7 consecutive weeks on the upside and 12.2% returns local currency returns. Make that 13.2% in US dollar returns. Absolutely fantastic.

Will the Phisix Go Vertical?

What you see depends on where you stand. Reference point matters.

Last week, I exhibited the chart of the Phisix in a transition to a parabolic phase.

From the longer term perspective or from the trough of post Lehman bankruptcy in March of 2009, the nearly four year chart reveals of the three stages of acceleration, represented by the steepening angle or slope of the evolving trend lines.

At the current rate of growth, the Phisix could go vertical.

I am NOT saying it will, but we simply can’t rule out such possibility.

The local benchmark yielded about 7.4% last January. At 7% a month, the Phisix at 10,000 will be reached in about 8 months. As of Friday’s close, February’s gains have accrued to about 4.4%, with 9 trading sessions to go for the month. Will February deliver another 7%?

And a Phisix 10,000 by the yearend translates to 72% returns for 2013. Of course, this would represent another fulfilment of my decade long prediction.

Again the narrative above signifies an extrapolation of the current trend into the future. Yet past performance should not be relied on as an airtight measure of the future.

Nevertheless, the intensifying boom can be seen as partly playing into the “regression to the mean” trade.

I wrote at the start of the year[1],

Average returns from 1985 to 2012 or over 27 years is about 26% based on the annual nominal local currency. The first cycle (1985-1996) generated 50% nominal returns yearly. This cycle (2003-2012) has yielded only 23.61%, still distant from the 27 year average or from the post martial law first cycle.

This is NOT to suggest that the Phisix will need to repeat the returns of the first cycle boom, whose environment has been immensely distinct from today’s cycle. The Philippines then emerged from economic stagnation, high inflation, a debt moratorium and from the clutches of the two decades of dictatorship.

But if the 27-year average should come into play, then this means that the Phisix will need to deliver far greater returns than 2012, particularly 47.45% for 2013, just to reach the mean. This assumes that the Phisix boom ends next year, which I doubt.

47% gains would translate to Phisix 8,500. This makes 10,000 not far off the radar screen.

BSP Data Reveals of the Deepening Credit Driven Mania

The real reason behind the possibility of the reinforcement of the current boom has been the evolving manic phase in the local financial markets and major parts of the real economy in response to incumbent domestic social policies, as well as, to the influences of the external equivalent.

Mania, in my definition, is the phase of the bubble cycle characterized by the acceleration of the yield chasing phenomenon, which have been rationalized by vogue themes or by popular but flawed perception of reality, enabled and facilitated by credit expansion.

Bubble cycles are not just about irrational pricing of securities, but rather bubble cycles represent the market process in response to social policies where irrationalities are fueled or shaped by credit expansion accompanied or supported by faddish themes.

The fundamental risk that underlies the cycle of manias, panic and crashes is that of the massive build-up of debt founded on malinvestments and speculative excesses that becomes a systemic issue that eventually has to unravel.

The Philippine central bank, the Bangko Sentral ng Pilipinas (BSP), recently released its loans outstanding data from the banking sector for 2012. This gave me the opportunity to do a back search on the previous years[3] from which I used to construct the chart below.

On the surface, over the past 7 years the compounded average credit growth for the overall economy or for “Production by Economic Activity” has been at about 7.7%.

This would seem just about normal and or in harmony with the statistical economic growth data. Nothing to see here move along.

But as they say, the devil is in the details.

Over the last 3 years, bank loan data reveals that “Aquinonomics” has been about the inflation of a) Financial Intermediation[4] (blue bar)--which represents the banking, non-bank financials (pension and provident funds), insurance and Auxiliary activities—b) Real Estate, renting and other Business Activities (maroon bar)—which covers property, ownership dwelling and rents, and lastly c) wholesale and retail trade[5] (green bar).

Notice that rate of growth for these industries have spiked to the 25% levels and above in 2012.

I would suspect that the astounding loan growth in financial intermediation may have partly been channeled to the stock market. Thus the growth rate of this sector would seem like good proxy or bellwether for net margin debt in the stock market.

