Move over shale gas, here comes methane hydrate. (Perhaps.) On Tuesday the Japanese government’s drilling ship Chikyu started flaring off gas from a hole drilled into a solid deposit of methane and ice, 300 metres beneath the seabed under 1000 metres of water, 30 miles off the Japanese coast.The real significance of this gas flare probably lies decades in the future, though the Japanese are talking about commercial production by 2018. The technology for getting fuel out of hydrated methane, also known as clathrate, is in its infancy. After many attempts to turn this “fire ice” into gas by heating it proved uneconomic, the technology used this week – depressurizing the stuff – was first tested five years ago in Northern Canada. It looks much more promising.Methane hydrate is found all around the world beneath the seabed near continental margins as well as in the Arctic under land. Any combination of low temperature and high pressure causes methane and water to crystallise together in a sort of molecular lattice. Nobody knows exactly how much there is, but probably more than all the coal and oil put together, let alone other gas.The proof that hydrate can be extracted should finally bury the stubborn myth that the world will run out of fossil fuels in any meaningful sense in the next few centuries, let alone decades. In 1866, William Stanley Jevons persuaded Gladstone that coal would soon run out. In 1922 a United States Presidential Commission said “Already the output of gas has begun to wane. Production of oil cannot long maintain its present rate.” In 1956, M. King Hubbert of Shell forecast that American gas production would peak in 1970. In 1977 Jimmy Carter said oil production would start to decline in “six or eight years”. Woops.The key will be cost. However, Japan currently pays more than five times as much for natural gas as America so even high-cost gas will be welcome there. The American economy, drunk on cheap shale gas, will not rush to develop hydrate. (Unlike oil, there is no world price of gas because of the expense of liquefying it for transport by ship.)

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, March 16, 2013

Welcoming the Gas Age

Tuesday, December 04, 2012

Shale Gas Boom Attracts Record Asian Takeovers

Woodside Petroleum Ltd. (WPL)’s purchase of a stake in Israel’s largest natural gas deposit takes Asia- Pacific oil and gas acquisitions to a record $99 billion this year, tying the U.S. for the first time.Australia’s second-largest petroleum producer yesterday said it will pay partners including Noble Energy Inc. (NBL) an initial $696 million and as much as $2.3 billion for part of the Leviathan field. Deals by U.S. energy companies have fallen 35 percent to $98.7 billion in 2012, while Asia-Pacific purchases increased 3.8 percent, according to data compiled by Bloomberg.The Leviathan deal underlines the growing appetite for oil and gas assets among Asia-Pacific companies after energy demand in the region grew at more than double the world average of 2.5 percent in 2011. China Petroleum & Chemical Corp. (600028), Cnooc Ltd. (883) and India’s Oil & Natural Gas Corp. (ONGC) have secured supplies abroad as new fields are found from North America to Africa.“There are so many more options for Asian companies now with new discoveries around the world,” said Laban Yu, head of Asian oil and gas equity research at Jefferies Hong Kong Ltd. “The trend will be led by China, which has a large foreign- exchange reserve and is seeking hard assets.”…A surge in oil and gas production from shale rocks in the U.S. and Canada is prompting operators to rope in partners to meet capital expenditure. Canada, home to the world’s third- biggest oil reserves, will require almost C$650 billion ($655 billion) of investments to develop the nation’s biggest resource projects over the next decade, according to Natural Resources Minister Joe Oliver.“Higher production in North America means large amounts of capital and operators have no option but to sell some of their assets,” said Sonia Song, a Hong Kong-based analyst at Nomura Holdings Inc. “Buyers from Asia are stepping in.”

Tuesday, September 04, 2012

Natural-Shale Gas Revolution Spreads to Israel

The natural-shale gas boom spreads to Israel.

Reports the Financial Times (hat tip Carpe Diem’s Professor Mark Perry)

With reserves of almost 10 trillion cubic feet of natural gas, the Tamar field is a hugely valuable asset for the Israeli economy. Discovered in January 2009, it was the biggest gas find in the world that year, and by far the biggest ever made in Israeli waters. But the record held for barely two years. In December 2010, Tamar was dwarfed by the discovery of the Leviathan gasfield some 20 miles farther east – the largest deepwater gas reservoir found anywhere in the world over the past decade. The two fields, together with a string of smaller discoveries, will cover Israel’s domestic demand for gas for at least the next 25 years, and still leave hundreds of billions of cubic feet for sale abroad. The government take from the gasfields alone is forecast to reach at least $140bn over the next three decades – a staggering sum for a relatively small economy such as Israel’s.

