And when it rains

You`re shining down for me

I just can`t get enough

I just can`t get enough

Just like a rainbow

You know you set me free

I just can`t get enough

I just can`t get enough

-I Just Can’t Get Enough, Depeche Mode

Last week I pointed out that signs of market divergences in the global markets and a seeming convergence of many local indicators pointed to a possible sustained momentum for a rally.

I wrote[1]

All these factors, particularly chart formation, rallying peso, improving market breadth, bullish local investors, appears to have converged to signify possibly as a significant tailwind in favor of the bulls.

With lady luck seemingly smiling at me, events have proven this short term observation to be stunningly accurate.

The Phisix (black candle) makes an all important watershed with a rousing breakout (light blue circle) from the massive 8-month reverse and shoulder formation (orange arcs).

In Bullmarkets, Everyone is a Genius

Before I proceed, I’d like to make additional comments on what I think will be forthcoming mindset that will dominate the equity markets as the bullmarket flourishes.

Bullmarkets create the impression of infallibility, smugness, invincibility and expansive risk appetite. That’s because erroneous or defective reasoning, beliefs and or strategies will be validated by prices actions regardless of the soundness of the imputed causal relationship. In short, luck determines most of successes.

Yet most will get immersed with self-attribution bias[2], particularly self-serving bias[3], where people attribute successful outcomes to their own skill, but blame unsuccessful outcomes on bad luck.

In convention, many will argue that ‘fundamentals’ will reflect on price actions. Others will argue that chart trends will serve as the critical factors in establishing fundamentals.

Both these groups essentially argue from the perspective of historical determinism, where past performances have been assumed to determine future outcomes.

Black Swan author Nassim Nicolas Taleb exposes the shortcomings of such presumptions; Mr. Taleb writes[4], (emphasis added)

When you look at the past, the past will always be deterministic, since only one single observation took place. Our mind will interpret most events not with the preceding ones in mind, but the following ones. Imagine taking a test knowing the answer. While we know history flows forward, it is difficult to realize that we envision it backwards.

Their fundamental mistake is to overestimate causality and oversimplify market’s actions as easily explainable from superficial perspectives.

Further, these groups will also fall captive to the reflexivity theory where expectations and outcomes would play a critical self-reinforcing feedback mechanism

The aspect where I agree with Mr. George Soros[5] is this theory, (bold emphasis mine)

The structure of events that have no thinking participants is simple: one fact follows another ending in an unending casual chain. The presence of thinking participants complicates the structure of events enormously: the participants thinking affects the course of action and the course of action affects the participants thinking. To make matters worst, participants influence and affect each other. If the participants’ thinking bore some determinate relationship to the facts there would be no problem: the scientific observer could ignore the participants’ thinking and focus on the facts. But the relationship cannot be accurately determined for the simple reason that the participants’ thinking does not relate to facts; it relates to events in which they participate, and these events become facts only after the participants’ thinking has made its impact on them. Thus the causal chain does not lead directly from fact to fact, but from fact to perception and from perception to fact with all kinds of additional connections between participants that are not reflected fully in the facts.

In short, hardly anyone understands that such reflexive feedback loop process, which functions as the psychological backbone or stepping stones for boom bust cycles, are shaped by actions of policymakers whose political goal has been to sustain perpetual quasi booms.

As the great Austrian economist, Ludwig von Mises writes[6], (bold highlights added)

Nothing harmed the cause of liberalism more than the almost regular return of feverish booms and of the dramatic breakdown of bull markets followed by lingering slumps. Public opinion has become convinced that such happenings are inevitable in the unhampered market economy. People did not conceive that what they lamented was the necessary outcome of policies directed toward a lowering of the rate of interest by means of credit expansion. They stubbornly kept to these policies and tried in vain to fight their undesired consequences by more and more government interference

The effect of inflationism is to distort economic or business calculations. This will further cause massive misallocation of capital or an inducement to excessive speculations which subsequently gets manifested on the marketplace, including the stock markets via a boom bust cycle.

Bottom line: Bull market geniuses will fall short of the recognition and comprehension of the true drivers of the marketplace. They would continue to latch on cognitive biases backed by technical gobbledygook (‘macro-micro fundamentals’, political-economic ideology, mechanical charting) to argue for their cases. When the bubble pops all these arguments evaporates.

‘I Told You So’ Moment on Divergences

This leads us back to the significant chart breakout by the Phisix above.

An important reminder is that while charts are representative of past actions of the market, patterns alone do not suggest of the reliability of statistical precision of repetitive occurrences for reasons cited above, such as analytics tenuously derived from historical determinism.

That’s why charts must work in consonance with other indicators. Importantly, charts must be grounded on theory as basis for such prognosis. In short, charts should only play the role of guidepost in measuring theory. It would serve as a grave mistake to interpret charts as the foundation for theory.

Friday’s upside pop (green circle) beyond the reverse head and shoulders resistance levels may have signaled the second wind or the next significant upside leg which may bring the Phisix to the 4,900-5000 level (this implies returns of 12-15%) to the yearend.

Of course, returns will vary according to the actions of specific issues but the returns of the Phisix would essentially reflect on the average of the returns from the 30 elite issues included in the local basket bellwether.

Unfortunately, the Philippine Stock Exchange does not have an Exchange Traded Fund (ETF) listed locally that may reflect on the actions of the Phisix. Nevertheless for residence abroad, the first Philippine Exchange Traded Fund, the iShares MSCI Philippines Investable Market Index Fund (EPHE) has been listed since September of last year[7] One can take advantage of the possible Phisix rally through the EPHE.

