7,000. The Phisix has finally breached the psychological 7,000 level. This represents an amazing 20.86% gain year to date. This accrues to an average of about 5.2% a month since the start of the year. At the rate at of such gains, 10,000 will be reached by the end of the year which should translate to over 40% nominal currency peso returns.

Up, Up and Away!

Financial markets are supposed to represent as discounting mechanisms. Considering the heavy expectation built on “credit rating” upgrades, after an earlier upgrade by Fitch Rating[1], last week’s upgrade by Moody’s should have been a yawner.

But no, the local stock markets used such events instead to furiously bid up on the markets. The Phisix zoomed by 2.32% on Monday on rumors of the upgrade (left window, chart from technistock.com).

The following day, the local benchmark retrenched 80% of the Monday gains or fell by 1.94% day on day on supposedly on “valuation” issues.

Analysts, foreign and local, had been quoted as saying the local equities were “beyond the correct valuation” and therefore “expensive”[2]. But again no one explained or was quoted to elucidate on how and why local stocks “have gone up and become expensive”.

Contrary to such ‘expert’ rationalization, the public evidently liked “expensive”. They pushed the markets beyond the 7,000 levels. Whoever said market traded on valuations[3]?

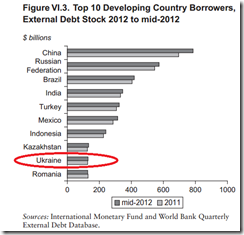

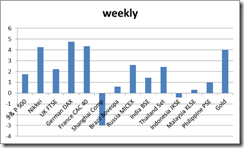

The Phisix was up .98% over the week, along with ASEAN peers with the exception of Indonesia’s JCE. Suddenly there had been a marked rebound on global equity markets, in what appears to be a sign of the resumption of a “risk ON” environment.

US markets have also been exhibiting signs of a parallel universe where earnings expectations and stock prices have gone in opposite directions[4].

As one would note, the recycling of supposedly good news means that bulls have been steadfastly refusing for the need to correct or for normal cycles to prevail, and this only means that the mania phase has deepened.

There is no way but, to borrow from Superman, up, up and away!

The Secret of Asia’s Rising Star: Credit Bubble

Moody’s upgrade has been justified as the Philippines representing “Asia’s Rising Star”. Glenn Levine Moody’s analyst responsible for the publication of the upgrade was quoted by FinanceAsia.com as “Investors are bullish on the Philippines, and so are we”[5].

So has “appeal to the popular” replaced economic analysis as basis for upgrades? Or is it that Moody’s simply wants to jump on the bandwagon like everyone else?

Another article says that the other reasons for Moody’s bullishness have been due to construction and business process outsourcing sectors and domestic demand[6].

However the upgrade on the Philippines didn’t come with enough scrutiny, again FinanceAsia quotes the Moody’s analyst

“A stock market bubble would affect relatively few, but the Philippines’ real estate market is a concern, since housing investment is more widespread,” says Levine. “The scant available data on the Philippines’ real estate, alongside anecdotal evidence, suggest that prices and construction may be rising ahead of fundamentals. This bears watching.”

The above represents the changes of loans from the banking sector to the supply side and the demand side. Data from BSP.

Since 2010 financials, real estate and trade, which accounts for more than 40% of total banking loans, have been running past 20% and rapidly increasing. I didn’t include construction loans despite its monstrous jump 57% year on year jump last February due to time constraints.

Does the analyst from Moody’s know how much of the 20% increase year-to-date increase in the Phisix, aside from last year’s 32% returns, has been based on borrowed money from banks? From the above statement they are clueless.

Yet lending in financial intermediaries has jumped by over 30% in 2011-2012 and 27% this February (year on year).

So if a lot of money loaned from the banks has been channelled into the stock market, then despite the stock market’s small penetration level, a stock market hit will also extrapolate to a hit on loans and the banking system and other creditors. Thailand, may not be the Philippines, but the recent increase imposed by regulators in collateral requirements for margin trades jolted the SET[7], whom at the start of the year had been running neck to neck with the Phisix.