Also the stupendous growth of the wholesale and retail trade sector reinforces my concerns over the increasing risks of a shopping mall bubble[6].

Compounded annual growth rate for the 6 year period (2007-2012) for wholesale and retail trade is at 16.83%, financial intermediation 10.86%, and real estate 16.099%. However, a caveat with CAGRs is that such metric doesn’t accurately capture the inflection points or the major turns in trend dynamics. When people begin to lever up to chase for yields, CAGRs will then only manifest on such changes ex-post.

As a side note, I didn’t include the 2005-2006 data for two reasons: one categorization of financials has been lumped together with real estate, and second, household credit has been excluded. The BSP has still way much room to improve in showing to the public the necessary economic and financial information.

Yet the cumulative loans by the booming trio, the financial intermediaries-property-retail sector, accounts for 44.32% share of the total loans issued by the banking sector on “production on economic activity” in 2012.

Independently, the share of real estate sector loans represents 18.82%, wholesale and retail trade 15.78% and financial intermediation 9.73%.

Manufacturing has the largest share at 19.42%. But one fundamental thing that makes me think that manufacturing hasn’t been a bubble is the lack of popular appeal.

Of course unlike the more concentrated property sector, manufacturing even according to national statistics has been more diversified[7]. And due to this bias and to time constraints I haven’t been able to include this in my recent calculations.

The widening disparity between the rapid growth in the abovementioned supply side sectors bankrolled by credit have likewise been reflected on the growth rate on consumer loans.

Since 2009, total household consumption credit (blue bars) has grown from 9.12% to 16.12%.

The growth in auto loans has been in decline from a peak of 30.62% over the same period, but still at significant levels of 18.62%. Credit card, which accounts for 57% of the consumer loans, rose from single digits to a modest 12% in 2012.

The “other” category which accounts for 10% share of the consumer loans, that are likely about personal and salary loans[8] have likewise been on a sharp upswing.

I am confused with the BSP’s statistics, though.

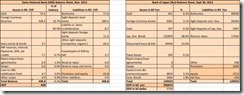

The publicized tables on household consumption don’t include residential real estate loans. However in a first semester 2011 publication[9], residential loans have accounted for the biggest portion of consumer loans (left window). I suspect that residential real estate loans may have been incorporated as part of the supply side segment of the Real Estate classification.

Consumer spending will be determined mainly by productivity growth, by savings, and or by debt acquisition. The lopsided rate of credit growth responsible for the rapid expansion of the financial-property-shopping industries has been conspicuously disproportionate with consumption growth even seen through the lens of consumer loans (right window).

Eventually such imbalances will be vented on the marketplace.

Don’t Underestimate the Risks from a Surge of Systemic Credit

Domestic credit provided by the banking sector as share of GDP was last reported at 51.84% according to tradingeconomics.com[10] based on World Bank’s published report in 2012.

Banking sector credit was over 80% of GDP at the onset of the Asian Financial crisis. While such data may seem distant from the pinnacle of the boom, it pays not to underestimate the possible scaling up of the pace of loan that can occur during a mania

So far, bank loans have been “bottoming out” and have only began to show marginal improvements by going above the “mean”.

And given the recent substantial rate of increase of overall banking loans relative to statistical economic growth, I expect such figures to increase to around 60% in 2012.

During onset of the last mania in 1993 where the Phisix returned 154% in local currency terms, the share of banking loans relative to the GDP was even less than today’s level! But bank loans skyrocketed (red ellipse) as the boom progressed through the year and the succeeding years until Asian crisis.

It’s simply the same strain of crowd feeding frenzy that should be expected if loose monetary conditions remain in place. And while I am not sure when exactly this should happen, I suspect that this sooner rather than later, perhaps this year or next. Again all this will depend on feedback mechanism between social policies and the marketplace.

The boom in financial-property sector can also be seen in the other credit markets particularly corporate bonds.

