``The most important benefit of population size and growth is the increase it brings to the stock of useful knowledge. Minds matter economically as much as, or more than, hands or mouths.”- Julian Simon, More People, Greater Wealth, More Resources, Healthier Environment

Our projections are not only getting validated in the financial markets but also in the political front.

Many have come to fallaciously believe that the election of a new leadership would prompt for an overhaul in the management of the Philippine government. Now grinding reality has gradually been unmasking the mirage of “change”.

The Aquino administration is being rocked by several controversies. One is the hostage drama which has turned out to be a foreign policy relations disaster and has put into question the competence of the fledging administration.

Next is the allegation that the people close to the Aquino administration have been on the take[1], where the immaculacy of graft and corruption free image is evidently being chaffed.

As we have earlier argued[2], regulations that ignore the fundamental law of economics will only backfire.

Prohibition laws only foster and nurture violence, corruption and criminality and would not eliminate demand for the outlawed products or services, whether it is about drugs, abortion, prostitution or gambling.

Prohibition only worsens the situation by bringing these activities underground which undermines social institutions.

Apparently hardly anyone seems to have learned from history or from recent experience (President Estrada’s downfall was due to jueteng).

This is the fundamental pitfall of converting political “moral” issues into legal statutes without discerning on the responses of the individual.

Population Bill Controversy: Looking At The Wrong Picture

Another controversy hounding the Aquino administration is the religious uproar over the population control bill being sponsored by the administration.

This has placed incumbent leadership in direct confrontation with the largest religious cum political lobby group—the Catholic Church, which has even threatened President Aquino with excommunication[3]. The Church reportedly backtracked[4] on this.

While I agree that people should be given a free choice on what to do with their lives, the population control issue is fundamentally a deflection of the genuine pathology surrounding the Philippine political economy—the lack of capital and the dependency culture.

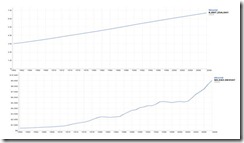

Figure 1: Google Public Data[5]: Population versus Wealth Creation

It’s basically false to impute population growth as the cause of poverty.

As figure 1 from the World Bank (Google Public Data) shows, world population growth (upper window) has more than doubled from 3 billion in 1960 to 6.7 billion in 2008. Yet global GDP per capita leapt from $445 to $9045 or some 19 times!

One would note that the gist of the improvement of global GDP per capita occurred when China opened her “to get rich is glorious[6]” doors to international trade in 1980 and when India likewise joined the global community which gave rise to globalization.

Globalization, which anchored China’s economic reforms, led to a massive decline in poverty rates “from 64% at the beginning of reform to 16% in 2004”[7].

The same holds true for India whose poverty rate declined sharply: According to the criterion used by the Planning Commission of India 27.5% of the population was living below the poverty line in 2004–2005, down from 51.3% in 1977–1978, and 36% in 1993-1994[8].

So in contrast to popular wisdom, two of the most populous nations saw a massive improvement in wealth creation as trade diffused into their economies.

In other words, contra neo-Malthusians, population growth is a positively associated with wealth creation because having more people enhances the division of labor and specialization as well as the broadening of the diversity of knowledge which increases the chances of innovative ideas. Thus, the essence to economic growth is the coordination of these attributes, channelled through voluntary exchange, which would allow more products and services or economic goods to be offered for exchange.

Here is Jean Baptiste Say’s* rejoinder to Thomas Malthus[9] who believed that population growth would adversely affect the distribution of resources (bold emphasis mine)

When men are once provided with the means of producing, they appropriate their productions to their wants, for the production itself is an exchange in which the productive means are supplied, and in which the article we most want is demanded in return. To create a thing, the want of which does not exist, is to create a thing without value: this would not be production. Now from the moment it has a value, the producer can find means to exchange it for those articles he wants.

As we earlier pointed out it is the lack of capital and the culture of dependency that hampers economic development which policymakers erroneously pinpoint to population growth. And the starting point of the lack of capital is the inadequate protection of property rights.

As Murray N. Rothbard explains[10],

The Third World suffers from a lack of economic development due to its lack of rights of private property, its government-imposed production controls, and its acceptance of government foreign aid that squeezes out private investment. The result is too little productive savings, investment, entrepreneurship, and market opportunity. What they desperately need is not more UN controls, whether of population or of anything else, but for international and domestic government to let them alone. Population will adjust on its own. But, of course, economic freedom is the one thing that neither the UN nor any other bureaucratic outfit will bring them.