What’s the point? Thailand’s booming stock market has likewise been founded on a credit boom.

So, to conclude that the impact will be “relatively few” seems groundless and signifies a reckless conclusion.

On the demand side, household credit has risen to the mid-teen levels or more than double the statistical growth of the local economy.

This represents the robust domestic demand?

People have been confusing credit intoxication with productivity. Credit does not, in most occasions, translate to productive growth.

Yet ironically, the mainstream can’t seem to fathom the difference between statistical growth and real growth. Statistical GDP numbers has been computed based on the growth rate pumped up by such underlying credit growth.

This means that the statistical growth has been much puffed up. Without the credit boom statistical GDP will reflect on significantly lower numbers.

I have not enough data for BPOs to make any comments.

Are credit bubbles sustainable?

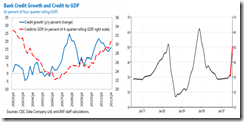

Bank credit growth has been running amuck, close to 30% (year on year; blue line, left window) and nearly 20% (4 quarter rolling GDP, red line)! This is according to the chart from the latest IMF 2013 ARTICLE IV CONSULTATION[8].

Domestic credit to the private sector as percentage of the GDP has spiked to 50.4% by the end of 2012 according to the BSP chief (right window). I previously quoted his speech on my last comment on this[9], now the same figure has been splashed over at media[10]. In 2011 the data was only at 31.78%. This means that in 2012, debt as % to GDP rocketed by 18.62%!

And given the rate of acceleration, which will be compounded by all these upgrades, we can expect that, regardless of the price levels of the Phisix (10,000 or not) at the end of the year, domestic debt to the private sector in % will likely balloon to anywhere around 60-70% or even more!

The BSP chief has the public routine of comparing Philippine debt levels with that of our regional peers. According to him, local debt levels are “low” given the 100%+ levels of our neighbors.

But again this really represents the fallacious apples to oranges comparison. Political money authorities feel like having attained a state of celestial bliss. This time is different. This is the new order.

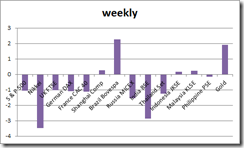

In their chronicles of global financial crises over the eight centuries, Harvard Professor’s Carmen Reinhart and Kenneth Rogoff in their book points out, that debt intolerance or the “extreme duress” of debt levels which “involves a vicious cycle of loss of confidence, spiralling interest rates on external government debt and political resistance to paying foreign creditors”[11], have had “very different thresholds for various individual countries”.

Furthermore they state that “the worst the history, the less the capacity to tolerate debt”[12].

In the past, the Philippines fell into a recession or a crisis when debt levels reached 51.59% in 1983 and 62.2% in the pre-Asian crisis of 1997. While the level of debt intolerance may increase, expectations of 100% levels similar to our peers signifies as sheer fantasy.

A famous quote from Karl Marx in his book the Eighteenth Brumaire of Louis Napoleon[13] "History repeats ... first as tragedy, then as farce" seems very applicable today.

And given the dramatic deluge of debt, confidence can evaporate with a snap of a finger, where “rising star” may became a wayward meteor, especially when creditors become increasingly sceptical of the debtor’s ability to settle on their liabilities

In short, while I expect the mania may go on through the year, anytime the Philippines reaches or even surpasses the 1997 debt levels then she will become increasingly fragile or vulnerable to a recession or a crisis that may be triggered internally or externally.

BSP Officials on Bubbles: Yes and No

This week other BSP officials have offered mixed signals.

Some reportedly acknowledged the existence of bubbles, but like Thai authorities, deny of their risks, since they presume to have the tools to rein them.

But Deputy Governor Nestor Espenilla issued the strongest statement on bubbles so far, as quoted by Bloomberg[14]

“Our source of concern is the rapid growth of credit,” Espenilla said in his office on April 24. “The central bank is very mindful of seeing the foundation of an asset bubble that can burst and create dislocations in the economy.