It’s not just in Israel but as I previously pointed out the Natural-Shale gas revolution will become a world wide phenomenon.

And we are seeing some evidence of such progress. Again the FT,

Experts are convinced that Tamar and Leviathan will not be the last big Israeli discoveries. They point to the US Geological Survey, which estimates that the subsea area that runs from Egypt all the way north to Turkey, also known as the Levantine Basin, contains more than 120 trillion cubic feet of natural gas. Israeli waters account for some 40 per cent of the total. Should these estimates be confirmed through discoveries in the years ahead, Israel’s natural gas reserves would count among the 25 largest in the world, on a par with the proven reserves of Libya and ahead of those of India and The Netherlands.

Earlier Israel seems to have been devoid of energy resources.

For decades a barren energy island, forced to import every drop of fuel, Israel today stands on the cusp of an economic revolution, fuelled by the vast riches that lie below its waters.

left chart from Financial Times, right chart from Financial Post

But thanks to human ingenuity, massive advances in technology have transformed what was once resources of little economic value to become abundant highly economically valuable commodities.

Hopefully Israel’s newly discovered energy resources will serve as blessings than a (resource) curse. But this will depend on how the domestic and geopolitical trends in Israel and the Middle East will evolve.

Saturday, June 09, 2012

Shale Revolution Fuels Agricultural Boom in Parts of India

One of the multiplier effects of the ongoing Shale gas boom has been to promote a special agricultural product, a bean grown in India, required for horizontal fracking.

From the Wall Street Journal (hat tip Professor Mark Perry)

From its place on humble Indian tables, a little-known Indian bean called “guar” is making the fortunes of poor farmers.

The demand for guar has soared since gum made from guar seeds started being used to extract shale gas late last year.

Mostly grown in the heart of India’s desert lands, the price of the vegetable has jumped from about 40 rupees ($0.7) a kilogram at the time of the September-October harvest to around 300 rupees ($5.4) per kilogram today.

As a result, barefoot farmers who until recently struggled to make a living are now riding cars and motorbikes and carefully locking the seeds away, according to B.D Aggarwal, managing director of Vikas WSP, an exporter of guar gum.

“There was very strong demand from the overseas oil industry because of a new technology – that is horizontal fracking – for shale gas extraction. There is no alternate to guar for this technology,” said Mr. Aggarwal.

Shale gas, natural gas trapped within shale formations, has become an increasingly important source of natural gas in the United Stated over the past decade, with some analysts expecting its supply to surge to around half of the natural gas production there by 2020.

Horizontal fracking, which requires the use of guar gum as a gelling agent, is considered safer for the environment than the other alternative – a technology known as “hydraulic fracking.”

Guar gum has other uses as well, including for oil drilling and in the textile and paper industries.

Mr. Aggarwal estimates that around 80% of the 1.2 million tons of guar that were harvested last season were snapped up for oil and gas drilling.

For investors such opportunity is what one would call a "pick and shovel play" (Investopedia.com) or a strategy where investments are made in companies that are providers of necessary equipment for an industry, rather than in the industry's end product.

Sunday, June 05, 2011

Poker Bluff: No Quantitative Easing 3.0?

It would be a mistake to assume that the modern organization of exchange is bound to continue to exist. It carries within itself the germ of its own destruction; the development of the fiduciary medium must necessarily lead to its breakdown. Once common principles for their circulation-credit policy are agreed to by the different credit-issuing banks, or once the multiplicity of credit-issuing banks is replaced by a single world bank, there will no longer be any limit to the issue of fiduciary media.-Ludwig von Mises

The US Federal Reserve’s Quantitative Easing programs will be terminated at the end of this month and some have suggested that this program will be discontinued for good.

I’ll say they’re dead wrong.

Same Old Song

I have heard this music before. In late 2009 going into 2010, as the markets recovered the mainstream blabbered about “exit strategies”.

I called this Bernanke’s poker bluff[1].

Bottom line: Interest Rate Derivatives, Expanding GSE Operations, Economic Ideology Record Debt Issuance, Rollover and Interest Payments, Devaluation as an unofficial policy, Political Influences On Policy Making and the Question Of Having To Conduct Successful Policy Withdrawals all poses as huge factors or incentives that would drive any material changes in the Federal Reserve and or the US government policies.

