Investing without research is like playing stud poker and never looking at the cards. - Peter Lynch

The story of the week belongs no less than to the buyout of Taipan Gokongwei owned Digitel Telecommunications [DGTL] by the largest phone company and publicly listed firm Philippine Long Distance Telecommunication [TEL].

PLDT’s Buyout of DGTL Provides Bulls The Excuse To Bid Up Markets

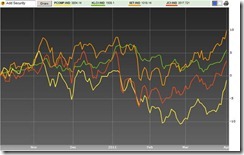

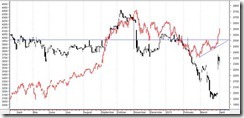

Figure 2: Recovering Phisix Buttressed By PLDT Buyout Story

It would be inaccurate to say that the PLDT-DGTL story entirely drove the domestic market higher.

The fact that MAJOR ASEAN markets were significantly higher this week, only suggests that bullish sentiment underpinned the markets in the Philippines and among our ASEAN contemporaries.

In addition, the Phisix (red bar chart in Figure 2) has been recovering even prior to the recent spike in PLDT (black candle) share prices last week.

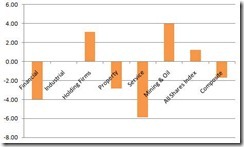

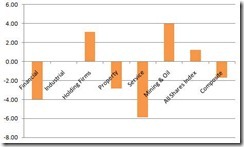

Figure 3: Weekly Sectoral Performance

Besides, while the service sector vastly outperformed the general market led by PLDT rival Globe Telecoms [GLO] (up 22.3%) which ironically eclipsed PLDT’s superb (16.4%) gains over the week, even if Globe had been outside the buyout story, the Phisix which surged by an astounding 6.5% was also driven by advances from the broader market.

Yes, all sectors registered positive gains (figure 3). But only the service sector posted gains far above the Phisix while the financial sector was nearly at par with that of the Phisix. All the rest underperformed.

This means that the extraordinary surge in PLDT prices has materially influenced the gains of the Phisix, given that PLDT commands the largest share in terms of market cap weightings of the Phisix basket.

In other words, the PLDT-DGTL buyout story has nudged the overall market higher. Bulls, whom have been looking for a crucial excuse to bid up the markets (as shown by the gradual ascent prior to last week), appears to have found one in the PLDT-DGTL narrative.

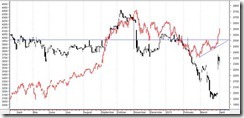

Figure 4: Rotational Effects In Play

Yet this week’s exemplary actions have nearly closed the year-to-date deficits of the various sectors in the Philippine Stock Exchange including the Phisix.

As of Friday’s close, the Phisix is just down 1.7% from the start of the year.

But the more important story is one of the rotational effects.

The tale of the two sectoral outperformers (service and financials) for this week is a splendid manifestation of the Livermore-Machlup model[1] in action-where stock price movements are largely or mainly influenced by inflationist policies (Machlup) which can be empirically observed by relative price actions (rotations) but results to increases in general price levels overtime (Livermore).

Both these sectors have alot of catching up to do, considering that both have lagged the general market as shown above. In short, erstwhile laggards have turned into leaders.

This is further evidenced by the turnaround in the ALL shares index which has popped to the positive zone. This also means that the broader market has been substantially outperforming key Service and Financial issues until last week.

Yet if the tailwinds should persist to fuel the bull’s newfound momentum in the coming sessions or weeks, where the former laggards, many of which constitute as the core Phisix heavyweights, should spearhead an accelerated recovery, then we should see the Phisix clamber out of the rut and possibly post hefty positive returns by the end of April.

Stake In PLDT: Taipan Gokongwei’s Dream Come True

As we earlier said, the bulls found a pretext to fillip the markets, which was through the announcement of PLDT’s buyout of rival company Gokongwei owned Digitel [DGTL].

Here are some information on the buyout as per PSE disclosure[2]

Almost the entire transactions for the buyout (or 51.5% of DGTL) will be executed and financed via share swaps.

