward guidance”. And in an official statement Mr. Carney declared that “any expectations that interest rates would rise soon from their current record low level were misguided”[14]

And like Pavlov’s drooling dogs, steroid starved markets swung heavily to the upside…until the US jobs reports, which offset much of the earlier gains.

In the past, it took a few months for central bankers to weave their magic in tempering bond yields. Now the honeymoon seems to take just a day. UK (left), French (middle) and German (right) 10 Year yield soar along with US yields even as the ECB and BoE says that interest rates are bound to go lower.

The bond vigilantes appear to be in open defiance against central bankers!

One can see how Friday’s bond market rout has affected Europe and the US[15]. Since Europe’s market closed earlier than the US, my guess is that selling pressures in Europe has been subdued as US yields soared at the close of the trading session.

If Asia should carryover the bond market carnage, then it is likely that the meltdown should persist in Europe.

Nevertheless given the oversold conditions a temporary pullback should be expected.

Notice too how bond yields in all American and European has surged strongly over a month.

The lessons of history are that rising yields have largely been incompatible with sustained stock market booms. Both may concomitantly rise but the eventual outcome has been a bear market cycle (2007-2008, dotcom bubble), stock market crash (1987) or a quasi-bear markets (1983-1984 or 1981-1982).

The relationship has hardly been statistical but causal—rising rates eventually prick unsustainable debt financed bubbles.

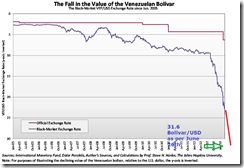

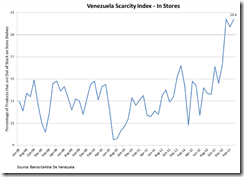

Yet a stock market boom can be engineered by governments that could destroy historical precedents. Venezuela should be an example. Venezuela’s stock market has been up a stratospheric 160% year to date. This translates to star bound 460% in one and a half years. But Venezuela’s deceiving outperformance comes at a heavy toll: the collapse of her currency the Bolivar which means rising stocks are symptoms of hyperinflation.

Again rioting bond markets as expressed through rising yields (which are indicative of higher policy rates) seems like the proverbial ‘sword of Damocles’[16] which hangs over the heads of the stock markets.

Differently put, unless bond markets stabilize, rising stock markets in the US or elsewhere, looks like an accident waiting to happen.

Risk is high.

Trade with utmost caution.