In knowing the above, I wouldn’t dare call on their bluffs.

In November or 10 months later, Bernanke’s Fed unraveled the QE 2.0[2].

Have any of the above variables changed for the better?

The short answer is NO.

All of the above factors seem in play and some may have turned for the worst.

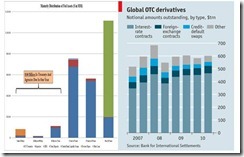

One, while growth of derivatives (see right window) have slowed they remain sizeable. Importantly growth in interest rate contracts has reached pre-crisis highs.

Reports the Economist[3],

Interest-rate contracts, which make up the bulk of the market, reached $465 trillion in December 2010, exceeding their pre-financial-crisis level. While notional amounts are one measure of market size, the BIS says that gross market values, which measure the cost of replacing all existing contracts, more accurately assess the amounts that are actually at risk. The gross market values fell by 13% in the six months to December 2010, to $24.5 trillion.

So even if growth in gross market values of derivatives has been slightly reduced, an environment of higher interest rates will still risk unsettling the derivatives markets for its sheer size and complexity. That’s the reason why investment guru Mark Mobius currently warned that derivatives may trigger the next financial crisis[4]. For me, derivatives as shown by the sensitivity to interest rates movements represent a symptom rather than the cause.

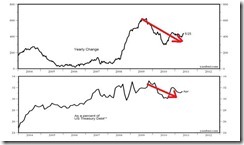

Second, the average maturity holdings of US treasuries has declined to all time lows, which according to Zero Hedge’s Tyler Durden, just hit 62 months[5] (see left window)

This only means that aside from financing the current fiscal record[6] deficits, the shorter maturities adds to the financial burdens of rolling over of some of these old debts. In short, the US treasury will deal with new debts as well as old ones.

Yet considering that the foreign official sector represents as the only parties (aside from the Fed) that have significant control on the supply holdings of US treasuries to materially influence prices, their recent actions does not indicate continued support to finance of US spending programs.

Foreign buying of US treasuries have been on a decline based on yearly change basis and as % of overall ownership (chart from yardeni.com[7]).

Faced with the risk of bond auction failure, the US government will likely try to avert this or get some insurance by having another round of QE.

Proof of this, as I presented last week, exhibits that nearly 100%[8] of US treasury issuance has been presently financed by the US Federal Reserve.

Morgan Stanley’s David Greenlaw estimates FED buying has accounted for 88% during the first quarter of 2011[9]. He also mentions that QE 1 reduced interest rates by 50 basis points on longer maturity securities, according to a Fed study which has on their calculation.

There seems to be a deepening relationship of dependency taking hold. And this certainly is not an auspicious sign.

The private sector as I earlier mentioned have accounted for as a marginal buyer. In addition, new regulations have financially repressed these institutions which compels them to finance (or acquire) government debts to comply with capital adequacy ratios that would meet with the Basel standards[10].

The record debt levels should also mean higher interest rate payments which should place additional burden on the economy.

Thus, the existence of the central bank has been to manipulate rates to benefit the government, aside from the banking sector, which intermediates such financing in behalf of the government.

More Rationalization and Signaling channel

Of course, I have also pointed out that the US housing appears to have regressed to a recession[11]

And all these are being vented on the equity prices of banking and financial sector.

As the US property sector staggers, such dynamic impairs or adds pressures to the values of the banking system’s balance sheets. The S&P Bank Index (BIX), the Dow Jones Mortgage Finance Index (DJUSMF), S&P 500 Financials (SPF) and the (XLF) Financial Select Sector have all been rolling over.

To say that NO quantitative easing would be in the pipeline would either mean an apostasy in economic ideology or the recognition of the mistakes from the past policies.

This also means disregarding the trillions thrown to support the banking sector during the last crisis (Neil Barofsky, special inspector general for the Treasury’s Troubled Asset Relief Program says $23.7 trillion[12] or CNN says $11 trillion committed and $3 trillion invested[13])

The fact that the Fed has been obstinately denying the causal linkages between QE and the commodity price increases coupled with patent serial interventions in the commodity marketplace by private regulators (most likely from indirect political pressures applied) via continuous increases in credit margins further suggests that part of the pre-deployment of QE 3.0 has been to condition or rationalize to the public of its necessity[14].

