``To understand reality is not the same as to know about outward events. It is to perceive the essential nature of things. The best‐informed man is not necessarily the wisest. Indeed there is a danger that precisely in the multiplicity of his knowledge he will lose sight of what is essential. But on the other hand, knowledge of an apparently trivial detail quite often makes it possible to see into the depth of things. And so the wise man will seek to acquire the best possible knowledge about events, but always without becoming dependent upon this knowledge. To recognize the significant in the factual is wisdom.” Dietrich Bonhoeffer (1906-1945) German Lutheran Pastor

I recently picked up a short remark on the cyberspace about how the most recent febrile punts from “Meralco” could have caused a “rotation” in the general markets. The idea is that those who profited from the recent upside volatility in Meralco may have buoyed the general market by using profits earned from recent trades to shift into other issues.

This seems similar to the conventional thinking where occasions of huge IPOs or other security offerings (e.g. preferred shares, bonds) in the domestic financial system are deemed as having to adversely “suck the liquidity out” of the Philippine Stock Exchange.

The general idea for both assertions is that money flows “in” and “out” of the Philippine Stock Exchange .

The fact is that money DOES NOT flow in or out of the stock market.

Why?

On any given trading day unless a publicly listed company issues new or additional securities, shares available to the market are fixed.

This means that a transaction occurs only when buyers and sellers agrees to voluntarily exchange cash for a specified security at a particular price.

Let’s say Pedro has Php 100 in cash and agrees to buy Juan’s ownership of publicly listed XYZ company shares for Php 10 a share. The transaction would prompt for a shift in ownership: Pedro’s cash will be credited to Juan’s account while Juan’s XYZ shares will be transferred to Pedro’s account.

In short, in contrast to conventional thinking there is no money flows.

The price directions in the exchange merely reflect on the aggressiveness of the buyers in bidding up the price level of a security (hence, higher prices) or of the assertiveness of sellers in selling down a security at certain price levels (hence lower prices).

As we recently wrote at A Primer On Stock Markets-Why It Isn’t Generally A Gambling Casino, ``Yet prices are always set on the margins. What you read on the stock market section in the newspapers account for as prices determined by marginal investors, where daily traded volume represent only a fraction of total shares outstanding or market capitalization, and not the majority owners.”

As in the case of Meralco, there had been buyers and sellers at recently low prices as much as there had equally been buyers and sellers at the recent high prices. Thereby the suggested “rotation” from punts signifies as “rationalization”-probably holds true for some but not all (fallacy of composition)-than of reality.

In addition, the “sucking out of liquidity” from a monster $800 million record bond offering of San Miguel Brewery , which was reportedly oversubscribed by 16 times, to exclusively the domestic market hasn’t drained liquidity from the PSE, the fact is that despite the resurgence of broadmarket NET foreign selling, the Phisix is up by about 15% from the close of the SMB bond offering last March 16th.

The SMB offering only suggests that there is a vast pool of non-equity market liquidity sloshing in the domestic financial system.

Importantly, the recent recovery in the Phisix likewise extrapolates to local liquidity substituting for the net foreign selling which has been accounted for in the market since the credit crisis erupted in 2007.

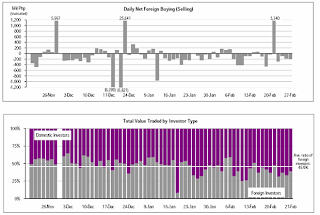

Figure 1: PSE: NET Foreign Selling (above), Transition from Foreign Dominance to Local Dominance

Figure 1: PSE: NET Foreign Selling (above), Transition from Foreign Dominance to Local Dominance

Figure 1 from the PSE gives an abbreviated view of the ongoing dynamics in the local exchange.

The chart manifests of the prevalent net foreign selling since last quarter of the 2008 and the shifting regime of trading ascendancy which was previously controlled by foreign investors (grey line) to presently local investors (maroon line) seen at the lower pane entitled ‘Total Value Traded By Investor Type’.

The other vital point to consider is that the transactions in the PSE represents for as a continuing flux of the character of ownership than one of technical “money flows”. As cited above, one of the current tangible alterations in the ownership has been that of local money replacing foreign money.

Fundamentally, it would rather be irrelevant if the issue of ownership transfers will be just from speculators to market punters or scalpers whom are looking to profit from minor price fluctuations.