Now we are talking.

A major market participant mentioned in the same article seems in a state of denial

“Demand is still growing,” Henry Sy Jr., chief executive officer of SM Development Corp. (SMDC), said in an April 24 interview. “But there’s danger in some areas because good days don’t last forever.”

But the Bloomberg reports that the SM group plans to invest up to 71 billion pesos on expansion up until 2015. Such magnitude of spending doesn’t seem to suggest that “good days don’t last forever”, because these implies of an investment payoff from 2015 and beyond!

Yet demand continues to grow, because of the acceleration of the credit boom.

And it gets more interesting. From the same article

“There could be some surplus in the upper end of the market,” central bank Deputy Governor Diwa Guinigundo told reporters yesterday. “On the more significant parts of the market like the low-cost, socialized and medium-cost, there are no signs of a bubble formation.”

Some very noteworthy aspects from the comment.

The good Deputy Governor Diwa Guinigundo resorts to the fallacy of substitution and composition. The allusion to areas supposedly unaffected by bubbles or the absence of bubbles doesn’t validate or invalidate the presence of bubbles elsewhere. Such represents an ambiguous statement designed to evade the question or that the good governor has poor grasp of bubbles.

Bubbles are concentrated on capital intensive popular themes that reflect on the cluster of entrepreneurial errors as incentivized by policies.

As the great dean of the Austrian school of economics, Murray N. Rothbard explained[15].

But the regular, systematic distortion that invariably ends in a cluster of business errors and depression—characteristic phenomena of the "business cycle"—can only flow from intervention of the banking system in the market

Yet Mr. Guinigundo seems to echo US Federal Reserve Chairman Ben Bernanke, who denied of a housing bubble and of the 2007 crisis until it blew up on the face of the US Federal Reserve

In a 2010 speech, Mr. Bernanke admitted to his failure to act on a national housing bubble[16].

Although the house price bubble appears obvious in retrospect--all bubbles appear obvious in retrospect--in its earlier stages, economists differed considerably about whether the increase in house prices was sustainable; or, if it was a bubble, whether the bubble was national or confined to a few local markets.

Also it would signify as an obvious mistake to presume bubbles as merely a “upper higher end of the market” phenomenon.

Shopping malls[17] and the casino industry, whom are part of the property sector, have been acquiring substantial amounts of banking loans in support their rapid growth. The rate of which has gone far beyond the growth rates of their respective demand side of the markets, particularly domestic consumers and regional bettors, respectively.

In other words, property projects for different classes of customers that have not been limited to the upper scale.

Shopping malls have catered largely to the general local population depending on the malls, whereas the coming casino complex has likely been targeted at regional or foreign clienteles.

Casino Bubble Redux

One of the four grand casino projects by the incumbent regime has reportedly obtained 14 billion pesos of debt from 3 banks for expansion. Three more grand casinos have been slated to open within 3 years[18].

Melco Crown (Philippines) Resorts Corp has reportedly raised $377 billion from follow on IPO offering[19]. My guess is that the next phase of fund raising will be on debt, whether from bonds or banking loans, perhaps similar to the path of the newly opened Solaire Manila which is owned and controlled by Enrique Razon led Bloombery Resorts [PSE BLOOM].

These marquee casinos are essentially competing with the regional casinos for the regions bettors rather than dependent on local peers. So the fate of these companies are essentially anchored or leveraged on regional growth.

Mainstream observers also say that such elaborate projects should help the tourism industry seems largely misunderstood. Many foreign based high rollers hardly go around the country as regular tourists. Their itinerary consists of the sojourn between casino and the airports. So while the casino, select hotels, and allied services and the airports benefits, they are hardly considered tourism in the conventional context.

Nevertheless, as discussed before, the gaming industry is said to grow at 28% CAGR from 2012-2018, when the average regional growth will be about the growth rate of the Philippines.

