Back to my Japan debt crisis watch.

The spectacular rollercoaster ride in Japan financial markets continues.

The spectacular rollercoaster ride in Japan financial markets continues.

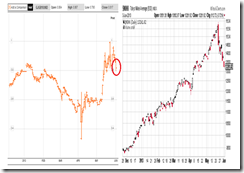

Falling yields from yesterday, apparently had been carried over to the early session (red line marks the boundary from yesterday) where Japanese 10 year yields fell to .8%.

As of this writing, the 10 year spiked anew to .85-.86%.

This is in contrast to the 30 year bonds which traded largely rangebound today

On the other hand, the Nikkei began today’s session plumbing to bear market lows.

Near the close of the session, the Nikkei made a fantastic 500 points or 3.9% swing to the positive area and closed only marginally lower from yesterday.

The huge late day recovery apparently was prompted by reports that Japan’s biggest pension fund, the Government Pension Investment Fund (GPIF), announced compliance with Japan PM Shinzo Abe’s recent urging for the public pension fund company to rebalance their portfolio holdings to increase exposure on risk assets.

From Reuters:

Japan's public pension fund, the world's largest with more than $1 trillion in assets, said on Friday it would lift its weighting in stocks and cut its allocation target for Japanese government bonds(JGB) in a bid to seek higher returns.The Government Pension Investment Fund (GPIF) said it would now allocate 12 percent of its portfolio to Japanese stocks, up from 11 percent previously, while lowering its JGB weighting to 60 percent from 67 percent.The revisions are the most significant for GPIF in years and are likely to have big implications for Japanese financial markets, which have gyrated in recent weeks over the prospect of change to the fund's investment strategy.

Unfortunately, while the GPIF will indeed reduce JGBs which may have led to the current surge in yields, a shift to Japan’s equity markets as noted above will only be by a meager 1%. Thus the likely effect is short term.

So Abenomics desperately attempts to provide a boost to their stock markets by political suasion. Notice the timing to prevent the realization of a bear market?

And the bad news is that the GPIF rebalancing will be tilted towards foreign assets. From the same article:

GPIF said it would increase its weighting in foreign stocks to 12 percent from 9 percent and lift its allocation of foreign bonds to 11 percent from 8 percent.

So Japan’s biggest pension fund will essentially support foreign stocks and bonds.

Yet buying of foreign assets also discreetly implies of capital flight.

If public pension funds will seek safety overseas to preserve the purchasing power of savers, so will the private sector. Hence, the direction of fund flows from Abenomics will be towards seeking shelter abroad. A stream of capital exodus will hardly be a boost to the Japanese economy.

On the alleged targeting of the Japanese yen

Some have the impression that the BoJ’s policies have been directed towards targeting the yen.

Based on official communications this hasn’t been true (yet). I say “yet” because current policies may evolve.

From another Reuters article:

Economy minister Akira Amari on Friday repeated Tokyo's mantra that it had no intention to manipulate currency levels.

Yen targeting also has not been the case in terms of technical actions.

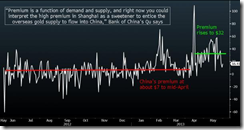

The BoJ’s interventions reveal that the thrust of asset purchases has been mainly on JGBs and commercial debt papers which expanded 6.58% and 30.68% from April to May respectively.

Foreign currency reserves grew by a pithy 1.33%

Given that JGBs constitute the largest segment 77.55% of BoJ’s assets, a 6.58% growth can be considered as substantial whereas commercial paper and foreign currency assets account for 1% and 2.76% share.

This means that BoJ’s the 2% inflation target through the doubling of monetary base in 2 years has been directed principally towards JGBs and barely the yen (yet).

In other words, the actions of the yen signify as symptoms, where the yen only responds to the BoJ’s direct interventions on the JGB markets (aside from the market forces)

Until the BoJ pursues direct forex interventions, it is misguided to see BoJ’s policies as targeting the yen.

Notice that I hardly include the yen in my JGB watch