In the Book of Revelation in the Christian Bible, the end of the world or the ‘Last Judgment’ will be presided by the four horseman of the apocalypse. These figurative horsemen embodies conquest, war, famine and death.

While not exactly according to biblical prophesy, such allegorical omen may be seen as applicable to today’s modern day financial and monetary central bank based fractional reserve money system.

From the Sovereign Man’s prolific Simon Black (bold mine)

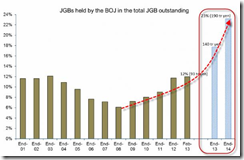

Today’s financial system is dominated by central bankers who have been awarded nearly dictatorial control of global money supply.In allowing them to set interest rates, they are able to control the ‘price’ of money, thus controlling the price of… everything.This power rests primarily in the hands of four men who control roughly 75% of the entire world money supply:-Zhou Xiaochuan, People’s Bank of China-Mario Draghi, European Central Bank-Haruhiko Kuroda, Bank of Japan-Ben Bernanke, US Federal ReserveFour guys. And they control the livelihoods of billions of people around the world.So, how are they doing?We could wax philosophically about the dangers of fiat currency. Or the dangers of the rapid expansion of their balance sheets. Or the profligacy of wanton debasement through quantitative easing.But let’s just look at the numbers.In theory, a central bank is like any other bank. It has income and expenses, assets and liabilities.For a central bank, assets are typically securities or commodities which have value in the international marketplace, such as gold or US Treasuries.Central bank liabilities are all the trillions of currency units floating around… dollars, euros, yen, etc.The difference between assets and liabilities is the bank’s equity (or capital). And this is an important figure, because the higher the capital, the healthier the bank.Lehman Brothers famously went under in 2008 because they had insufficient capital. They had assets of $691 billion, and equity of just $22 billion… about 3%.This meant that if Lehman’s assets lost more than 3% of their value, the company wouldn’t have sufficient cushion, and they would go under.This is exactly what happened. Their assets tanked and the company failed.So let’s apply the same yardstick to central banks and see how ‘safe’ they really are:US Federal Reserve: $54 billion in capital on $3.57 trillion in assets, roughly 1.53%. This is actually less than the 1.875% capital they had in December. So the trend is getting worse.European Central Bank: 3.69%Bank of Japan: 1.92%Bank of England: 0.843%Bank of Canada: 0.532%Each of these major central banks in ‘rich’ Western countries is essentially at, or below, the level of capital that Lehman Brothers had when they went under.What does this mean?Think about Lehman again. When Lehman’s equity was wiped out, it caused a huge crisis. The company’s liabilities instantly lost value, and almost everyone who was a counterparty to Lehman Brothers lost a lot of money because the company could no longer pay its debts.Accordingly, if the US Federal Reserve’s assets unexpectedly lose more than 1.5% of their value, the Fed’s equity would be wiped out. This means that any counterparty holding the Fed’s liabilities (i.e. Federal reserve notes) would lose.More specifically, that means everyone holding dollars.Theoretically if a central bank becomes insolvent, it can be bailed out. It happened in Iceland a few years ago.There’s just one problem with that thinking.Iceland’s government wasn’t in debt at the time. So they were able to borrow money in order to bail out their central bank. Today the government is in debt over 100% of GDP, but the central bank is solvent.But governments in the US, Europe, Japan, England, etc. are all too broke to bail out their central banks. These governments are already insolvent. So if the central bank becomes insolvent, there won’t be anyone to bail them out.This is one of the strongest indicators of all that the financial system as we know it is finished. When central banks can no longer credibly issue liabilities, and their home government are too broke to bail them out, this paper currency standard can no longer function.Such data really underscores the importance of owning real assets such as productive land and precious metals.Given its nominal roller coaster ride lately, there has certainly been a lot of scrutiny and skepticism about gold.But to paraphrase Tony Deden of Edelweiss Holdings, if you dispute the validity of gold as a hedge against declining fiat currency, that makes you, by default, a paper bug. Can you really afford to be confident in this system?

As been repeatedly noted here, QEs by major central banks have been meant to shore up asset markets which underpins the assets on the balance sheets of crony banks, and their guardians, the central banks.

Of course QEs has fostered a low interest rate environment, which in effect, subsidizes debt financed government spending and the welfare warfare bureaucracy that the banking system, by virtue of Basel regulations, holds mainly as 'risk free' collateral.

And the same set of collateral have been used by crony banks to get loans from discount windows of central banks, and likewise, these collateral constitutes one of the major instruments used by central banks to conduct QE.

So all these ‘merry-go-around” or 'cul-de-sac' or 'loop-a-loop' arrangement has been designed to eliminate the threat of insolvencies of the cartelized unsustainable centralized debt-based political economic system

But there’s more. For the major economies, central banks can use changes in accounting methodologies to elude insolvencies, similar to the US Federal Reserve in January 2011.

As Austrian economist Robert Murphy noted, “It is now mathematically impossible for the Fed to become insolvent, through the magic of "negative liabilities."”

Ultimately central banks will tap the printing press should "bank runs” occur.

Again Professor Murphy:

But for the case of the Federal Reserve — with dollar-denominated liabilities — it is hard to see what actual constraints it would face, should its accountants suddenly announce its insolvency. Even if there is a "run on the Fed," where all of the commercial banks want to withdraw their electronic reserves on the same day, the central bankers need not panic: they can order the Treasury to run the printing press in order to swap paper currency for electronic checkbook entries. (This is a neat trick unavailable to the mere commercial bankers.)

The smaller central banks will not have the same privileges. Nonetheless, their assets are also anchored on assets of their major contemporaries.

I would like to further point out that aside from Iceland, another example of a bailed out insolvent central bank has been the defunct Central Bank of the Philippines (CBP)

As I wrote in June 2012

Central Bank of the Philippines, the predecessor of the BSP, suffered massive losses to the tune of an estimated Php 300 billion as consequence of the series of bailouts provided by then President Cory Aquino to her favorites.The losses were eventually transferred to the central bank board of liquidators.

Don’t take just take it from me. Canadian monetary analyst JP Koning recently noted (bold mine)

Consider the case of the Central Bank of Philippines (CBP), for instance. According to Lamberte (2002), the CBP was harnessed by the government in the 1980s to engage in off-balance sheet lending and to assume the liabilities of various government-controlled and private companies. All of this was to the benefit of the government as it lowered the deficit and kept spending off-budget. Later on these loans proved to be worthless, leaving the central bank holding the refuse. This has shades of Enron, which used various conduits and SPVs to hide its mounting losses.The CBP was replaced in 1993 by the newly chartered Bangko Sentral ng Pilipinas (BSP). The BSP took over the CPB's note and deposit liabilities, as well as its foreign reserves and other valuable assets (the bad assets were allocated elsewhere).

A non-partisan observation on the populist perception which sees political leadership then as a 'virtuous' regime.

Bottom line: Small central banks will be bailed out. But if troubles of the four biggest and the most important central banks aggravates, then as Mr. Black notes “the financial system as we know it is finished” or financial apocalypse from the biblical equivalent of the four horsemen.