That’s hardly signs of conversion.

Furthermore, political authorities have been addicted to inflationism, which I have argued as signifying economic ideology and path dependency. This seems not only confined to the Fed but likewise to every major governments around the world.

Proof of this is the second round of bailouts being worked out for Greece[15].

And perhaps in anticipation of this cyclical slowdown, China has been in the process of threshing out a new massive bailout scheme[16] for local governments and their banking system, as well as, partially implementing new stimulus measures aimed at boosting the economy with large scale low cost housing projects[17]. Combined, these two grand projects could even surpass in scale, the 2008-9 $586 billion stimulus[18].

Adding to such bailout fad has been Russia and IMF’s rescue of Belarus[19] which appears to be on the brink of hyperinflation[20].

To top it all, the current signs of weakness in the US[21] or in China[22] or in the Eurozone[23] appear to be changing market’s sentiment everywhere.

Like addicts to illegal substance, even a local (Philippine) broadsheet carried a foreign report which appears to be subtly arguing for the rational of QE 3.0[24].

Meanwhile even the commodity marketplace, which has been under duress from the recent spate of interventions, doesn’t seem to be suggesting of the end of QE.

Gold continues to swiftly recover lost ground, while silver appears to be consolidating. The Reuters CRB (CCI[25] is an equal weighted index representing 17 commodities) seems to chime with gold but to a lesser degree. Importantly, natural gas which has been the perpetual laggard among the commodity spectrum seems likewise in an ascendant mode.

Gold Says QE 3.0

Rallying gold prices are not emblematic of desistance of QE, but rather a continuity of currency debasement activities conducted by global governments especially by the country which holds the principal privilege of seignorage—the US dollar.

We are not in a gold standard. While gold has shown incredible improvement in its reception as part of the financial system, where gold has recently been reckoned as collateral eligible[26], it is not money yet. Not yet anyway. We don’t use gold in payment and in settlement transactions.

Having said so, a disinflationary environment from a cessation of QE will lead to its price decline. Since markets operate as information discounting mechanism, then gold prices should not be rallying.

This will even be more pronounced if debt deflation does occur. Gold is unlikely a debt deflation hedge[27] as demand for cash would vastly increase under such conditions. Such dynamic was clearly evident in 2008[28] until the US Federal Reserve began its QE operations.

I’d further add that surging natural gas prices would imply as the deepening of inflation cycle. As I wrote in November 2010[29]

I’d be convinced of the deepening risks of the inflation cycle, when Natural Gas chimes in. So far, this hasn’t been so.

Well, the bull market in natural gas prices could have just begun.

It’s important to point out that many people, as the great Ludwig von Mises said[30],

think that there are higher and more important aims of economic policy than a sound monetary system. They hold that although inflation may be a great evil, yet it is not the greatest evil, and that the state might under certain circumstances find itself in a position where it would do well to oppose greater evils with the lesser evil of inflation. When the defense of the fatherland against enemies, or the rescue of the hungry from starvation is at stake, then, it is said, let the currency go to ruin whatever the cost.

This has also been manifested by the mainstream doctrine, which mistakenly believes that currency devaluation signify as an important tool to solve the economic problems. QEs has, thereby, worked as part of this measure to devalue the US dollar for purported economic ends.

Thus, the current lust for inflation signifies as a severe misunderstanding of the economic phenomenon which the mainstream mistakenly sees politics as a facile means to attain an economic end, from which usually backfires.

One should not also forget that in the US, policymakers are biased towards rising stock markets which for them serves as the trickle down multiplier from the “wealth effect” that works to boost spending and likewise triggers the “animal spirits” of the marketplace.

Thus the US stock markets constitute part of the coverage of the Fed’s policies[31]. To end the QE would extrapolate to the end of the support on the confidence transmission mechanism and to severe what they see as an important wealth effect multiplier.

Bottom line: NONE of the premises I wrote about in 2010, where I accurately predicted QE 2.0, has improved or has been resolved. In some instances they have worsened.