But it would be materially relevant if the conveyance reflects a shift from major stockholders to a wider spectrum of public shareholder ownership because a larger breadth of public participation should entail a broader cognizance of the basic functions of capital markets.

And since capital markets operate as non-banking alternative option to raise, access, avail or price in or value investment capital, it has an economically vital function of channeling society’s savings into productive investments.

Moreover, when we argue about the low penetration rates of domestic investors in the local equity markets, which according to the PSE is estimated at less than half of 1% of the population even at the peak of the market, we are thinking along the premise of concentrated degree of ownership or of the limited float on the supply side (of listed companies) and or the lack of widespread market participation from the local public savers on the demand side. Of course, here the PSE looks at only direct investments, but glosses over the indirect investments through Unit Investment Trust Funds and mutual funds-where we estimate market exposure increases to somewhere at 1%.

The point is that these glaring deficiencies essentially reflect on the severe underdeveloped nature of the local equity markets.

And these are further compounded by the dearth of sophisticated instruments to hedge on “naked” positions, the “gambling” or overtrading culture disseminated as “education” by conventional brokers and the high cost structures from regulatory compliance that serve as material barriers to entice additional listing from privately owned unlisted enterprises into tradeable or investable publicly listed financial instruments.

Market Ignorance and Political Serfdom

Let me add that it doesn’t help or do justice to the public or to society to induce “trading” assimilation programs because it “tunnels” vulnerable neophytes to believe that the stockmarket is merely a gaming platform to play with, based on a very narrow time frame expectations regardless of prevailing risk conditions.

Ironically, what is the use to study the risk reward nature of markets (or even to obtain course certificates as Chartered Financial Analyst-CFA) if only markets operate in the analogy of games played in the casino or the racetrack?

People who get burned from wrong expectations tend to shy away from a bad experience. It is out of such adverse outcome that the “casino” imprint gets etched into mainstream psyche. And worst, a tarnished image has viral (word of mouth) repercussions. So short term gain always come at the expense of long term losses (in the form of monetary loss and mental anguish) which equally poses as a considerable obstacle to economic development.

On the philosophical aspect, the paucity of exposure to the capital markets is one substantial reason for the “overdependence” of Filipinos to the government as the ever elusive elixir for societal ills.

The problem is that government as the solution has served as perpetual illusion. The problem isn’t due to the “bad” attitudes by the Filipinos, as repeatedly floated in emails, but attitudes fostered by an entitlement and welfare privileged class or the “dependency culture” which is a common trait to a society highly dependent on government.

Yet the eternal search for virtuousness can’t be reconciled with political realities, where each incidence of hope from a new beginning eventually turns out as a mass frustration.

Mr. Robert LeFevre in his The Nature of Man and His Government tells us why, ``Government is a tool. The nature of the tool is that of a weapon…government, designed for protection, always ends up by attacking the very persons it was intended to protect…Government begins by protecting some against others and ends up protecting itself against everyone."

Notwithstanding, we Filipinos have not yet to realize that entrepreneurship and its quintessential feature of risk taking serve as fundamental conditions for economic and financial progress.

The Law Of Demand And Supply Applied To Equities

Going back on how the law of demand-and-supply of equities impact pricing, two charts from Northern Trust reveals of the basic laws of economics at work in the recent collapse of the US equity markets…

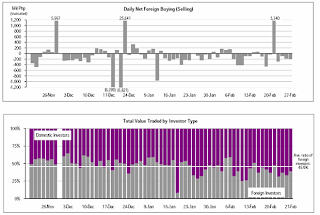

Figure 2: Northern Trust: How Demand and Supply Impacts Stock Prices During the Recent Crisis

Figure 2: Northern Trust: How Demand and Supply Impacts Stock Prices During the Recent Crisis

Last year’s meltdown came in conjunction with a record amount of net equity issuance which totaled $986 billion during the fourth quarter of last year, or at a seasonally-adjusted annual rate or equivalent to 6.9% to nominal GDP.

And who was doing the record issuance?

Northern Trust Chief Economist Mr. Paul Kasriel makes as an astute observation, ``it was the financial system, desperate for new capital to replace a huge amount of old “depreciated” capital, that was doing all the issuing. At a seasonally-adjusted annual rate, financial institutions were net issuers of equity to the tune of $1.4 trillion in the last year’s fourth quarter while nonfinancial corporations were net “retirers” of $450 billion of equity.