Yet these casinos appear to be political “pet” projects. These companies will operate on the government owned 8 hectare property envisioned as a Las Vegas entertainment complex known Entertainment City[20] and under the auspices or supervision of the Philippine Gaming and Amusement Board (PAGCOR)[21].

This also means that to obtain such privileges one has to be considered favorably within the circles of the incumbent political elite. And this is why one of the four major license holder whom is a Japanese mogul had been accused of bribery because such license had been acquired during the previous administration[22].

But political “pet” projects are unlikely good bets. They barely exists to serve customers. Instead these politically privileged agents use government “licensing” as economic moats from competition in order to extract financial rent, which they share with government directly and indirectly.

If the successes of political pet projects are to be measured, US President Barack Obama green energy “pet” projects could be used as paradigm. Obama’s green energy embodies a roster of failures[23]. Recently another supposed hybrid electric car company that got $200 million from the US government has been on the verge of bankruptcy[24].

I know, green energy projects are not casinos and Philippine politics haven’t been the same as American politics. But the hoopla of supposed gains where according to a study quoted by Finance Asia[25] “gaming revenues to more than double to $3.2 billion in 2015 from an estimated $1.4 billion in 2012, and reach $4.1 billion by 2016 as the supply increases” conspicuously ignores the risks from a severe regional economic slowdown, or a bursting bubble.

Such studies, which the political class relies on, overlook why global central banks need to keep interest rates at zero bound, and why central banks of developed economies need to expand balance sheets.

Nonetheless these big 4 casino operators will likely get bailed out once financial conditions turn against their expectations, which seems as why such aggressive risk taking behavior.

Early Signs of the Periphery to the Core?

Of course the most important kernel of wisdom from Mr. Guinigundo’s quip looks like a revelation of what I call “periphery to the core” dynamics developing in the property sector.

He notes that there are “some surplus in the upper end of the market” without explaining the ramifications.

Well, allow me.

Surpluses may lead to cash flow problems for highly leveraged firms that may prompt for foreclosures.

If the incidences of surpluses multiply, then this could put to risk the entire bubble structure.

An overleveraged sector amplifies the risks of insolvencies that would undermine creditors, particularly the banking system which has been the source of much of the financing as shown above[26].

Bond creditors will also get hurt. And the impairment of assets of the banking industry would mean a general tightening of credit conditions.

Such contraction in bank assets would also translate to debt deflation or a bubble bust which also implies the race to liquidate or to raise cash, capital or margin calls at depressed price levels.

Thank you for the clues, Deputy Governor Mr. Guinigundo.

For shopping malls, the “periphery to the core” would start from the mall areas with the least traffic and from marginal malls or arcades.

Surpluses amidst a boom which implies high rents, high cost of operations such as wages, electricity and other inputs prices, would place pressure on profits of retail tenants competing for consumers with limited purchasing capacity.

Periphery to the core would mean initially fast turnover from retail tenants on stalls of lesser traffic areas and of marginal malls. Then the length of vacancy extends and the number of vacancy spreads.

Leveraged malls and arcades thus will suffer from the same vicious cycle of cash flow problems and eventual insolvencies that will impair creditors and will spread to many sectors of the economy.

Why has the Philippine Bond Yield Curve been Flattening?

The slope of the Philippine yield curve has dramatically been flattening (red arrow) since the start of the year. This week (red line) the 10 year revealed of a strong move. This compares with the previous week (green) or end of March (blue). Also see table on the right from Asianbondsonline.com[27]

This has been in stark contrast with our neighbors whose curves have registered marginal changes.

Rates from the longer end of the curve, particularly the 10 year bonds, have materially declined, which has been down by 137.5 bps year-to-date as of Thursday.

Why are investors stampeding into the Peso based government 10 year bonds? Are they discounting price inflation amidst the so-called ‘Rising Star of Asia’ boom?

Has this been merely yield chasing? Particularly by foreigners? Or has this been an anomaly? Why lock into 2.775% for 10 years, if so-called boom could lead to the risks of inflation or “ overheating” pressures?