Thus for many reasons, especially applied to the US—the risk of bond auction failure, risk of imploding derivatives from higher interest rates, debt rollover risks and higher interest payments on sovereign liabilities, the implied policy of devaluation, risks of deterioration of the balance sheets of the major banking institutions, dogged refusal to instill fiscal discipline, ideological leanings and the path dependency of central bankers, risks of a downturn in the stock markets, rallying gold prices—all of which are strongly suggestive that there will be QE 3.0, 4.0, 5.0 until the nth.

It would take another monumental catastrophic crisis or a major transformation of people’s belief to embrace sound money and eschew the principle of inflationism for such policies to end.

And this won’t be happening anytime soon.

Lastly never trust government’s words, they always seem mellifluous but are usually laced.

[1] See Poker Bluff: The Exit Strategy Theme For 2010, January 11, 2010

[2] CNN Money QE2: Fed pulls the trigger, November 3, 2010

[3] Economist.com Global OTC derivatives, May 31, 2011

[4] See Will Derivatives Cause the Next Financial Crisis? May 31, 2011

[5] Durden, Tyler Fed Balance Sheet And Monetary Base Update - New Records All Around, Zero Hedge, June 2, 2011

[6] Financial Times, Record US budget deficit projected, January 26, 2011

[7] Yardeni.com, US Government Finance

[8] See How External Forces Influence Activities of the Phisix, May 29, 2011

[9] Greenlaw David Who Will Be the Marginal Buyer of Treasuries Post-QE2?, Morgan Stanley June 2, 2011

[10] See Financial Repression Drives The Bond Markets, May 23, 2011

[11] See How could the Euro be so strong? June 1, 2011

[12] See $23.7 Trillion Worth Of Bailouts?, July 29, 2010

[13] CNNMoney.com CNNMoney.com's bailout tracker

[14] See War on Commodities: Intervention Phase Worsens and Spreads With More Credit Margin Hikes!, May 14, 2011

[15] See Serial Bailouts For Greece (and for PIIGS), June 4, 2011

[16] See China Prepares For Massive Bailout!, June 1, 2011

[17] See China’s Bubble Cycle Deepens with More Grand Inflation Based Projects, June 2, 2011

[18] Wikipedia.org Chinese economic stimulus program

[19] Bloomberg.com Belarus to Receive $3 Billion Russian-Led Loan, Kudrin Says (1), June 4, 2011

[20] See A Crack-up Boom in Belarus, May 26, 2011

[21] Businessinsider.com United States: Brace For The Slowdown, June 1, 2011

[22] Wall Street Journal, China Shares End At 4-Month Low; Slowdown Concerns Dominate, June 2, 2011

[23] Reuters.com GLOBAL ECONOMY-Asia's factories feel the chill as U.S., Europe cool, June 1, 2011

[24] Businessworldonline.com US Federal Reserve mulling third QE?, June 2, 2011

[25] Wikipedia.org Continuous Commodity Index (CCI)

[26] See Two Ways to Interpret Gold’s Acceptance as Collateral to the Global Financial Community, May 27, 2011

[27] See Gold Unlikely A Deflation Hedge, June 28, 2010

[28] See Gold Fundamentals Remain Positive, January 31, 2011

[29] See Oil Markets: Inflation is Dead, Long Live Inflation, November 4, 2010

[30] Mises, Ludwig von Monetary Policy Defined, Part 2 Chapter 13 The Theory of Money and Credit, Mises.org

[31] See The US Stock Markets As Target of US Federal Reserve Policies, May 12, 2011

Monday, August 02, 2010

US and Global Economy: Pieces Of The Jigsaw Puzzles All Falling In Place

``Deflationary credit contraction is, necessarily, severely limited. Whereas credit can expand (barring various economic limits to be discussed below) virtually to infinity, circulating credit can contract only as far down as the total amount of specie in circulation. In short, its maximum possible limit is the eradication of all previous credit expansion.” Murray N. Rothbard

Mainstream expert analyses are mostly hinged on heuristics (mental shortcuts), except that they often argue from the context of technical gobbledygook which appeals and overwhelms the naive public to assume such abstraction as universal reality.

For instance, many go at length to argue that low interest levels in US Treasury exhibit signs of deflation. Heck, as if deflation or falling prices in the mainstream definition means the end of world. Well, falling prices also means greater purchasing power, which from the fundamental standpoint of demand and supply, it means more goods that one can acquire. So the end of the world, it is not.