A tender offer will be made to the minority shareholders at a ratio of 2,500 pesos or 1 PLDT share for the equivalent number of DGTL shares held—valued at 1.60 per share.

The value of transactions for the Gokongwei owned shares are at php 69.2 billion. If an all cash outlay for the minority tender will be incorporated, the transaction value would rise to php 74.1 billion. If it will be an all share swap transaction minority plus the Gokongwei group will own 13.7% of PLDT. Definitely, the tender offer will translate to somewhere in between (cash tenders or PLDT swaps).

The completion of the buyout would mean that the Gokongwei flagship company JGS summit would hold 12.8% of PLDT.

Ascertaining the derivative value per share of the PLDT’s acquisition of DGTL seems ambiguous because it includes other matters that had not been appropriately detailed—such as the treatment of DGTL’s zero coupon convertible bonds which represents an approximate 18.6 billion of shares (or php 29.76 billion @1.6 per share-my estimates) and DGTL’s intercompany cash advances of 34.1 billion.

If we add both the intercompany cash advance with the estimated convertible bond equivalent, then the net value of the transaction would tally to php 63.86 billion. Thus, the variance between the broadcasted prices of the deal at php 69.2 billion and the above (cash advances plus bond convertible) or php 5.34 billion could have represented as goodwill money.

Digitel’s current outstanding shares is at 6,356,976,310 (PSE data) while the 51.5% stake involved in the PLDT buyout transaction is declared at 3,277,135,882 shares.

Simply dividing the net declared amount of php 69.2 billion with the outstanding or with the 51.5% stake or even including the 18.6 billion shares (from zero bond convertible) would result to prices far above the current share value. This is not to imply of an undervaluation, but of the black area arising from the incompleteness of the divulged or disclosed information.

The more important issue for me is that the Gokongwei group has been eyeing a significant stake in PLDT since October of 2002. The botched attempt in 2002 had been predicated on conflict of interest issues from the former’s ownership of Digitel[3].

Apparently this time around, the conflict of interest issue has been circumvented or resolved by using DGTL as the key vehicle for Gokongwei’s long wish to gain a foothold at PLDT.

I am partly puzzled by the seeming obsession of Taipan Gokongwei to secure a stake on PLDT despite some makeover in PLDT’s business model from the 2002 and today.

PLDT has branched out to the energy industry through a substantial claim on Meralco’s equity[4].

Meralco, as we have earlier written[5], epitomizes the Philippine brand of state capitalism. Meralco’s legalized monopoly translates to economic rents for the economic clients of the high echelon political patrons. Remember, Meralco’s pricing system is controlled by the Energy Regulatory Board (ERB) an agency which is directly under the Office of the President. In short, the President of the Philippines decides on how much these private sector owners of the energy monopoly franchise earns[6].

Though of course, Gokongwei’s passion for PLDT could also be due to the latter’s stranglehold of having the significant majority in the market share of the mobile business in the Philippine telecom industry.

Figure 5: nadventures.com[7] mobile market share

My naughty (outside the box) mind whispers to me that this buyout, which has its roots since 2002, could also have been incented from either flows of political money trying to find a legitimate front or that such acquisition could have operated from more from political incentives than from an economic one.

Nevertheless, my suspicions are just that...suspicions until evidence can back these up.

[1] See Are Stock Market Prices Driven By Earnings or Inflation? January 25, 2009

[2] Digitel Telecommunications, JG Summit To Acquire Stake In PLDT In All-Share Transaction, Philippine Stock Exchange, March 29, 2011

[3] CNN.com Gokongwei still eyeing PLDT stake, October 3, 2002

[4] Philstar.com PLDT buys 20% Lopez stake in Meralco, March 14, 2009

[5] See Bubble Thoughts Over Meralco’s Bubble August 2, 2009

[6] See Has Meralco’s Takeover Been A Good Sign?, March 22, 2009

[7] Zita, Ken Philippine Telecom Brief (Network Dynamics Associates) nadventures.com