Yet if such slope flattening continues, where the short end begins to rise while the longer end continues to fall then we may segue into an inverted yield curve: a harbinger of recession as a liquidity squeeze from malinvestment gets reflected on diametric moves of coupon yields across the maturity curve.

Moreover, flattening of the slope will theoretically reduce the banking system’s net interest margins[28].

Although today’s banking system has been more sophisticated since they don’t rely on net interest income alone.

But the Philippine banking’s income statement shows that as of June 2012 net interest income is at 122.543 billion pesos relative to 73.876 billion pesos of non interest income according to BSP data[29]. So the banking system will have to rely on non-loan markets, otherwise there will be pressure on profits.

Developments in the Philippine bond markets appear to be a conundrum to the Rising Star of Asia meme.

The “Controlled Deficits” Travesty

Another supposed bullish reason with Moody’s on the Philippines is the so-called “controlling fiscal deficits”.

One would wonder, if the Philippines has indeed been booming, why the tremendous pressure to raise taxes on the public?

Why does the Aquino regime resort to an implicit class warfare campaign of “ostracization” against the Chinese community[30] and on Forbes billionaires over taxes[31]?

Current fiscal conditions offers as some clues.

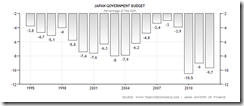

Cash operation on National government continues to operate on deficits, where expenditures have been more than revenues, as shown by the 2012 BSP Annual Report[32], since the advent of the Aquino presidency.

The same changes in deficits can be seen in % year-on-year and as % of GDP changes from the IMF’s paper.

Since 2009, tax revenues has been blossoming alright, but this represents less than 10% y-o-y growth, which should reflect on economic performance, or that tax revenues fluctates from about 4-8% GDP. But the government’s spending at 20% y-o-y, 8-12% of GDP has ballooned by even more!

Some controlling deficits eh?

The reason statistical debt-to-gdp or deficit-to-gdp ratio continues to exhibit signs of resilience has been mainly because of accounting treatment. Statistical gdp, which has been bolstered by a credit boom, has reduced the increases of government liabilities.

Moreover, government expenditures have been growing in a straight line (green arrow). But taxes mainly depend on, and are entirely sensitive to economic performance. So the revenue side of the government’s accounting book are variable while the expenditure side are at a fixed trend growth. Such asymmetry is a recipe for instability.

Should an economic slowdown occur, or worst, if a recession happens, those deficits will balloon as tax revenues collapse. Thus “controlled deficits” are really a charade.

While one can argue about from collection efficiencies, taxes essentially crowds out productive investments, so I would counter that tax collection inefficiencies are a good thing or adds to economic efficiency. As the great Ludwig von Mises would say “Capitalism breathes through those loopholes.[33]”

The US crisis of 2007-2008 was felt only in 2009, where a massive decline in tax revenue led to a jump in fiscal deficits. This transpired even when the Philippines didn’t fall into a recession.

Yet given that government spending continues to swell, now at far more than the 2009 levels, any regression of tax revenues to the 2009 levels would amplify deficits. The 2009 event is a clue to what will happen in the future…but magnified.

Moody’s will be exposed for another flawed call.

Moody’s and the false acclaim of political ascendancy along with all the rest are symptoms of the credit bubble in full motion.

As the great Ludwig von Mises warned[34],

All governments, however, are firmly resolved not to relinquish inflation and credit expansion. They have all sold their souls to the devil of easy money. It is a great comfort to every administration to be able to make its citizens happy by spending. For public opinion will then attribute the resulting boom to its current rulers. The inevitable slump will occur later and burden their successors. It is the typical policy of après nous le déluge. Lord Keynes, the champion of this policy, says: "In the long run we are all dead." But unfortunately nearly all of us outlive the short run. We are destined to spend decades paying for the easy money orgy of a few years.

[12] Reinhart and Rogoff Op. cit p.25

[26] IMF Country Report Philippines Op cit p.19