``At the same time the financial institutions were issuing record absolute and relative amounts of new equity, I think it is safe to say that investors’ demand for financial institutions’ equities was somewhat inhibited…”

So as the US financial institutions had been undertaking intense balance sheet deleveraging by selling off liquid assets worldwide to raise capital, which further crimped on general market sentiment and which similarly contained demand interests for equity assets, we also saw financial institutions flooding the equity markets with new issuance or simply supply overwhelmed demand which prompted for a meltdown.

Mr. Kasriel rightly concludes, ``In sum, there is no mystery as to why the broad U.S. stock indexes took a dive in the fourth quarter of last year. It simply was a matter of an increase in supply accompanied a decrease in demand.”

The equity demand supply dynamics in the US hasn’t been the case in the Philippine equity markets as the latter has suffered mainly from the contagion impacts, as the exposure to “toxic” assets had been inconsequential that didn’t require equity issuance to plug losses.

The Myth Of Cash On The Sidelines

To further expand the thought about the misguided “money flows” in and out of the stockmarket, this should include the misimpressions about sitting “cash on the sidelines” as potential drivers of the market.

Dr. John Hussman rightly and eloquently argues (bold highlight mine), ``savings equals investment, and new savings can finance new investment. But what investors often point to and call “cash on the sidelines” is really saving that has already been deployed and used either to offset the dissavings of government or to finance investments made by other companies. Once those savings have been spent, you can't, in aggregate, use the IOUs (in the form of money market securities) to do it again.

``In other words, the amount of cash that investors hold “on the sidelines” is determined by the amount of borrowing that has occurred in the form of money market securities like T-bills and commercial paper. It's a lapse of proper thinking to believe that investors, as a group, can move their “cash on the sidelines” into the stock market, or that companies, taken together, can turn their “cash on the sidelines” into new investment and capital spending.”

Technically speaking, money invested in corporate or government bonds account for as money having been already spent and thus a shift into the equity markets does not account for as “money flows” into “new” capital investment.

So what is commonly perceived as drivers for equity prices in terms of “cash in the sidelines” isn’t accurate. Equity prices again are driven by the aggressiveness of either buyer or seller in the marketplace.

Other than that the exercise of paper shuffling, the switching of assets simply can be construed as realignment or rebalancing of portfolio holdings.

Applied to the Philippines, this implies that a genuine measure of money flow into the equity market should translate to savings financing a new equity issuance in the form of an IPO, which generally flourishes during boom days or is pro-cyclical [see The Prudent Way To Profit From IPOs!], and or secondary listings which are meant to finance fresh projects or company expansions.

Summary and Conclusion

The point of this article is to refute the fallacious mainstream notion that daily transactions signify as some mystic form of money flowing in and out of the equity markets.

Money flows into the equity markets only occur when savings are utilized to finance new capital spending projects by virtue of new corporate equity issuances in the form of IPO or secondary listing.

Instead, the directions of equity prices are driven by the aggressiveness of buyer or seller, where daily transactions only reflect on the dynamics of changing of ownership of mostly marginal investors.

In addition, the fundamental laws of demand and supply applied to equity distribution have been shown to have a material impact on its price values. Thus it is important not only to look at the elements encompassing macro or micro environment dynamics and its impact to earnings or to the national economy but likewise on the variables that may directly influence the demand and supply allocation of equities.

Finally the population penetration level of equity investors can be reflective of the nature of a society’s understanding of how capitalism works. The small diffusion of domestic public investors seems highly correlated to the statist biases of the local populace. Since the capital markets function as an important conduit of capital accumulation through the development of the country’s production structure, the corollary of the underdevelopment of the capital markets is manifested by the nation’s suboptimal economic growth.

Hence, until the local population can materially increase their comprehension over how markets fundamentally work or how their savings can be recycled into productive investments, the local markets will remain underutilized and underinvested if the misperception that markets are simply “games” to dabble with remains.

We hope that our industry colleagues will authentically “educate” the public that sets aside short term gains in exchange for long term economic progress.

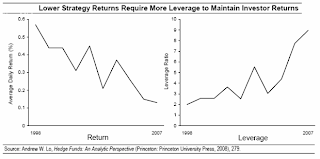

Chart from Michael Mauboussin of Legg Mason

Chart from Michael Mauboussin of Legg Mason