While the Philippine bond market growth has been modest in 2012 and mostly directed towards government securities, by the third quarter of the same year, corporate bonds mainly from banking-financials, real estate and holding companies had been the top issuers, according to the Asian Bond Monitor[11]. And most of the corporate bond issuers have been publicly listed companies.

This only means that many publicly listed companies have diversified in gaining access to credit through the bond markets.

Such boom continues to resonate in the Phisix.

The recent leader, the mining sector had been bogged down by another environmental headline hugging controversy of an unfortunate landslide that claimed 5 lives of workers[12] sent heavyweight Semirara [PSE:SCC] into funk, which significantly weighed on the index. So price rotation meant a shift in attention back to the finance-property companies.

The property sector now has widened its lead, as the financial sector closes the gap with mines. One possible additional interim blackeye will likely be from the recent drop of precious metal prices which I think is in a shakeout mode.

Myth of Money Flows in the PSE, Redux; Financial Investing is an Art

I recently heard people talk about how money has been flowing into domestic stocks.

In truth, there is no money flows into stocks. For every buyer of a particular security is an equivalent counterparty—a seller of the same security. The transaction or exchange only means that money shifts from the buyer to the seller of a specific security. There is no money flows.

This applies whether we reckon about board transactions, odd lots or about IPOs, secondary offerings or other forms financial securities.

I previously dwelt with this in length[13]

So when people speak of foreign money “flowing” into stocks, what they are really saying is a change in the composition of ownership. For instance when foreigners (whether individual or institution) buy, they buy from selling locals (individual or institution).

What drives prices up or down are people’s subjective valuation of specific securities. Rising prices means buyers are more aggressive. Falling prices means sellers are more forceful. Unchanged prices mean that neither buyer nor seller have been dominant, or that prices are momentarily at relative equilibrium levels.

In terms of foreign participation, any buying or selling of foreigners at the Philippine Stock Exchange will not necessarily correspond to an assumed relative corresponding rise or fall in securities as many people think.

Simply said, the presence foreign buyers don’t necessarily extrapolate to higher prices. This would depend on the valuation of every participant, whether the foreigner acts for himself or in behalf of a fiduciary fund from which his/her valuations and preferences would translate into action.

If the foreigner is aggressive then he/she may bid up prices. But again since people’s valuations differ, the scale of establishing parameters for each action varies individually.

A foreign participant can also be conservative, who may rather patiently accumulate, than bid up prices.

If an investment fund is managed by a team, then the team’s priorities, that prompts for subsequent actions, will be set according to agreement/s from the value scales of team members or from the team leader.

Such examples deal with the misimpression that the presence of foreigners imply mechanically positive for the markets or of the implicit inferiority complex where we see foreign participants as having superior force in shaping prices.

The bottom line is that every individual whether foreign or local will have their own technique or preferred means of dealing with the financial markets which are based on their subjective valuations, preferences and opinions that gets translated via actions (buy, sell or wait).

In other words, people, not nationalities, acting on individual priorities establish prices.

And this is also why financial investing is an art more than it is a science.

Global Pandemic of Bubbles

I have wanted to show you this last week but was comprised by time and space.

The general idea which I wanted to impart is that today has immensely been different than the era which culminated with a crisis represented by the 2008 Lehman bankruptcy.

First, political authorities were reactive to the bubble bust then. Today, political authorities can be considered as having been pro-active, pre-emptive or activists, such that any incipient signs of sap in economic strength has led political authorities to utilize increasingly powerful shock therapy responses.

However, drastic policies which results to short term equally commanding market response only dissipates over the long run. Such dynamic can be described as the Risk ON Risk OFF volatility.

Second, during the last crisis, emerging markets (China and ASEAN) and similarly developed economies as Canada, Australia or New Zealand filled some of the slack left by economies slammed hard by the crisis.

Today, what I call as the “periphery” nations appear to be enduring the same malaise or risks of fragility from the bubble pathology, even as the hangover from the crisis lingers

In short bubble cycles have become a global pandemic.