For us, deflation isn’t a one size fits all dynamic. We see this market force as operating from different previous actions; one that deals with productivity growth or one that deals with government property confiscation, or bank credit contraction or cash building. So the social impact won’t be the same. Yet when the mainstream hears or reads of deflation they seem to develop a reflexive revulsion to the word.

What the mainstream actually refers to is of the credit contraction order- which according to them has a feedback mechanism which forces liquidation, reduces collateral values, curbs aggregate demand, which leads to excess supplies and subsequently falling prices which gets exacerbated by expectations of people to hoard cash and back to the loop.

It’s a story long been told even during the days of my Dad, but this has hardly occurred. Not even with Japan, which the mainstream has arrantly mislabelled[1].

Although deflation had an instance of reality in 2008, our rebuttal has been that in a world central banking, governments have the incentive and the tools to temporarily offset credit contraction by serially blowing up new bubbles. How? By keeping interest rates excessively low and by printing an ocean of money.

Yet mainstream insist that this is a demand problem and that government actions won’t have an impact.

On the contrary we persist to argue that this is mostly a supply dilemma—one where banks have been stuffed with questionable assets and that reluctance to lend is a function of some distrust.

And the disruption from the near seizure in the US banking system, which prompted for a short episode of deflation, as consequence to the Lehman bankruptcy is why the US government put to risk some $23.7 Trillion worth of taxpayer money[2], according to a US official.

In short, US officials have been acting on the current financial quandary predicated on a liquidity issue.

It’s funny how many gawk at the actions of the marketplace only to put meaning into them based on their bias or economic religion.

The mainstream refuses to acknowledge that government are people too and are driven by incentives. They see government in a paradox. On one aspect, they believe government operates like supermen whom would act on every single social problem that emerges. Yet on another aspect, particularly on the financial markets, they treat governments as passive onlookers!

From our perspective, the abnormally low yields in the US treasury markets may not be due to the fear of lending or the lack of demand to borrow, but rather from government intervention.

With the US budget deficit expected to hit $1.56 trillion in 2010[3], what better way to attract cheap private financing and create an environment of marketplace confidence (animal spirits) than by manipulating interest rates down!

Since there have been little signs of inflation in the past, then the US government can simply use its covert dealers to conduct interest rate manipulation operations.

And it may not be limited to stealth actions; it may even be reported.

In three weeks since June 30, the Federal Reserve balance sheet has registered consecutive additions to its US treasury positions by $45 billion, according to the data provided by the Federal Reserve Bank of Cleveland[4].

This seems consistent with some signs of unease from select Federal Reserve officials, such as James Bullard, president of the Federal Reserve Bank of St. Louis, who called for renewed buying of treasury securities or the resumption of quantitative easing[5].

Yet these guys seem to be looking at the wrong picture.

First of all, the banking system doesn’t represent the entire US capital markets.

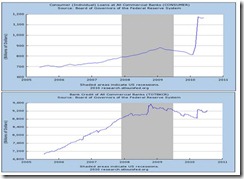

Figure 4: St. Louis Fed: Consumer and Bank Credit at ALL Commercial Banks

But even if we deal with the banking system we are seeing not widespread signs of contraction but signs of credit expansion (see figure 4)!

True business and industrial loans are still down, but nominal lending in US dollars by consumers at all commercial banks have recently skyrocketed (upper window). And we seem to be seeing material improvement in credit activities of bank credit of all commercial banks, perhaps directed at consumers.

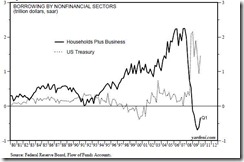

Figure 5: Yardeni.com[6]: Flow of Funds

We predicted[7] that the influence of the yield curve lags by about 2-3 year period, which if we are right we could see an acceleration in the activities in the US credit markets by this yearend, could we be seeing the seeds of this turnaround (see figure 5)? Oops....

Now as we earlier said, banks aren’t the sole source of funding for the US economy, which the mainstream loves to fixate on. And I think signs have saying they’re dead wrong.

Why? Because the corporate bond market is likewise booming!

This from Businessweek/Bloomberg[8],

``U.S. corporate bond sales soared 31 percent to $85.7 billion this month, the busiest July on record, as yields fell to the lowest in more than six years on growing investor confidence in the economic recovery. The London interbank offered rate, or Libor, which banks say they can borrow at for three months in dollars, fell the most today in almost 11 months, dropping to the least since May 14.”

