Ideas and only ideas can light the darkness. These ideas must be brought to the public in such a way that they persuade people. We must convince them that these ideas are the right ideas and not the wrong ones. The great age of the nineteenth century, the great achievements of capitalism, were the result of the ideas of the classical economists, of Adam Smith and David Ricardo, of Bastiat and others. What we need is nothing else than to substitute better ideas for bad ideas-Ludwig von Mises

Markets operate on a pricing system. And prices are manifestations of people’s actions guided and coordinated by information aimed at the efficient allocation of resources.

As the great F. A. Hayek wrote[1],

Fundamentally, in a system in which the knowledge of the relevant facts is dispersed among many people, prices can act to coördinate the separate actions of different people in the same way as subjective values help the individual to coördinate the parts of his plan.

The financial or capital markets (stock markets, bond, currency, derivatives, etc...) function the same way. They are information sensitive since they operate as intermediaries of savings and investments. Perhaps they even could even represent more information sensitivity than the real economy for the following reasons:

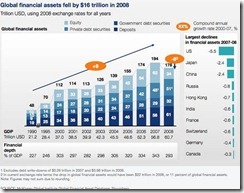

-Financial markets today are organized formal markets that are far larger than the economy

According to the table above from McKinsey Quarterly[2], despite the 2008 crisis, financial depth still accounted for 293% of the GDP (Here financial markets include equity, bank deposits, private and government debt)

-Financial markets are more globally integrated have been buttressed by the digital technology

-Financial markets are more liquid and volatile, and have been lubricated by the central banking based monetary system.

Of course not all information are equally useful or relevant.

There are information that are considered as useful or to quote Hayek anew “only the most essential information is passed on and passed on only to those concerned[3]” and that many information are not.

Furthermore information isn’t complete. They are dispersed, localized and account only for a portion of the system, writes author Peter L. Bernstein[4], (bold emphasis mine)

The past or whatever data choose to analyze, is only a fragment of reality. That fragmentary quality is crucial in going from data to a generalization. We never have all the information we need (or can afford to acquire) to achieve the same confidence with which we know, beyond a shadow of a doubt, that a die has six sides, each with a different number, or that a European roulette wheel has 37 slots (American wheels have 38 slots), again each with a different number. Reality is a series of connected events, each dependent on one another, radically different from the games of chance in which the outcome of any single throw has zero influence on the outcome of the next throw. Games of chance reduce everything to a hard number, but in real life we use such measures as “a little”, “a lot” or “not too much please” much more often than we use a precise quantitative measure.

Falsifying Popular Delusions

This brings us to the gist of what supposedly are useful information/ facts/ data sets for the financial markets.

Here is a great example, this isn’t being nostalgic for 2008 crisis but should be a thought provoking exercise

Information/Fact A

According to ABS CBN[5] (bold emphasis mine)

In a statement Sunday, the PSE reported that the combined net income of publicly listed firms dropped to P198.91 billion in 2008 from P281.54 billion in 2007, a banner year...

Lim noted, however, that revenues of listed firms grew 12.8 percent to P2.67 trillion from P2.37 trillion.

The recent data were culled from the latest financial statements submitted by 233 out of 246 listed companies. Of the 233 reporting firms, 159 posted net gains while the remaining 74 posted net losses.

Interpretation: Public listed companies were down from a RECORD highs in 2007 but remained overall positive. To add, 68% of publicly listed posted profits in 2008.

Information/Fact B

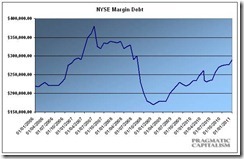

The above is the % change of the Philippine economy courtesy of tradingeconomics.com[6]

Interpretation: Like corporate profits, the Philippine economy slowed but did not suffer a recession in 2008.

Information/ Fact C

The Phisix closed at the end of 2007 at 3,621.6 and at the year end of 2008 at 1,872.85

Interpretation: The Phisix fell 48.28% in 2008!

Analysis:

Fact A partly reflected on Fact B because Fact A is part of the computation of Fact B, or corporate profits are part of the computation for the GDP[7]

Where the conventional wisdom is to generalize

Fact A (corporate profits) + Fact B (economic growth) = Fact C (rising stock markets),

then we see that three facts tells us the contrary

A+B ≠C

The conventional wisdom of A+B=C has been demonstrably falsified.

Let me add Fact D

According to Bloomberg at yearend of 2008[8],

The S&P 500 decreased 38.5 percent, the most since the 38.6 percent plunge in 1937, to 903.25 and sank to an 11-year low of 752.44 on Nov. 20. Volatility increased, with the index rising or falling 5 percent in a single day 18 times. The Dow Jones Industrial Average slumped 34 percent to 8,776.39 for the steepest drop since 1931.

Additional analysis: The Phisix did not suffer a recession or a crisis, yet the local stock market endured MORE losses compared to the epicentre or the source of the crisis—the US markets.

In short, there has been no meaningful correlation or even an established causation nexus between corporate profits and the economy relative to the stock market under the local setting.

Asymmetric Risk Taking

Why this matters?

Because any serious or prudent investors would attempt to pursue information or assimilate knowledge that are relevant or one that works, something which Nassim Taleb calls as “positive knowledge[9]”, and presumably ignore those that don’t.

Not every individual engaged in the stockmarket or the financial markets share the same incentives: instead of the primary pursuit for profits or returns, many are there for the adrenalin (thrill or the gambling tic) or to stimulate the dopamine “brain’s pleasure centers” (intellectual or ideological strawman), some are merely active for social purposes (signalling via talking points) or possibly to simply to keep busy.