Canada, having been known to have withstood previous economic dislocations, may not seem invincible at all. Home prices in Canada may have reached bubble proportions[14]. And this has been undergirded by Bank of Canada’s (BoC) stealth balance sheet expansion which according to Zero Hedge[15] has grown by 21% year on year—the most since 2009 through 46% growth in purchases of Canadian government bonds.

And it’s not just Canada. Another commodity currency may be in trouble.

Australian banks may be in the process of seguing into a bubble bust which the BCA Research[16] euphemistically calls as “deleveraging”. The Canadian research outfit discerns that the unsustainable growth in household liabilities in both countries will impair their respective banking system soon.

My point is that there are limits to the powerful potion or shock therapy, which are seen as elixirs, applied by central banks. And once the bursting bubbles ripples and overwhelms significant parts of the world, parading or shooting policy bazookas will not guarantee the revival of the risk ON risk OFF environment.

But I am certain that such policy bazookas will be boldly and loosely used as they are today.

So I’d stick by the hedges against such repercussions.

Black Swans Around the Corner, Conclusion

For the Philippine markets, I expect the Phisix as well as local assets, bonds and the Peso to remain strong until at least the end of the first quarter. But we should expect a much needed short term reprieve to occur anytime soon.

After the first quarter, again the fate of the Phisix will be shaped by the expected direction of interest rates which mostly will be determined by domestic factors but will also be sensitive to external influences. This will depend, of course, on the feedback loop or the ping pong relationship between social policies and market responses.

Yet we are seeing more and more signs of the transition towards a credit fueled mania. If the current pace of expansion of systemic debt intensifies, then we shouldn’t discount that the hunt for yield may lead to a blowoff phase for the Phisix or for other Philippine asset markets.

In short, I wouldn’t rule out a Phisix 10,000 soon, in as much as I wouldn’t rule out a 10% correction.

But I don’t expect an inflection point to a bear market yet, perhaps not in 2013.

I also expect the hunt for yield to also generate interests from foreign investors mostly in response to the coordinated easing policies.

These intensifying yield chasing phenomenon are really about capital flight and equally natural responses to social policies that have been designed to undermine short sellers, to depreciate the purchasing power of respective national currencies, to manipulate short term booms in order to support the largely insolvent political institutions, as well as, to coax and force the public through the moral hazard “Central Banking Puts” ala the Bernanke Put and via negative real interest rates, into speculative orgies in order to support the asset markets which underpins the balance sheets of the politically privileged banking system, who are financiers of the government.

Nevertheless in the Philippine Stock Exchange, there are no money flows as buyers and sellers balance out each trade. Individuals, not nationalities, determine prices.

As we are seeing signs of bubbles in the Philippines, China and in Thailand, we are also seeing signs of bubbles in Canada and Australia. The consequence of the global pandemic of bursting bubbles will probably not be what the consensus or the mainstream expects. Since systemic fragility has only been heightening through aggressive risk taking, which has been bolstered by equally aggressive policy responses, one cannot discount huge market dislocations to abruptly occur. Black Swans are just around the corner.

Finally my advice for readers, especially to the tyros, is to avoid chasing prices.

Instead, since price level rotations has been a natural phenomenon in an inflationary boom, a less risky proposition is to position into issues that haven’t significantly moved up and hope that the rising tide eventually lifts all boats.

Of course, there is NO guarantee for anything. Many choices we make could end up as the exception rather than the rule. We live in a world where we think we can predict the effects of passing meteors/asteroids when really can’t[17].

[10] Tradingeconomics.com DOMESTIC CREDIT PROVIDED BY BANKING SECTOR (% OF GDP) IN PHILIPPINES The Domestic credit provided by banking sector (% of GDP) in Philippines was last reported at 51.84 in 2011, according to a World Bank report published in 2012. Domestic credit provided by the banking sector includes all credit to various sectors on a gross basis, with the exception of credit to the central government, which is net. The banking sector includes monetary authorities and deposit money banks, as well as other banking institutions where data are available (including institutions that do not accept transferable deposits but do incur such liabilities as time and savings deposits). Examples of other banking institutions are savings and mortgage loan institutions and building and loan associations.

