``There’s a simple and elegant test of whether there is skill in an activity: ask whether you can lose on purpose. If you can’t lose on purpose, or if it’s really hard, luck likely dominates that activity. If it’s easy to lose on purpose, skill is more important.” Michael J. Mauboussin

Mayhem struck the Philippine Stock Exchange (PSE), this week. What was expected to be a smooth transition in the migration of the old MakTrade system to the New Trading System turned out to be quite messy.

Aside from the erroneous data feed which resulted to a whopping one day 14% jump in the Phisix on the first day of the new system, news reports say that it took more than three hours[1] to correct the figures in the benchmark index.

The glitch wasn’t just seen in the major benchmark figures. This extends all the way to the data, particularly on the daily quotes. Previous computations for foreign trade seem to have been altered, so as with the breadth (daily number of issues traded-formerly sum of advance, decline and unchanged issues), this I would have to clarify with the PSE.

So unless the PSE resolves to align this week’s quote with the past, the new system will render our previous data as invalid.

Though this is a technical issue which eventually should be resolved, I am not sure how the PSE will make good the right adjustments, considering that it could be costly to reprogram (if this is included in the package).

In addition, the posting of the daily quotes at the PSE website has been way delayed. The quote for July 30th trading session had been uploaded only this morning, August 1st.

The Unseen Cost Of Inefficiencies

Meanwhile, a PSE official, quoted by media, rushed to exculpate the disorderly transition by insensibly claiming that such transition represents as a mere “minor” issue and emblematic of normal “birth pains”. This is not only ridiculous, but is unwarranted.

Such statement exemplifies on what we call as the stakeholder’s problem—where the urgency to know and act is fundamentally based on the perceived stake by the agent involved.

In this case, because the officer’s stake isn’t in the trading business, but as an employee of the PSE, his sentiment reveals of the seeming paucity in the urgency to patch up the system, as well as, the undeserved insensate remarks.

One should realize that distortions in the price signals engender imbalances in the capital markets.

This includes an increase in the perception of operational uncertainty which could result to heightened volatility, the expanded risk premium of holding local equities relative to other local and foreign assets, higher cost of transactions and a higher hurdle rate required by both local and foreign institutional investors for them to consider allocating their funds to Philippine equities.

In short, uncertainty translates to the risks of lesser investments!

Proof of this is that even if the Phisix bellwether did register a marginal gain this week, the average volume fell by 13% (Php 2.9 billion) and the average number of daily trades fell by 23%!

So when we are talking of billions of pesos per day (estimated at Php 3 billion or US $66 million), “minor” problems and “birth pangs” translate to Php 100 millions+ (US $2.2 million) lost in daily transactions. Think of all the multiplier effect from the lost transactions applied to the participants and to the PSE itself.

Figure 1: Bloomberg: Year To Date Performance Of The ASEAN 4

I would even suggest that the underperformance of the Phisix relative to our ASEAN neighbours amidst a seemingly sprightly market backdrop (see figure 1) could signify as the unseen ‘negative’ ramifications from the “birth pains” (see blue circle).

Except for Malaysia (orange), all three major ASEAN bourses have broken above the 2010 resistance levels, and this includes the Philippine Phisix (green). However the rally in the Phisix appears to have stalled while the others persisted.

So the lost opportunities in terms of trading volume and a higher Phisix level could have been the side effect of the unwieldy migration to the new system.

New Trading System Positioned For Derivatives Markets

The New Trading System (NTS) reportedly cost a staggering Php 197.39 million[2] (US $4.32 million-current exchange rate) whose trading platform is supposedly designed from one of the world’s largest stock market companies. According to the Inquirer.net[3],

``trading software product developed by NYSE Technologies SAS, the commercial technology unit of NYSE Euronext, which in turn operates the largest exchanges around the world including the New York Stock Exchange and Euronext.”

By concept, the NTS or the new platform seems promising, primarily because it is supposedly a system that would also service “cash, debt and derivative instruments”.

Among the major ASEAN bourses, the Philippines is a laggard in the derivatives markets as we have yet to implement one through the local stock exchange. Hence, the understandable shift to incorporate a trading platform that would allow for this expansion.

In other words, the New Trading System (NTS) is meant to position for a derivatives exchange market and not just the stock exchange.

By allowing investors the instrument to hedge, which is the main function of derivatives, this facility could enhance investor returns, which should ultimately attract more public participation.

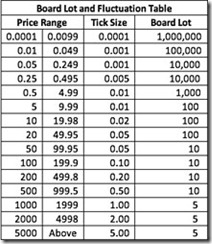

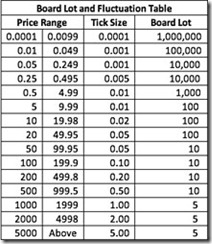

Figure 2: Manila Bulletin: NTS Revised Ticker and Board Lot

There are many salient trading enhancements in the new program. This includes the adoption of a reduced tick size (price fluctuation) and board lot[4] (see figure 2); real-time monitoring of foreign ownership; new order and validity types; and the standardization of the account code[5].

I think some of the most noteworthy, among the many supposed new functions[6], that could be widely used are the following:

-stop order which consists of the stop-loss [order that is queued as a must be filled as soon as the trigger price is reached] and the stop limit [order that is queued as a limit order as soon as the trigger limit price is reached]

-market order [order that is filled irrespective of the price whereby the unfilled quantity will be queued into the order book.]

-market to limit order [order executed at the best opposite price for shares whatever is available; remaining unfilled quantity will be put in the order book at the execution price]

-good till date [order remains valid until the date specified by the user]

So in my view, the transition towards NTS, given the specified features, should extrapolate to a medium to long term advantage, if the PSE would use this platform to expand into financial derivatives, and most importantly, to the much needed commodity futures market.