The deviance from the pursuit of profits makes risk taking activities largely asymmetric.

Thus the demand for workable ‘positive’ knowledge in the financial markets would be proportional to the desire to generate real returns. We increase our profits by dealing with information or knowledge that will give us profits.

The famous Wall Street maxim, ‘bulls and bear make money but pigs get slaughtered’ are representative of market participants who see profits or returns as a secondary priority. Of course, everyone will likely say that they are in for profits but their subsequent actions will reveal of their unstated or subliminal priorities—or that actions should speak louder than words.

The great part in today’s marketplace is that the internet has allowed us vast access to information and on real time basis. This gives us the opportunity to screen information. And this also means that filtering information will tilt one into an information junkie to the risk of an information overload.

Again from Peter Bernstein[10], (bold emphasis mine)

We tend to believe that information is a necessary ingredient to rational decision making and that the more information we have, the better we can manage the risk we face. Yet psychologists report circumstances in which additional information gets in the way and distorts decisions, leading to failures of invariance and offering people in authority to manipulate the kinds of risk that people are willing to take.

In short information or facts can be tainted.

Agency Problem, Again

This brings us to the most sensitive part of information sourcing: the principal-agent or the agency problem

Economic agents or market participants have divergent incentives, and these different incentives may result to conflicting interests.

To show you a good example, let us examine the business relationship between the broker and the client-investor.

The broker derives their income from commissions while the investor’s earning depends on capital appreciation or from trading profits or from dividends. The economic interests of these two agents are distinct.

How do they conflict?

The broker who generates their income from commissions will likely publish literatures that would encourage the investor to churn their accounts or to trade frequently. In short, the literature will be designed to shorten the investor’s time orientation.

Yet unknown to the investor, the shortening of one’s time orientation translates to higher transaction costs (by churning or frequent trading). This essentially reduces the investor’s return prospects and on the other hand increases his risk premium.

How? By diverting the investor’s focus towards frequency (of small gains) rather than the magnitude. Thus, a short term horizon tilts the risk-reward scale towards greater risk.

Nassim Taleb has shown this in the analogy of the Turkey problem[11] as shown in the chart[12] above.

The Turkey is fed from day 1 and so forth, and as a consequence gains weight through the feeding process.

From the Turkey’s point of view such largesse will persist.

However, to the surprise of the Turkey on the 1,001th day or during Thanksgiving Day, the days of glory end: the Turkey ends up on the dinner table. The turkey met the black swan.

The turkey problem is a construct of the folly of reading past performance into the future, and likewise the problem of frequency versus the magnitude, both of which serves as the cornerstone for Black Swan events.

Going back, such conflict of interest may also apply to bankers too. Bankers are likely to publish literatures that goad their clients to use their facilities where the bankers earn from having more fees than focusing on the client’s interests of generating above average returns.

At the end of the day, for both cases the gullible investor ends up holding the proverbial empty bag.

So unless one is aware of such distinction, information embellished by statistics which may be construed as facts can instead represent promotional materials.

It is important to note that conflicts of interests emanating from the agency problem played a significant or crucial role during the bubble days that was also responsible for the last crisis[13].

In addition, the common practise of politicians and their apologists to present statistical facts to promote their interventionist agenda is another example of agency problems.

Most of these facts do not objectively represent the problems in a holistic sense, but instead are selectively chosen facts or data mined statistics that fits into their theories. These proposals are also usually wrapped in logical fallacies.

And most of their so-called solutions are usually framed with noble sounding intentions so that these will easily sell to the vulnerable voters. Little do the hapless voters know that such policies focuses on the short term are booby trapped with unintended consequences.

Conclusion: Ideas Have Consequences

Bottom line:

Ideas have consequences.

And so with ideas forged by false theories.

Prudent investors need to screen, test and falsify ideas and observe their validity rather than simply accepting them without due scrutiny. Failing to do so is to assume the risks of the proverbial Wall Street Pigs that have been the traditional fodder of Bears and Bulls.

Moreover, prudent investors should adapt on ideas that are likely to produce positive results over the long term at the same time reducing the prospects of being swallowed by black swan events.

In short, prudent investors need a critical and constructive mind to examine the usefulness of information as sources for ideas that underpins the subsequent action.

In addition, prudent investors must be vigilant with the source of information as this can reflect more of the interest of the information conveyor than that of the recipient.

[1] Hayek, Friedrich von, The Use of Knowledge in Society

[2] McKinsey Global Institute Global Capital Markets Entering a New Era, September 2009

[3] Hayek, Friedrich von ibid

[4] Bernstein, Peter L. Against The Gods: The Remarkable Story of Risk, p 121

[5] Abs-cbnNews.com Listed firms' profits down 29% in 2008, May 31, 2010

[6] Tradingeconomics.com Philippines percent change in GDP at constant prices

[7] Bureau of Economic Analysis, National Economic Accounts

[8] InfiniteUnknown.net U.S. Stocks Post Steepest Yearly Decline Since Great Depression, Bloomberg.com December 31, 2008

[9] Taleb Nassim Nicolas Anti Fragility, How To Live In A World We Don’t Understand, Chapter 5, How (NOT) To Be A Prophet fooledbyrandomenss.com

[10] Bernstein, Peter Op. cit. P.278

[11] Wikipedia.org Black swan theory

[12] Kinsella Stephan, The Turkey Problem

[13] See Agency Problem: Examples, Risks and Lessons, December 25, 2009