And the boom in the bond markets aren’t restricted to the US markets but around the world!

According to the Wall Street Journal[9], (bold emphasis mine)

``The global corporate-bond boom is gathering steam as companies rush to take advantage of some of the lowest borrowing costs in history....

``This month has been the busiest July on record for sales by U.S. companies with junk-credit ratings. Asia's debt market is on pace for a record year, and European companies are also raising money apace.

``The low borrowing costs are the culmination of an unprecedented bond-market rally that began in the depths of the credit crisis in late 2008 and early 2009 and has defied every prediction that it would soon run out of steam. But individual and professional investors continue to plow money into the bond market, giving companies a constant source of funds to tap.”

Defied every prediction? Not for us, as we have been predicting this all along!

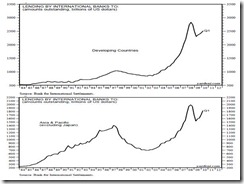

And in terms of bank lending guess where the gist of the activities has been? (see figure 6)

Figure 6: Yardeni.com Lending by International Banks

If you guessed the Emerging Markets and Asia, then you are absolutely correct!

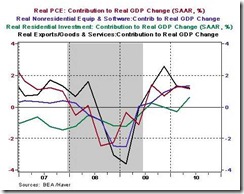

Now if we examine the contribution of economic growth in the US by sector, the mainstream seems caught somewhat surprised. Growth expectations didn’t come from the sectors they’d expected them to be (see figure 7).

Figure 7: Northern Trust: Sectoral Contribution To Growth Rates

According to Asha Banglore of Northern Trust[10], (bold highlights mine)

``In the second quarter of 2010, equipment and software spending (+1.36%) made the largest positive contribution to real GDP, followed by exports (1.22%), consumer spending (1.15%), inventories (1.1%), and residential investment expenditures (0.6%).

``In terms of growth rates, equipment and software spending posted a hefty increase of 21.9% after an upwardly revised 20.4% gain in the first quarter. Consumer spending moved up 1.6% in the second quarter after a downwardly revised 1.9% gain in the first quarter.

So technology and the world economy appear to be heavy lifting the growth momentum of the US economy.

As per the technology sector, here is what I wrote last February[11],

``What I am trying to say is that the contribution of the technology sector to the real economy could perhaps be more accurately reflected on the performance of S&P, however, such contribution may have been underrepresented by conventional statistical metrics.”

Not anymore.

For us, the current developments postulates to the following:

-US economic growth dynamics seem to be shifting from the housing to the technology and export sector.

-Investment in the US and the job growth will likely gravitate into these sectors.

-The pattern of growth in the US seem to confirm the boom in the global bond markets and the bank lending patterns of international banks

-Since technology is partly tied to exports, wealth accumulation in emerging markets is likely to fuel increasing demand for tech savvy products

-the global economy should be expected to sustain momentum as globalization deepens, and this will be in stark contrast to the prediction of deglobalization advocated by PIMCO’s Bill Gross.

-Of course, this is another bubble cycle. The next bubble will likely emanate from the emerging markets or the US technology industry[12], or the US treasury. But the risk of bubble implosion would only surface as inflation accelerates and hamstrings government efforts to intervene.

Speaking of which, where inflation is thought to be non-existent, here is a little surprise (see figure 8)...

Figure 8: stockcharts.com: Commodity Laggards

Oops, even the commodity laggards seem to be generating some reanimated activities!

We seem to seeing resurgence in agricultural products (DBA-Powershares DB Multisector Commodity Trust Agricultural Fund), as well as in Natural gas (NATGAS), the Industrial metals (Dow Jones UBS Industrial Metals-DJAIN) and the broad based commodity index (Reuters-CRB).

So far, pieces of the grand jigsaw puzzle seem to be falling in their rightful place, as we have seen it.

[1] See Japan’s Lost Decade Wasn’t Due To Deflation But Stagnation From Massive Interventionism, July 6, 2010

[2] See $23.7 Trillion Worth Of Bailouts?