As a side note, because of the dire lack of capital in the Philippines, despite being a relatively low wage low export country, a large part of the Philippine economy remains mired in the agricultural age. Thus, a commodity futures market should enhance pricing, logistics and distributional efficiency that should positively impact our farmers, as I have long been arguing[7] for.

In short, since I am not a Luddite (political zombies who are afraid of technological adaption), but one who embraces innovation, the NTS, based on its current features, looks enticingly positive.

How Competition Can Improve On The PSE

However, what I have cavilled about is the executional inefficiencies and the lack of sensitivity by the PSE in the migration process.

The PSE should have backtested the new platform with the MakTrade system into near precision first before formally replacing the latter that would have resulted to an orderly transition.

Birth pains serve as no justification in today’s transition towards the information age. Yet if such reasoning holds true, then technology ‘birth pangs’ should translate into catastrophic crashes for the new airplane models as the Boeing’s 787 Dreamliner and the Airbus 380. Such rationalization is effectively a non-sequitur.

Instead, what these shortcomings manifest are symptoms of companies operating, outside of the discipline of consumers (or shareholders in this setting) in a monopolistic environment, which technically is what the Philippine Stock Exchange is.

As Professor Murray N Rothbard explained[8] (bold emphasis added, italics- Professor Rothbard)

``One form of partial product prohibition is to forbid all but certain selected firms from selling a particular product. Such partial exclusion means that these firms are granted a special privilege by the government. If such a grant is given to one person or firm, we may call it a monopoly grant; if to several persons or firms, it is a quasi-monopoly grant. Both types of grant may be called monopolistic. An example of this type of grant is licensing, where all those to whom the government refuses to give or sell a license are prevented from pursuing the trade or business.

``It is obvious that a monopolistic grant directly and immediately benefits the monopolist or quasi monopolist, whose competitors are debarred by violence from entering the field. It is also evident that would-be competitors are injured and are forced to accept lower remuneration in less efficient and value-productive fields. It is also patently clear that the consumers are injured, for they are prevented from purchasing products from competitors whom they would freely prefer. And this injury takes place, it should be noted, apart from any effect of the grant on prices.”

And according to former PSE President Jose Yulo Jr.[9]

``On March 4, 1994 the Securities and Exchange Commission granted the Philippine Stock Exchange, Inc. its license to operate as a securities exchange in the country stating that “a unified Stock Exchange is vital in developing a strong capital market and a sustainable economic growth.” It simultaneously canceled the licenses of the MSE and the MKSE.

``The Philippine Stock Exchange is currently the only organized exchange in the Philippines licensed for trading stocks and warrants.” (emphasis added)

So while it is true that stock exchanges of Thailand, Malaysia, Taiwan and Korea are monopolies in a sense (all others have multiple stock exchanges[10] including Pakistan), we see these organizations as more sensitive to the interest of the shareholders due to a deeper penetration level which make them a lot more efficient than the local contemporary.

That’s because shareholders exert pressure on listed companies as well as through the stock exchanges in terms of participation and through shareholder activism—or the use of equity stake to influence corporate management.

And a deep penetration level of shareholder’s base would naturally impact the way the exchange business are operated.

Besides, since the Philippines has a minute shareholder base[11] (less than 1% of the population direct and indirect) and whose listed companies are mostly companies owned by local tycoons, the lack of minority shareholder activism is one of the contributing factor that accentuates the negative dynamics of the monopolistic structure.

Figure 3: ADB[12]: Average Foreign Holdings of Equity—2003 to 2007 and 2008 (as % of market capitalization)

Another possible variable is the competition to attract foreign investors (see figure 3).

As one would note, except for Malaysia, the other monopolist Korea, Taipei and Thailand comprise the largest in terms of the average share of foreign participation as a percentage of the market capitalization.

This means that the respective markets are seen as highly liquid or has deep public participation levels, are considered sophisticated and shareholder friendly enough to generate large following from foreign funds.

Thus, inefficient management of the trading platform will curtail the interest of foreign investors to the detriment of the economy (lack of avenues to intermediate savings and investment) and to the investment public (returns relative risks).

So the PSE management should not only look slough off the monopolistic attitude, and on the competitive side work to attract investors by having more efficient implementation and a stable upkeep of the trading platform, but likewise have a PR communiqué that won’t be seen as snooty.

As a long time shareholder of the company, which is my expression of optimism for the Phisix and for the domestic capital markets, I hope that this critique would be deemed as constructive enough to make the PSE a more shareholder (market) friendly institution.

[1] Inquirer.net, New system throws Philippine bourse into disarray, July 27, 2010

[2] Philippine Stock Exchange, Security Exchange Commission Form 17-A, May 17, 2010

[3] Inquirer.net, loc. sit.

[4] Manila Bulletin, PSE implements new trading system, July 25, 2010

[5] Business Mirror, SEC approves PSE shift to new trading system, April 26, 2010

[6] Philippine Stock Exchange, NTS Update Session 1, October 2008

[7] See A Prospective Boom in Philippine Agriculture! and see Rice Crisis: The Superman Effect And Modern Agriculture

[8] Rothbard, Murray N. Triangular Intervention: Product Control, Man Economy & State Chapter 12

[9] Yulo, Jose Luis U. Jr. Knowing The Philippine Stock Exchange A guide for Investors

[10] tdd.lt Stock Exchanges Worldwide Links

[11] Philippine Stock Exchange, Less than half of 1% of Filipinos invest in stock market, PSE study confirms, June 16, 2008

[12] Asian Development Bank, Asia Capital Markets, May 2010