The breakout of the Phisix appears to be validated by the actions of the Philippine Peso (red candle) where the USD-Peso chart echoed on an equally sharp downside move (green circle) for the US dollar. The Peso closed at 43.175 on Friday for a .6% gain over the week.

One would note that while the Phisix exudes a bullish backdrop, the Peso’s chart has exhibits what chartists call as a “whipsaw” or a chart pattern failure or in stockcharts.com’s definition “when a buy or sell signal is reversed in a short time”[8]

Early this month, the US dollar broke to the upside against the Peso, but this breakout was essentially expunged by this week’s rally in the Peso (light blue circle).

This should be a good example how charts can’t be used as a standalone metric.

The tight Peso-Phisix correlation suggest that for the time being, the Phisix appears to lead the price actions of the Peso, as I previously noted[9]

currency traders must take heed of the activities in the PSE as part of their studies from which to derive their predictions

Again this has been premised mostly on the favorable relative demand for Peso assets, aside from the lesser inflationary path by the Peso based on the supply side.

This Phisix-Peso correlation appears as being bolstered by a spike in Foreign buying which turned positive this week (red circle).

Net foreign buying accounted for 44.46% of this week’s peso volume traded at the Philippine Stock Exchange.

Divergent external policies are likely to continue to drive foreign funds into local shores.

Market Internals Swings To Positive Zone

As an idiom goes, ‘The proof of the pudding is in the eating’.

All sectors posted gains this week with Industrials and Financials taking the leadership from the mining sector (see graphic above).

Even from the midterm basis, All sectors have been on an uptrend (Financials, Industrials and Holdings-left column; Property, Services and Mining and Oil-right column) despite the recent corrections.

What Friday’s sprightly activities did was to magnify on these gains.

Said differently, while Friday’s rally may have hallmarked a significant and symbolical turnaround, in reality, most of the sectors have already been on an upside creep way before Friday, most notably coming from the troughs in mid June.

Further, this interim rally seems to reinforce the medium term trend dynamics.

“I just can’t get enough” is a song by new wave band called Depeche Mode during the early 1980s. To borrow from Depeche Mode, I just can’t seem to get enough to further show how markets have been validating our expectations.

The advance-decline ratio (left window) has oscillated to favor of the bulls, while issues traded daily has turned to the upside backed by a seeming double bottom (red) and an interim ascendant trend.

A rising Phisix will induce more trades that will be reflected on volume expansion. That’s how reflexivity theory incentivizes people: As prices go higher more people will start chasing prices and higher prices will be read as improvements on economic and corporate output which will further lead to rationalizing of price chasing dynamics, hence, the feedback loop.

Also, an ascendant Phisix will tilt the balance of ‘frequency’ of the advance-decline differentials mostly to the positive or advancing side. So the advance decline chart would show denser on the positive column where advancing issues dominate.

From Divergence to Convergence

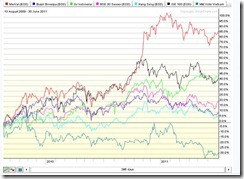

The current divergent phenomenon should not be misread as decoupling. We may see another series of re-convergence in global stock markets.

The US S&P 500 (SPX), Europe’s Dow Jones EURO STOXX 50 (STOX5E), Asia’s Dow Jones Asia/Pacific Index (P1DOW) and the Emerging Markets’ (MSEMF) MSCI Emerging Markets Free Index (EOD) have all bounced strongly from last week (green arrows).

With global equity markets on a heady upside explosion following the ratification of the Greece austerity vote which paves way for the Greece Bailout 2.0 (estimated at 85 billion Euros[10]), we should expect the previously divergent international signals to transition towards re-convergence.

Global markets are being flushed with liquidity once more. This time the flow will not only be coming from the Greece bailout 2.0, but likewise from the proposed bailout by Japan of the embattled nuclear industry, which would signify as an indirect bailout of her Banking industry which has massive loan exposure on the former[11].

The wave of bailouts appears as being intensified by increasing expectations for the reinstitution of asset purchases or Quantitative Easing by the Bank of England[12] (BoE)[13]. Guess who would be next?

Again the serial bailouts, divergent monetary policies by developed and emerging markets, negative real interest rates (here and abroad) and artificially low interest rates represent as key contributors to the prospective extension of the bullish momentum.

Of course, momentum won’t go straight forward, there will be interim or intermediate corrections. Yet these corrections should be seen as windows of opportunities to position.

[1] See Phisix: Divergences Point to a Bullish Momentum, June 26, 2011

[2] self-attribution-bias.behaviouralfinance.net, Self Attribution bias

[3] Wikipedia.org Self-serving bias

[4] Taleb Nassim Nicolas Fooled by Randomness, The Hidden Role of Chance in Life and in the Markets Random House 2005, p.56

[5] Soros George The Alchemy of Finance, John Wiley and Sons, p. 318

[6] Mises, Ludwig von, Free Banking and Contract Law, Chapter 17 Human Action, Mises.org

[7] Rowland Ron iShares Gives U.S. Investors Their First Philippines ETF, October 1, 2010, Seeking Alpha

[8] Stockcharts.com Glossary - W

[9] See ASEAN’s Equity Divergence, Foreign Fund Flows and Politically Driven Markets, June 5, 2011

[10] Bloomberg.com Euro Area Backs Greek Aid, Looks to New Bailout, July 03, 2011

[11] See Japan Mulls More Bailouts for the Nuclear Industry (and Mega Banks) June 28, 2011

[12] Express.co.uk SOFT PATCH CLOUDS OUTLOOK, July 3, 2011

[13] Bloomberg.com BIS Says Central Banks Need to Start Increasing Rates to Contain Inflation, June 27, 2011