[3] CNN Money U.S. deficit streak at 20 months, June 20 2010

[4] Federal Reserve Bank of Cleveland, Credit Easing Policy Tools

[5] New York Times, Fed Member’s Deflation Warning Hints at Policy Shift, July 29, 2010

[6] Yardeni.com: Flow of Funds, July 7, 2010

[7] See Influences Of The Yield Curve On The Equity And Commodity Markets, March 22, 2010

[8] Businessweek, Bloomberg: U.S. 10-Year Swap Negative for Fourth Day as Debt Sales Rise, July 30, 2010

[9] Wall Street Journal, Bonds Soar to Rare Heights, July 29, 2010

[10] Northern Trust, U.S. Economy – Q2 GDP Contained a Few Surprises Although Headline Was Close to Forecast, July 30, 2010

[11] See Statistics Don't Reveal Extent Of The Evolution To The Information Age, February 15, 2010

[12] See ASEAN Markets Surge, Where will The Next Bubble Emerge?, July 11, 2010

Thursday, March 18, 2010

Natural Gas: Alternative Energy Of The Future

The article goes to show that the world isn't running out of energy. It's just a matter of markets aided by technology, adapting to the current conditions.

Here's an excerpt, (all bold highlights mine)

``The source of America’s transformation lies in the Barnett Shale, an underground geological structure near Fort Worth, Texas. It was there that a small firm of wildcat drillers, Mitchell Energy, pioneered the application of two oilfield techniques, hydraulic fracturing (“fracing”, pronounced “fracking”) and horizontal drilling, to release natural gas trapped in hardy shale-rock formations. Fracing involves blasting a cocktail of chemicals and other materials into the rock to shatter it into thousands of pieces, creating cracks that allow the gas to seep to the well for extraction. A “proppant”, such as sand, stops the gas from escaping. Horizontal drilling allows the drill bit to penetrate the earth vertically before moving sideways for hundreds or thousands of metres.

``These techniques have unlocked vast tracts of gas-bearing shale in America. Geologists had always known of it, and Mitchell had been working on exploiting it since the early 1990s. But only as prices surged in recent years did such drilling become commercially viable. Since then, economies of scale and improvements in techniques have halved the production costs of shale gas, making it cheaper even than some conventional sources.

More from the Economist,

More from the Economist,``The Barnett Shale alone accounts for 7% of American gas supplies. Shale and other reservoirs once considered unexploitable (coal-bed methane and “tight gas”) now meet half the country’s demand. New shale prospects are sprinkled across North America, from Texas to British Columbia. One authority says supplies will last 100 years; many think that is conservative. In 2008 Russia was the world’s biggest gas producer; last year, with output of more than 600 billion cubic metres, America probably overhauled it. North American gas prices have slumped from more than $13 per million British thermal units in mid-2008 to less than $5. The “unconventional”—tricky and expensive, in the language of the oil industry—has become conventional.

``The availability of abundant reserves in North America contrasts with the narrowing of Western firms’ oil opportunities elsewhere in recent years. Politics was largely to blame, as surging commodity prices emboldened resource-rich countries such as Russia and Venezuela to restrict foreign access to their hydrocarbons. “Everyone would like to find more oil,” says Richard Herbert, an executive at Talisman Energy, a Canadian firm using a conventional North Sea oil business to finance heavy investment in North American shale. “The problem is, where do you go? It’s either in deep water or in countries that aren’t accessible.” This is forcing big oil companies to get gassier."

Read the rest here

My comments:

As we have repeatedly said, politics has been the fundamental reason for the elevated prices in oil, caused mainly by geological restrictions or limited access (mentioned by the article) combined with artificial demand from inflationism and or policies, such as subsidies (not mentioned in the article).

Nevertheless, because people adjust to the circumstances they are faced with, such as the pain of higher prices and political constrains, the perpetual desire to satisfy human needs makes possible for ingenuity to pave way for innovative technology which would allow for more access to supplies or substitution.

In the case of natural gas, since there is a recognition, out of the existing technologies, of the abundance of reserves, higher oil prices will likely compel producers to compete to convert erstwhile uneconomical resources into utilizable reserves, ergo "forcing big oil companies to get gassier" as the article mentioned.

And if successful, which I am optimistic of, this will have a spillover effect to the midstream (processing, storage, marketing and transportation) and the downstream (retail outlets, derivative products, etc...). In other words, part of the transformation would likely see global transportation evolve to natural gas as default fuel.

So in the future, we should expect natural gas to also play a big role in the transition to diversify energy sources.

The following chart caught my eye. If the technology to access shale oil becomes universally commercial, guess where the bulk of reserves are?

In Asia Pacific!

In Asia Pacific!