In other words, persistent government intervention serves as a major hurdle to promoting productive activities of trade and free exchange and significantly hampers the development of “the political and institutional conditions required for a smooth and by and large uninterrupted progress of the process of larger-scale saving, capital accumulation, and investment.[11]”

And by culture of dependency, we refer to the welfare state, whereby population growth is impliedly encouraged by institutional policies such as public education.

The fundamental premise is if people are not held liable for their actions, or when the cost of committing errors are low, then the incentive to repeat such mistakes are high. For instance, since the cost of public education is borne by the taxpayers, the underprivileged will exercise little restraint on sexual reproduction knowing that education is “free”.

So while it would seem “compassionate” on the surface to finance the education of the poor, what is not seen is the cost of redistribution or the transfer of resources away from productive activities to non-productive activities. Such transfers not only reduce productivity or lower the standards of living but likewise encourage irresponsible behaviour. In short, or irresponsible actions are rewarded while productive actions are punished. Thus, the negative aspects of population growth as portrayed by media.

One should add that more government control over our lives chafes at our freedom.

Of course the chief beneficiaries of these have NOT been the recipients of redistribution but the administrators of the government. For they not only financially benefit from such transfers, they benefit by the inequality of distribution of power or that they exercise undue control over our lives.

And it is why despite the high penetration levels of education in the Philippines, we end up exporting labor as a consequence of a cauldron of interventionist policies, the symptoms of which are: mass production of low quality of education (industrial age mentality), the glaring mismatch of required skills for the available jobs relative to the output (graduates) of public education [e.g. Business Process Outsourcing], skyrocketing cost of private education[12], the heavily politicized education sector, high levels of unemployment, combined with the lack of property rights, underdeveloped and politicized markets and social institutions, the lack of savings and investments, and etc...

Political Talking Points: Do As I Say, But Not As I Do

Finally, the battle between the religious cum political lobby group (the Catholic Church) and the population bill proponents reveal the nature of Philippine politics—the struggle to promote their versions of statist doctrines reinforced by economic and political (religion) biases.

Like loose cannons, many shout out nonsensical “moral” arguments or politically correct sounding talking points which they either don’t understand or don’t practise at all. The essence of their opinions has been founded on blind faith[13] rather than reality.

For instance, the Catholic Church as a political lobby group hardly seem to practice on what they preach.

They have been allegedly staunch pro-environment (anti-mining) advocates by rhetoric, but actions appear to speak louder than words (see figure 2)

Figure 2: Philippine Stock Exchange: Catholic Church: Do As I Say Not What I Do?

Philex Mining, one of the top mining companies in the Philippines, in its disclosure of the top 100 shareholders of June 2010[14], reveals that some entities of the Catholic Church have significant shareholdings in the company, which ironically practices what they allege as engaging in a morally wrong act of environmental degradation.

I would wonder if their self-contradictory stance is about defeating competition more than ‘well meaning’ pronouncements.

Bottom line: I’d advise you to be very careful about heeding the specious arguments of sanctimonious statists.

*in my newsletter mailing list, I erroneously placed John Stuart Mill for Jean Baptiste Say

[1] Inquirer.net Aquino won’t ax Puno yet, September 24, 2010,

GMAnews.tv Bishop links moves to oust Robredo to jueteng, September 12, 2010

[2] See Plus Ca Change: President Aquino's Policy On Jueteng, May 24, 2010

[3]Inquirer.net Aquino faces threat of excommunication, October 1, 2010

[4]Inquirer.net CBCP: No threat vs Aquino, October 2, 2010

[5] Google Public Data Explorer, World Bank: Population and GDP per capita

[6] Wikipedia.org, Deng Xiao Peng Quote commonly attributed to Deng Xia Peng but has NOT been sourced

[7] Wikipedia.org, Poverty In China

[8] Wikipedia.org, Poverty In India

[9] Say Jean Baptiste Second letter to Malthus 1821 (The Pamphleteer)

[10] Rothbard, Murray N. Population Control Chapter 41, Making Economic Sense

[11] Mises, Ludwig von Period of Production, Waiting Time, and Period of Provision, Chapter 18 Section 4, Human Action

[12] See Is There A Brewing Bubble In The Philippine Education System? August 11, 2010

[13] See Blind Faith Analysis, October 1, 2010

[14] Philippine Stock Exchange, Philex Mining Corporation Top 100 Stockholders As Of 06/30/2010