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhE3OphNDfz40L2Kgxh6T-docKixO2r4V1IF4C9YLVQNkH4d1vJqQrMOTPrbsvw0GjJYfU80ToaaC6OO_xicR-NOxYmU5dfnNqc4QB5cpNPY0ORq_n531nVVCRwl2tOBJ4GgyKZ/?imgmax=800)

![clip_image004[4] clip_image004[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg2BYW4aFPrrrfJBF_Brxjypm7V_d-Li4AT08at1HJkVHuFCWe4UOu_Tspv_xvywv3qjMBawwM4pHPY3LA5-IqbSsf8qf_iaUTxOzU6zeSLxmBF8a3c6Y8493ljBvhyK-2MQuVh/?imgmax=800)

![clip_image005[4] clip_image005[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhexMwu9KyBWMgiRnsapQlWeS_2AbbWZg5WBgO7Yu0NFllDW3CqUiWNs0LKERPSMFPM1Wba6Wtb6LOYSIunzA9pC8cFsBGrbHkDgdT2n3Ic3HDm5Ung53_69L8jMiZsYG_cPjR0/?imgmax=800)

![clip_image006[4] clip_image006[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhE7uAkjsHUyStphuF7utqe5Fgwu4_k1CNUJiqPT_2g45wxELTLUIsRlcuk9CQhuM1WGc-iNfQUvbJ7KtTUIe3Pgyfi8vO-0Ca2NzZ1-t95Y8T4HvOnpEOFD9EulQtOo_1DrIZR/?imgmax=800)

![clip_image007[4] clip_image007[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgTnWuYac9mPxfXAVvmxEL7va_Yo3dr4LMd4IrIJmshfSKn1bEfVYND_5ER6fMg4UerMvjSKQVGeWQffP62s_RDKH1lAx_JEwBdu-LXi1wU4RUOrPomw-4bY6BCEXokeqYvn-v9/?imgmax=800)

![clip_image009[4] clip_image009[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjNk65b_ILA4-KruvaWRkWyLgoRecFL6iluY-grVWgSgXxa-4CKgFDBTT0boRYUJ-iTdeHancvDoJY9IHAU4jgAOL8EsI8Gu9GW0NeocOsb6keERwxYGxO-TXI-XRZFwmjmb44M/?imgmax=800)

![clip_image011[4] clip_image011[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgLcTBMjHvRo4O_cWJ_L4D5tb2oxdqnkOGKzlO2IKpaPrxYOkx3kMdF77g28IsZ8QbHLoGiZlbUET7IHpQn5I-s1OjT1habhCHqqOOs-VPE2HWsWzh4CTTgNZySgzPNrhyHRvQS/?imgmax=800)

![clip_image013[4] clip_image013[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiqq9mLG-Jhij6fwDDyZbTXAIgGWgW7y9HoRbAyipwlMff-nUwGIDjPCBElzavWataXSZgWGWn26tJQJkYS6KSoDTDDS98flYHmc6DUgk2zQoo08wONMJUih3KNVt6045kOWhCP/?imgmax=800)

![clip_image014[4] clip_image014[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiDjHNufu5f8DCLY-F4FlnsHHpd6hafayoNvM0tbk7gmMh221uh4fzfy9FJzLMexwWGT0xhTwb3b6_MNPmPCkWNKxAVLzZygWja_EnR7-GAmVDLh5JNVSvkNRwSw6WpHVoa4Qoh/?imgmax=800)

![clip_image015[4] clip_image015[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgw0zJgNtwvSR9FPdKTThFKxQyrgABK1_LroxR1hwv52jMTRfS9Q7epi2fNwJJtVcFBi8zDr14L7TeXkrYjRllzr0gk2pekKdUJc4taand7Ok0rJhW5YWAy4fPp9yVa4Waz2IML/?imgmax=800)